TIDMSAE

RNS Number : 7699V

SIMEC Atlantis Energy Limited

05 December 2023

5 December 2023

SIMEC Atlantis Energy Limited

("SAE Renewables", "SAE", the "Company" and, together with its

subsidiaries, the "Group")

Freehold land sale at Uskmouth, proposed Abundance Bonds

extension and Business update

Sale of land to Electric Land

SAE is delighted to announce that it has today signed an

agreement with EL (Uskmouth) Limited a subsidiary of FPC Electric

Land Ltd for the sale ("Sale") of the freehold land owned by SAE

and currently leased by a portfolio company of Quinbrook

Infrastructure Partners who are constructing the first battery

energy storage system ("BESS") at Uskmouth Sustainable Energy Park

("USEP"), as announced by the Company on 24 May 2023. SAE will

receive a total cash consideration of GBP9.8 million from the Sale.

The consideration will be received in a series of milestone

payments, linked to the BESS construction progress, throughout 2024

and into 2025. SAE had previously notified its intention to

monetise the lease income on the land and the Sale is the

culmination of that process, allowing SAE to deliver against its

objectives. The Sale also validates SAE's valuation assumptions for

the BESS projects available at USEP. As the owner of significant

freehold land at USEP, SAE is able to deliver both project

development premiums and income from monetising the land leases on

future BESS projects.

As announced on 30 August 2022, SAE entered a revenue sharing

agreement with SIMEC UK Energy Holding Ltd ("SIMEC") for this first

BESS. To close this agreement out, SAE has agreed to pay SIMEC

GBP0.7 million of the received revenue from the GBP9.8 million for

the full settlement of this agreement.

Business Update

At the USEP, progress continues to be made on the additional

120MW BESS project, which re-uses the site of the cooling towers of

the former Uskmouth power station. The planning application for

this project has been submitted and a decision is expected in Q1

2024. SAE is working with another developer on a 249MW BESS project

and has secured additional grid capacity of 349MW. Furthermore, the

first BESS project has rights under agreements with SAE to expand

from 230MW to 349MW. This brings the total potential capacity at

USEP for BESS projects to over 1GW.

Additionally, SAE is developing a 200MW BESS utilising the

MeyGen grid connection. The BESS project will be located close to

the MeyGen tidal array's onshore substation and will operate

alongside the consented 86MW tidal stream project when built.

As well as the delivery of the BESS projects, SAE is making good

progress on the delivery of the world leading MeyGen tidal stream

project. The three operating turbines are working well following

their upgrades and SAE is on track to have the fourth deployed in

Q2 2024.

The delivery of the 50MW next phase of MeyGen continues to be a

priority for management. While the delivery of this project remains

hugely challenging, securing the revenue for 50MW of capacity is a

huge step forward. We are working with all stakeholders to continue

to move forward the delivery of this project and the future phases.

In this regard, we welcome the recently announced increase in the

Administrative Strike Price to GBP261/MWh for tidal stream projects

for the next auction round, which is due in 2024 and is expected to

provide opportunities for further expansion of the MeyGen

project.

Proposed Abundance Bonds extension

SAE is today issuing a communication (which may be viewed on the

Company's website at www.saerenewables.com/investor-relations ) to

the holders of the debentures issued in 2017 through Atlantis Ocean

Energy (the "AOE 2017 debentures"), the holders of debentures

issued in 2018 through Atlantis Future Energy (the "AFE 2018

debentures") and the holders of the debentures issued in 2019

through Atlantis Future Energy (the "AFE 2019 debentures"), with

the support of Abundance Investment Limited, requesting amendments

to the debenture deeds.

The requested changes will allow SAE to unlock significant

revenue opportunities through the delivery of multiple utility

scale BESS projects, along with further development of its tidal

business. SAE is confident that the income from these projects will

be sufficient to repay the debenture capital, (as more fully

detailed below) while still delivering on its business

objectives.

The full request to the debenture holders includes:

-- extend the AOE 2017 debentures maturity date from 30 June 2024 to 30 June 2029,

-- extend the AFE 2018 debentures maturity date from 31 March 2024 to 30 June 2029,

-- extend the AFE 2019 debentures maturity date from 30 September 2024 to 30 June 2029,

-- pay an enhanced interest rate for the extension period

applicable to the AFE 2019 debentures of 10% p.a.,

-- pay an enhanced interest rate for each of the three

debentures from 1 January 2027 to 31 December 2027 of 11% p.a.,

-- pay an enhanced interest rate for each of the three

debentures from 1 January 2028 to 31 December 2028 of 12% p.a.,

-- pay an enhanced interest rate for each of the three

debentures from 1 January 2029 to 30 June 2029 of 13% p.a.,

-- make an early capital repayment allocable across all three

debentures of GBP1,000,000 on the 31 December 2025,

-- make an early capital repayment allocable across all three

debentures of GBP2,000,000 on the 31 December 2026, and

-- make an early capital repayment allocable across all three

debentures of GBP3,000,000 on the 31 December 2027.

The requested amendments require the agreement of 75% of the

debenture holders by value. The results of the vote are expected

during December 2023.

SAE Renewables will provide a further update at that time.

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014, as it

forms part of United Kingdom domestic law by virtue of the European

Union (Withdrawal) Act 2018, as amended, and has been announced in

accordance with the Company's obligations under Article 17 of that

Regulation.

For further information, please contact:

SAE Renewables

Sean Parsons, Director of External

Affair +44 (0)7739 832 446

Strand Hanson Limited (Nominated

and Financial Adviser)

Richard Johnson

Rory Murphy

David Asquith +44 (0)20 7409 3494

Zeus Capital Limited (Broker)

Louisa Waddell

Simon Johnson +44 (0)20 3829 5000

Notes to Editors

SAE Renewables is a global developer, owner and operator of

sustainable energy projects. SAE owns the world's flagship tidal

stream project, MeyGen. SAE is also the owner of the Uskmouth Power

Station site that is being repurposed into a sustainable energy

park, initially housing one of the UK's largest battery energy

storage projects. https://www.saerenewables.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFFRFILEIIV

(END) Dow Jones Newswires

December 05, 2023 11:22 ET (16:22 GMT)

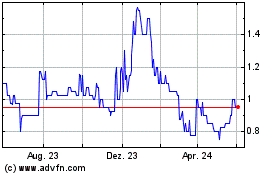

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

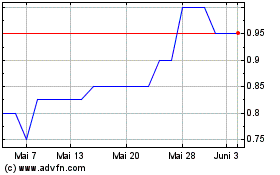

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025