TIDMAMGO

RNS Number : 0488V

Amigo Holdings PLC

03 April 2023

3 April 2023

Amigo Holdings PLC

Update on Employee Share Schemes and Total Voting Rights

Amigo Holdings PLC ("Amigo" or "the Company"), a provider of

mid-cost credit in the UK reports, following the announcement on 23

March 2023 that the Company was reverting to an orderly wind-down

of the business, on the changes noted below to the Company's share

schemes.

Long Term Incentive Plan ('LTIP')

With effect from 31 March 2023, all outstanding awards in favour

of directors, PDMR and employees made under the Amigo Holdings PLC

Long Term Incentive Plan were cancelled for nil consideration. At

the time of the cancellation, there were outstanding LTIP awards

over 8,047,349 ordinary shares of 0.25 pence each in the Company

("Ordinary Shares"). Over the course of the period since the

introduction of the LTIP, no LTIP awards over Ordinary Shares have

vested. Details of the cancelled LTIP held by PDMR, totalling

awards over 3,500,000 Ordinary Shares are set out in the tables

below.

All Employee Shares Incentive Plan ("SIP")

With effect from 31 March 2023 the Company's SIP ceased to

accept all new contributions made on behalf of participants. In due

course, following distribution of the assets retained in the SIP,

the Company will seek to wind up the SIP, in line with the

requirements of the SIP and the HMRC.

Save As You Earn ("SAYE")

The Company intends to close the SAYE to all new contributions

from participants and will return to participants their

contributions. In due course, following distribution of the cash

held in the SAYE, the Company will seek to wind up the SAYE, in

line with the requirements of the SAYE and the HMRC. As a result of

the closure of the SAYE, all outstanding SAYE options over Ordinary

Shares will be cancelled for nil consideration.

Total voting rights

The total number of Ordinary Shares in the Company with voting

rights is 475,333,760 and this figure may be used by shareholders

in the Company as the denominator for the calculation by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Following the closure of the LTIP and SAYE, there will be no

outstanding options over Ordinary Shares.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014. The

person responsible for this announcement is Roger Bennett, Company

Secretary.

The below information and notification is made in accordance

with the EU Market Abuse Regulation.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM

Details of Persons Discharging Managerial Responsibilities

"PDMR" / person closely associated with them ('PCA')

=== ==========================================================================

a) Name Nicholas Beal

=== ======================== ================================================

2. Reason for notification

=== ==========================================================================

b) Position / status Chief Restructuring Officer/PDMR

=== ======================== ================================================

c) Initial notification Initial notification

/ amendment

=== ======================== ================================================

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

=== ==========================================================================

b) Name Amigo Holdings PLC

=== ======================== ================================================

c) LEI 213800PUHEBLCWDW9T74

=== ======================== ================================================

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

=== ==========================================================================

a) Description of Ordinary shares of GBP0.0025 each

the financial

instrument

GB00BFFK8T45

Identification

code

=== ======================== ================================================

b) Nature of the Cancellation of options to acquire ordinary

transaction shares under the Company's Long Term Incentive

Plan.

=== ======================== ================================================

c) Price(s) and Price(s) Volume(s)

volume(s) Nil cost 1,000,000

----------

=== ======================== ================================================

d) Aggregated information

Aggregated volume

Price 1,000,000

Nil per share

=== ======================== ================================================

e) Date of the transaction 31 March 2023

=== ======================== ================================================

f) Place of the Outside of trading venue

transaction

=== ======================== ================================================

Details of Persons Discharging Managerial Responsibilities

"PDMR" / person closely associated with them ('PCA')

=== ==========================================================================

a) Name Paul Dyer

=== ======================== ================================================

2. Reason for notification

=== ==========================================================================

b) Position / status Chief Operating Officer

=== ======================== ================================================

c) Initial notification Initial notification

/ amendment

=== ======================== ================================================

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

=== ==========================================================================

b) Name Amigo Holdings PLC

=== ======================== ================================================

c) LEI 213800PUHEBLCWDW9T74

=== ======================== ================================================

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

=== ==========================================================================

a) Description of Ordinary shares of GBP0.0025 each

the financial

instrument

GB00BFFK8T45

Identification

code

=== ======================== ================================================

b) Nature of the Cancellation of options to acquire ordinary

transaction shares under the Company's Long Term Incentive

Plan.

=== ======================== ================================================

c) Price(s) and Price(s) Volume(s)

volume(s) Nil cost 1,500,000

----------

=== ======================== ================================================

d) Aggregated information

Aggregated volume

Price 1,500,000

Nil per share

=== ======================== ================================================

e) Date of the transaction 31 March 2023

=== ======================== ================================================

f) Place of the Outside of trading venue

transaction

=== ======================== ================================================

Details of Persons Discharging Managerial Responsibilities

"PDMR" / person closely associated with them ('PCA')

=== ==========================================================================

a) Name Jacob Ranson

=== ======================== ================================================

2. Reason for notification

=== ==========================================================================

b) Position / status Chief Customer Officer

=== ======================== ================================================

c) Initial notification Initial notification

/ amendment

=== ======================== ================================================

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

=== ==========================================================================

b) Name Amigo Holdings PLC

=== ======================== ================================================

c) LEI 213800PUHEBLCWDW9T74

=== ======================== ================================================

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

=== ==========================================================================

a) Description of Ordinary shares of GBP0.0025 each

the financial

instrument

GB00BFFK8T45

Identification

code

=== ======================== ================================================

b) Nature of the Cancellation of options to acquire ordinary

transaction shares under the Company's Long Term Incentive

Plan.

=== ======================== ================================================

c) Price(s) and Price(s) Volume(s)

volume(s) Nil cost 1,000,000

----------

=== ======================== ================================================

d) Aggregated information

Aggregated volume

Price 1,000,000

Nil per share

=== ======================== ================================================

e) Date of the transaction 31 March 2023

=== ======================== ================================================

f) Place of the Outside of trading venue

transaction

=== ======================== ================================================

ENDS

Enquiries

Company

Amigo Holdings PLC investors@amigo.me

Kate Patrick Investor Relations Director

Roger Bennett Company Secretary

Media enquiries Amigoloans@lansons.com

Ed Hooper 07783 387713

Peel Hunt LLP 020 7418 8900

James Britton

Oliver Jackson

About Amigo Loans

Amigo is a public limited company registered in England and

Wales with registered number 10024479. The Amigo Shares are listed

on the Official List of the London Stock Exchange. On 23 March 2023

Amigo announced that it has ceased offering new loans, with

immediate effect, and would start the orderly solvent wind-down of

the business. Amigo provided guarantor loans in the UK from 2005 to

2020 and unsecured loans under the RewardRate brand from October

2022, offering access to mid--cost credit to those who are unable

to borrow from traditional lenders due to their credit histories.

Amigo's back book of loans is in the process of being run off with

all net proceeds due to creditors under a Court approved Scheme of

Arrangement. Amigo Loans Ltd and Amigo Management Services Ltd are

authorised and regulated in the UK by the Financial Conduct

Authority.

Additional Information

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation, or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell, or

otherwise dispose of, any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to this announcement

or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHNKBBQKBKBCQK

(END) Dow Jones Newswires

April 03, 2023 02:00 ET (06:00 GMT)

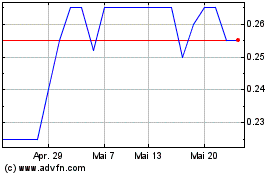

Amigo (LSE:AMGO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Amigo (LSE:AMGO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025