Interim Management Statement

11 Mai 2010 - 6:04PM

UK Regulatory

TIDMCRWN

Interim Management Statement

Introduction

I am pleased to present the Crown Place VCT PLC's interim management statement

for the period from 1 January to 11 May 2010 as required by the UK Listing

Authority's Disclosure and Transparency Rule 4.3.

Performance and dividends

The Company's unaudited net asset value (NAV), based on management accounts, as

at 31 March 2010 was GBP24.1 million (31 December 2009: GBP24.8 million) or 33.5

pence per share (excluding treasury shares) (31 December 2009: 34.2 pence per

share). This is after accounting for the second dividend for the year to 30 June

2010 of 1.25 pence per share (total cost: GBP902,000), paid on 9 April 2010 to

shareholders on the register as at 12 March 2010.

After adding back the second dividend for the financial year, the net asset

value has risen by 0.6 pence or 2 per cent. since 31 December 2009, mainly as a

result of an increase in the valuation of the Company's unquoted investments.

Share issues, buybacks and discount management

On 9 April 2010, the Company issued 110,944 Ordinary shares of 10 pence each at

a price of 32.93 pence per share under the Dividend Reinvestment Scheme.

During the period from 1 January 2010 to 11 May 2010, the Company purchased

554,546 shares for cancellation at an average price of 29 pence per share.

It remains the Board's policy to buy back shares in the market, subject to the

overall constraint that such purchases are in the Company's interest, including

the maintenance of sufficient resources for investment in existing and new

investee companies and the continued payment of dividends to shareholders.

It is the Company's intention that, subject to the sufficiency of cash resources

and any market constraints, share buy-backs will take place at a discount of

around 10 per cent. to the prevailing net asset value.

Portfolio

The following investments have been made during the period from 1 January 2010

to 11 May 2010:

+-----------------------------------+------+-----------------------------------+

|Name | GBP000's| |

+-----------------------------------+------+-----------------------------------+

|Orchard Portman Hospital Limited |384 |The two portfolio companies are |

|(new investment) | |invested in a project which is |

| | |converting a nursing home in |

|Taunton Nursing Home Limited (new |100 |Taunton, Somerset into a mental |

|investment) | |health hospital |

+-----------------------------------+------+-----------------------------------+

|Forth Photonics Limited (further |140 |Developer, manufacturer and seller |

|investment) | |of medical devices for the |

| | |detection of epithelial cancers |

+-----------------------------------+------+-----------------------------------+

|Prime Care Holdings Limited |120 |Provider of domiciliary care |

|(further investment) | |services |

+-----------------------------------+------+-----------------------------------+

|The Stanwell Hotel Limited (further|54 |Owner and operator of the Stanwell |

|investment) | |Hotel at Heathrow airport |

+-----------------------------------+------+-----------------------------------+

|Oxsensis Limited (further |47 |Developer and producer of |

|investment) | |industrial sensors used in |

| | |super-high temperature environments|

+-----------------------------------+------+-----------------------------------+

|Mi-Pay Limited (further investment)|43 |Provider of mobile payment services|

+-----------------------------------+------+-----------------------------------+

|Rostima Limited (further |21 |Provider of workforce management |

|investment) | |solutions software |

+-----------------------------------+------+-----------------------------------+

|GB Pub Company VCT Limited (further|4 |Freehold pub owner and operator |

|investment) | | |

+-----------------------------------+------+-----------------------------------+

Disposal of a material investment

On 9 March 2010, the Board noted it was in advanced discussions to sell its

interest in one of its investee companies. Discussions to sell its interest in

this investee company are ongoing and if the investee company were sold it is

likely to result in a material uplift in Crown Place VCT PLC NAV per share but

there remains no certainty as to whether any transaction will complete. Further

announcements will be made as appropriate.

Other disposals

During the period from 1 January 2010 to 11 May 2010, the Dunedin Pub Company

VCT Limited repaid GBP120,000 of loan stock, and River Bourne Limited repaid

GBP4,000 of loan stock. In addition, proceeds of GBP229,000 were received in

relation to the part disposal of Avanti Communications plc.

Top ten qualifying holdings (as at 31 March 2010)

+-----------------------------------+---------------------+

| Investment | Carrying/fair value |

| | GBP000's |

+-----------------------------------+---------------------+

| The Crown Hotel Harrogate Limited | 2,111 |

+-----------------------------------+---------------------+

| ELE Advanced Technologies Limited | 1,712 |

+-----------------------------------+---------------------+

| The Stanwell Hotel Limited | 1,169 |

+-----------------------------------+---------------------+

| The Charnwood Pub Company Limited | 1,133 |

+-----------------------------------+---------------------+

| Kensington Health Club Limited | 1,065 |

+-----------------------------------+---------------------+

| Kew Green VCT (Stansted) Limited | 942 |

+-----------------------------------+---------------------+

| Geronimo Inns VCT I Limited | 824 |

+-----------------------------------+---------------------+

| Geronimo Inns VCT II Limited | 824 |

+-----------------------------------+---------------------+

| Avanti Communications plc | 771 |

+-----------------------------------+---------------------+

| Blackbay Limited | 627 |

+-----------------------------------+---------------------+

There have been no further significant events or transactions that the Board are

aware of which would have a material impact on the financial position of the

Company between 1 January 2010 and 11 May 2010.

Further information regarding historic and current financial performance and

other useful shareholder information can be found on the Fund's website

underwww.albion-ventures.co.uk <http://www.albion-ventures.co.uk/>/Our

Funds/Crown Place VCT PLC.

Patrick Crosthwaite, Chairman

11 May 2010

For further information please contact:

Patrick Reeve, Albion Ventures LLP - tel: 020 7601 1850

[HUG#1414943]

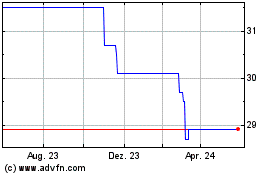

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024