TIDMSAE

RNS Number : 6888N

SIMEC Atlantis Energy Limited

27 September 2023

27 September 2023

SIMEC ATLANTIS ENERGY LIMITED

("SAE", the "Company" and, together with its subsidiaries, the

"Group")

Interim results

SAE announces its unaudited interim results for the six months

ended 30 June 2023. A complete version of the interim results can

be found on the Company website

(www.saerenewables.com/investor-relations/company-documents).

Chairman's Statement

I am pleased to report a strong first half of 2023 for SIMEC

Atlantis Energy Limited ("SAE"), with SAE completing the sale of

its first battery energy storage system ("BESS") development

project at Uskmouth and delivering much improved financial

performance with a profit of GBP4.5million, a result both of the

development premium realised from the sale of this first BESS

development project as well as the significant restructuring of the

business undertaken in 2022.

SAE has built and continues to develop a strong pipeline of

projects on which it is actively executing with a clear focus on

delivering on our strategy to develop alternative energy

solutions.

Marine Energy

MeyGen Phase 1

The MeyGen Phase 1 array continues to operate successfully, with

three turbines in stable operations whilst the fourth is currently

undergoing preventative maintenance and upgrade works and will

return to operation next year.

The MeyGen operations team is doing an excellent job operating

and maintaining the MeyGen Phase 1 turbines and has developed

invaluable expertise and experience that is both enabling the

ongoing successful operation of MeyGen Phase 1 and which is being

brought to the development of MeyGen Phase 2.

Whilst MeyGen Phase 1 has had its challenges, the operating

track record and learnings that have been accumulated since the

commissioning of the MeyGen Phase 1 project have proven the

economic viability of tidal stream generation. I would particularly

like to thank the MeyGen funders, Scottish Enterprise and Crown

Estate Scotland, for their continued unwavering support and

patience, as well as the junior lenders, Engie and Morgan

Stanley.

MeyGen Phase 2

On 8 September 2023, we were delighted to announce that we had

secured a total of 22 MW over four Contracts for Difference

("CfDs") from the UK government in the AR5 allocation round for the

MeyGen site. This is in addition to the 28 MW CfD that we secured

in the AR4 allocation round for MeyGen in July 2022, providing an

aggregate of 50 MW of CfDs for the next phase of the MeyGen

project. The higher strike price of the CfDs awarded under AR5

compared with AR4, coupled with the economies of scale afforded by

the increase in the size of the project to 50 MW, provide a

significant boost to the project economics.

Work continues apace on the development of the MeyGen Phase 2

project, with financial close targeted for Q2 2025 and operation of

the 50 MW array commencing in 2027. Whilst MeyGen Phase 2 remains a

hugely challenging project, securing the revenue for 50 MW of

capacity is a huge step forwards and we will now turn our attention

to securing tidal turbine supply for 3MW turbines, consenting

variations to enable the larger turbines and financing for the

project.

Battery Energy Storage Systems

A key highlight for the first half of 2023 was the successful

execution of the lease agreement for the 230 MW BESS project with

Uskmouth Energy Storage Limited, a portfolio company of Quinbrook

Infrastructure Partners, in June 2023, following which in July 2023

we received the final GBP4.0 million instalment of the GBP10.0

million upfront premium. We are currently exploring options for

monetising the lease income from this project which could deliver

further cashflows to SAE in the short to medium term.

Since closing the sale of this project, we have turned our focus

to developing a pipeline of further BESS projects at Uskmouth and

are actively working on three new BESS projects at Uskmouth that

have the potential to deliver further significant value to

shareholders. We continue to work on the development of a

comprehensive plan for the redevelopment of the Uskmouth site into

a Sustainable Energy Park, in which these BESS projects will form a

key part.

We also continue work on a more than 200 MW BESS project at

MeyGen that could be connected as early as 2027.

The development of BESS projects is critical in support of the

growing dependence of electricity grids on weather dependent

renewable energy sources. With its existing grid connections, real

estate portfolio and experienced engineering and project

development teams, SAE is ideally placed to capitalise on this

opportunity.

Summary of Results

The profit before tax of GBP4.5 million for the six months ended

30 June 2023 compares to a loss of GBP8.6 million reported for the

same period in 2022. The profit reported in this period arises from

the recognition of the GBP10 million development premium received

from Uskmouth Energy Storage Ltd as revenue, following the signing

of the Uskmouth land lease agreement on 20 June 2023. The Group

continues to see the benefits of the restructure it completed in

2022 with lower employee and depreciation costs compared to the

same period last year. Whilst the results were adversely affected

by tidal turbine repair and maintenance costs at MeyGen, these were

also lower than the same period last year.

The GBP4.0 million balance of the development premium described

above was received in July 2023. The initial GBP6.0 million was

received in 2022 as a loan and was recognised as income on the

signing of the Uskmouth land lease in June 2023.

Finance costs in the period are materially in line with the same

period last year.

The unaudited consolidated cash position of the Group as at 30

June 2023 was GBP1.5 million (30 June 2022: GBP3.4 million).

Included in cash and cash equivalents in the statement of financial

position are encumbered deposits of GBP0.8 million (30 June 2022:

GBP0.8 million).

Duncan Black

Chairman

Condensed consolidated statement of profit and loss and

other comprehensive income

For the six months ended 30 June 2023

Group

Six months ended

30 June 30 June

Note 2023 2022

GBP'000 GBP'000

Revenue 12,440 1,266

Other gains and losses 507 2,167

Employee benefits expense (938) (1,323)

Subcontractor costs (2,422) (3,067)

Depreciation and amortisation (1,623) (4,037)

Other operating expenses (1,230) (1,675)

---------- -----------

Total expenses (6,213) (10,102)

Results from operating activities 6,734 (6,669)

Finance costs (2,258) (1,933)

Profit/(loss) before tax 4,476 (8,602)

Tax (charge)/ credit - (1)

Profit/(loss) for the period 4,476 (8,603)

Other comprehensive income:

Items that are or may be reclassified

subsequently to profit or loss

Exchange differences on translation

of foreign operations 43 16

---------- -----------

Total comprehensive income for

the period 4,519 (8,587)

========== ===========

Profit/(loss) attributable

to:

Owners of the Group 5,228 (7,859)

Non-controlling interests (752) (744)

---------- -----------

Total comprehensive income/(loss)

attributable to:

Owners of the Group 5,271 (7,843)

Non-controlling interests (752) (744)

---------- -----------

Profit/(loss) per share (basic

and diluted) (pence) 5 0.68 (1.09)

========== ===========

Condensed consolidated statement of financial position

As at 30 June 2023

Group

30 June 31 December

2022 2022

GBP'000 GBP'000

Assets

Property, plant and equipment 72,842 74,455

Intangible assets 1,465 1,465

Right-of-use assets 1,489 1,331

Investment in joint venture 133 133

Non-current assets 75,929 77,384

------------- --------------

Trade and other receivables 6,928 3,584

Cash and cash equivalents 2,282 3,701

Current assets 9,210 7,285

------------- --------------

Total assets 85,139 84,669

============= ==============

Liabilities

Trade and other payables (6,768) (6,573)

Lease liabilities (296) (296)

Loans and borrowings (12,876) (15,895)

Current liabilities (19,940) (22,764)

------------- --------------

Lease liabilities (1,166) (1,000)

Provisions (12,688) (12,581)

Loans and borrowings (40,345) (41,890)

Deferred tax liabilities (752) (752)

------------- --------------

Non-current liabilities (54,951) (56,223)

------------- --------------

Total liabilities (74,891) (78,987)

------------- --------------

Net assets 10,248 5,682

============= ==============

Equity

Share capital 201,496 201,496

Capital reserve 12,665 12,665

Translation reserve 7,101 7,058

Share option reserve 419 420

Accumulated losses (211,009) (216,285)

Total equity attributable to owners

of the Company 10,672 5,354

Non-controlling interests (424) 328

------------- --------------

Total equity 10,248 5,682

============= ==============

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2023

Attributable to owners of the Company

------------------------------------------------------------

Share Non-

Share Capital Translation option Accumulated controlling

capital reserve reserve reserve losses Total interest Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Group

At 1 January 2022 201,496 12,665 7,121 576 (206,910) 14,948 1,739 16,687

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total comprehensive

income for the

period

Loss for the period - - - - (7,859) (7,859) (744) (8,603)

Other comprehensive

income - - 16 - - 16 - 16

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total comprehensive

income for the

period - - 16 - (7,859) (7,843) (744) (8,587)

Transactions with

owners

Contributions and

distributions

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Issue of share - -

capital - - - - - -

Recognition of

share-based

payments - - - 53 - 53 - 53

Transfer between

reserves - - - (250) 250 - - -

Total transactions

with owners - - - (198) 250 53 - 53

------- ------- ----------- ------- ----------- ------- ----------- -------

At 30 June 2022 201,496 12,665 7,137 379 (214,519) 7,158 995 8,153

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total comprehensive

income for the

period

Loss for the period - - - - (1,790) (1,790) (667) (2,457)

Other comprehensive

loss - - (79) - - (79) - (79)

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total comprehensive

income for the

period - - (79) - (1,790) (1,869) (667) (2,536)

Transactions with

owners

Contributions and

distributions

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Issue of share

capital

net of issue costs - - - - - - - -

Recognition of

share-based

payments - - - 65 - 65 - 65

Transfer between

reserves - - - (24) 24 - - -

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total transactions

with owners - - - 41 24 65 - 65

------- ------- ----------- ------- ----------- ------- ----------- -------

At 31 December 2022 201,496 12,665 7,058 420 (216,285) 5,354 328 5,682

Total comprehensive

income for the

period

Profit/(Loss) for

the

period - - - - 5,228 5,228 (752) 4,476

Other comprehensive

income - - 43 - - 43 - 43

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total comprehensive

income for the

period - - 43 - 5,228 5,271 (752) 4,519

Transactions with

owners

Contributions and

distributions

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Issue of share - -

capital

net of issue costs - - - - - -

Recognition of

share-based

payments - - - 47 - 47 - 47

Transfer between

reserves - - - (48) 48 - - -

-------------------- ------- ------- ----------- ------- ----------- ------- ----------- -------

Total transactions

with owners - - - (1) 48 47 - 47

------- ------- ----------- ------- ----------- ------- ----------- -------

At 30 June 2023 201,496 12,665 7,101 419 (211,009) 10,672 (424) 10,248

------- ------- ----------- ------- ----------- ------- ----------- -------

Condensed consolidated statement of cash flows

For the six months ended 30 June 2023

Group

Six months ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Cash flows from operating activities

Profit/(loss) before tax for the

period 4,476 (8,602)

Adjustments for:

Grant income - (31)

Depreciation of property, plant and

equipment 1,623 4,018

Amortisation of intangible asset - 19

Interest income (31) (10)

Finance costs 2,258 1,933

Share-based payments 47 53

Provision movement - (84)

Net foreign exchange (83) 103

Operating cash flows before movements

in working capital 8,290 (2,601)

Movement in trade and other receivables (3,344) (301)

Movement in trade and other payables 195 (354)

Interest received 31 -

Net cash used in operating activities 5,172 (3,256)

------------- -------------

Cash flows from investing activities

Purchase of property, plant and equipment - -

Loan to joint venture - (24)

Proceeds from disposal of scrap - 1,155

Net cash used in investing activities - 1,131

------------- -------------

Cash flows from financing activities

Proceeds from grants received - 31

Proceeds from borrowings - 2,500

Repayment of borrowings (6,000) -

Deposits (pledged) / released (13) (1)

Payment of lease liabilities (44) (31)

Interest paid (571) -

Net cash from financing activities (6,628) 2,499

------------- -------------

Net (decrease)/increase in cash

and cash balances (1,456) 375

Cash and cash equivalents at beginning

of period 2,929 3,004

Effect of foreign exchange on cash

held in currency 24 (4)

Cash and cash equivalents at end

of period 1,497 3,375

============= =============

Included in cash and cash equivalents in the statements of

financial position is GBP0.8 million (2022: GBP0.8 million) of

encumbered deposits.

Notes to the Consolidated Interim Financial Statements

The unaudited condensed consolidated statement of financial

position of SIMEC Atlantis Energy Limited (the "Company") and its

subsidiaries (the "Group") as at 30 June 2023, the condensed

consolidated statement of profit or loss and other comprehensive

income, the condensed consolidated statement of changes in equity

and the condensed consolidated statement of cash flows for the

Group for the six-month period then ended and certain explanatory

notes (the "Consolidated Interim Financial Statements"), were

approved by the Board of Directors for issue on the 26(th)

September 2023.

These notes form an integral part of the Consolidated Interim

Financial Statements.

The Consolidated Interim Financial Statements do not comprise

statutory accounts of the Group within the meaning in the

provisions of the Singapore Companies Act, Chapter 50. The Group's

statutory accounts for the year ended 31 December 2022 were

prepared in accordance with Singapore Financial Reporting Standards

(International) (SFRS(I)) and International Financial Reporting

Standards (IFRS). SFRS(I)s are issued by the Accounting Standards

Council Singapore, which comprise standards and interpretations

that are equivalent to IFRS issued by the International Accounting

Standards Board. All references to SFRS(I)s and IFRSs are

subsequently referred to as IFRS in these financial statements

unless otherwise specified.

The Group's statutory accounts for the year ended 31 December

2022 were approved by the Board of Directors on 25 July 2022.

1 Domicile and activities

The Company is a company incorporated in Singapore. The

Company's registered office address is c/o Level 4, 21 Merchant

Road, #04-01, Singapore 058267. The principal place of business is

26 Dublin Street, Edinburgh, EH3 6NN, United Kingdom.

The principal activity of the Group is to develop and operate as

a global sustainable energy provider. The Group holds equity

positions in the world's flagship tidal stream project, MeyGen, and

the Uskmouth power station site, that is being repurposed into a

Sustainable Energy Park initially housing battery energy storage

projects.

2 Significant accounting policies

Basis of preparation

The Consolidated Interim Financial Statements have been prepared

in accordance with the AIM Rules for Companies and are therefore

not required to comply with International Accounting Standard 34

Interim Financial Reporting to maintain compliance with IFRS. In

all other respects, the financial statements are drawn up in

accordance with International Financial Reporting Standards as

issued by the International Accounting Standards Board.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial position and performance of the Group since

the last annual consolidated financial statements as at and for the

year ended 31 December 2022.

The Consolidated Interim Financial Statements, which do not

include the full disclosures of the type normally included in a

complete set of financial statements, are to be read in conjunction

with the last issued consolidated financial statements of the Group

as at and for the year ended 31 December 2022.

Accounting policies

The accounting policies and method of computation used in the

Consolidated Interim Financial Statements are consistent with those

applied in the last issued consolidated financial statements of the

Group for the year ended 31 December 2022.

3 Critical accounting judgements and key sources of estimation uncertainty

In preparing this set of Consolidated Interim Financial

Statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 31 December

2022.

4 Going concern basis

In adopting the going concern basis for preparing the Interim

Financial Statements, the Board has considered the Group's business

activities, together with factors likely to affect its future

development, its performance and principal risks and uncertainties.

The Board has undertaken the assessment of the going concern

assumptions using financial forecasts for the period to 31 December

2024.

Management has prepared a forecast through to 31 December 2024

based on contractually committed revenues and costs, an estimate of

additional costs required and the income arising from development

projects that are expected to be delivered within the forecast

period.

The Directors' assessment of the appropriate use of the going

concern basis included the following factors:

-- Repayment of the Abundance bond principals falling due in

March 2024, June 2024 and September 2024. The Company may either

seek to repay the bonds, extend the repayment date of the bonds or

refinance the bonds with new debt.

-- Timing of the potential repayment of historical grant funding

of an amount of GBP3.4 million as reported in the consolidated

financial statements for the year ended 31 December 2022. The Board

are of the view that there are grounds for disputing any clawback

of this grant and

the Company has evidence to support this position.

The Board has identified significant factors that are of a

material amount as outlined above, and the Board has identified

sufficient evidence of success that includes achievable new sources

of revenue that mitigate against the existence of material

uncertainties about the Group's ability to continue as a going

concern. The evidence is summarised as follows:

-- Monetising the rental income from the first battery energy storage system lease at Uskmouth

-- Sale of a ready to build site for a 120MW battery energy

storage system at Uskmouth, with a targeted completion date in

2024.

Accordingly, the Board of Directors concluded that it is

appropriate to adopt the going concern basis of accounting in

preparing the Interim Financial Statements.

5 Other notes

In respect of the six months to 30 June 2023, the diluted

earnings per share is calculated on a profit attributable to owners

of the Company of GBP5.3 million on the weighted average of

722,812,335 ordinary shares (30 June 2022: loss of GBP7.9 million

and basic weighted average shares of 722,812,335). Share options

were excluded from the diluted weighted average number of ordinary

shares calculation as their effect would have been anti-dilutive.

No dividend has been declared (2022: nil).

6 Events after the reporting date

As announced on 8 September 2023, the Group secured a Contract

for Difference (CfD) allocation from the UK Government guaranteeing

GBP198/MWh for 15 years for 22MW of clean, predictable power from

the MeyGen site.

For further information, please contact:

SAE Renewables

Sean Parsons, Director of External

Affair +44 (0)7739 832 446

Strand Hanson Limited (Nominated

and Financial Adviser)

Richard Johnson

Rory Murphy

David Asquith +44 (0)20 7409 3494

Zeus Capital Limited (Broker)

Louisa Waddell

Simon Johnson +44 (0)20 3829 5000

Notes to Editors

SAE is a global developer, owner and operator of sustainable

energy projects. SAE owns the world's flagship tidal stream

project, MeyGen. SAE is also the owner of the Uskmouth Power

Station site that is being repurposed into a sustainable energy

park, initially housing one of the UK's largest battery energy

storage projects.

https://www.saerenewables.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VQLBLXKLEBBD

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

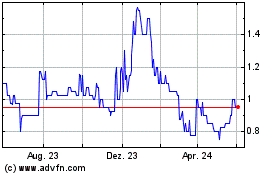

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

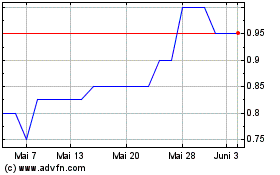

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025