Crown Place VCT PLC Crown Place Vct Plc : Interim Management Statement

22 April 2020 - 6:30PM

UK Regulatory

TIDMCRWN

Crown Place VCT PLC

Interim Management Statement

LEI Code: 213800SYIQPA3L3T1Q68

Introduction

I present Crown Place VCT PLC's (the "Company's") interim management

statement for the period from 1 January 2020 to 31 March 2020.

Impact of coronavirus (Covid-19) and Net asset value

The Board has been monitoring the ongoing disruption caused by the

coronavirus (Covid-19) pandemic and its current and potential impact on

portfolio companies.

In light of this, the Company announces its unaudited net asset value

(NAV) as at 31 March 2020 of GBP63.12 million or 32.02 pence per share

(excluding treasury shares). After accounting for a dividend of 1 penny

per share paid on 31 March 2020, the NAV has decreased by 1.71 pence per

share (5.07%) since 31 December 2019. This reflects reductions across

the portfolio, which is carried at fair value, as a result of market

conditions arising from the healthcare pandemic. The Board has

reassessed the carrying values of all companies within the portfolio and

has reduced those which are affected by the current situation. The

portfolio is well diversified and has weightings in sectors that are

less badly affected by coronavirus (Covid-19), such as renewable energy,

and many companies within the portfolio are well suited to operating in

a remote environment.

Principally as a result of disposals towards the end of 2019, and the

allotment of new shares under the Albion VCTs Prospectus Top Up Offers

2019/20, the Company had cash balances of GBP24.7 million at 31 March

2020. This represents 39% of net assets and somewhat mitigated the

effect of coronavirus (Covid-19) on the Company. Under current

challenging economic conditions, it is helpful for the Company to have

significant cash and reserves.

These are, however, unprecedented times with major uncertainty as to the

ongoing economic and societal impact of the coronavirus (Covid-19)

pandemic. The Board is therefore mindful that further adjustments to

valuations may need to be made in subsequent quarters.

After taking account of the total 2.00 pence per share of dividends paid

on 29 November 2019 (1 penny) and 31 March 2020 (1 penny), the

comparable ex-dividend NAV as at 30 June 2019 was 33.29 pence per share.

Therefore, the NAV has decreased by 1.27 pence per share or (3.81%)

since 30 June 2019.

Fundraising and share issues

During the period from 1 January 2020 to 31 March 2020, the Company

issued the following new Ordinary shares of nominal value 1 penny per

share under the Albion VCTs Prospectus Top Up Offers 2019/20:

Issue price per share

Number of shares (including costs of Net proceeds

Date issued issue) GBP'000

---------------- ---------------------- ---------------------- ------------

31 January 2020 10,639,813 35.4p to 35.8p 3,712

---------------- ---------------------- ---------------------- ------------

Share buy-backs

During the period from 1 January 2020 to 31 March 2020, the Company

purchased 939,582 shares for GBP306,000 including stamp duty, at an

average price of 32.39 pence per share. All of the shares are to be held

in treasury.

Given the uncertainty on valuations caused by the coronavirus (Covid-19)

and its impact on financial markets in recent times, the Board agreed to

suspend the Company's buy back operation on 18 March 2020 until such

time as the Company could provide an updated valuation as at 31 March

2020 of the portfolio and the Company's NAV.

With this announcement of the NAV of the Company at 31 March 2020, the

Board is pleased to announce the resumption of its share buy-back policy,

subject to the overall constraint that such purchases are in the

Company's interest, including the maintenance of sufficient resources

for investment in existing and new portfolio companies and the continued

payment of dividends to shareholders. However, the level of share

buybacks until the announcement of the Company's year end results,

expected during September 2020, shall be limited to GBP500,000.

It is the Board's intention for such buy-backs to be at around a 5 per

cent. discount to net asset value, so far as market conditions and

liquidity permit.

Portfolio

The following material investments have been made during the period from

1 January 2020 to 31 March 2020:

New

investments GBP000s Activity

------------- ------- ------------------------------------------------------

A software provider bringing real-time behavioural

Concirrus data analytics to the marine and transport insurance

Limited 755 industries

------------- ------- ------------------------------------------------------

Credit Kudos Challenger credit bureau helping lenders optimise

Limited 378 and automate their affordability and risk assessments

------------- ------- ------------------------------------------------------

Total new

investments 1,133

------------- -------

There have been no disposals during the period from 1 January 2020 to 31

March 2020.

Top ten holdings as at 31 March 2020:

% of

net

Carrying value asset

Investment GBP000s value Activity

--------------- -------------- ----- -------------------------------------------------------

Shinfield Lodge Owner and operator of a 66 bed care home in Shinfield,

Care Limited 3,894 6.2 Berkshire

--------------- -------------- ----- -------------------------------------------------------

Chonais River Owner and operator of a 2 MW hydro-power scheme in

Hydro Limited 3,196 5.1 the Scottish Highlands

--------------- -------------- ----- -------------------------------------------------------

Radnor House

School (TopCo)

Limited 2,598 4.1 Independent school for children aged 5-18

--------------- -------------- ----- -------------------------------------------------------

Active Lives Owner and operator of a 75 bed care home in Cumnor

Care Limited 2,584 4.1 Hill, Oxfordshire

--------------- -------------- ----- -------------------------------------------------------

Proveca Limited 2,412 3.8 Reformulation of paediatric medicines

--------------- -------------- ----- -------------------------------------------------------

Ryefield Court 1,987 3.1 Owner and operator of a 60 bed care home in Hillingdon,

Care Limited Middlesex

--------------- -------------- ----- -------------------------------------------------------

Quantexa 1,816 2.9 Network analytics platform to detect financial crime

Limited

--------------- -------------- ----- -------------------------------------------------------

Gharagain River 1,608 2.5 Owner and operator of a 1 MW hydroelectricity plant

Hydro Limited in the Scottish Highlands

--------------- -------------- ----- -------------------------------------------------------

Mirada Medical 1,039 1.6 Developer of medical imaging software using Deep

Limited Learning

--------------- -------------- ----- -------------------------------------------------------

G. Network 1,009 1.6 Ultra-fast fibre optic broadband provider in central

Communications London

Limited

--------------- -------------- ----- -------------------------------------------------------

Board composition

The Board announced on 21 April 2020 that, following a formal selection

process, Ian Spence has been appointed to the Board as a non-executive

director with effect from 1 May 2020. Ian is highly experienced in the

technology sector, having researched and advised companies in this

industry for over 20 years. Ian joins the Board at a time when

increasing numbers of tech investment opportunities are being considered

by the Company.

Material events and transactions after the period end

There have been no significant events or transactions that the Board is

aware of which would have a material impact on the financial position of

the Company between 1 April 2020 to 22 April 2020.

Further information

The Company continues to offer a Dividend Reinvestment Scheme to

existing shareholders. Details of this Scheme can be found at

https://www.globenewswire.com/Tracker?data=gQcGMzqZFYjcEiJcXVdZLbMoWH2clqbzlxH9NDqzHTxoKavv86e-jK7tPbQ4x1iXX4jZWvAcozq3seUpIrc6wkY0YrHuMDRMyCnFz02F6GUmX3H3U13GV6nFwhSNMVqY

www.albion.capital/funds/CRWN.

Further information regarding historic and current financial performance

and other useful shareholder information can be found on the Company's

webpage on the Manager's website at

https://www.globenewswire.com/Tracker?data=gQcGMzqZFYjcEiJcXVdZLbMoWH2clqbzlxH9NDqzHTzXFgZ1IZyDTeJMr0RzT_f5nu4DfJiVOpEG3YEkSaRTnnr0S8rZMayHPP5Dl6iWUMYb0DCm8ksc2uYO6E6dpPch

www.albion.capital/funds/CRWN.

Richard Huntingford, Chairman

crownchair@albion.capital

22 April 2020

For further information please contact:

Albion Capital Group LLP -- Tel: 020 7601 1850

(END) Dow Jones Newswires

April 22, 2020 12:30 ET (16:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

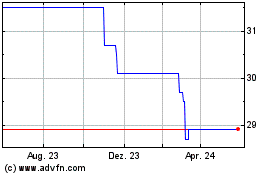

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024