Singapore Dollar Falls To New Multi-day Lows Against Majors

12 Oktober 2009 - 7:35AM

RTTF2

Monday during early deals, the Singapore dollar fell to new

multi-day lows against its European, US, Hong Kong and UK

counterparts after the Singapore central bank kept its current

policy stance unchanged despite raising its economic outlook for

the year.

The Ministry of Trade and Industry upgraded its economic growth

forecast for 2009 to -2.0 to -2.5 percent as the economy expanded

0.8 percent in the third quarter of 2009 from a year earlier,

returning to growth after three quarters of annual contraction.

"Singapore's economic prospects in 2010 will be closely tied to

the conditions in the external environment," the MTI said. "The

manufacturing sector will be supported by inventory cycle

adjustments and any uplift in private final demand in the external

economies. Trade-dependent sectors are likely to continue to

benefit from a gradual resumption in global and regional trade

flows in 2010."

The Monetary Authority of Singapore said it will maintain the

current policy stance of a zero percent appreciation of the

Singapore dollar nominal effective exchange rate or S$NEER policy

path. There will no change to the width of the policy band and the

level at which it is centred, said MAS.

In early deals on Friday, the Singapore dollar weakened against

its European counterpart. The Singapore currency hit a 4-day low of

2.0611 against the euro by about 11:40 pm ET, compared to hit

2.0566 late Friday in New York. If the Singapore currency drops

further, 2.068 is seen as the next downside target level.

The German September wholesale price index is expected in the

upcoming session.

The Singapore dollar lost ground against its US counterpart

during early Asian trading on Monday. The Singapore dollar slumped

to a 4-day low of 1.4021 against the greenback around 11:40 pm ET,

down by more than 0.25 percent from Friday's close of 1.3954. If

the domestic unit ticks down further, support is likely seen at the

1.412 level.

The Singapore dollar that was worth 5.5520 against the Hong Kong

dollar at Friday's New York session close dropped to a 5-day low of

5.5284 during Monday's early trading. If the Singapore currency

slides further, 5.499 is seen as the next downside target

level.

The Singapore dollar eased against the pound after rising to a

5-month high of 2.2076 during Monday's early Asian trading. As of

now, the Singapore currency is trading at 2.2192 against the UK

currency, with 2.25 seen as the next downside target level. At

Friday's New York session close, the pair was quoted at 2.2121.

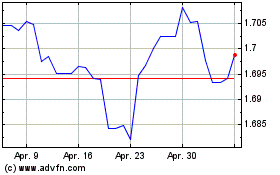

Sterling vs SGD (FX:GBPSGD)

Forex Chart

Von Apr 2024 bis Mai 2024

Sterling vs SGD (FX:GBPSGD)

Forex Chart

Von Mai 2023 bis Mai 2024