FlexShares® ETFs Notice to Shareholders

19 Dezember 2023 - 6:36PM

UK Regulatory

TIDMQDFD TIDMQVFD

Date: 19 December 2023

Notice to Shareholders of the following sub-fund(s) of FlexShares ICAV (the

"Company"):

+---------------------------------+--------------------+------------+------+

|Sub-Fund |Share Class |ISIN |TICKER|

+---------------------------------+--------------------+------------+------+

|FlexShares® Developed Markets Low|USD Accumulating ETF|IE00BMYDBG17|QVFD |

|Volatility Climate ESG UCITS ETF | | | |

+---------------------------------+--------------------+------------+------+

|FlexShares® Developed Markets |USD Distributing ETF|IE00BMYDBM76|QDFD |

|High Dividend Climate ESG UCITS | | | |

|ETF | | |DFDU |

+---------------------------------+--------------------+------------+------+

(each a "Fund" together, the "Funds")

IMPORTANT - PLEASE READ - ACTION REQUIRED ON OR BEFORE 16 JAN 2024

Dear Shareholder,

Following a recommendation of the Funds' Manager, Northern Trust Fund Managers

(Ireland) Limited and acting in accordance with the applicable provisions of the

Prospectus, the Directors of the Company intend to the close the Funds on the

basis that each of the Funds are below their stated Minimum Fund Size of USD 20

million.

The Directors wish to give notice to all holders of shares in the Funds (the

"Shares") that it is the intention of the Company to (i) permanently de-list the

Funds from all Relevant Exchanges (as defined below) (the "De-listing"), (ii)

permanently close the Funds further subscriptions and redemptions by Authorised

Participants and (iii) compulsorily redeem any residual shareholdings in the

Funds (the "Compulsory Redemption") in accordance with the procedure and the

dates set out under the headings "Procedure and Key Dates respectively below.

PLEASE NOTE THAT:

1) If you have not sold your Shares on or before 16 JAN 2024 (the last day

for trading on each Relevant Exchange) and you remain registered as a

Shareholder in any of the Funds as at 26 JAN 2024; OR

2) If you have not validly applied for redemption of your Shares on or

before 17 JAN 2024 and you remain registered as a Shareholder in any of the

Funds as at 26 JAN 2024,

The Directors will exercise their discretion in accordance with Article 39.2 of

the Company's Instrument of Incorporation to compulsorily redeem your shares in

the Funds for cash.

Procedure and Key Dates

As part of the process of closing and winding-up the Funds, it will be necessary

for the following steps to take place:

1) The final day for trading on each of the stock exchanges on which the Shares

are listed, such exchanges being Euronext Amsterdam, London Stock Exchange and

Deutsche Börse (the "Relevant Exchanges"), shall be 16 JAN 2024 (the "Final

Exchange Trading Date").

2) De-listing: The Shares of each Fund shall be de-listed (or suspended from

trading, in respect of the Deutsche Börse) from each of the Relevant Exchanges

with effect from 17 JAN 2024 which shall also be the last day on which

applications for subscriptions and redemptions by authorised participants shall

be accepted.

3) The last "Dealing Day" (as such term is defined in the Prospectus) in respect

of which applications for subscriptions and redemptions shall be accepted from

Authorised Participants shall be 18 JAN 2024 (the "Final Primary Dealing

Date"). Applications for subscriptions and redemptions in respect of the Final

Primary Dealing Date must be received no later than 4:00pm on 17 JAN 2024 (i.e.,

the "Dealing Deadline" applicable to the Funds as prescribed by the Prospectus)

otherwise they shall be rejected.

4) Dealing in the Funds shall be suspended (i.e., closed to further

subscriptions and redemptions) with effect from and including the day

immediately following the Final Primary Dealing Date and the investments in the

Sub-Funds will be liquidated for the purposes of the payment distribution to

Shareholders on or shortly after the Final Distribution Date (as defined below).

5) Please note that if you have not sold your Shares on or before the Final

Exchange Trading Date or redeemed your Shares in full on or before the Final

Primary Dealing Date, and you remain listed as a shareholder of Shares in either

of the Funds as at 26 JAN 2024 (the anticipated "Compulsory Redemption Date"),

the Directors will exercise their discretion to compulsorily redeem your Shares

in the relevant Fund on the Compulsory Redemption Date for cash.

6) If your shareholding is compulsorily redeemed, it will be redeemed at the

appropriate net asset value per share on the date on Compulsory Redemption Date

and your Compulsory Redemption proceeds shall be distributed on or around 02 FEB

2024 (the "Final Distribution Date"). Subject to all redemption requests

requirements having been complied with, the proceeds of the Compulsory

Redemption will be paid to the account of the relevant shareholder on record

with the Paying Agent of the Company for the relevant Shareholder.

Further Information:

Shareholders may obtain the prospectus, a copy of the supplement, the key

information documents, the latest annual and semi-annual reports and copies of

the instrument of incorporation free of charge from the local representatives in

the countries where the Company is registered, including from the Manager,

Northern Trust Fund Managers (Ireland) Limited, 54-62 Townsend Street, Dublin 2,

Ireland, who also acts as EEA Facilities Agent, the German Facilities Agent,

ACOLIN Europe AG at Reichenaustrasse 11a- c, 78467 Konstanz, Germany and via

www.flexshares.com or by writing to the Fund's administrator Northern Trust

International Fund Administration Services (Ireland) Limited at George's Court,

54-62 Townsend Street, Dublin 2, Ireland.

Please note that as part of the closure process and before the final redemption

date, the ability to meet the investment objective of the Funds may be

compromised as the underlying portfolios are liquidated and there may

accordingly be an increased risk of tracking error in the Funds. The additional

costs incurred in respect of closing the Funds will be paid by Investment

Manager. The Funds' normal operating costs and transaction costs will continue

to be borne by the Funds and their respective Shareholders in accordance with

the terms of the Prospectus for the Funds.

Investors should consult their own professional advisers as to the tax

implications of the Compulsory

Redemption and closure of the Funds under the laws of the countries of their

nationality, residence,

domicile or incorporation.

If you have sold or transferred your Shares in the relevant Fund please pass

this letter at once to the purchaser or transferee of the Shares, as the case

may be, or to the Authorised Participant or other agent through whom the sale or

transfer was affected, for transmission to the purchaser or transferee as soon

as possible.

In closing the Fund, the Directors would like to extend our thanks for your

support of the Fund. If you have any questions or need any additional support or

information, please email EMEA_FlexShares@ntrs.com or contact your usual

financial adviser, and they can provide you with the necessary fund information

and documents.

Yours sincerely,

[image]

__________________

Director

for and on behalf of

FlexShares ICAV

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 19, 2023 12:36 ET (17:36 GMT)

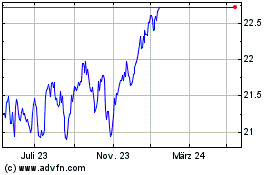

Flexshares Dm V (LSE:QVFD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Flexshares Dm V (LSE:QVFD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025