Crown Place VCT PLC Crown Place Vct Plc : Annual -3-

02 Oktober 2014 - 6:08PM

UK Regulatory

share during the year, offset by the total return for the year of 2.28

pence per share.

The consolidated cash flow for the business has been a net outflow of

GBP1,314,000 for the year (2013: inflow GBP1,039,000) due to the

purchase of investments, dividends paid and the purchase of shares for

cancellation and treasury offset by cash generated from operations, the

disposal of investments and the issue of new share capital.

Review of business and future changes

A review of the Company's business during the year and future prospects

is contained in the Chairman's statement.

In addition to the companies mentioned in the Chairman's statement,

companies that are particularly worth noting include Lowcosttravelgroup,

the online travel specialist, which has seen strong growth over the past

year, particularly in Continental Europe; Mi-Pay Limited which merged

its business with a company quoted on the Alternative Investment Market

(AIM) on the London Stock Exchange, creating a combined business which

is now called Mi-Pay Group Plc; and Process Systems Enterprise (computer

simulation of complex industrial processes) continues to grow revenue at

20 per cent. per annum - and counts five out of the top six oil majors

as its clients. Against this, it is disappointing that Helveta has gone

into administration, following the removal of support for forestry

projects by the international aid agencies.

The Directors do not foresee any major changes in the activity

undertaken by the Company in the current year and have laid out their

expectations on the direction of the portfolio above. The Company

continues with its objective to invest in unquoted companies throughout

the United Kingdom with a view to providing both capital growth and a

reliable dividend income to shareholders over the long term.

Details of significant events which have occurred since the end of the

financial year are listed in note 19. Details of transactions with the

Manager are shown in note 4. The subsidiary undertakings affecting the

profits and net assets of the Group in the year are listed in note 11 to

the Financial Statements.

Future prospects

The key drivers for returns within the portfolio are those sectors that

have exposure to longer term growth trends. These include healthcare in

an ageing population, sustainable energy against a background of climate

change, and the developing use of information technology in an

environment of universal information. The portfolio is well positioned

to take advantage of these changes.

Key performance indicators

The Directors believe that the following key performance indicators,

which are typical for venture capital trusts, will provide shareholders

with sufficient information to assess how effectively the Company has

been applying its investment policy to meet its objectives. These are:

1. Increase in total shareholder value

The graph on page 9 of the full Annual Report and Financial Statements

shows the increase in total shareholder value.

Total shareholder value increased to 78.77 (2013: 76.49) pence per share

for the year ended 30 June 2014.

2. Dividend distributions

The graph on page 9 of the full Annual Report and Financial Statements

shows the dividend distributions since Albion Ventures LLP became

Manager on 6 April 2005.

Dividends paid in respect of the year ended 30 June 2014 were 2.50 pence

per share (2013: 2.50 pence per share), in line with the Board's

dividend objective. Cumulative dividends paid since launch (on 18

January 1998) amount to 46.73 pence per share.

3. Ongoing charges

The ongoing charges ratio for the year to 30 June 2014 was 2.7 per cent.

(2013: 2.8 per cent.). The ongoing charges ratio has been calculated

using the Association of Investment Companies' (AIC) recommended

methodology. This figure shows shareholders the total recurring annual

running expenses (including investment management fees charged to

capital reserve) as a percentage of the average net assets attributable

to shareholders. The Directors expect the ongoing charges ratio for the

year ahead to be approximately 2.7 per cent.

4. Running yield

The running yield on the portfolio (gross income divided by the average

net asset value) for the year to 30 June 2014 was 3.4 per cent. (2013:

3.7 per cent.).

VCT regulation

The investment policy is designed to ensure that the Company continues

to qualify and is approved as a VCT by HMRC. In order to maintain its

status under Venture Capital Trust legislation, a VCT must comply on a

continuing basis with the provisions of Section 274 of the Income Tax

Act 2007, details of which are provided in the Directors' report on page

22 of the full Annual Report and Financial Statements.

The relevant tests to measure compliance have been carried out and

independently reviewed for the year ended 30 June 2014. These showed

that the Company has complied with all tests and continues to do so.

As part of the Government's wider review of the VCT regime, new rules

have been introduced under the Finance Act 2014, which include:

-- allowing investors to subscribe for shares via nominee accounts;

-- restricting individuals' entitlement to VCT income tax relief where

investments have been made within six months of a disposal of shares in

the same VCT; and

-- preventing VCTs from returning capital that does not relate to profits on

investments within three years of the end of the accounting period in

which shares were issued to investors.

Gearing

As defined by the Articles of Association, the Company's maximum

exposure in relation to gearing is restricted to 10 per cent. of the

adjusted share capital and reserves. The Directors do not currently have

any intention to utilise long term gearing.

Management agreement

The Company has delegated the investment management of the portfolio to

Albion Ventures LLP, which is authorised and regulated by the Financial

Conduct Authority. Albion Ventures LLP also provides company secretarial

and other accounting and administrative support to the Group. The

management agreement can be terminated by either party on 12 months'

notice and is subject to earlier termination in the event of certain

breaches or on the insolvency of either party.

Under the terms of the management agreement, the Manager is paid an

annual fee equal to 1.75 per cent. of the net asset value of the Company

plus GBP50,000 fee per annum for administrative and secretarial

services. Total normal running costs, including the management fee, are

limited to 3.5 per cent. of the net asset value. The Manager is entitled

to an arrangement fee, payable by each portfolio company in which the

Company invests, in the region of 2.0 per cent. on each investment made,

and is also entitled to non-executive director fees when placing an

investment executive from Albion Ventures LLP on the portfolio company

Board.

Further details of fees paid to the Manager can be found in note 4.

Management performance incentive

In order to provide the Manager with an incentive to maximise the return

to investors, the Manager is entitled to charge an incentive fee in the

event that the returns exceed minimum target levels per share.

The target level requires that the aggregate of the growth in the net

asset value per share and dividends paid by the Company or declared by

the Board and approved by the shareholders during the relevant period

(both revenue and capital), compared with the previous accounting date,

exceeds the average base rate of the Royal Bank of Scotland plc plus 2.0

per cent. If the target return is not achieved in a period, the

cumulative shortfall is carried forward to the next accounting period

and has to be made up before an incentive fee becomes payable.

There was no management performance incentive fee payable during the

year (2013: nil). As at 30 June 2014 the cumulative shortfall of the

target return was 7.42 pence per share and this amount needs to be made

up in the next accounting period before an incentive fee becomes

payable.

Evaluation of the Manager

The Board has evaluated the performance of the Manager based on the

returns generated by the Company, the continuing achievement of the 70

per cent. investment requirement for venture capital trust status, the

long term prospects of current investments, a review of the management

agreement and the services provided therein, and benchmarking the

performance of the Manager to other service providers. The Board

believes that it is in the interest of shareholders as a whole, and of

the Company, to continue the appointment of the Manager for the

forthcoming year.

Alternative Investment Fund Managers Directive ("AIFMD")

The Board has considered the impact on your Company of the AIFMD, an EU

Directive that came into force in July 2013 to regulate the Managers of

Alternative Investment Funds. The Board has agreed to appoint Albion

Ventures LLP as the Company's AIFM, as required by the AIFMD. Albion

Ventures LLP's registration as an AIFM was approved by the Financial

Conduct Authority on 3 June 2014. This will not impact on the day-to-day

investment activities.

Discount management and share buy-back policy

It remains the Board's primary objective to maintain sufficient

resources for investment in existing and new portfolio companies and for

the continued payment of dividends to shareholders. The Board's policy

is to buy back shares in the market, subject to the overall constraint

that such purchases are in the VCT's interest and it is the Board's

intention for such buy-backs to be in the region of a 5 per cent.

discount to net asset value, so far as market conditions and liquidity

permit.

Further details of shares bought back during the year ended 30 June 2014

can be found in note 14 of the Financial Statements.

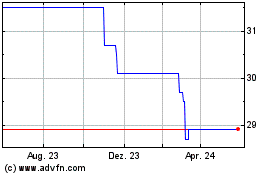

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024