Pound Retreats After BoE Rate Hike, Recession Warning

22 September 2022 - 12:23PM

RTTF2

The pound retreated from early highs against its most major

counterparts in the European session on Thursday, after the Bank of

England raised its key rate by 50 basis points, but predicted a

recession in the third quarter of this year.

The nine-member rate-setting committee decided to raise the bank

rate by a half percentage point to 2.25 percent from 1.75

percent.

Policymakers reiterated that policy is not on a pre-set path and

the committee will, as always, consider and decide the appropriate

level of Bank Rate at each meeting.

The monetary policy committee unanimously decided to begin the

sale of UK government bonds held in the Asset Purchase Facility

shortly after this meeting.

The BoE now forecast UK GDP to decline by 0.1 percent in the

third quarter, in contrast to its previous projection of a 0.4

percent growth.

Nonetheless, inflation is forecast to remain above 10 percent

over the following few months, before starting to fall back.

The pound pulled back to 1.1271 against the greenback, after

rising to 1.1364 around 6:45 am ET. It had dropped to a 37-1/2-year

low of 1.1211 at 3 am ET. The pound is likely to challenge support

around the 1.11 level.

The pound declined to near a 4-month low of 159.12 against the

yen, from a 2-day high of 164.43 seen at 4 am ET. The pound is seen

finding support around the 153.00 area.

The pound eased to 0.8753 against the euro, following a 1-week

high of 0.8691 set around 6:45 am ET. If the pound falls further,

it is likely to test support around the 0.90 region.

In contrast, the pound remained higher at a 9-day high of 1.1149

against the franc, from near a 48-year low of 1.0814 seen around

3:15 am ET. At Wednesday's close, the pair was worth 1.0880.

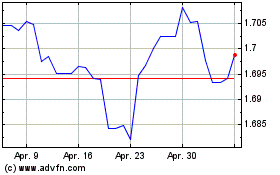

Sterling vs SGD (FX:GBPSGD)

Forex Chart

Von Nov 2024 bis Dez 2024

Sterling vs SGD (FX:GBPSGD)

Forex Chart

Von Dez 2023 bis Dez 2024

Echtzeit-Nachrichten über Pound Sterling vs Singapore Dollar (Forex): 0 Nachrichtenartikel

Weitere Pound Sterling vs Singapore Dollar News-Artikel