Falcon Oil & Gas Ltd - Results of Fundraising

THIS ANNOUNCEMENT (INCLUDING THE

APPENDIX) AND THE INFORMATION CONTAINED HEREIN IS RESTRICTED AND IS

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, BY ANY MEANS OR MEDIA, IN OR INTO OR FROM

THE UNITED STATES, AUSTRALIA, NEW ZEALAND, JAPAN OR THE REPUBLIC OF

SOUTH AFRICA, OR ANY OTHER JURISDICTION IN WHICH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION

PURPOSES ONLY AND DOES NOT ITSELF CONSTITUTE A PROSPECTUS OR

OFFERING MEMORANDUM NOR DOES IT CONSTITUTE AN ADMISSION DOCUMENT

PREPARED IN ACCORDANCE WITH THE AIM RULES OR FORM PART OF ANY

OFFER, RECOMMENDATION, INVITATION TO SELL OR ISSUE, OR ANY

SOLICITATION OF ANY OFFER TO PURCHASE OR SUBSCRIBE FOR, ANY

SECURITIES IN THE CAPITAL OF THE COMPANY. ACCORDINGLY, THIS

ANNOUNCEMENT HAS NOT BEEN APPROVED BY OR FILED WITH THE FCA AND

NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS DISTRIBUTION SHOULD

FORM THE BASIS OR, OR BE RELIED ON IN CONNECTION WITH, ANY

INVESTMENT DECISION IN RESPECT OF THE COMPANY OR OTHER EVALUATION

OF ANY SECURITIES OF THE COMPANY OR ANY OTHER ENTITY AND SHOULD NOT

BE CONSIDERED AS A RECOMMENDATION THAT ANY INVESTOR SHOULD

SUBSCRIBE FOR OR PURCHASE ANY SUCH SECURITIES.

THE INFORMATION COMMUNICATED IN THIS

ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF

ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) NO.596/2014

(AS IT FORMS PART OF UK DOMESTIC LAW BY

VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018)

("UK MAR"). IN ADDITION, MARKET SOUNDINGS

(AS DEFINED IN UK MAR) WERE TAKEN IN RESPECT OF CERTAIN OF THE

MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH

THE RESULT THAT CERTAIN

PERSONS BECAME AWARE

OF SUCH INSIDE INFORMATION, AS PERMITTED

BY UK MAR. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE,

THIS INSIDE

INFORMATION IS

NOW CONSIDERED

TO BE IN THE

PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE

IN POSSESSION OF INSIDE INFORMATION.

22 April

2024

Falcon Oil

& Gas

Ltd

(“Falcon”, the “Company” or the

“Group”)

Results of Fundraising

Falcon Oil & Gas Ltd (AIM: FOG, TSXV: FO.V),

the international oil and gas company engaged in the exploration

and development of unconventional oil and gas assets, is pleased to

confirm the results of the proposed Fundraising announced by the

Company on 18 April 2024.

The Company can confirm that the Bookbuild has

been completed and Falcon has, conditionally, raised gross proceeds

of c. $4.9 million (c. £3.9 million) through the Subscription and

Placing, for a total number of 64,794,087 New Common Shares at an

Issue Price of 6p per share.

As previously announced, alongside the

Fundraising, Falcon Oil & Gas Australia Limited

(“Falcon Australia”) has agreed to grant Daly

Waters Energy, LP (“Daly Waters”) and a major

US-based energy industry service provider overriding royalty

interests (“ORRIs”) over Falcon Australia’s

working interests in the Beetaloo Sub-Basin exploration permits in

return for cash payments of US$3 million and US$1 million,

respectively. Completion of the grant of the ORRIs is subject to

agreement of final legal documentation and to submission to the

Northern Territory Government, Australia for registration.

The net proceeds of the Fundraising, together

with the Company’s existing cash resources of c.US$4.3 million, the

balance of Falcon’s net carry of A$3.75m due from Tamboran and the

consideration from the grant of the ORRIs, if finalised, will

primarily be used to fund Falcon’s share of estimated capital

expenditure in respect of the work to be carried out on the

proposed Shenandoah South Pilot Project (the

“Pilot”) in 2024, including the drilling of two

3,000m horizontal wells and the stimulation and flow test of two

wells in the Beetaloo Sub-basin, Australia. These proceeds will

also enable Falcon to fund its share of the cost of the planned

330km2 of 3D seismic survey around the Pilot area, which

it is expected will be acquired during Q4 24 with processed results

being available by Q1 25.

Sheffield Holdings LP

Participation

Sheffield Holdings LP

(“Sheffield”), an affiliate of Daly Waters, has

subscribed for a total of 19,912,791 New Common Shares as part of

the Subscription. Following the issue of the New Common Shares,

Sheffield will have a total interest in 116,386,398 Common Shares,

representing 10.49 per cent of the enlarged issued share capital.

Exceeding 10 per cent will result in Sheffield becoming an insider

of the Company, which requires the approval of the TSX Venture

Exchange. Accordingly, Sheffield’s participation in the

Subscription will be effected in two tranches – firstly, through

the issue of 13,274,194 New Common Shares to Sheffield (which will

be issued and admitted to trading on AIM alongside the other

Placing Shares and Subscription Shares (together, the

“First Admission”)) and, secondly, through the

issue to Sheffield of a further 6,638,597 New Common Shares (which

will be admitted to trading on AIM following TSX Venture Exchange

approval of Sheffield as an insider of the Company (the

“Second Admission”)).

Director Participation

Thomas Layman, a Director of the Company,

participated in the Fundraising. The number of New Common Shares

conditionally subscribed for by him pursuant to the Subscription,

and his resulting shareholding on First Admission, is set out

below:

|

Director |

Number of Existing Ordinary Shares |

Number of Subscription Shares |

Number of Common Shares on First Admission

1 |

Percentage of Enlarged Issued Share Capital on Admission

1 |

|

|

|

|

|

|

|

Thomas Layman, NED |

1,120,000 |

663,760 |

1,783,760 |

0.16% |

|

|

|

|

|

|

- Assuming that no employee share

incentives or options are exercised between the date of this

Announcement and First Admission.

|

Application for Admission

The Fundraising is conditional on the admission

of the New Common Shares to trading on AIM and the approval of the

TSX Venture Exchange. It is expected that settlement of the

relevant New Common Shares forming part of the First Admission

(being 58,155,490 New Common Shares) will occur on 26 April 2024

and that admission will become effective and dealings in those New

Common Shares will commence on AIM at 8.00 a.m. on 26 April 2024.

The New Common Shares will not trade on the TSX Venture Exchange

Market until the date that is four months and a day after the day

of issuance.

The New Common Shares will, when issued, be

subject to the articles of association of the Company and credited

as fully paid and will rank equally in all respects with the

existing Common Shares, including the right to receive all

dividends and other distributions declared, made or paid in respect

of such Common Shares after the date of issue of the Placing

Shares. The Company’s total issued share capital following First

Admission will be 1,102,502,915 Common Shares. A separate

announcement will be made in respect of the Second Admission.

UK Market

Abuse Regulation

This Announcement contains inside information

for the purposes of Article 7 of UK MAR. Market soundings, as

defined in UK MAR, were taken in respect of the Placing, with the

result that certain persons became aware of inside information, as

permitted by UK MAR. That inside information is set out in this

Announcement and has been disclosed as soon as possible in

accordance with paragraph 7 of Article 17 of UK MAR. Therefore,

those persons that received inside information in a market sounding

are no longer in possession of inside information relating to the

Company and its securities. The person responsible for arranging

the release of this announcement on behalf of Falcon is Phillip

O’Quigley.

|

For further information on the Announcement, please contact: |

|

|

Falcon Oil &

Gas Ltd |

+353 1 676 8702 |

|

Philip O’Quigley / Anne Flynn |

|

Cavendish Capital Markets Limited

(Nominated Adviser and

Bookrunner)

|

+44 131 220 9771 |

Neil McDonald / Adam Rae

|

|

Capitalised terms used but not defined in the

text of this Announcement shall have the meanings given to them in

the announcement made by the Company at 12.30 on 18 April 2024.

About Falcon

Oil & Gas

Ltd

Falcon is an international oil and gas company

engaged in the exploration and development of unconventional oil

and gas assets, with the current portfolio focused in Australia,

South Africa and Hungary. Falcon is incorporated in British

Columbia, Canada and headquartered in Dublin, Ireland with a

technical team based in Budapest, Hungary.

Falcon is listed on AIM and the TSX Venture

Exchange Market.

EXCHANGE RATES

Conversions from A$ to US$ in this announcement

have been conducted at an exchange rate of 1.55:1 being the

relevant exchange rate on 18 April 2024. Conversions from US$ to £

in this announcement have been conducted at an exchange rate of

0.8:1 being the relevant exchange rate on 18 April 2024.

Forward-Looking Information

The Announcement contains (or may contain)

certain forward-looking statements that are subject to risks and

uncertainties. Forward looking statements include statements

relating to the following: (i) future capital expenditures,

expenses, revenues, earnings, synergies, economic performance,

indebtedness, financial condition, dividend policy, losses and

future prospects; (ii) business and management strategies and the

expansion and growth of the Company’s operations; (iii) completion

of the grant of the ORRIs; (iv) the completion of the Fundraising,

including the First Admission and the Second Admission; and (v) the

use of proceeds of the Fundraising and the grant of the ORRIs.

These statements, which sometimes use words such as "anticipate",

"believe", "intend", "estimate", "expect", "will", "may", "should",

"plan", "target", "aim" and words of similar meaning or similar

expressions or negatives therefor, reflect the Directors' beliefs

and expectations and involve a number of risks, uncertainties and

assumptions that could cause actual results and performance to

differ materially from any expected future results or performance

expressed or implied by any such forward-looking statement. Many of

these risks and uncertainties relate to factors that are beyond the

Company’s ability to control or estimate precisely, such as (i)

price fluctuations in crude oil and natural gas; (ii) currency

fluctuations; (iii) drilling and production results; (iv) reserves

estimates; (v) loss of market share and industry competition; (vi)

environmental and physical risks; (vii) risks associated with the

identification of suitable potential acquisition properties and

targets, and successful negotiation and completion of such

transactions; (viii) legislative, fiscal and regulatory

developments including regulatory measures addressing climate

change; (ix) economic and financial market conditions in various

countries and regions; (x) political risks, including the risks of

renegotiation of the terms of contracts with governmental entities,

delays or advancements in the approval of projects and delays in

the reimbursement of shared costs; (xi) drilling wells is

speculative, often involving significant costs that may be more

than estimated and may not result in discoveries and (xii) changes

in trading conditions. The Company cannot give any assurance that

such forward-looking statements will prove to have been correct.

Statements contained in the Announcement regarding past trends or

activities should not be taken as a representation that such trends

or activities will continue in the future. The information

contained in the Announcement is subject to change without notice

and, except as required by applicable law, neither the Bookrunner

nor the Company assumes any responsibility or obligation to update

publicly or review any of the forward-looking statements contained

herein whether as a result of new information, future events or

otherwise. You should not place undue reliance on forward-looking

statements, which speak only as of the date of the Announcement.

Nothing contained herein shall be deemed to be a forecast,

projection or estimate of the future financial performance of the

Company or any other person following the implementation of the

Placing or otherwise.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Director / PDMR Shareholding

|

1 |

Details of the person discharging managerial

responsibilities/person closely associated |

|

|

a) |

Name |

Tom Layman |

|

2 |

Reason for notification |

|

|

a) |

Position/Status |

Non - Executive Director |

|

b) |

Initial notification/Amendment |

Initial Notification |

|

3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

|

a) |

Name |

Falcon Oil & Gas Ltd. |

|

b) |

LEI |

213800KQY87Z1KNPIM76 |

|

4 |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

|

a) |

Description of the financial instrument, type of instrument

Identification code |

Common shares in the Company

AIM: FOG TSXV: FO |

|

b) |

Nature of the transaction |

Purchase of common shares in the Company |

c)

|

Price(s) and volume(s)

|

Price(s) |

Volume(s) |

|

£0.06 |

663,760 common shares in the Company |

|

d) |

Aggregated information

|

N/A |

|

e) |

Date of the transaction |

19 April 2024 |

|

f) |

Place of the transaction |

Off market |

- 042224 - FINAL - Results Announcement

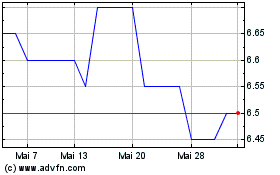

Falcon Oil & Gas (LSE:FOG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Falcon Oil & Gas (LSE:FOG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024