TIDMTAN

RNS Number : 4528G

Tanfield Group PLC

15 November 2022

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement via a Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public domain

Tanfield Group Plc

("Tanfield" or the "Company")

Snorkel Investment Update

The Board of Tanfield (the "Board") is pleased to update the

market on its investment in Snorkel International Holdings LLC

("Snorkel"), the aerial work platform business.

Investment Background

-- Tanfield is a 49% shareholder in the equity of Snorkel

following the joint venture between the Company and Xtreme

Manufacturing LLC ("Xtreme") (the "Contemplated Transaction"), a

company owned by Don Ahern of Ahern Rentals Inc, relating to

Snorkel, in October 2013.

-- T he Snorkel investment is valued at GBP19.1m. The outcome of

the US Proceedings referenced below could have an impact on this

valuation.

-- On 22 October 2019, the Company announced that it had

received a Summons and Complaint, filed in Nevada (the "US

Proceedings") by subsidiaries of Xtreme, relating to the

Contemplated Transaction .

-- On 24 October 2019, the Company announced it had become

necessary to issue and serve a claim in the English High Court (the

"UK Proceedings") against its former solicitors acting for the

Company at the time of the Contemplated Transaction.

-- On 18 October 2022, the Company announced that it had fully

settled its claim in relation to the UK Proceedings on a no-fault

basis for a total of GBP6.9m.

Highlights

-- In the third quarter of 2022, Snorkel's sales increased

slightly to US$42.4m, compared to US$42.2m for the third quarter of

2021. This resulted in sales for the first 9 months of 2022 being

US$131.0m, compared to US$113.9m for the same period in 2021, an

increase of 15.0%.

-- The EBITDA for the third quarter of 2022 was a loss of

US$3.1m, compared to a loss of US$2.8m for the third quarter of

2021. Despite the 15% increase in sales for the first 9 months of

2022, which amounted to GBP17.1m of additional sales, the EBITDA

loss for the first 9 months of 2022 increased to US$10.9m, compared

to US$5.3m for the same period in 2021.

Business Update

Tanfield is a 49% shareholder in the equity of Snorkel following

the joint venture between the Company and Xtreme, a company owned

by Don Ahern of Ahern Rentals Inc, relating to Snorkel, in October

2013 .

In the third quarter of 2022, Snorkel's sales increased slightly

to US$42.4m, compared to US$42.2m for the third quarter of 2021.

While Snorkel's recovery from the impact of the global COVID-19

pandemic has slowed in the third quarter, sales for the first 9

months of 2022 increased to US$131.0m, compared to US$113.9m for

the same period in 2021, an increase of 15.0%.

The EBITDA for the third quarter of 2022 was a loss of US$3.1m,

compared to a loss of US$2.8m for the third quarter of 2021.

Despite the 15% increase in sales for the first 9 months of 2022,

which amounted to GBP17.1m of additional sales, the EBITDA loss for

the first 9 months of 2022 increased to US$10.9m, compared to

US$5.3m for the same period in 2021. While the Board note that the

gross profit margin has increased slightly in the third quarter of

2022 to 6.9%, compared to 2.8% in the second quarter of 2022, the

gross profit margin for the first 9 months of 2022 is only 4.6%.

The Board continues to believe that the gross profit margins are

not in line with the industry averages and work to investigate this

is ongoing.

Below is a summary of the consolidated financial statement for

the third quarter and year to date of 2022, including comparative

figures for 2021:

US$000's Q3 2022 YTD 2022 Q3 2021 YTD 2021

Net sales 42,422 130,976 42,203 113,920

Cost of goods sold 39,487 125,001 40,120 106,246

Gross profit 2,935 5,975 2,083 7,674

-------- --------- -------- ---------

6.9% 4.6% 4.9% 6.7%

Selling, general & administrative

costs 4,945 14,814 4,865 12,722

Foreign currency exchange

(gain)/loss 1,125 2,040 36 248

EBITDA profit/(loss) (3,135) (10,879) (2,818) (5,296)

Depreciation & non-operating

costs 650 1,831 671 1,829

Net profit/(loss) (3,785) (12,710) (3,489) (7,125)

-------- --------- -------- ---------

The Board views the year-to-date increase in sales as a positive

development.

The Company are now focussing on the US Proceedings which are

continuing, with a jury trial currently expected to take place

around the summer of 2023.

The Board continue to believe that a positive outcome to the US

Proceedings is possible. So far as it is necessary, the Company

will continue to vigorously defend its position, whilst continuing

to seek advice.

Further updates will be provided to Shareholders as and when

appropriate.

For further information:

Tanfield Group Plc 020 7220 1666

Daryn Robinson

WH Ireland Limited - Nominated Advisor / Broker

James Joyce / Megan Liddell 020 7220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFESUIEESEIF

(END) Dow Jones Newswires

November 15, 2022 04:54 ET (09:54 GMT)

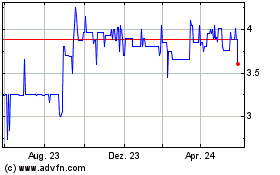

Tanfield (LSE:TAN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

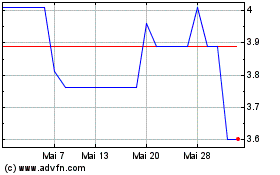

Tanfield (LSE:TAN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024