Crown Place VCT PLC Crown Place Vct Plc : Annual -2-

02 Oktober 2014 - 6:08PM

UK Regulatory

diseases; and GBP231,000 in Relayware Limited, a company providing

software systems to multinational companies allowing them to manage

their indirect sales channels.

Overall, the value of the Company's unquoted investment portfolio

increased by GBP1,837,000 during the year, while that of the small AIM

portfolio fell by GBP55,000.

Amongst the unquoted investments, good progress was made by Radnor House

School, which has recently launched its Sixth Form enabling it to expand

its student numbers further. Oakland Care Centre Limited and Taunton

Hospital Limited are experiencing increasing demand for their services

with consequent growth in profits. The renewable energy investments

have also appreciated in value. In the growth portfolio, Masters

Pharmaceuticals and Hilson Moran are growing profitably, while many of

the technology investments are making good progress in expanding their

businesses. Against this, Helveta has struggled to gain sufficient

commercial traction within the constraints of its available funding and

has been placed into administration, leading to a further reduction in

its value to GBP22,000. The three hotel investments in the portfolio

are also seeing improved trading over recent months, and the Manager is

cautiously optimistic about their future performance.

Risks and uncertainties

The UK economic climate is improving and so is investment sentiment,

though a number of risks remain. The Company's investment portfolio is

well diversified and many of the sectors in which its portfolio

companies operate are resilient. Approximately two-thirds of the

unquoted portfolio is invested in companies with tangible assets, which

support their valuation. It remains the Company's general policy that

portfolio companies should have no external bank borrowings, which

reduces financial risk. In addition, we believe the new portfolio

companies are positioned to grow despite the broader economic

uncertainties. Therefore, as the investment portfolio continues to

mature, the prospects on the whole look positive. A detailed review of

risk management is set out in the Strategic report.

Albion VCTs Top Up Offers 2013/2014

The Albion VCTs Top Up Offers 2013/2014 launched on 6 November 2013.

Following higher than anticipated demand for the offer, Albion Ventures

took the decision to launch the Albion VCTs Prospectus Top Up Offers

2013/2014 on 19 March 2014, working within a very short timescale in

order to capitalise on the opportunity. An encouraging level of

subscriptions have been received across both Offers, raising GBP3.2m for

Crown Place VCT PLC. Following full subscription, the Albion Prospectus

Top Up Offers 2013/2014 closed for the Company on 24 September 2014. The

proceeds of the Offers have been used to provide further resources to

the Company at a time when a number of attractive new investment

opportunities are being seen.

Further Top Up Offers are planned for later this year and details are

expected to be sent to shareholders in November 2014.

Dividend re-investment scheme

During the year the Company raised GBP166,000 from the dividend

re-investment scheme. Through the scheme, shareholders may elect to

reinvest the whole of the dividend received by subscribing for new

shares in the Company. Under current tax rules, individual shareholders

re-investing their dividends will be eligible for the income and capital

gains tax advantages available to investors subscribing to new shares in

venture capital trusts and will be able to increase their shareholding

in the Company simply and without incurring dealing costs or stamp duty.

Full details of the scheme and the application form are available on the

Manager's website at: www.albion-ventures.co.uk/ourfunds/CRWN.

Board composition

Having served on the Board for over 8 years, I have decided to retire at

the forthcoming Annual General Meeting. I would like to thank my fellow

Directors, the Manager and particularly the Shareholders for their

support. Richard Huntingford, who has been on the Board since May 2012,

will succeed me as Chairman and I wish him and the Company well for the

future. The Board will seek to appoint a new independent director in due

course.

Outlook and prospects

While we are seeing continuing improvement in the economic environment

in the UK and increased demand for growth funding by smaller companies,

access to traditional funding channels remain difficult. Your Company

has capitalised on this opportunity to make 11 new investments during

the financial year, more than doubling its investment rate from the

previous year, and the investment pipeline remains strong. The Manager

has strong proprietary deal flow, enabling it to achieve reasonable

entry valuations and attractive investment structures.

The Company's portfolio is well diversified. It includes a number of

investments in more resilient sectors, such as healthcare, education and

renewable energy, as well as companies with good growth prospects. In

addition, the great majority of investments are structured to be cash

generative in order to provide further support for your Company's

dividend. We look forward to the current financial year with

confidence.

Patrick Crosthwaite

Chairman

2 October 2014

Strategic report

Investment objective and policy

The Company's investment objective is to provide investors with a

regular and predictable source of income, combined with the prospect of

longer term capital growth. The Company's investment portfolio is thus

structured to provide a balance between income and capital growth for

the longer term through a diversified, balanced approach to investment.

The asset-based portfolio, which currently accounts for about two-thirds

of unquoted investments by value, is designed to provide stability and

income whilst maintaining the potential for capital growth. The growth

portfolio is intended to provide diversified exposure through its

portfolio of investments predominately in unquoted UK companies. In

neither category do portfolio companies normally have any external

borrowing with a charge ranking ahead of the Company.

Business model

The Company operates as a Venture Capital Trust. This means that the

Company has no employees other than its Directors and has outsourced the

management of all its operations to Albion Ventures LLP, including

secretarial and administrative services. Further details of the

Management agreement can be found below.

Current portfolio sector allocation

The pie chart at the end of this announcement shows the split of the

portfolio valuation by industrial or commercial sector as at 30 June

2014. The portfolio remains well diversified and as at the year end

comprised 56 investments. There were 26 unquoted asset-based investments

accounting for 60 per cent. of the net asset value of the Company, 27

unquoted growth investments accounting for 32 per cent. of the net asset

value of the Company and 3 AIM quoted investments, accounting for 3 per

cent. of the net asset value of the Company.

Direction of portfolio

During the year, the Company continued to increase its exposure to the

less cyclical healthcare and renewable energy sectors which, in addition

to the education sector, now account for approximately 45 per cent. of

the portfolio value.

Looking ahead, the healthcare sector will continue to be a core area of

investment, both in asset-based businesses such as psychiatric hospitals

and care homes, and in medical technology. Additional renewable energy

investments in the current pipeline will allow the Company to reach its

target of 15 per cent. of the portfolio - their main role being to

provide more stable, long term, inflation protected income flows to the

Company. The IT sector of the portfolio has grown during the year as we

have made a number of investments to back new technology developments,

such as e-mail encryption and contextual analysis for on-line

advertising. The education investment, in the form of Radnor House

School, is expected to grow in time as we aim to fund further premises

for growth in student numbers, subject to availability of a suitable

site.

Results and dividend policy

GBP'000

Consolidated revenue return for the year ended 30

June 2014 525

Consolidated capital return for the year ended 30

June 2014 1,451

Dividend of 1.25p per share paid on 29 November 2013 (1,053)

Dividend of 1.25p per share paid on 31 March 2014 (1,079)

Transferred from reserves (156)

Net assets as at 30 June 2014 29,050

Net asset value per share as at 30 June 2014 (pence) 32.04p

As described in the Chairman's statement, the Board has declared a first

dividend for the year ending 30 June 2015 of 1.25 pence per share. This

dividend will be paid on 28 November 2014 to shareholders on the

register as at 7 November 2014.

As shown in the Group's statement of comprehensive income, investment

income has decreased slightly to GBP925,000 (2013: GBP967,000). This is

as a result of the disposal of high yielding loan stock investments in

the previous year, resulting in a decrease of revenue return to

GBP525,000 (2013: GBP590,000). The capital return for the year was a

profit of GBP1,451,000 (2013: GBP1,136,000), as a result of unrealised

gains on investments, in particular Radnor House School, Tower Bridge

Health Club and Oakland Care Centre, offset by management fees charged

to capital. The total return for the year was 2.28 pence per share

(2013: 2.14 pence per share).

The Consolidated balance sheet shows that the net asset value has

decreased slightly over the year to 32.04 pence per share (2013: 32.26

pence per share), due to the payment of the dividend of 2.50 pence per

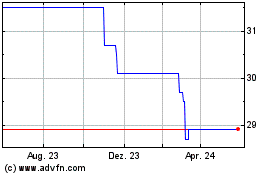

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024