2019: mixed operational results, high net profit.

Regulated information – 20 March 2020 - 18:50

Needless to say that 2019 was characterized by

lots of uncertainties, which created more volatility in commodity

markets.

The Climate change debate and continuous

changing demands and taxes on combustion engine cars, forced the

automotive sector in an accelerated transition / electrification

phase. Campine’s products have a certain dependency on the

automotive markets. Not only are car batteries the main user of

lead alloys from the Metals Recycling division, but cars also need

lots of flame retardant plastics, which are supplied by Campine’s

Specialty Chemicals division. The slow down and uncertainties in

the automotive market ultimately lead to a domino effect of lesser

demand throughout our value chain.

We were able to counter the short-term lower

demand in lead products. Campine even had a small growth thanks to

volumes for new industrial customers and some higher sales to

commodity traders. Unlike other base metals, the lead LME price was

supported in 2019 by the 6 months outage of a large lead producer

in Australia, reducing the expected global surplus in lead.

In our Specialty Chemicals division, it was much

more difficult to fill the temporary lower demand, as several

products are tailor-made for specific applications or customers.

The lower demand in China for antimony products also lead to a

higher Chinese export and thus more competition on the global

markets. Beside the negative volume impact, the abundant supply of

antimony in China (also caused by high availability of Russian

antimony ore) created a downward price spiral for antimony

products, which lasted for the main part of 2019.

Financial results

Campine‘s net result was largely impacted by the

decision of the General Court of the EU to refund 3,9 mio € on the

original European Commission fine of 8,2 mio €. The verdict in this

appeal case was announced on November 7, 2019. It confirms the

lesser involvement of Campine in the alleged purchase cartel. The

3,9 mio € refund, which was received on our bank accounts in

December, has no tax implications. With legal expenses being mostly

booked in the previous years, the refund contributes almost in full

amount to the net result.

Revenue

In 2019 Campine had a revenue of 192,5 mio €, in

comparison with 212,4 mio € in 2018 (-9%). This lower revenue is

related to the reduced metal prices (mainly antimony), which form

the basis of Campine sales prices and the lower sales volumes in

the Division Specialty Chemicals.

EBIT

The EBIT reached 9,6 mio € (including the 3,9

mio € refund of the EC fine), which is 19% higher compared to the

8,1 mio € of 2018. The net result for 2019 is 8,0 mio € (including

the 3,9 mio € refund of the EC fine) compared to 5,8 mio €in 2018

(+37%).

Solvency

Our financial ratios have strengthened again in

2019. With a solvency ratio of 61% (equity / balance total) we have

the financial resources to progress with our large investment

program as set forward in our business plan.

Dividend

The board proposes to pay a dividend amounting

to 2,625 mio € based on the 2019 results. The pay out of 1,75 €

gross per share is planned for June 12th 2020.

Results per Division

Metals Recycling – sales 128,6 mio € (-4%) –

EBIT (excl fine EC) € 6,0 mio € (+22%)

This Division is composed of the Business Units

Lead and Metals Recovery.

Sales volumes increased with 2,5% compared to

2018 and reached approx. 64.300 ton.

Revenue and EBIT both strongly depend on the

metal prices, mainly on the lead LME price. Our margins are under

pressure when LME has a downward trend and margins recover during

upward LME movements. Despite the small difference between the lead

LME in January (1.746 €/ton) and December (1.707 €/ton) there was

some volatility throughout the year, with an average LME even at

1.787 €/ton.

Consequently, the revenue decreased by 4% to

128,6 mio € whereas the EBIT increased to 6,0 mio €

(+22%).

Specialty Chemicals – sales 77,1 mio € (-14%) –

EBIT (excl fine EC) -0,2 mio € (-107%)

This division is composed of the Business Units

Antimony and Plastics.

Sales volumes in the Specialty Chemicals

division reduced for the first time in years and reached approx.

13.600 ton. This represents a decrease of 12% compared to 2018.

Revenue is linked to the evolution of antimony

metal prices. The average Antimony Metal-Bulletin price in 2019 of

6.722 USD/ton is substantially lower than the average of 8.316

USD/ton in 2018. Consequently our revenue amounted only to 77,1 mio

€ (-14% vs 2018).

The downward price trend continued during the

entire year caused a significant value reduction of our stocks

through the year as the antimony price on January 1st was 8.000

USD/ton and 6.000 USD/ton at the end of the year.

In relation with the lower sales volumes and the

drastic price fall of antimony products in 2019, the EBIT reduced

significantly to a loss of 0,2 mio €.

Perspectives for 2020

Giving a perspective on 2020 is extremely

difficult under the current dramatical circumstances of the corona

epidemic.

Demand for our Specialty Chemicals regained

ground so far in 2020. Prices were in an upward trend due to

shortages of Antimony metal from China. This price uptake seems to

stabilize now that the Chinese export is gearing up again.

In our Metals Recycling Division it will be

important to track the macro economic developments. Demand so far

has been in line with 2019. However with shutting down of

automotive assembly lines, the demand for lead will decrease on

short terms. In recent days, customers are indeed lowering their

demand forecasts. Lead LME prices have – like most commodities -

suffered a fierce decline, with low’s going below the 1.500 € / ton

level. Campine’s profits in recycling are directly linked to lead

LME values.

Some large investments will be carried out

during 2020 in the Metals Recycling Division: a 3rd line to recover

metals from industrial waste streams other than batteries will be

built and should be operational at the end of 2020. In the lead

refinery a new ingot line, which should increase our operational

efficiency and overall capacity, will be taken into production

early 2021. As to the project to recover the polypropylene plastic

from the battery cases, construction work will start in the 2nd

semester of 2020.

Our auditor, Deloitte Bedrijfsrevisoren, represented by Luc Van

Coppenolle, has confirmed that the audit procedures of the

consolidated financial statements are substantially completed and

that these procedures have not revealed any material modification

that would have to be made to the accounting information, derived

from the consolidated financial statements and included in this

communiqué.

The annual financial report will be made

available for the public on 24 April 2020 on the website of

Campine.

For further information you can contact Karin

Leysen: tel. +32 14 60 15 49 / email: Karin.Leysen@campine.be

- devos 2019

- 2020-03-20 year

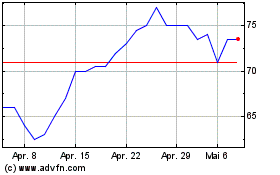

Campine NV (EU:CAMB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Campine NV (EU:CAMB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024