Pound Slides As U.K. Parliament Opens Door For Brexit Talks

14 März 2017 - 4:46AM

RTTF2

The pound declined against its major counterparts in the Asian

session on Tuesday, as the U.K. Parliament cleared the Brexit bill

to let the U.K. Prime Minister Theresa May to begin formal

withdrawal process by the March-end deadline.

The Commons earlier voted overwhelmingly to overturn two

previous Lords amendments, permitting the Parliament to grant a

"meaningful vote" on terms of final Brexit deal and guaranteeing

the rights of EU nationals living in the UK. This follows the House

of Lords approval to resist these amendments by a majority vote,

mainly because Labor peers decided to abstain.

The bill when signed by the Queen would become law, clearing way

for May to launch Article 50 talks on leaving the EU by the end of

March.

In economic front, the British Chambers of Commerce upgraded the

UK growth outlook for this year citing an upward revision to UK GDP

growth data in the final quarter of 2016, and stronger than

expected levels of consumer spending.

Gross domestic product was forecast to expand 1.4 percent

instead of 1.1 percent this year. Growth of 0.4 percent was

expected in the first quarter of 2017.

Meanwhile, Asian stock markets are trading mixed, following the

lackluster cues overnight from Wall Street and on caution as the

U.S. Federal Reserve kicks off its two-day monetary policy meeting

later in the day. Investors are also awaiting industrial output and

retail sales data from China today.

The Fed is widely expected to increase interest rates at the

culmination for its two-day meeting on Wednesday. Investors will

also focus on Fed Chair Janet Yellen's accompanying press

conference for clues about whether rates will be hiked again in the

coming months.

The pound climbed on Monday after Scotland's First Minister

Nicola Sturgeon announced plan for a second independence referendum

within two years. It rose 0.4 percent against the greenback, 0.6

percent against the yen, 0.6 percent against the euro and 0.2

percent against the Swiss franc for the day.

The pound dropped to 1.2239 against the Swiss franc, its lowest

since January 17. On the downside, 1.18 is possibly seen as the

next support level for the pound.

The pound slipped to near a 2-month low of 1.2124 against the

dollar, compared to Monday's closing value of 1.2217. If the

pound-dollar pair extends decline, it may challenge support around

the 1.20 region.

Reversing from an early high of 0.8713 against the euro, the

pound weakened to 0.8773. Continuation of the pound's downtrend may

see it challenging support around the 0.89 level.

The pound, having advanced to 140.42 against the Japanese yen at

6:30 pm ET, reversed direction and fell to 139.55. The pound is

poised to find support around the 138.00 area.

Looking ahead, Eurozone industrial production for January and

German ZEW economic sentiment index for March are due to be

released in the European session.

In the New York session, U.S. NFIB small business index and U.S.

PPI, both for February, are slated for release.

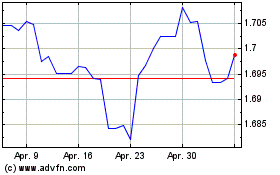

Sterling vs SGD (FX:GBPSGD)

Forex Chart

Von Okt 2024 bis Nov 2024

Sterling vs SGD (FX:GBPSGD)

Forex Chart

Von Nov 2023 bis Nov 2024