Press release Biocartis Group NV: Disclosure of transparency notifications

09 Dezember 2022 - 5:40PM

Press release Biocartis Group NV: Disclosure of transparency

notifications

PRESS RELEASE: REGULATED INFORMATION

9

December 2022, 17:40 CET

Disclosure of transparency

notifications

Mechelen,

Belgium, 9

December 2022 – Biocartis Group

NV (the ‘Company’ or ‘Biocartis’), an innovative molecular

diagnostics company (Euronext Brussels: BCART), announces today, in

accordance with Article 14, paragraph 1 of the Belgian Act of

2 May 2007 on the disclosure of major shareholdings in issuers of

which shares are admitted to trading on a regulated market and

laying down miscellaneous provisions (the ‘Belgian Transparency

Act’), that it received the following transparency

notifications:

1) A transparency notification

dated 7 December 2022 indicating that on 2 December 2022 the

shareholding of the Belgian State (through

SFPI-FPIM or Société Fédérale de Participations et

d'Investissement - Federale Participatie- en

Investeringsmaatschappij) has crossed the 5% notification

threshold. The notification contains the following information:

- Reason for the notification: Acquisition or disposal of voting

securities or voting rights.

- Notification by: A parent undertaking or a controlling

person.

- Person subject to the notification requirement: SFPI-FPIM,

Avenue Louise 32 box 4, 1050 Brussels, Belgium; Belgische

Staat/Etat belge, Wetstraat 12 and Koloniënstraat 11, 1000

Brussels, Belgium.

- Transaction date: 2 December 2022.

- Threshold that is crossed: 5%.

- Denominator: 92,061,563.

- Details of the notification: The notification sets out that it

concerns an upward crossing of the 5% notification threshold. On

the date of the notification, SFPI-FPIM held 7.29% of the voting

rights in Biocartis.

- Full chain of controlled undertakings through which the holding

is effectively being held: SFPI-FPIM is 100% controlled by the

Belgian State.

2) A transparency notification

dated 7 December 2022 indicating that on 2 December 2022 the

shareholding of the Flemish Region (through

ParticipatieMaatschappij Vlaanderen NV or PMV

NV) has decreased below the 3% notification

threshold. It concerns a passive downward crossing of the lowest

notification threshold. The notification contains the following

information:

- Reason for the notification: Downward crossing of the lowest

threshold. Passive crossing of a threshold.

- Notification by: A parent undertaking or a controlling

person.

- Person subject to the notification requirement: Vlaams Gewest,

Havenlaan 88, 1000 Brussels, Belgium; PMV NV, Oude Graanmarkt 63,

1000 Brussels, Belgium.

- Transaction date: 2 December 2022.

- Threshold that is crossed: 3%.

- Denominator: 92,061,563.

- Details of the notification: The notification sets out that it

concerns a passive downward crossing of the lowest (3%)

notification threshold. On the date of the notification, the

Flemish Region (through PMV NV) had an aggregate position of

2.54%.

- Full chain of controlled undertakings through which the holding

is effectively being held: The Flemish Region (Vlaams Gewest)

controls and owns 100% of the shares in PMV NV.

- Additional information: Downward crossing of the lowest

threshold/Passive downward crossing due to dilution - PMV decided

not to subscribe to capital increase. Recent review has shown that

the notification from 21 February 2018 regarding the number of

shares held by PMV NV in Biocartis was not completely accurate. PMV

NV held 501,484 shares instead of the stated 428,000 shares. This

brought the total number of shares held at that moment to 2,342,345

shares instead of 2,268,861 shares.

3) A transparency notification

dated 7 December 2022 indicating that on 2 December 2022 the

aggregate number of voting rights and equivalent financial

instruments held by Credit Suisse

(Schweiz) AG, a subsidiary of Credit Suisse Group

AG, decreased to 1.68%, as further explained below. On the date of

the notification, Credit Suisse Group AG, the parent company, held

an aggregate position of 3.61% (as compared to 3.62% notified to

Biocartis on 29 November 2022). The notification contains the

following information:

- Reason for the notification: Acquisition or disposal of voting

securities or voting rights.

- Notification by: A parent undertaking or a controlling

person.

- Person subject to the notification requirement: Credit Suisse

Group AG, Paradeplatz 8, CH-8001 Zürich, Switzerland.

- Transaction date: 2 December 2022.

- Threshold that is crossed: 3%.

- Denominator: 92,061,563.

- Details of the notification: The notification sets out that it

concerns a group notification with a downward crossing of the 3%

threshold at the level of the subsidiary Credit Suisse (Schweiz)

AG. On the date of the notification, this entity held an aggregate

position of 1.68% of voting rights and equivalent financial

instruments (i.e., shares which it has out on loan to third parties

with a right to recall) as compared to 3.20% notified to Biocartis

on 29 November 2022. Together with the participation of 1.93% of

Credit Suisse Fund Management S.A., another subsidiary of

Credit Suisse Group AG, the latter held an aggregate position of

3.61% (as compared to 3.62% notified to Biocartis on 29 November

2022).

- Full chain of controlled undertakings through which the holding

is effectively being held: Credit Suisse Group AG, Credit Suisse

AG, Credit Suisse Asset Management International Holding Ltd.,

Credit Suisse Asset Management & Investor Service (Schweiz)

Holding AG, Credit Suisse Fund Management S.A./ Credit Suisse Group

AG, Credit Suisse AG, Credit Suisse (Schweiz) AG.

4) A transparency notification

dated 8 December 2022 indicating that on 2 December 2022 the

shareholding of Johnson & Johnson

Innovation - JJDC, Inc., a subsidiary of Johnson &

Johnson, has decreased below the 5% notification threshold. It

concerns a passive downward crossing of the 5% threshold. The

notification contains the following information:

- Reason for the notification: Passive crossing of a

threshold.

- Notification by: A parent undertaking or a controlling

person.

- Person subject to the notification requirement: Johnson &

Johnson, 1 J&J Plaza, New Brunswich, New Jersey, 08901 United

States of America; Johnson & Johnson Innovation - JJDC, Inc.,

410 George Street, New Brunswich, New Jersey, 08901, United States

of America.

- Transaction date: 2 December 2022.

- Threshold that is crossed: 5%.

- Denominator: 92,061,563.

- Details of the notification: The notification sets out that it

concerns a passive downward crossing of the 5% notification

threshold. On the date of the notification, Johnson & Johnson

Innovation - JJDC, Inc. had an aggregate position of 4.18%.

- Full chain of controlled undertakings through which the holding

is effectively being held: Johnson & Johnson Innovation - JJDC,

Inc. is a wholly owned subsidiary of Johnson & Johnson. Johnson

& Johnson is not a controlled entity.

For further information, reference is made to

the notifications which are available here on the Biocartis

website.

Pursuant to the Belgian Transparency Act and the

articles of association of the Company, a notification to the

Company and the Belgian Financial Services and Markets Authority

(‘FSMA’) is required by all natural and legal persons in each case

where the percentage of voting rights in the Company held by such

persons reaches, exceeds or falls below the threshold of 3%, 5%,

10%, and every subsequent multiple of 5%, of the total number of

voting rights in the Company.

--- END ---

More information: Renate

DegraveHead of Corporate Communications & Investor Relations

Biocartise-mail rdegrave@biocartis.com tel

+32 15 631 729

mobile +32 471 53 60 64

About Biocartis

With its revolutionary and proprietary Idylla™

platform, Biocartis (Euronext Brussels: BCART) aspires to enable

personalized medicine for patients around the world through

universal access to molecular testing, by making molecular testing

actionable, convenient, fast and suitable for any lab. The Idylla™

platform is a fully automated sample-to-result, real-time PCR

(Polymerase Chain Reaction) based system designed to offer in-house

access to accurate molecular information in a minimum amount of

time for faster, informed treatment decisions. Idylla™'s

continuously expanding menu of molecular diagnostic tests address

key unmet clinical needs, with a focus in oncology. This is the

fastest growing segment of the molecular diagnostics market

worldwide. Today, Biocartis offers tests supporting melanoma,

colorectal, lung and liver cancer, as well as for COVID-19, Flu,

RSV and sepsis. For more information, visit www.biocartis.com

or follow Biocartis on Twitter @Biocartis_ , Facebook or

LinkedIn.

Biocartis and Idylla™ are registered trademarks

in Europe, the United States and other countries. The Biocartis and

Idylla™ trademark and logo are used trademarks owned by Biocartis.

Please refer to the product labeling for applicable intended uses

for each individual Biocartis product. This press release is not

for distribution, directly or indirectly, in any jurisdiction where

to do so would be unlawful. Any persons reading this press release

should inform themselves of and observe any such restrictions.

Biocartis takes no responsibility for any violation of any such

restrictions by any person. This press release does not constitute

an offer or invitation for the sale or purchase of securities in

any jurisdiction. No securities of Biocartis may be offered or sold

in the United States of America absent registration with the United

States Securities and Exchange Commission or an exemption from

registration under the U.S. Securities Act of 1933, as amended.

Forward-looking statements

Certain statements, beliefs and opinions in this

press release are forward-looking, which reflect the Company's or,

as appropriate, the Company directors' or managements' current

expectations and projections concerning future events such as the

Company's results of operations, financial condition, liquidity,

performance, prospects, growth, strategies and the industry in

which the Company operates. By their nature, forward-looking

statements involve a number of risks, uncertainties, assumptions

and other factors that could cause actual results or events to

differ materially from those expressed or implied by the

forward-looking statements. These risks, uncertainties, assumptions

and factors could adversely affect the outcome and financial

effects of the plans and events described herein. A multitude of

factors including, but not limited to, changes in demand,

competition and technology, can cause actual events, performance or

results to differ significantly from any anticipated development.

Forward-looking statements contained in this press release

regarding past trends or activities are not guarantees of future

performance and should not be taken as a representation that such

trends or activities will continue in the future. In addition, even

if actual results or developments are consistent with the

forward-looking statements contained in this press release, those

results or developments may not be indicative of results or

developments in future periods. No representations and warranties

are made as to the accuracy or fairness of such forward-looking

statements. As a result, the Company expressly disclaims any

obligation or undertaking to release any updates or revisions to

any forward-looking statements in this press release as a result of

any change in expectations or any change in events, conditions,

assumptions or circumstances on which these forward-looking

statements are based, except if specifically required to do so by

law or regulation. Neither the Company nor its advisers or

representatives nor any of its subsidiary undertakings or any such

person's officers or employees guarantees that the assumptions

underlying such forward-looking statements are free from errors nor

does either accept any responsibility for the future accuracy of

the forward-looking statements contained in this press release or

the actual occurrence of the forecasted developments. You should

not place undue reliance on forward-looking statements, which speak

only as of the date of this press release.

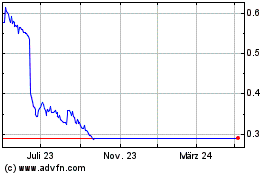

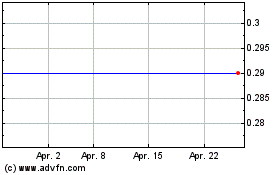

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Jul 2023 bis Jul 2024