Merit Group PLC Trading Update (5981J)

28 April 2022 - 8:00AM

UK Regulatory

TIDMMRIT

RNS Number : 5981J

Merit Group PLC

28 April 2022

28 April 2022

Merit Group plc (formerly Dods Group plc)

("Merit", the "Company" or "the Group")

Merit Group plc, the data and intelligence business, provides

the following trading update for the year ending 31 March 2022.

The Group traded ahead of market expectations in the year.

Revenues for the year ending 31 March 2022 were over 10% up year on

year, contributing to adjusted EBITDA being ahead of market

expectations at around GBP2.8m (FY22 GBP2.0m). Stronger trading

contributed to the Group finishing the year with net debt also

better than market expectations at GBP2.2 million (pre lease

liabilities).

In April 2021 the Group changed its name from Dods Group to

Merit Group to signal its intention to focus on the business

intelligence sector through its technology enabled data and

intelligence business streams. The Group is a leading provider of

UK and European political intelligence to a subscriber base of

c1000 blue chip clients. Through its Merit Data & Technology

division, based in Chennai, India, the Group also provides large

volume data capture and analysis using its proprietary technology

and skilled workforce. Both these parts of the Group benefit from

very high levels of recurring revenue, with the political

intelligence product sold as a long term subscription service.

The Board is encouraged by the improvement in its revenue during

the year and expects to build on this during the year ending 31

March 2023. The global implications of the war in Ukraine and

ongoing inflationary pressures across the world economy are risk

factors faced by all.

Full details of the Company's performance in the year ending 31

March 2022 will be disclosed with the publication of its audited

results in July.

David Beck, CEO of Merit Group plc, said;

"We look forward to publishing audited results for the year that

will show a continuing recovery in both revenue and adjusted

EBITDA, ahead of market expectations. The Group's recovery and

improved financial performance will allow us to concentrate on our

strategic goal of building a strong growth company focused on

technology enabled business intelligence."

For further information, please contact:

Merit Group plc

Mark Smith - Non-Executive Chairman 020 7593 5500

David Beck - CEO

www.meritgroupplc.com

Canaccord Genuity Limited (Nomad and Broker)

Bobbie Hilliam 020 7523 8150

Georgina McCooke

Prior to publication the information communicated in this

announcement was deemed by the Company to constitute inside

information for the purposes of article 7 of the Market Abuse

Regulations (EU) No 596/2014 as amended by regulation 11 of the

Market Abuse (Amendment) (EU Exit) Regulations No 2019/310 ('MAR').

With the publication of this announcement, this information is now

considered to be in the public domain. This announcement is being

made on behalf of the Group by David Beck, Chief Executive

Officer.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKLXAADAEFA

(END) Dow Jones Newswires

April 28, 2022 02:00 ET (06:00 GMT)

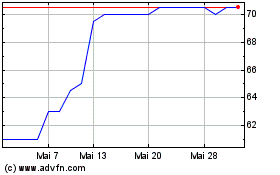

Merit (LSE:MRIT)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Merit (LSE:MRIT)

Historical Stock Chart

Von Apr 2024 bis Apr 2025