Harland & Wolff Group Holdings PLC Update re. New Credit Facility (1207Y)

29 Dezember 2023 - 8:00AM

UK Regulatory

TIDMHARL

RNS Number : 1207Y

Harland & Wolff Group Holdings PLC

29 December 2023

This announcement contains inside information.

29 December 2023

Harland & Wolff Group Holdings plc

("Harland & Wolff" or the "Company")

GBP200 Million Credit Facility & Associated

UK Export Finance Export Development Guarantee

Harland & Wolff Group Holdings plc (AIM: HARL), the UK

quoted company focused on strategic infrastructure projects and

physical asset lifecycle management, reports that it has sought and

obtained permission from Ministers to advance negotiations in

relation to the proposed GBP200 million guaranteed loan facility

with UK Export Finance (UKEF) under its Export Development

Guarantee Scheme ("EDG Scheme").

In order to ensure that the proposed loan facility is compliant

with the relevant rules where UKEF was to provide a 100% guarantee

to UK commercial lending banks ("Banks"), UKEF will now appoint an

independent third party to ascertain an appropriate premium over

SONIA. This process will commence in January 2024.

Following ministerial approval to progress negotiations, the

Company will now firm up the Bank syndicate and appoint a lead

arranger. In parallel, the Company will commence necessary

documentation in relation to the credit and guarantee agreements as

well as the security package that will be offered. It is likely

that the security package will entail providing the Banks with a

first charge on substantially all the assets of the Company,

similar to what has been provided to Riverstone Credit Partners in

March 2022. This transaction will be subject to the agreement of

Ministers, final approval of the financing terms, and Investment

Committee approvals of the Banks.

The Company also reports that no warrants are expected to be

issued to the Banks or UKEF.

Through a combination of cash currently held on the balance

sheet and expected cash flows in 2024 generated from existing

contracts, the Directors consider that the Company has sufficient

funds to meet its working capital requirements until the new loan

facility is completed.

A further detailed announcement will be made by the Company in

the event that this credit facility and associated guarantee is

placed, and the transaction has been executed.

For further information, please visit www.harland-wolff.com or contact:

Harland & Wolff Group Holdings plc +44 (0)20 3900

John Wood, Chief Executive Officer 2122

Arun Raman, Chief Finance Officer investor@harland-wolff.com

media@harland-wolff.com

Cavendish Securities plc (Nominated Adviser

& Broker)

Stephen Keys / Callum Davidson / Dan Hodkinson

(Corporate Finance) +44 (0)20 7397

Michael Johnson (Sales) 8900

----------------------------

Liberum Capital Limited (Joint Broker) +44 (0)20 3100

Nicholas How / Edward Mansfield 2000

----------------------------

Radnor Capital Partners (Investor Relations) +44 (0) 20 3897

Neville Harris / Joshua Cryer 1838

----------------------------

About Harland & Wolff

Harland & Wolff is a multisite fabrication company,

operating in the maritime and offshore industry through five

markets: commercial, cruise and ferry, defence, energy and

renewables and six services: technical services, fabrication and

construction, decommissioning, repair and maintenance, in-service

support and conversion.

Its Belfast yard is one of Europe's largest heavy engineering

facilities, with deep water access, two of Europe's largest

drydocks, ample quayside and vast fabrication halls. As a result of

the acquisition of Harland & Wolff (Appledore) in August 2020,

the company has been able to capitalise on opportunities at both

ends of the ship-repair and shipbuilding markets where there will

be significant demand.

In February 2021, the company acquired the assets of two

Scottish-based yards along the east and west coasts. Now known as

Harland & Wolff (Methil) and Harland & Wolff (Arnish),

these facilities will focus on fabrication work within the

renewables, energy and defence sectors.

In addition to Harland & Wolff, it owns the Islandmagee gas

storage project, which is expected to provide 25% of the UK's

natural gas storage capacity and to benefit the Northern Irish

economy as a whole when completed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBIBDDDDDDGXI

(END) Dow Jones Newswires

December 29, 2023 02:00 ET (07:00 GMT)

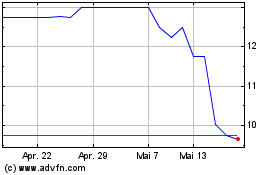

Harland & Wolff (LSE:HARL)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Harland & Wolff (LSE:HARL)

Historical Stock Chart

Von Jan 2024 bis Jan 2025