Interim Management Statement

11 November 2009 - 1:04PM

UK Regulatory

TIDMCRWN

Interim Management Statement

Introduction

I am pleased to present the Crown Place VCT PLC's interim management

statement for the period from 1 July to 11 November 2009 as required

by the UK Listing Authority's Disclosure and Transparency Rule 4.3.

Performance and dividends

The Company's unaudited net asset value (NAV), based on management

accounts, as at 30 September 2009 was GBP24.4 million (30 June 2009:

GBP24.8 million) or 33.7 pence per share (excluding treasury shares)

(30 June 2009: 34.2 pence per share). This is after accounting for

the first revenue dividend for the year to 30 June 2010 of 1.25 pence

per share (total cost: GBP904,960), paid on 6 November 2009 to

shareholders on the register as at 9 October 2009.

After adding back the first dividend for the new financial year, the

net asset value has risen by 0.7 pence or 2 per cent. since 30 June

2009, mainly as a result of an increase in the value of the Company's

holding in the AIM-quoted Avanti Communications plc.

Cancellation of Share Premium Account

The Company has cancelled its share premium account by way of special

resolution at a General Meeting held on 1 September 2009. The share

premium account amounting to GBP14,437,830 was cancelled on 16

September 2009 by order of the High Court and the Notice regarding

the cancellation was registered at Companies House on 17 September

2009.

Share issues and buybacks

On 6 November 2009, the Company issued 106,946 Ordinary shares of 10

pence each at a price of 32.95 pence per share under the Dividend

Reinvestment Scheme.

During the period from 1 July 2009 to 11 November 2009, the Company

did not purchase any shares for cancellation or to be held in

treasury.

Portfolio

The following investments have been made during the period from 1

July 2009 to 11 November 2009:

+-------------------------------------------------------------------+

| Name | GBP000's | |

|--------------------------+--------+-------------------------------|

| Geronimo Inns VCT I | 720 | Freehold pub owner and |

| Limited (new investment) | | operator |

|--------------------------+--------+-------------------------------|

| Geronimo Inns VCT II | 720 | Freehold pub owner and |

| Limited(new investment) | | operator |

|--------------------------+--------+-------------------------------|

| Vibrant Energy Assessors | 33 | Energy performance |

| Limited (further | | certificate provider |

| investment) | | |

|--------------------------+--------+-------------------------------|

| Red-M Wireless Limited | 36 | Service and software provider |

| (further investment) | | |

|--------------------------+--------+-------------------------------|

| Bravo Inns II Limited | 100 | Freehold pub owner and |

| (further investment) | | operator |

|--------------------------+--------+-------------------------------|

| Rostima Limited (further | 40 | Provider of workforce |

| investment) | | management solutions software |

|--------------------------+--------+-------------------------------|

| Mi-Pay Limited (further | 12 | Provider of mobile payment |

| investment) | | services |

|--------------------------+--------+-------------------------------|

| RFI Global Services | 31 | Provider of conformance |

| Limited (further | | testing to the cellular, |

| investment) | | wireless and smart card |

| | | industries |

+-------------------------------------------------------------------+

During the period, the Company invested in a floating rate note held

by Wells Fargo (maturity 25/01/2012) for liquidity management

purposes.

Disposals

During the period from 1 July 2009 to 11 November 2009, Nationwide

floating rate note matured on 7 July 2009 and proceeds of GBP2,720,000

were received. In addition, GB Pub Company VCT Limited repaid GBP45,000

of loan stock, and House of Dorchester Limited repaid GBP41,000 of loan

stock.

As a result of the consolidation of part of the pub portfolio, the

site management has been entrusted to a single management team. Crown

Place VCT PLC exchanged its shareholdings in the Charnwood Pub

Company (Hotels) Limited, Welland Inns VCT Limited, Welland Inns VCT

(Hotels) Limited and Novello Limited for additional shareholdings in

the Charnwood Pub Company Limited on 21 September 2009.

Top ten qualifying holdings (as at 30 September 2009)

+---------------------------------------------------------+

| Investment | Carrying/fair value |

| | GBP000's |

|-----------------------------------+---------------------|

| The Crown Hotel Harrogate Limited | 2,099 |

|-----------------------------------+---------------------|

| ELE Advanced Technologies Limited | 1,759 |

|-----------------------------------+---------------------|

| The Charnwood Pub Company Limited | 1,142 |

|-----------------------------------+---------------------|

| The Stanwell Hotel Limited | 1,125 |

|-----------------------------------+---------------------|

| Avanti Communications plc | 1,032 |

|-----------------------------------+---------------------|

| Kensington Health Club Limited | 1,020 |

|-----------------------------------+---------------------|

| Kew Green VCT (Stansted) Limited | 948 |

|-----------------------------------+---------------------|

| Geronimo Inns VCT I Limited | 729 |

|-----------------------------------+---------------------|

| Geronimo Inns VCT II Limited | 729 |

|-----------------------------------+---------------------|

| House of Dorchester Limited | 648 |

+---------------------------------------------------------+

There have been no further significant events or transactions that

the Board are aware of which would have a material impact on the

financial position of the Company between 1 July 2009 and 11 November

2009.

Further information regarding historic and current financial

performance and other useful shareholder information can be found on

the Fund's website under www.albion-ventures.co.uk/Our Funds/Crown

Place VCT PLC.

Patrick Crosthwaite, Chairman

11 November 2009

For further information please contact:

Patrick Reeve, Albion Ventures LLP - tel: 020 7601 1850

=--END OF MESSAGE---

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

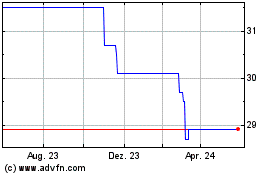

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024