TIDMAT.

RNS Number : 9992Y

Numis Securities Limited

10 May 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA ,

AUSTRALIA , CANADA , JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY

OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION IN RELATION TO THE

COMPANY FOR THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE

REGULATION (EU) 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY

VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (MAR).

10 May 2023

PROPOSED SECONDARY PLACING OF ORDINARY SHARES IN ASHTEAD

TECHNOLOGY HOLDINGS PLC (THE "COMPANY" OR "ASHTEAD TECHNOLOGY")

BP Inv2B Bidco Ltd ("BP Bidco"), an entity controlled and

majority-owned by Buckthorn Partners LLP ("Buckthorn Partners"),

and Joe Connolly, the Buckthorn Partners nominee on the Board of

Ashtead Technology, announce their intention to sell ordinary

shares of 5 pence each in the Company (the "Shares") through a

placing, by way of an accelerated bookbuild, to institutional

investors (the "Placing").

BP Bidco has indicated an intention to sell approximately 7.1

million ordinary shares in Ashtead Technology, representing

approximately 8.9% of the Company's issued share capital. Following

the Placing, it is expected that BP Bidco will be liquidated.

In addition, Joe Connolly, a Non-Executive Director of the

Company and nominee director of Buckthorn Partners, has indicated

his intention to sell 77,000 Shares held directly as part of the

Placing for personal financial and estate planning purposes. Joe

Connolly currently holds 122,000 Shares directly and has a small

indirect beneficial interest in the Company through BP Bidco.

The Shares to be offered by BP Bidco and Joe Connolly (together

the "Sellers") pursuant to the Placing (the "Placing Shares"),

being, in aggregate, approximately 7.2 million Shares, represent

approximately 9.0% of the Company's issued share capital.

BP Bidco currently holds approximately 7.3 million Shares,

representing approximately 9.1% of the issued share capital of the

Company. Following the proposed liquidation, certain employees of

Buckthorn Partners (including Joe Connolly) who are underlying

holders in BP Bidco, wish to retain the balance of the Shares held

by BP Bidco directly. This is expected to represent less than 0.5%

of the Company's issued share capital in aggregate following the

Placing.

The Placing will be launched immediately following this

announcement. Numis Securities Limited ("Numis") is acting as Sole

Bookrunner in connection with the Placing.

The final number of Placing Shares to be placed, and the price

at which the Placing Shares are to be placed, will be agreed by

Numis and the Sellers at the close of the bookbuild process, and

the results of the Placing will be announced as soon as practicable

thereafter. The timings for the close of the bookbuild process are

at the absolute discretion of Numis.

The Company will not receive any proceeds from the Placing.

ENQUIRIES

Numis (Sole Bookrunner ) +44 (0) 207 260 1000

Julian Cater / George Price / Tom Burrows

Smith

Jamie Loughborough / William Baunton

(ECM)

IMPORTANT NOTICE

This announcement is not for publication, distribution or

release, directly or indirectly, in or into the United States of

America (including its territories and possessions, any state of

the United States and the District of Columbia ) (collectively, the

" United States "), Australia , Canada , Japan or the Republic of

South Africa or any other jurisdiction where such an announcement

would be unlawful. The distribution of this announcement may be

restricted by law in certain jurisdictions and persons into whose

possession this document or other information referred to herein

comes should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction.

This announcement is not an offer of securities or investments

for sale nor a solicitation of an offer to buy securities or

investments in any jurisdiction where such offer or solicitation

would be unlawful. No action has been taken that would permit an

offering of the securities or possession or distribution of this

announcement in any jurisdiction where action for that purpose is

required. Persons into whose possession this announcement comes are

required to inform themselves about and to observe any such

restrictions.

The Placing Shares may not be offered to the public in any

jurisdiction in circumstances which would require the preparation

or registration of any prospectus or offering document relating to

the Placing Shares in such jurisdiction. No action has been taken

by the Company or any of its respective affiliates that would

permit an offering of the Placing Shares or possession or

distribution of this announcement or any other offering or

publicity material relating to such securities in any jurisdiction

where action for that purpose is required.

The Placing Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the "Securities

Act"), and may not be offered or sold, directly or indirectly, in

or into the United States except pursuant to an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and in compliance with the securities laws of

any state or any other jurisdiction of the United States.

Accordingly, the Placing Shares are being offered and sold by the

Company only (i) outside the United States in "offshore

transactions" (as such terms are defined in Regulation S under the

Securities Act ("Regulation S")) in reliance on Regulation S under

the Securities Act and otherwise in accordance with applicable

laws; and (ii) in the United States to a limited number of persons

reasonably believed to be "qualified institutional buyers" (as

defined in Rule 144A under the Securities Act). There will be no

public offer of any securities in the United States .

The Placing Shares have not been approved or disapproved by the

U.S. Securities and Exchange Commission, any state or other

securities commission or other regulatory authority in the United

States , and none of the foregoing authorities has passed upon or

endorsed the merits of the Placing or the accuracy or adequacy of

this announcement. Any representation to the contrary is a criminal

offence in the United States .

No prospectus, admission document or offering document has been

or will be prepared in connection with the Placing. Any investment

decision to buy securities in the Placing must be made solely on

the basis of publicly available information. Such information is

not the responsibility of and has not been independently verified

by any of the Sellers, Numis, or any of their respective

affiliates.

No reliance may be placed, for any purposes whatsoever, on the

information contained in this announcement or on its completeness

and this announcement should not be considered a recommendation by

the Company, any of the Sellers, Numis, or any of their respective

affiliates in relation to any purchase of or subscription for

securities of the Company. No representation or warranty, express

or implied, is given by or on behalf of the Company, any of the

Sellers, Numis, or any of their respective directors, partners,

officers, employees, advisers or any other persons as to the

accuracy, fairness or sufficiency of the information or opinions

contained in this announcement and none of the information

contained in this announcement has been independently verified.

Save in the case of fraud, no liability is accepted for any errors,

omissions or inaccuracies in such information or opinions.

Members of the public are not eligible to take part in the

Placing. This Announcement and the information set out herein are

for information purposes only and are directed at and may only be

communicated to (a) in the European Economic Area ("EEA"), persons

who are "qualified investors" within the meaning of Article 2(e) of

Prospectus Regulation (Regulation (EU) 2017/1129); and (b) in the

United Kingdom , at "qualified investors" within the meaning of

Article 2(e) of the UK version of Prospectus Regulation (Regulation

(EU) 2017/1129) which forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018 who are also (i) persons

having professional experience in matters relating to investments

who fall within the definition of "investment professionals" in

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the "Order"), (ii) high net worth

bodies corporate, unincorporated associations and partnerships and

trustees of high value trusts as described in Article 49(2) of the

Order, or (iii) persons to whom it may otherwise lawfully be

communicated (all such persons referred to in (a) and (b) together

being referred to as "Relevant Persons").

Any investment or investment activity to which this Announcement

relates is only available to, and will be engaged in only with,

Relevant Persons. Persons distributing this Announcement must

satisfy themselves that is lawful to do so.

This announcement does not purport to identify or suggest the

risks (direct or indirect) which may be associated with an

investment in in the Company or its shares.

This announcement includes statements that are, or may be deemed

to be, forward-looking statements. These forward-looking statements

may be identified by the use of forward-looking terminology,

including the terms "intends", "expects", "will", or "may", or, in

each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts and

include statements regarding intentions, beliefs or current

expectations. No assurances can be given that the forward-looking

statements in this announcement will be realised. As a result, no

undue reliance should be placed on these forward-looking statements

as a prediction of actual events or otherwise.

Numis, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom , is acting only for the

Sellers in connection with the Placing and neither Numis nor any of

its affiliates will be responsible to anyone other than the Sellers

for providing the protections offered to the clients of Numis, nor

for providing advice in relation to the Placing or any matters

referred to in this announcement, and apart from the

responsibilities and liabilities (if any) imposed on Numis by the

Financial Services and Markets Act 2000, any liability therefor is

expressly disclaimed. Any other person in receipt of this

announcement should seek their own independent legal, investment

and tax advice as they see fit.

References to time in this announcement are to London time,

unless otherwise stated. All times and dates in this announcement

may be subject to amendment.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

Information to Distributors

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that the Placing Shares are: (i) compatible

with an end target market of (a) retail investors, (b) investors

who meet the criteria of professional clients and (c) eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Numis will only procure investors who meet the criteria

of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any 'manufacturer' (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that such Placing Shares are: (i)

compatible with an end target market of: (a) investors who meet the

criteria of professional clients as defined in point (8) of Article

2(1) of Regulation (EU) No 600/2014 as it forms part of domestic UK

law by virtue of the European Union (Withdrawal) Act 2018 and the

European Union (Withdrawal Agreement) Act 2020; (b) eligible

counterparties, as defined in the FCA Handbook Conduct of Business

Sourcebook ("COBS"); and (c) retail clients who do not meet the

definition of professional client under (b) or eligible

counterparty per (c); and (ii) eligible for distribution through

all distribution channels as are permitted by Directive 2014/65/EU

(the "UK target market assessment"). Notwithstanding the UK target

market assessment, distributors should note that: the price of the

Placing Shares may decline and investors could lose all or part of

their investment; the Placing Shares offer no guaranteed income and

no capital protection; and an investment in the Placing Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The UK target market assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the UK target market assessment, Numis will

only procure investors who meet the criteria of professional

clients and eligible counterparties. For the avoidance of doubt,

the UK target market assessment does not constitute: (a) an

assessment of suitability or appropriateness for the purposes of

COBS 9A and COBS 10A, respectively; or (b) a recommendation to any

investor or group of investors to invest in, or purchase or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own UK

target market assessment in respect of the Placing Shares and

determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEBLFFXELLBBD

(END) Dow Jones Newswires

May 10, 2023 11:40 ET (15:40 GMT)

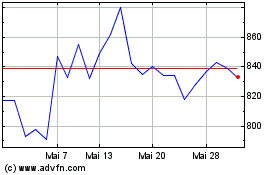

Ashtead Technology (LSE:AT.)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ashtead Technology (LSE:AT.)

Historical Stock Chart

Von Nov 2023 bis Nov 2024