ONWARD Medical N.V. (the “Company”) (Euronext: ONWD), the medical

technology company creating innovative spinal cord stimulation

therapies to restore movement, function, and independence in people

with spinal cord injury (SCI), today announces that it successfully

raised an amount of EUR 50 million in gross proceeds by way of an

upsized bookbuild offering through a private placement with

institutional investors of 10 million new ordinary shares (the

“Private Placement” and such shares the “New Shares”) via the Joint

Bookrunners (as defined below). The New Shares were offered at an

issue price of EUR 5.00 per share (the “Issue Price”).

“We are delighted to complete this successful transaction, which

will support the Company’s expected commercialization of the ARC-EX

System and other important development, clinical, and commercial

activities for two years or more. We are also very pleased to

welcome Ottobock as a strategic investor and partner,” said Dave

Marver, CEO of ONWARD Medical. “Now that this financing is

complete, we look forward to exploring opportunities to collaborate

closely with Ottobock to enhance and accelerate our ability to

develop and commercialize our breakthrough therapies

worldwide.”

“We are delighted with the successful transaction that has made

Ottobock the Cornerstone Investor in ONWARD Medical,” said

Professor Hans Georg Näder, Chairman of the Board and owner of

Ottobock SE & Co. KGaA. “As the innovation leader in our

industry, we see great potential in their therapy approaches for

people with spinal cord injuries. With more than 100 years of

experience in medical technology innovation, our global network and

our strong brand, we will support ONWARD Medical in realizing their

potential.”

“With the investment into ONWARD we are underlining our ambition

to drive breakthrough innovation. Our technological competences are

very complementary, and we will make a change to people living with

Spinal Cord Injury and other neurological indications. Our

investment is a starting point for several collaboration

opportunities ahead of us,” said Oliver Jakobi, CEO of Ottobock SE

& Co. KGaA.

ONWARD Medical currently envisions using the net proceeds of the

Private Placement to:

- Fund research & development activities, including continued

product development, clinical studies and regulatory activities for

the investigational ARC-EX® System to restore hand and arm

function, the investigational ARC-IM® System for improved blood

pressure regulation after SCI and other exploratory indications,

and the investigational ARC-BCI™ System to restore thought-driven

movement of the human body after SCI (40%);

- Support the expected commercial launch of the ARC-EX System in

the United States later this year, including hiring a field sales

organization and conducting selling activities, producing training

and education materials and conducting training events, attending

congresses, developing customer support capabilities and conducting

customer support activities, and conducting market access and

reimbursement activities (30%);

- Build quality, operations, and administrative capabilities

(20%);

- Fund working capital requirements and potential strategic

opportunities, aimed at establishing, maintaining, or strengthening

competitive advantage through license arrangements, acquisitions

whether by assets or shares, or other arrangements (partnering or

otherwise) (5%); and

- Cover financing costs associated with existing obligations

under current and anticipated debt funding (5%).

The net proceeds from the Private Placement are expected to

extend the current cash runway of the Company to two years or

more.

During the bookbuilding period of one business day for the

Private Placement, trading of the Company’s shares on the regulated

markets of Euronext Brussels, Euronext Amsterdam and Euronext Paris

was temporarily suspended and shall resume today (October 24, 2024)

as of the start of the trading day.

The New Shares are expected to be listed and admitted to trading

on Euronext Brussels, Euronext Amsterdam and Euronext Paris on

October 28, 2024, and payment and delivery of the New Shares are

expected to take place on October 28, 2024. The New Shares will

rank pari passu in all respects with the existing ordinary shares

in the Company.

Following the closing of the Private Placement, Ottobock SE

& Co. KGaA (“Ottobock") will hold c.10% of the Company’s share

capital. The pricing was determined by the Company’s Pricing

Committee.

The Company, Ottobock, as well as certain members of the

Management and the Board of Directors have agreed to a 180-day

lock-up, subject to customary exceptions.

UBS AG London Branch and Bryan, Garnier & Co acted as Joint

Global Coordinators and, together with Bank Degroof Petercam SA/NV,

as Joint Bookrunners (the “Joint Bookrunners”), and KBC Securities

as Co-Lead Manager, of the Private Placement.

To learn more about ONWARD Medical’s commitment to partnering

with the SCI Community to develop innovative solutions for

restoring movement, function, and independence after spinal cord

injury, please visit ONWD.com.

Note: All ONWARD® Medical devices and therapies, including but

not limited to ARC-IM®, ARC-EX®, ARC-BCI™, and ARC Therapy™, alone

or in combination with a brain-computer interface (BCI), are

investigational and not available for commercial use.

About ONWARD Medical

ONWARD® Medical is a medical technology company creating

therapies to restore movement, function, and independence in people

with spinal cord injury (SCI) and movement disabilities. Building

on more than a decade of scientific discovery, preclinical, and

clinical research conducted at leading hospitals, rehabilitation

clinics, and neuroscience laboratories, the Company has developed

ARC Therapy™, which has been awarded ten Breakthrough Device

Designations from the US Food and Drug Administration (FDA).

ONWARD ARC Therapy is targeted, programmed spinal cord

stimulation designed to be delivered by the Company’s

external ARC-EX® or implantable ARC-IM® platforms.

ARC Therapy can also be delivered by the Company’s ARC-BCI™

platform, which pairs the ARC-IM System with brain-computer

interface (BCI) technology to restore movement after SCI with

thought-driven control.

Use of non-invasive ARC-EX Therapy significantly improved upper

limb function after SCI in the global pivotal Up-LIFT trial, with

results published by Nature Medicine in May 2024. The

Company has submitted its regulatory application to the FDA for

clearance of the ARC-EX System in the US and is preparing for

regulatory submission in Europe. In parallel, the Company is

conducting clinical studies with its ARC-IM Therapy, which

demonstrated positive interim clinical outcomes for improved blood

pressure regulation following SCI. Other ongoing clinical studies

focus on using ARC-IM Therapy to address mobility after SCI and

gait challenges in Parkinson’s disease as well as using the ARC-BCI

platform to restore thought-driven movement of both upper and lower

limbs after SCI.

Headquartered in Eindhoven, the Netherlands, ONWARD Medical has

a Science and Engineering Center in Lausanne, Switzerland and a US

office in Boston, Massachusetts. The Company is listed on Euronext

Paris, Brussels and Amsterdam (ticker: ONWD).

For more information, visit ONWD.com, and connect with us

on LinkedIn and YouTube.

For Media Inquiries: Aditi Roy, VP

Communications media@onwd.com

For Investor Inquiries: Amori Fraser, Finance

Directorinvestors@onwd.com

About Ottobock

For more than 100 years, Ottobock has been developing innovative

fitting solutions for people with reduced mobility. As a Human

Empowerment Company, Ottobock promotes freedom of movement, quality

for life and independence. This is supported by more than 9,000

employees. With innovative power, outstanding technical solutions

and services in the fields of Prosthetics, Orthotics, NeuroMobility

and Patient Care, they enable people in 135 countries to live their

lives the best possible way they want them to. As a market leader

in wearable human bionics, the company founded in 1919 is

constantly setting new standards and pushing ahead with the

digitalisation of the industry – together with its partners, the

medical supply companies and international research institutions.

Since 2018, Ottobock has been transferring its expertise in

biomechanics to exoskeletons for ergonomic workplaces. The

international activities of the company are coordinated from the

head office in Duderstadt (state of Lower Saxony). Ottobock has

been supporting the Paralympic Games with its technical expertise

since 1988.

For more information, visit Ottobock.com, and connect with us

on LinkedIn and YouTube.

For Media Inquiries: Merle Florstedt, Head of Corporate

CommunicationsMerle.Florstedt@ottobock.de

Disclaimer

Certain statements, beliefs, and opinions in this press release

are forward-looking, which reflect the Company’s or, as

appropriate, the Company directors’ current expectations and

projections about future events. By their nature, forward-looking

statements involve several risks, uncertainties, and assumptions

that could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These

risks, uncertainties, and assumptions could adversely affect the

outcome and financial effects of the plans and events described

herein. A multitude of factors including, but not limited to,

delays in regulatory approvals, changes in demand, competition, and

technology, can cause actual events, performance, or results to

differ significantly from any anticipated development.

Forward-looking statements contained in this press release

regarding past trends or activities should not be taken as a

representation that such trends or activities will continue in the

future. As a result, the Company expressly disclaims any obligation

or undertaking to release any update or revisions to any

forward-looking statements in this press release as a result of any

change in expectations or any change in events, conditions,

assumptions, or circumstances on which these forward-looking

statements are based. Neither the Company nor its advisers or

representatives nor any of its subsidiary undertakings or any such

person’s officers or employees guarantees that the assumptions

underlying such forward-looking statements are free from errors nor

does either accept any responsibility for the future accuracy of

the forward-looking statements contained in this press release or

the actual occurrence of the forecasted developments. You should

not place undue reliance on forward-looking statements, which speak

only as of the date of this press release. All ONWARD Medical

devices and therapies referenced here, including but not limited to

ARC-IM®, ARC-EX®, ARC-BCI™ and ARC Therapy™, are investigational

and not available for commercial use.

Additional important information

These materials may not be published, distributed or transmitted

in the United States, Canada, Australia or Japan. These materials

do not contain, constitute or form part of an offer of securities

for sale or a solicitation of an offer to purchase securities (the

“Securities”) of ONWARD Medical N.V. (the “Company”), in the United

States, Australia, Canada, Japan or any other jurisdiction in which

such offer or solicitation is unlawful. The Securities of the

Company may not be offered or sold in the United States absent

registration or an exemption from registration under the U.S.

Securities Act of 1933, as amended (the “Securities Act”). There

will be no public offering of the Securities in the United States.

The Securities of the Company have not been, and will not be,

registered under the Securities Act. The Securities referred to

herein may not be offered or sold in Australia, Canada or Japan or

to, or for the account or benefit of, any national, resident or

citizen of Australia, Canada or Japan subject to certain

exceptions. No public offering of the securities will be made in

the United States.

This document (and the information contained within) is an

advertisement and not a prospectus within the meaning of the

Regulation (EU) 2017/1129 in each member state (“Member State”) of

the European Economic Area (the “Prospectus Regulation”). The

Company has not authorised any offer to the public of Securities in

any Member State of the European Economic Area. With respect to

each Member State (each a “Relevant State”), no action has been

undertaken or will be undertaken to make an offer to the public of

securities requiring publication of a prospectus in any Relevant

State. As a result, the Securities may and will only be offered in

Relevant States (i) to any legal entity which is a qualified

investor as defined in the Prospectus Regulation; or (ii) in any

other circumstances falling within Article 1(4) of the Prospectus

Regulation. For the purpose of this paragraph, the expression

"offer of securities to the public" means the communication in any

form and by any means of sufficient information on the terms of the

offer and the Securities to be offered so as to enable the investor

to decide to exercise, purchase or subscribe for the

Securities.

This document (and the information contained within) is an

advertisement and not a prospectus within the meaning of Regulation

(EU) 2017/1129, as it forms part of U.K. domestic law by virtue of

the European Union (Withdrawal) Act 2018 (the “U.K. Prospectus

Regulation”). No action has been undertaken or will be undertaken

that constitutes an offer of the securities referred to herein to

the public in the United Kingdom or requires the publication of a

prospectus in the United Kingdom. The securities referred to herein

may not and will not be offered in the United Kingdom, except to

qualified investors as defined in the UK Prospectus Regulation in

the United Kingdom.

In the United Kingdom, this document is only being distributed

to and is only directed at “qualified investors” within the meaning

of the U.K. Prospectus Regulation, and who are also (i) investment

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended, the "Financial Promotion Order"), (ii) high net worth

entities or other persons falling within Article 49(2)(a) to (d) of

the Financial Promotion Order or (iii) persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of section 21 of the Financial Services and Markets Act

2000 (as amended)) in connection with the issue or sale of any

securities may otherwise lawfully be communicated or caused to be

communicated (all such persons being referred to as “Relevant

Persons”).This document is directed only at Relevant Persons and

must not be acted on or relied on by persons who are not Relevant

Persons. Any investment or investment activity to which this

document relates is available only to Relevant Persons and will be

engaged in only with Relevant Persons.

This communication is not a prospectus for the purposes of the

Prospectus Regulation. This communication cannot be used as basis

for any investment agreement or decision. Acquiring investments to

which this announcement relates may expose an investor to a

significant risk of losing the entire amount invested. Persons

considering making such investments should consult an authorised

person specialising in advising on such investments. This

announcement does not constitute a recommendation concerning the

securities referred to herein.

No announcement or information regarding the offering, listing

or securities of the Company referred to above may be disseminated

to the public in jurisdictions where a prior registration or

approval is required for such purpose. No steps have been taken, or

will be taken, for the offering or listing of securities of the

Company in any jurisdiction where such steps would be required,

except for the admission of the offered shares on the regulated

market of Euronext Brussels, Euronext Amsterdam and Euronext Paris.

The issue, exercise, or sale of, and the subscription for or

purchase of, securities of the Company are subject to special legal

or statutory restrictions in certain jurisdictions. The Company is

not liable if the aforementioned restrictions are not complied with

by any person.

Information to Distributors

Manufacturer Target Market (MiFID II/UK MIFIR Product

Governance): Professional clients and eligible

counterparties only.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the offered shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the offered shares and determining

appropriate distribution channels.

UBS, Bryan, Garnier & Co, Degroof Petercam, and KBC

Securities are acting exclusively for the Company and no one else

in connection with the Private Placement. In connection with such

matters, they, their affiliates and their respective directors,

officers, employees and agents will not regard any other person as

their client, nor will they be responsible to any other person for

providing the protections afforded to their clients or for

providing advice in relation to the Private Placement or any other

matters referred to in this announcement.

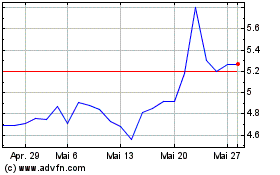

Onward Medical NV (EU:ONWD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Onward Medical NV (EU:ONWD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024