- H1 2023 sales revenue at €14.9 million, +80% vs. H1

2022

- Backlog1 at €10.3 million at June 30, 2023, down -6% vs. H1

2022

- Gross margin rate improved to 41% vs. 35% in H1

2022

- Cash position of €2.2 million at June 30, 2023

- Proposed tender offer by SoftBank Group to acquire BALYO

shares at €0.85 per ordinary share

- Financial position and outlook

Regulatory News:

BALYO (FR0013258399, Ticker: BALYO), technology leader in

the design and development of innovative robotic solutions for

industrial trucks, today announces its results for the first half

of 2023, approved by the Board of Directors on September 18,

2023.

Pascal Rialland, Chairman and CEO of BALYO, comments:

"Our results for the first half of 2023 have significantly improved

compared with 2022, marked by a significant improvement in our

gross margin and overall profitability metrics. This improvement is

mainly due to favorable seasonality in the execution of order

commitments with Linde. Nevertheless, direct sales orders in H1

fell short of our expectations. The Company must meet financing

requirements over the next 12 months, which will depend on the

success of SoftBank Group's takeover bid for the Company's shares

that would enable us to secure our financial position".

First half 2023 activity

As announced on the occasion of the release of the revenues for

the first half of 2023, BALYO recorded sales of €14.9 million in

the first half of 2023, up 80% over the first half of 2022.

In the second quarter of 2023, the Group recorded sales of €7.6

million, up 73% over the second quarter of 2022.

After integrating new orders of €3.3 million in the second

quarter of 2023, BALYO's order backlog1 stood at €10.3 million at

June 30, 2023, compared with €11.0 million for the same period last

year. This represents a decline of -6% compared with the first half

of 2022, due to a slowdown in business in the United States.

Over the period, BALYO generated 24% of its order intake

directly, compared with 36% in 2022, a lower level of performance

than the Company's ambitions, due in part to client delays.

2023 Half-Year financial results

The interim financial statements have been subject to a limited

review by the Statutory Auditors

In € million

H1 2023

H1 2022

Change

Sales revenue

14.89

8.29

+80%

Cost of sales

-8.76

-5.43

+61%

Gross profit

6.13

2.86

+114%

Gross margin rate

41%

35%

+19%

Research and Development

-2.36

-2.46

-4%

Sales and Marketing

-1.78

-1.33

+34%

General and administrative expenses

-3.72

-3.83

-3%

Share-based payment expense

-0.11

-0.21

-49%

Operating loss

-1.85

-4.98

+63%

Financial expense

-0.54

-0.02

-

Net loss

-2.43

-5.00

+52%

Cash position (as of June 30)

2.16

6.68

-

In the first half of 2023, gross margin stood at €6.13 million,

up +114% over the first half of 2022. This improvement is the

result of favorable seasonality in the execution of 2023 order

commitments with our partner Linde, and a more controlled cost

structure, with raw material costs stable and under control in

relation to revenues, combined with better absorption of personnel

costs. As a result, the gross margin improved from 35% to 41%.

Operating expenses stand at €7.87 million, up slightly by 3% due

to higher sales and marketing expenses (+34%). This increase can be

best explained by higher personnel and marketing costs following

participation in numerous trade fairs.

After taking these items into account, the operating loss for

the period came to -€1.85 million, a clear improvement compared

with the -€4.98 million recorded in the first half of 2022.

Net financial expense came to -€0.5 million, compared with

-€0.02 million for the corresponding period in 2022.

Overall, net income for the first half of 2023 totaled -€2.4

million, compared with -€5.0 million for the first half of

2022.

At the end of June 2023, BALYO had 178 employees, compared with

146 at the end of December 2022.

Change in order intake

At the date of this press release, firm orders intake over the

course of the 2023 3rd quarter amounted to €3.7 million, a level

that remains significantly lower than anticipated. As a result,

BALYO's order backlog stood at €12.5 million at September 18, 2023,

compared with €11.5 million for the corresponding period in

2022.

Reminder of the proposed takeover bid by SoftBank

Group

At the beginning of June, SoftBank Group (the “Offeror”)

initiated a proposed takeover bid to acquire the shares of BALYO.

This friendly offer is priced at €0.85 per ordinary share, €0.01

per preferred share and €0.07 per share purchase warrant. BALYO is

complementary to SoftBank's existing investments in the transport

and logistics sectors. Should the offer be successful, this

investment will enable SoftBank Group to expand its business in the

transportation and mobility sectors, while BALYO will gain access

to its partner's global network of over 470 technology-driven

companies to develop new business relationships. Should the offer

be successful, considering the SoftBank Group ecosystem, it is

expected that BALYO will benefit from a support to deliver on its

direct sales strategy.

In connection with the Offer, the Offeror has agreed to provide

interim financing of up to €5 million to BALYO to meet its working

capital requirements. This financing includes a payment in several

drawdowns and is structured in the form of convertible bonds issued

by BALYO to the Offeror, maturing on October 31, 2024. As a result

of softer than expected orders in H1, Balyo drew down a first

tranche of this financing on July 20, 2023 for an amount of €1.5

million, as well as a second tranche amounting to €0.5 million on

September 6, 2023. Besides, a drawdown of €1 million in September

2023 has been requested by BALYO, which has not yet been issued at

the date of publication of this press release. BALYO plans to

continue drawing on this financing in October and November, up to

the monthly contractual limit of €0.5 million.

The amount drawn down by BALYO under the financing is

convertible at the Offeror's selection, at the following price:

(i.) if the conversion occurs as from the date of filing of the

Offer but prior to the first of the following two dates: the first

settlement-delivery of the Offer or the termination of the Offer2,

at the Offer Price per share, provided that the Offeror has

announced its intention not to convert during the Offer;

(ii.) if the conversion occurs on or after the earlier of: the

first settlement-delivery of the Offer and the Termination of the

Offer and the Ordinary Shares are still listed on Euronext Paris,

at the lower of (A) the Offer Price, and (B) the price

corresponding to the VWAP of the BALYO share price calculated on

the basis of the last thirty (30) trading days preceding the date

of the conversion notice less a 20% discount;

(iii.) if the conversion occurs on or after the earlier of: the

first settlement-delivery of the Offer and the Termination of the

Offer and the shares have ceased to be listed on Euronext Paris

following the completion of a squeeze-out on the remaining

outstanding shares of BALYO, at the lower of (A) the Offer Price

per share, and (B) a 20% discount to the market value of the BALYO

shares.

Upon Termination of the Offer, the Financing will remain in

place but the amount available to BALYO shall be reduced to

€3,000,000 less any amounts that have previously been drawn3 (in

the event of drawdowns exceeding €3,000,000 prior to the Offer and

in the event of Termination of the Offer, the amount of authorized

financing will be reduced to the amount already drawn down).

BALYO's Board of Directors welcomed the Offer in principle on

June 13, 2023, pending the independent expert's conclusions on its

financial terms. BALYO's Economic and Social Council also issued a

favorable opinion on the Offer on July 5. All the documents

relating to the Offer has been filed with the AMF during the third

quarter of 2023, following the Board of Directors' reasoned opinion

on the Offer, with completion of the Offer scheduled for the fourth

quarter of 2023.

Pursuant to Article 261-1 I 2°, 4° and 5° and II of the AMF's

General Regulations, Eight Advisory (represented by Geoffroy

Bizard) has been appointed as an independent expert to issue a

report on the fairness of the Offer Price in the context of the

public tender offer.

On August 4, 2023, Eight Advisory issued a report concluding

that the financial terms of the Offer were fair. The addendum to

this report dated September 12, 2023 does not call into question

the fairness of the financial terms of the Offer. This addendum was

submitted to BALYO's Board of Directors and Ad Hoc Committee on

September 18, 2023, who reaffirmed their support for the Offer and

its interest for the Company, its employees and its shareholders,

particularly in the context of the Company's deteriorating cash

position.

Financial position and outlook

At June 30, 2023, prior to the first drawdown on July 20 on the

interim financing provided by the Offeror, BALYO's cash position

stood at €2.2 million, compared with €8.2 million at the end of

December 2022. In June 2023, BALYO has entered into an agreement

with its senior creditors regarding the extension of its existing

financing, for which the Company was not in a position to meet

upcoming payment deadlines.

Indeed, BALYO's cash flow forecasts, as previously established

prior to this agreement, indicated uncovered financing requirements

for September 2023 due to negative operating cash flow and

repayment deadlines for state-guaranteed bank loans known as "PGE".

It thus appeared necessary to postpone the repayment of the “PGEs”

and these discussions led to an agreement with Balyo's creditors on

a deferred payment divided into 2 periods: a firm period running

until September 30, 2023, and a conditional period running from

October 1 to December 31, 2023, subject to a fundraising of €10

million (repayments will otherwise resume on the basis of the

amortization schedule in January 2023).

Since then, forecasts have been adjusted downwards in June to

reflect 2nd quarter order intake. The further deterioration at the

end of August as observed today can be best explained by (i) the

absence of expected down payments on significant commercial

contracts currently under negotiation for which the receipt of down

payments was finally subject at the end of August to the obtaining

of bank guarantees for equivalent amounts (these guarantees are

still under discussion at the date of publication of this press

release) and (ii) the upward review of forecast cash outflows for

the 2nd half of the year. After taking into account the remaining

convertible bond issues with the Offeror and the postponement of

payment deadlines to 2024 granted to BALYO by one of its main

suppliers, the cash position would be positive until early

2024.

Based on its cash position at the end of June 2023, firm orders

intake and the level of order backlog at the date of this press

release, BALYO's Board of Directors considers that in the event of

the offer not being successful, or of commercial orders falling

short of expectations, and should the financing requirement

identified to the beginning of 2024 not be covered over the

subsequent period, BALYO might not be able to realize its assets

and liabilities and settle its debts in the normal course of

business. As a result, there is a significant uncertainty regarding

BALYO's ability to continue as a going concern.

In addition, the Company received the repayment of the Research

Tax Credit 2022 on September 18, 2023 (originally scheduled for

October).

In the last quarter of 2023, BALYO will particularly pay

attention to look for new partnerships after being notified by its

long-standing partner, Linde, of the non-renewal of order

commitments from 2024 onwards.

***

Next BALYO financial release: 2023 third quarter sales,

on October 26, 2023.

BALYO has made available to the public and submitted to the

Autorité des marchés financiers its half-year financial report as

of June 30, 2023. The Statutory Auditors' interim financial report

contains an observation concerning the Company's current cash

position, which gives rise to significant going concern

uncertainty.

The half-year financial report is available on BALYO’s website

at www.balyo.com, in the "Documentation" section.

About BALYO

Humans around the World deserve enriching and creative jobs. At

BALYO, we believe that pallet movements in DC and manufacturing

sites should be left to fully autonomous robots. To execute this

ambition, BALYO transforms standard forklifts into intelligent

robots thanks to its breakthrough Driven by Balyo™ technology. Our

leading geo guidance navigation system enables robots to locate

their position and navigate autonomously inside buildings - without

the need for any additional infrastructure. To accelerate the

material handling market conversion to autonomy, BALYO has entered

into two global partnerships with KION (Fenwick-Linde's parent

company) and Hyster-Yale Group. A full range of globally available

robots has been developed for virtually all traditional warehousing

applications; Tractor, Pallet, Stackers, Reach and VNA-robots.

BALYO and its subsidiaries in Boston and Singapore serve clients in

the Americas, Europe and Asia-Pacific. The company has been listed

on EURONEXT since 2017 and its sales revenue reached €24.1 million

in 2022. For more information, visit www.balyo.com.

___________

1 The backlog refers to all orders for projects received but not

yet fulfilled. The backlog evolves every quarter following the

taking into account of new orders, the revenue generated by

projects during the period and the cancellation of orders. 2

"Termination of the Offer" as defined in the TOA signed between the

Offeror and the Company. 3 Without any early repayment for any

amount above €3,000,000.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230918024230/en/

BALYO Frank Chuffart investors@balyo.com

NewCap Financial Communication and Investor Relations Thomas

Grojean / Aurélie Manavarere Phone: +33 1 44 71 94 94

balyo@newcap.eu

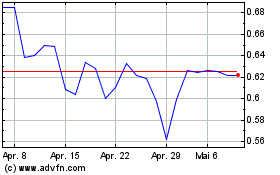

Balyo (EU:BALYO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Balyo (EU:BALYO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024