TIDMSAFE

RNS Number : 8105U

Safestore Holdings plc

28 November 2023

28 November 2023

Safestore Holdings plc

Fourth quarter trading update for the period 1 August 2023 to 31

October 2023

A year of significant strategic progress

Key Measures - Q4 Q4 Change Change YTD YTD Change Change

Total 2023 2022 CER(1) 2023 2022 CER(1)

-------------------------- ------ ------ ------- -------- ------ ------ ------- --------

Group

Revenue (GBP'm) 57.6 56.8 1.4% 1.4% 224.2 212.5 5.5% 4.8%

Closing Occupancy

(let sq ft- million)(3) 6.231 6.317 -1.4% n/a 6.231 6.317 -1.4% n/a

Closing Occupancy

(% of MLA) 77.0% 82.1% -5.1% n/a 77.0% 82.1% -5.1% n/a

Maximum Lettable

Area (MLA) 8.09 7.70 5.1% n/a 8.09 7.70 5.1% n/a

Average Storage

Rate (GBP) 30.22 29.64 2.0% 2.0% 30.26 29.25 3.5% 2.7%

REVPAF (GBP)(9) 28.24 29.25 -3.5% -3.4% 27.70 27.59 0.4% -0.2%

-------------------------- ------ ------ ------- -------- ------ ------ ------- --------

Key Measures - Q4 Q4 Change Change YTD YTD Change Change

Like-For-Like(5) 2023 2022 CER 2023 2022 CER

(1) (1)

----------------------- ------ ------ ------- ------- ------ ------ ------- -------

Group

Revenue (GBP'm) 53.7 53.9 -0.4% -0.4% 209.9 205.3 2.2% 1.7%

Closing Occupancy

(let sq ft- million)

(3) 5.583 5.793 -3.6% n/a 5.583 5.793 -3.6% n/a

Closing Occupancy

(% of MLA) 79.6% 82.8% -3.2% n/a 79.6% 82.8% -3.2% n/a

Average Occupancy

(let sq ft- million) 5.638 5.852 -3.7% n/a 5.586 5.779 -3.3% n/a

Maximum Lettable

Area (MLA) 7.02 7.00 0.3% n/a 7.02 7.00 0.3% n/a

Average Storage

Rate (GBP) 31.57 30.72 2.8% 2.8% 31.57 29.89 5.6% 5.0%

REVPAF (GBP) (9) 30.37 30.55 -0.6% -0.6% 29.91 29.34 1.9% 1.4%

----------------------- ------ ------ ------- ------- ------ ------ ------- -------

Highlights

-- Group revenue for the year in CER(1) was up 4.8% and 5.5% at actual exchange rates

-- Like-for-like(5) Group revenue for the year in CER(1) up 1.7%

-- Like-for-like (5) average rate for the year up 5.0% in CER(1)

-- Like-for-like(5) closing occupancy at 79.6% (2022: 82.8%)

-- Openings of four new stores and one extension since Q3 adding 150,100 sq ft of MLA

-- Two new pipeline sites/extensions in the quarter increased the pipeline by 100,000 sq ft.

-- Group Property Pipeline of 1.5m sq ft representing c. 18% of

the existing portfolio to be funded from existing financial

resources and expected to generate GBP25-GBP30m of stabilised

EBITDA.

Frederic Vecchioli, Chief Executive Officer, commented:

"After two years of out-performance in which the Group delivered

total like-for-like (5) revenue growth of c. 25%, 2023 has been a

resilient year in which significant strategic and operational

progress has been made.

In the year, at CER (1) , the Group's industry leading REVPAF

(9) grew by 1.4% on a like-for-like (5) basis with like-for-like

(5) revenue up 1.7%. Total Group revenue grew by 4.8% reflecting

recently added new stores and the annualisation effect of our

acquisition of the Benelux business.

We believe that the COVID period has acted as an accelerator of

growth for the self-storage industry. Whilst demand stabilised

during the year at a level that is below 2022, we are still seeing

enquiry levels that are ahead of the pre-COVID period.

We have made significant strategic progress during the year

having opened, acquired, or extended thirteen stores (five in the

UK, six in Spain and two in Netherlands) adding over 500,000 sq ft

of MLA to the portfolio. In addition, a pipeline of a further 1.5m

sq ft across 30 projects has been established which represents 18%

of the existing MLA of the business. A joint venture with Carlyle

was established earlier in the year, which facilitated the Group's

entry into the under-penetrated German market. In addition, the

integration of our Benelux business, acquired in 2022, is now

complete.

Looking beyond any potential short-term volatility, there

remains a significant under-supply of high quality self-storage

capacity across the UK and Europe which provides a structural

growth driver for the industry. New locations feed awareness which

subsequently drives demand. Safestore's industry leading business

model remains unchanged and we have substantial growth to deliver

both from filling the 1.8m square feet of fully invested, currently

unlet space, and from the new sites in our pipeline, across major

cities in the UK and continental Europe. Safestore has a proven

track record, and the returns we deliver are significantly ahead of

our cost of debt, so we look to the future with confidence.

For 2023, we anticipate that the business will deliver Adjusted

Diluted EPRA Earnings per Share (7) in line with the guidance given

in our third quarter trading statement (8) ."

Trading Performance

Trading Data- Total

Key Measures - Total Q4 2023 Q4 2022 Change YTD YTD Change

2023 2022

----------------------- -------- -------- ------- ------ ------ -------

Revenue

UK (GBP'm) 42.7 42.8 -0.2% 166.5 163.0 2.1%

Paris (EUR'm) 13.0 12.6 3.2% 50.5 48.8 3.5%

Spain (EUR'm) 1.3 0.9 44.4% 4.3 3.6 19.4%

Netherlands (EUR'm) 1.9 1.6 18.8% 7.2 3.6 100.0%

Belgium (EUR'm) 1.1 1.0 10.0% 4.1 2.3 78.3%

----------------------- -------- -------- ------- ------ ------ -------

Average Rate

UK (GBP) 30.26 29.58 2.3% 30.25 28.79 5.1%

Paris (EUR) 42.28 40.93 3.3% 42.05 40.47 3.9%

Spain (EUR) 32.15 34.88 -7.8% 33.12 34.07 -2.8%

Netherlands (EUR) 18.66 19.06 -2.1% 18.61 19.18 -3.0%

Belgium (EUR) 22.56 19.54 15.5% 21.45 18.79 14.2%

----------------------- -------- -------- ------- ------ ------ -------

REVPAF(9)

UK (GBP) 29.58 30.22 -2.1% 29.07 29.02 0.2%

Paris (EUR) 37.84 36.79 2.9% 37.10 35.81 3.6%

Spain (EUR) 14.72 31.49 -53.3% 12.64 29.78 -57.6%

Netherlands (EUR) 17.29 16.67 3.7% 16.53 16.20 2.0%

Belgium (EUR) 19.54 18.06 8.2% 18.68 17.43 7.2%

----------------------- -------- -------- ------- ------ ------ -------

Closing Occupancy

(3)

UK (million) 4.473 4.637 -3.5%

Paris (million) 1.107 1.112 -0.4%

Spain (million) 0.135 0.095 42.1%

Netherlands (million) 0.352 0.298 18.1%

Belgium (million) 0.164 0.175 -6.3%

----------------------- -------- -------- ------- ------ ------ -------

Closing Occupancy

(% of MLA)

UK (million) 78.1% 82.6% -4.5%

Paris (million) 81.3% 81.7% -0.4%

Spain (million) 39.5% 78.9% -39.4%

Netherlands (million) 80.7% 78.8% 1.9%

Belgium (million) 74.1% 78.8% -4.7%

----------------------- -------- -------- ------- ------ ------ -------

Maximum Lettable

Area (MLA)

UK (million) 5.730 5.620 2.0%

Paris (million) 1.360 1.360 -

Spain (million) 0.340 0.120 183.3%

Netherlands (million) 0.440 0.380 15.8%

Belgium (million) 0.220 0.220 -

----------------------- -------- -------- ------- ------ ------ -------

Trading Data- Like-For-Like(5)

Key Measures - Like-For-Like(5) Q4 2023 Q4 2022 Change YTD YTD Change

2023 2022

--------------------------------- -------- -------- ------- ------ ------ -------

Revenue

UK (GBP'm) 41.7 42.2 -1.2% 162.8 160.9 1.2%

Paris (EUR) 13.0 12.6 3.2% 50.5 48.8 3.5%

Spain (EUR) 0.9 0.9 - 3.6 3.6 -

Average Rate

UK (GBP) 30.33 29.62 2.4% 30.31 28.83 5.1%

Paris (EUR) 42.28 40.93 3.3% 42.05 40.47 3.9%

Spain (EUR) 37.14 35.02 6.1% 36.64 34.11 7.4%

REVPAF(9)

UK (GBP) 29.84 30.26 -1.4% 29.35 29.10 0.9%

Paris (EUR) 37.84 36.79 2.9% 37.10 35.81 3.6%

Spain (EUR) 33.80 34.48 -2.0% 33.33 33.05 0.8%

Average Occupancy

UK (million) 4.434 4.635 -4.3% 4.396 4.582 -4.1%

Paris (million) 1.117 1.122 -0.4% 1.103 1.103 -

Spain (million) 0.087 0.095 -8.4% 0.087 0.094 -7.4%

Closing Occupancy

(3)

UK (million) 4.392 4.587 -4.3%

Paris (million) 1.107 1.112 -0.4%

Spain (million) 0.084 0.093 -9.7%

Closing Occupancy

(% of MLA)

UK 79.2% 83.0% -3.8%

Paris 81.3% 81.7% -0.4%

Spain 77.9% 85.9% -8.0%

Maximum Lettable

Area (MLA)

UK (million) 5.550 5.530 0.4%

Paris (million) 1.360 1.360 -

Spain (million) 0.110 0.110 -

--------------------------------- -------- -------- ------- ------ ------ -------

Details of trading operating KPI's are included in the tables

above.

UK

UK revenue was up 2.1% for the year in total and 1.2% on a

like-for-like(5) basis.

In the fourth quarter like-for-like(5) revenue was stable across

the period and finished the quarter at 1.2% below the prior

year.

Demand, measured by enquiry levels, was down on the previous

year but ahead of pre-COVID levels.

In the business customer segment we saw a small improvement in

our customer numbers compared to the third quarter. In the fourth

quarter we saw a 25,000 sq ft inflow in business occupancy compared

to a 2,000 sq ft inflow in the same period last year.

We believe that our REVPAF(9) , a measure of how effectively we

yield manage our assets, is the strongest in the industry.

REVPAF(9) grew by 0.9% for the year on a like-for-like(5)

basis.

Paris

Our Paris business did not experience the same surge in demand

that we saw in the UK during the COVID period but continued to grow

steadily.

Paris revenue grew 3.5% in total for the year on a total and

like-for-like (5) basis. Like-for-like (5) revenue growth in the

fourth quarter was 3.2%.

Our REVPAF (9) , which we believe is significantly ahead of the

local competition, grew by a further 3.6% for the year.

Enquiry levels in Paris were marginally down compared to the

same period last year but ahead of pre-COVID levels.

Spain

Since acquiring our Spanish business in 2019 we have opened a

further seven stores. We now have eleven open stores and a pipeline

of a further five stores.

Over the year our Spanish business grew revenue by 19.4% and by

44.4% in the fourth quarter. Like-for-like (5) revenue was flat in

the quarter and across the year.

In line with our expectations, like-for-like (5) occupancy in

Barcelona has initially been diluted by the new Barcelona stores

which have opened in close proximity and within the same catchment

area as an existing store. Management believes that, given the

limited supply in central Barcelona, once the absorption phase has

been passed, the stores will generate higher revenue and profits

and provide significant long-term value.

Netherlands

Our Netherlands business, acquired on 30 March 2022, contributed

EUR1.9m revenue in the quarter and EUR7.2m for the year.

During the year, a new store in Amersfoort has opened and an

additional store in Apeldoorn was acquired. We now have eleven

stores open in the Netherlands and a pipeline of a further four

sites.

The Netherlands business is not treated as like-for-like (5)

during the 2023 financial year. However, the stores that were in

the Group for the whole of the fourth quarter in 2022 delivered

10.7% growth in Q4 2023.

Belgium

Our Belgium business, acquired with our Netherlands business on

30 March 2022, contributed EUR1.1m revenue in the quarter and

EUR4.1m for the year.

We have six stores open in Belgium and a pipeline of one

additional site.

The Belgian business is not treated as like-for-like(5) during

the 2023 financial year. However, the stores that were in the Group

for the whole of the fourth quarter in 2022 delivered 10.0% growth

in Q4 2023.

Property Pipeline Developments

Openings of New Stores and Extensions in the period

Open 2023 FH/LH MLA Other

------------------------ ------ ------- -----------

Redevelopments and Extensions

------------------------------------------------------

London- Paddington LH 8,400 Extension

Marble Arch

New Developments

------------------------------------------------------

Ellesmere Port FH 55,000 New build

Central Barcelona 3 LH 14,700 Conversion

Amersfoort- Netherlands FH 58,000 New build

Open 2023 (post-year FH/LH MLA Other

end)

--------------------- ------------------ ------- ----------------------

New Developments

--------------------------------------------------------------------------

Eastleigh LH 14,000 Conversion, Satellite

The extension of our London- Paddington March Arch store, two

new freehold stores in Ellesmere Port and Amersfoort, Netherlands

and one new leasehold site in Central Barcelona were opened in the

period adding 136,100 sq ft of MLA. The new satellite conversion at

Eastleigh was also open post year-end, adding a further 14,000 sq

ft of MLA.

New Development Projects added in the Period

We have added two development sites to the pipeline in the

period.

Paris West 4 is a freehold site with planning permission where

we will build a new build 53,000 sq ft store, opening in 2024.

In Belgium, we have exchanged contracts on a freehold site in

the Brussels conurbation at Melsbroek. We plan to open a 47,400 sq

ft new build store in 2025.

Pipeline Summary

We are leveraging our effective and scalable operating platform

to increase our expansion plans across both the UK and continental

Europe. This approach has resulted in the largest development

pipeline in our history which will be funded from our existing

financial resources. This pipeline of c. 1.5m sq ft represents c.

18% of our existing property portfolio. The pipeline and associated

financing is dilutive to earnings in the near term but, as the

stores mature, we are confident, based on our track record, that

reliable, secure and significant earnings and value accretion will

be achieved. We estimate that, on stabilisation, the current

pipeline will deliver in the range of GBP25-GBP30m of incremental

EBITDA.

Opening 2024 FH/LH Status* MLA Other

------------------------- ------- -------- ------- ----------------------

Redevelopments and Extensions

-----------------------------------------------------------------------------

London- Holloway FH C, STP 9,500 Extension

Paris- Poissy FH C, UC 12,000 Extension

Paris- Pyrenees LH C, UC 22,200 Extension

New Developments

-----------------------------------------------------------------------------

London- Paddington FH C, UC 13,000 Conversion, Satellite

Park West

London- Lea Bridge FH C, UC 76,500 New build

Eastleigh ** LH C, UC 14,000 Conversion, Satellite

**

Paris- South Paris FH C, UC 55,000 New build

Paris- West 3 FH C, UC 58,000 New build

Paris- East 1 FH C, PG 60,000 Conversion

Paris- North West 1 FH C, PG 54,000 Conversion

Paris- West 4 FH CE, PG 53,000 New Build

South West Madrid FH C, UC 46,800 Conversion

Southern Madrid 2 FH C, UC 68,800 Conversion

Central Barcelona 2 LH C, PG 20,400 Conversion

North East Madrid FH C, STP 66,000 Conversion

Almere- Netherlands FH C, UC 44,500 Conversion

Aalsmeer- Netherlands FH C, UC 48,400 New build

Rotterdam- Netherlands FH C, UC 71,000 New build

Opening 2025

-----------------------------------------------------------------------------

New Developments

-----------------------------------------------------------------------------

London- Woodford FH C, PG 76,000 New build

London- Walton FH C, PG 20,700 Conversion

London- Watford FH CE, STP 46,750 New build

London- Wembley FH C, STP 49,000 New build

Paris- West 1 FH C, PG 56,000 New build

Paris- La Défense FH C, UC 44,000 Mixed use facility

Pamplona FH C, PG 71,000 Conversion

Amsterdam- Netherlands FH CE, STP 61,400 New build

Melsbroek- Belgium FH CE, PG 47,400 New build

Opening Beyond 2025

-----------------------------------------------------------------------------

New Developments

-----------------------------------------------------------------------------

London- Old Kent Road FH C, STP 76,500 New build

London- Bermondsey FH C, STP 50,000 New build

London- Romford FH C, STP 41,000 New build

Shoreham FH CE, STP 54,000 New build

Total Pipeline MLA (let sq ft- million) c. 1.487

-------------------------------------------- -------------------------------

Total Outstanding CAPEX (GBP'm) c. 128.0

-------------------------------------------- -------------------------------

*C = completed, CE = contracts exchanged, STP = subject to

planning, PG = planning granted, UC = under construction

** Open post-year end

Ends

1 - CER is Constant Exchange Rates (Euro denominated results for

the current period have been retranslated at the exchange rate

effective for the comparative period, in order to present the

reported results on a more comparable basis).

2 - Q4 2022 is the quarter ended 31 October 2022.

3 - Occupancy excludes offices but includes bulk tenancy. As of

31 October 2023, closing occupancy includes 18,000 sq ft of bulk

tenancy (31 October 2022: 24,000 sq ft).

4 - MLA is Maximum Lettable Area.

5 - Like-for-like information includes only those stores which

have been open throughout both the current and prior financial

years, with adjustments made to remove the impact of new and closed

stores, as well as corporate transactions.

6 - The Spain business was acquired on 30 December 2019 with the

four originally acquired stores now considered like-for-like.

7- Adjusted Diluted EPRA EPS is based on the European Public

Real Estate Association's definition of Earnings and is defined as

profit or loss for the period after tax but excluding corporate

transaction costs, change in fair value of derivatives, gain/loss

on investment properties and the associated tax impacts. The

Company then makes further adjustments for the impact of

exceptional items, IFRS 2 share-based payment charges, exceptional

tax items and deferred tax charges. This adjusted earnings is

divided by the diluted number of shares. The IFRS 2 cost is

excluded as it is written back to distributable reserves and is a

non-cash item (with the exception of the associated National

Insurance element). Therefore, neither the Company's ability to

distribute nor pay dividends are impacted (with the exception of

the associated National Insurance element). The financial

statements will disclose earnings on a statutory, EPRA and Adjusted

Diluted EPRA basis and will provide a full reconciliation of the

differences in the financial year in which any LTIP awards may

vest.

8 - The analyst consensus for Adjusted Diluted EPRA EPS for the

current financial year, based on the forecasts of fifteen analysts,

is 48.0p. The fifteen analyst forecasts range from 47.3p to 50.0p.

In our third quarter trading statement we guided towards the lower

end of the range of analysts' forecasts for 2023. This guidance

remains in place for our fourth quarter.

9 - REVPAF is an alternative performance measure used by the

business. REVPAF stands for Revenue per Available Square Foot and

is calculated by dividing revenue for the period by weighted

average available square feet for the same period.

10 - Where reported amounts are presented either to the nearest

GBP0.1m or to the nearest 10,000 sq ft, the effect of rounding may

impact the reported percentage change.

Enquiries

Safestore Holdings PLC

Frederic Vecchioli, Chief Executive via Instinctif Partners

Officer

Andy Jones, Chief Financial

Officer

www.safestore.com

Instinctif Partners

Guy Scarborough/ Bryn Woodward 07917 178920 / 07739 342009

Notes to Editors

-- Safestore is the UK's largest self-storage group with 190

stores on 31 October 2023, comprising 133 wholly owned stores in

the UK (including 73 in London and the South East with the

remainder in key metropolitan areas such as Manchester, Birmingham,

Glasgow, Edinburgh, Liverpool, Sheffield, Leeds, Newcastle, and

Bristol), 29 wholly owned stores in the Paris region, 11 stores in

Spain, 11 stores in the Netherlands and 6 stores in Belgium. In

addition, the Group operates 7 stores in Germany under a Joint

Venture agreement with Carlyle.

-- Safestore operates more self-storage sites inside the M25 and

in central Paris than any competitor providing more proximity to

customers in the wealthiest and more densely populated UK and

French markets.

-- Safestore was founded in the UK in 1998. It acquired the

French business "Une Pièce en Plus" ("UPP") in 2004 which was

founded in 1998 by the current Safestore Group CEO Frederic

Vecchioli.

-- Safestore has been listed on the London Stock Exchange since

2007. It entered the FTSE 250 index in October 2015.

-- The Group provides storage to around 90,000 personal and business customers.

-- As of 31 October 2023, Safestore had a maximum lettable area

("MLA") of 8.090 million sq ft (excluding the expansion pipeline

stores) of which 6.231 million sq ft was occupied.

-- Safestore employs around 750 people in the UK, Paris, Spain, the Netherlands, and Belgium.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPGMWGUPWGQM

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

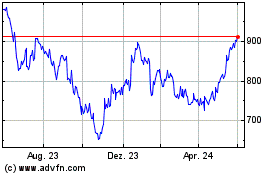

Safestore (LSE:SAFE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Safestore (LSE:SAFE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025