UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

ALSET

CAPITAL ACQUISITION CORP.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

April

26, 2023

Date

of Report (Date of earliest event reported)

ALSET

CAPITAL ACQUISITION CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41254 |

|

87-3296100 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

4800

Montgomery Lane, Suite 210

Bethesda,

MD |

|

20814 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (301) 971-3955

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one share of Class A Common Stock, one-half of one Redeemable Warrant and one Right |

|

ACAXU |

|

The

Nasdaq Global Market |

| Class

A Common Stock, par value $0.0001 per share |

|

ACAX |

|

The

Nasdaq Global Market |

| Redeemable

warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

ACAXW |

|

The

Nasdaq Global Market |

| Rights,

each entitling the holder to receive one-tenth of one share of Class A Common Stock |

|

ACAXR |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events.

Addition

of Risk Factor Concerning Excise Tax

The

following new risk factor titled “A new 1% U.S. federal excise tax could be imposed on us in connection with redemptions by us

of our shares” is being added to the Definitive Proxy Statement filed on April 13, 2023:

A

new 1% U.S. federal excise tax could be imposed on us in connection with redemptions by us of our shares.

On

August 16, 2022, the Inflation Reduction Act of 2022 (the “IR Act”) was signed into federal law. The IR Act

provides for, among other things, a new U.S. federal 1% excise tax (the “Excise Tax”) on certain repurchases

(including redemptions) of stock by publicly traded domestic (i.e., U.S.) corporations and certain domestic subsidiaries of publicly

traded foreign corporations. The excise tax is imposed on the repurchasing corporation itself, not its stockholders from which shares

are repurchased. The amount of the excise tax is generally 1% of the fair market value of the shares repurchased at the time of the repurchase.

Any

redemption or other repurchase that occurs in connection with an initial business combination, extension or otherwise, may be subject

to the excise tax. Whether and to what extent Alset Capital Acquisition Corp. (the “Company” or “Alset”) would

be subject to the excise tax in connection with an initial business combination would depend on a number of factors, including (i) the

fair market value of the redemptions and repurchases in connection with the initial business combination, (ii) the structure of the initial

business combination, (iii) the nature and amount of any “PIPE” or other equity issuances in connection with the initial

business combination (or otherwise issued not in connection with the initial business combination but issued within the same taxable

year of the initial business combination) and (iv) the content of regulations and other guidance from the U.S. Department of the Treasury.

In addition, because the excise tax would be payable by the Company, and not by the redeeming holder, the mechanics of any required payment

of the excise tax have not been determined.

For

the avoidance of doubt, the proceeds placed in the Company’s trust account and the interest earned thereon shall not be used to

pay for any excise tax due under the IR Act in connection with any redemptions of the Company’s Class A common stock prior to or

in connection with an extension or prior to its initial business combination.

Forward-Looking

Statements

This

Current Report on Form 8-K (the “Current Report”) is provided for informational purposes only and contains information

with respect to a proposed business combination (the “Proposed Business Combination”) among the Company and HWH International.,

Inc. (“HWH”). No representations or warranties, express or implied are given in, or in respect of, this Current Report. In

addition, this Current Report does not purport to be all-inclusive or to contain all the information that may be required to make a full

analysis of the Proposed Business Combination.

This

Current Report contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. The Company and HWH’s actual results may differ from their expectations, estimates

and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such

as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “might” and “continues,” and similar expressions are intended

to identify such forward-looking statements. These forward-looking statements include, without limitation, The Company and HWH’s

expectations with respect to future performance and anticipated financial impacts of the transactions (the “Transactions”)

contemplated by the Merger Agreement. These forward-looking statements involve significant risks and uncertainties that could cause actual

results to differ materially from expected results. Most of these factors are outside of the control of the Alset or HWH and are difficult

to predict. Factors that may cause such differences include but are not limited to: (i) the expected timing and likelihood of completion

of the Transactions, (ii) the occurrence of any event, change or other circumstances that could give rise to a failure of the conditions

to or the termination of the Business Combination Agreement; (iii) the ability of HWH to meet Nasdaq listing standards following the

Transactions and in connection with the consummation thereof; (iv) the occurrence of a material adverse change with respect to the financial

position, performance, operations or prospects of HWH or Alset; (v) failure to realize the anticipated benefits of the Proposed Business

Combination or risk relating to the uncertainty of any prospective financial information of HWH; (vi) the failure of HWH to meet projected

development and production targets; (vii) the possibility that the combined company may be adversely affected by other economic, business,

and/or competitive factors, and (viii) other risks and uncertainties described herein and other reports and other public filings with

the SEC by Alset, including Alset’s Form 10-K for the year ended November 30, 2022 as filed with the SEC on February 24,

2023 (the “10-K”) or the 10-Q for the quarterly period ended February 28, 2023 as filed with the SEC on April 14,

2023 (the “10-Q”), or that HWH has filed or intends to file with the SEC, including in the Registration Statement.

The foregoing list of factors is not exclusive. Should one or more of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements.

There may be additional risks that neither Alset nor HWH presently know, or that Alset and HWH currently believe are immaterial, that

could cause actual results to differ from those contained in the forward-looking statements. Readers are cautioned not to place undue

reliance upon any forward-looking statements, which speak only as of the date made. To the fullest extent permitted by law in no circumstances

will HWH, Alset or any of their respective subsidiaries, interest holders, affiliates, representatives, partners, directors, officers,

employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from

the use of this Current Report, its contents, its omissions, reliance on the information contained within it, or on opinions communicated

in relation thereto or otherwise arising in connection therewith. These forward-looking statements should not be relied upon as representing

HWH’s and Alset’s assessments as of any date subsequent to the date of this Current Report. HWH and Alset undertake no obligation

to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable

regulation.

Additional

Information About the Proposed Business Combination and Where to Find It

In

connection with the Proposed Business Combination, Alset has filed relevant materials with the SEC, including an Amendment No. 5 to Registration

Statement on Form S-4, which includes a preliminary proxy statement/prospectus of Alset , and a prospectus for the registration

of Alset’s securities in connection with the Proposed Business Combination (the “Registration Statement”). The

Registration Statement has not yet been declared effective. The parties urge its investors, stockholders, and other interested persons

to read, when available, the preliminary proxy statement/prospectus and definitive proxy statement/prospectus, in each case when filed

with the SEC and documents incorporated by reference therein because these documents will contain important information about Alset,

HWH and the Proposed Business Combination. After the Registration Statement is declared effective by the SEC, the definitive proxy statement/prospectus

and other relevant documents will be mailed to the stockholders of Alset as of the record date in the future to be established for voting

on the Proposed Business Combination and will contain important information about the Proposed Business Combination and related matters.

Shareholders of Alset and other interested persons are advised to read, when available, these materials (including any amendments or

supplements thereto) because they will contain important information about Alset, HWH and the Proposed Business Combination. Shareholders

and other interested persons will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus,

and other relevant materials in connection with the Proposed Business Combination, without charge, once available, at the SEC’s

website at www.sec.gov or by directing a request to: Alset Capital Acquisition Corp., Attention: Heng Fai Ambrose Chan, telephone: (301)

971-3955. The information contained on, or that may be accessed through, the websites or links referenced in this Current Report in each

case is not incorporated by reference into, and is not a part of, this Current Report.

Participants

in the Solicitation

Alset,

HWH and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Alset’s

stockholders in connection with the Proposed Business Combination. Alset’s stockholders and other interested persons may obtain,

without charge, more detailed information regarding the directors and officers of Alset, or persons who may under SEC rules be deemed

in the solicitation of proxies to Alset’s stockholders in connection with the Proposed Business Combination, in the Registration

Statement or in Alset’s Form 10-K or its Form 10-Q. Additional information regarding the interests of such persons are likewise

included in that Registration Statement. You may obtain free copies of these documents as described above.

Non-Solicitation

This

Current Report is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the Proposed Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities, or

a solicitation of any vote or approval, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offer

of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an

exemption therefrom.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Description |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

April 26, 2023

ALSET

CAPITAL ACQUISITION CORP.

| By: |

/s/

Heng Fai Ambrose Chan |

|

| Name:

|

Heng

Fai Ambrose Chan |

|

| Title:

|

Chief

Executive Officer |

|

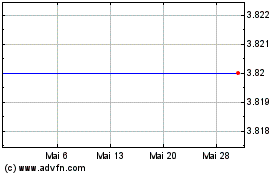

Alset Capital Acquisition (NASDAQ:ACAX)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

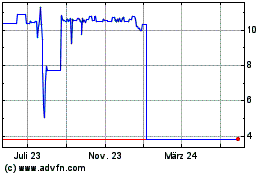

Alset Capital Acquisition (NASDAQ:ACAX)

Historical Stock Chart

Von Jun 2023 bis Jun 2024