Regulatory News:

Balyo (Paris:BALYO):

This press release does not constitute an offer to purchase

securities.

This press release (the "Press

Release") has been prepared and is being disseminated in

accordance with the provisions of Article 231-26 of the General

Regulations of the Autorité des marchés financiers (the

"AMF"). The draft tender offer, the draft offer document and

the draft reply document (the "Draft Reply Document") remain

subject to review by the AMF.

IMPORTANT NOTICE

Pursuant to Articles 231-19 and

261-1 et seq. of the General Regulation of the AMF, the report of

EightAdvisory, acting as independent expert, is included in the

Draft Offer Response.

The Press Release should be read in relation with all other

documents published in connection with the Offer. The Draft Offer

Document filed with the AMF on 16 August 2023 is available on

Balyo's website (www.balyo.com) and on the AMF's website

(www.amf-france.org) and may be obtained free of charge from

Balyo's registered office at 74 Avenue Vladimir Illitch Lenine,

94110 Arcueil.

In accordance with article 231-28 of the general regulation of

the AMF, information relating to the legal, financial and

accounting characteristics of Balyo will be filed with the AMF and

made available to the public, in the same way, no later than the

day before the opening of the tender offer.

A press release will be issued, no later than the day before the

opening of the tender offer, to inform the public of the procedures

for making these documents available.

1. PRESENTATION OF THE OFFER

Pursuant to Title III of Book II, and in particular articles

231-13 and 232-1 et seq. of the general regulation of the AMF (the

"General Regulation of the AMF"), SVF II STRATEGIC

INVESTMENTS AIV LLC, a Delaware corporation (United States), having

its registered office at Corporation Service Company, 251 Little

Falls Drive, Wilmington, Delaware 19808, USA, registered under

number 6207806 ("SVF AIV" or the "Offeror") has

irrevocably undertaken to offer to the shareholders and to warrants

holder of Balyo, a société anonyme with a Board of Directors and a

share capital of 2,749,258.96 euros, having its registered office

at 74 Avenue Vladimir Illitch Lenine, 94110 Arcueil, France,

registered under number 483 563 029 with the Créteil Trade and

Companies Register ("Balyo" or the "Company" and

together with its direct or indirect subsidiaries, the

"Group"), whose shares are listed on compartment C of the

Euronext Paris regulated market under ISIN code FR0013258399,

mnemonic "BALYO" (the "Shares"), to acquire in cash (i) all

their Ordinary Shares (as this term is defined below, subject to

the exceptions below) at a price of 0,85 per Ordinary Share (the

"Ordinary Share Offer Price"), (ii) all of their ADP (as

this term is defined below, subject to the exceptions below) at a

price of 0.01 euro per ADP (the "Offer Price per ADP"), and

(iii) all of their Warrants (as defined below) at a price of 0.07

euro per Warrant (the " Warrant Offer Price" together with

the Offer Price per Ordinary Share and the Offer Price per ADP, the

"Offer Price"), as part of a public tender offer, the terms

of which are set out below and described in greater detail in the

draft offer document prepared by the Offeror and filed with the AMF

(the "Draft Offer Document") (hereinafter the

"Offer").

The Offer relates to:

- the ordinary shares already issued, with

the exception of the Excluded Shares (as defined below), i.e., as

of 16 August 2023, a number of 34,141,873 ordinary shares; - the

ordinary shares likely to be issued before the close of the Offer

or the Reopened Offer following the exercise of the 830,000

stock-option (bons de souscription de parts de créateur

d'entreprise, the "BSPCE") which have not been renounced by

their holders (it being specified that these BSPCE are out of the

money as their exercise price is higher than the Offer Price of the

Ordinary Shares, and that they will become null and void at the

closing of the Offer (in the event of success)) and represent, to

the best of the Company's knowledge, as of the date of Press

Release, a maximum of 830,000 Ordinary Shares, i.e. around 2.42% of

the share capital and voting rights (together with the ordinary

shares already issued by the Company, the “Ordinary Shares”)

- 6,270 preference shares issued by the Company, i.e., as at 16

August 2023, 2,090 ADP T3, 2,090 ADP T4, and 2,090 ADP T5 (the

"ADP")1 ; and - all the warrants issued by the Company on 22

February 2019 to Amazon, i.e., 11,753,581 warrants as at 16 August

2023 (the “Warrants”);

(together the "Target Securities").

It is specified that the Offer is not aimed at:

- Ordinary Shares held in treasury by the

Company, representing 34,894 Ordinary Shares as of 16 August 2023

(the "Treasury Shares");

- the 180,000 Ordinary Shares, the 900 ADP

T3, the 900 ADP T4 and the 900 ADP T5 held by Mr. Pascal Rialland

subject to the constraints provided for by article L. 225-197-1. II

§4 of the French Commercial Code, pursuant to which (i) Balyo’s

Board of Directors imposed to Mr. Pascal Rialland, an obligation to

retain a percentage of his shares and (ii) such shares which are

subject to retention obligation are covered by a liquidity

mechanism, described at section 7.2.3 of the Press Release (the

“Unavailable Shares” and together with the Treasury Shares,

the “Excluded Shares”); and

- the 830,000 BSPCE issued by the Company,

which are non-transferable by virtue of the provisions of article

163bis G of the French General Tax Code.

As of the date of this Draft Offer Document, there are no other

equity securities or other financial instruments issued by the

Company or rights conferred by the Company that could give access,

immediately or in the future, to the Company's capital or voting

rights, subject to the issuance and, if applicable, conversion of

the Bonds as described in section of the Draft Response

Document.

The Ordinary Shares already issued are listed on compartment C

of the Euronext Paris regulated market under ISIN code FR0013258399

(mnemonic “BALYO”). The Preferred Shares and Company Warrants are

not listed on any market.

2. CONTEXT AND CHARACTERISTICS OF THE OFFER

2.1 Background and reasons for the Offer

Balyo’s activities consist of research and development

(R&D), the design of technologies enabling standard forklifts

for horizontal or vertical pallet transport to be automated, and

the marketing and sale of these robots and related services. With a

strong product offering of lift trucks with both vertical and

horizontal transport applications long-standing relationships with

its partners (warehouse operators and suppliers) and experience in

this sector, the Offeror considers the Balyo Group as being one of

the best in this robotics sector.

The Offeror, SVF AIV, is a wholly owned direct subsidiary of the

Japanese company SoftBank Group Corp. (hereinafter "SBG"),

which was founded in 1981 by Mr. Masayoshi Son. The SoftBank Group

invests in breakthrough technology to improve the quality of life

for people around the world. The SoftBank Groupe is comprised of

SBG (TOKYO: 9984), an investment holding company that includes

stakes in AI, smart robotics, IoT, telecommunications, internet

services, and clean energy technology providers, the SoftBank

Vision Funds and SoftBank Latin America Funds, which are investing

more than US$160 billion to help entrepreneurs transform industries

and shape new ones.

The Company's Board of Directors (the “Board of

Directors”) met on 13 June 2023 to review the proposed Offer.

At this meeting, the Company's Board of Directors unanimously

approved the proposed transaction and authorized the Company to

enter into a tender offer agreement with the Offeror (the

"TOA").

In accordance with the provisions of article 261-1, III of the

General Regulation of the AMF, the Company's Board of Directors, at

its meeting on 13 June 2023 decided to set up an ad hoc committee,

composed the following Directors:

- Ms Corinne Jouanny, independent Director ;

- Bénédicte Huot de Luze, independent Director ; and - Alexandre

Pelletier, Director ;

a majority of independent Directors, whose mission is to (i)

make a recommendation to the Company's Board of Directors on the

appointment of the independent expert, (ii) examine the conditions

of the Offer and monitor the follow up of independent expert's work

and (iii) prepare the draft reasoned opinion for the Company's

Board of Directors on the proposed Offer in accordance with the

provisions of article 261-1, III of the General Regulation of the

AMF.

On 13 June 2023, the Company's Board of Directors, on the

recommendation of the ad hoc committee, appointed Eight Advisory,

represented by Geoffroy Bizard, as independent expert in connection

with the proposed Offer, with the task of preparing a report

including a fairness opinion on the financial terms of the Offer,

including the squeeze-out, in accordance with the provisions of

article 261-1, I, 2°, 4°, 5° and II of the General Regulation of

the AMF.

On 13 June 2023, the Offeror entered into agreements with FPCI

FSN PME - Ambition Numérique represented by Bpifrance

Investissement,, Hyster-Yale UK Limited, SSUG PIPE Fund SCSp,

SICAVRAIF, Linde Material Handling, GmbH, and Thomas Duval, and on

14 June 2023 with Invus Public Equities, L.P., each of which is a

shareholder of the Company, pursuant to which each such shareholder

undertakes to tender the Targeted Securities held by it to the

Offer pursuant to the terms and conditions of such agreement. On 13

June 2023, the Offeror also entered into an agreement pursuant to

which Financière Arbevel, a shareholder of the Company, undertook

to tender any Targeted Securities held by it at the opening of the

Offer to the Offer and pursuant to the terms and conditions of such

agreement.

On 14 June 2023, the Company and the Offeror entered into the

TOA, under the terms of which the Offeror undertook to tender the

Offer to the Company, and the Company undertook to cooperate with

the Offeror in connection with the Offer. The main terms of the TOA

are described in section of the Draft Response Document.

On 14 June 2023, the Company and the Offeror announced, by way

of a joint press release, (i) the execution of the TOA, (ii) SBG's

intention to file a tender offer through a 100%-owned subsidiary to

acquire the Target Securities, (iii) the provision of the

Intermediary Financing (as such term is defined below) described in

section 7.3 of the Draft Response Document, (iv) the signature of

the agreement with the shareholders as described in section 7.2.1

of the Draft Response Document, and (v) the fact that the Company

entered into an agreement with its senior lenders on 13 June 2023

concerning the extension of the existing senior financing

agreement.

If the conditions are met, the Offeror also intends to implement

a squeeze-out procedure, pursuant to articles L. 433-4, II of the

French Monetary and Financial Code and 237-1 to 237-10 of the

General Regulation of the AMF, with a view to obtaining the

transfer of the Target Securities not tendered to the Offer in

consideration for an indemnity equal to the Offer Price.

On 15 June 2023, the Company initiated the

information-consultation procedure with its works council (the

"Comité Social et Economique" (the "CSE")), which met for

the first time on 16 June 2023. On 21 June 2023, the CSE held its

first hearing with SBG, followed by a second exchange of views on 5

July 2023, in accordance with article 2312-42, paragraph 3 of the

French Labor Code. On 5 July 2023, the CSE issued a favorable

opinion on the Offer.

2.2 Reminder of the terms of the Offer

2.2.1 Main terms of the Offer

The Offer is voluntary and will be carried out in accordance

with the normal procedure pursuant to articles 232-1 et seq. of the

General Regulation of the AMF.

In accordance with the provisions of article 232-4 of the

General Regulation of the AMF, unless the Offer is not successful,

it will be automatically reopened within ten (10) trading days of

the publication of the definitive result of the Offer, on terms

identical to those of the Offer (the "Reopened Offer").

Pursuant to articles L. 433-4 II of the French Monetary and

Financial Code and 232-4 and 237-1 et seq. of the General

Regulation of the AMF, the Offeror has indicated that it intends to

ask the AMF to implement, within ten (10) trading days of the

publication of the result of the Offer or, as the case may be,

within three (3) months of the closing of the Reopened Offer, of a

, a squeeze-out procedure for Balyo’s Ordinary Shares, Warrant and

Preferred Shares not tendered to the Offer and insofar as the

thresholds provided for in Article 237-1 et seq. of the General

Regulation of the AMF have been reached.

The Offer is subject to the acceptance threshold referred to in

article 231-9, I of the General Regulation of the AMF, as described

in section 2.3.1 of the Draft Response Document.

The Offer also includes a waiver threshold, in accordance with

article 231-9, II of the General Regulation of the AMF, as

specified in section 2.3.2. of the Draft Response Document.

The Offer is presented by Alantra Capital Markets (the

"Presenting Institution"), which guarantees the content and

irrevocable nature of the commitments made by the Offeror in

connection with the Offer in accordance with the provisions of

article 231-13 of the General Regulation of the AMF.

2.2.2 Terms of the Offer

The Draft Offer Document and the Draft Response Document were

filed with the AMF on 16 August 2023. A notice of filing was

published by the AMF on its website (www.amf-france.org) on 16

August 2023. The Draft Offer Document and the Draft Response

Document are available on Balyo's website (www.balyo.com) and of

the AMF (www.amf-france.org) and are available to the public free

of charge at Balyo's registered office, 74 Avenue Vladimir Illitch

Lenine, 94110 Arcueil.

The Draft Offer Document filed by the Offeror contains details

of the terms of the Offer, the conditions to which it is subject

and the contemplated timetable for the Offer.

The Company filed the Draft Response Document with the AMF on 16

August 2023. The AMF has published a notice of filing relating to

the Draft Response Document on its website (www.amf-france.org) on

16 August 2023. The Draft Response Document, as filed with the AMF,

was made available to the public free of charge at the Company's

registered office, and was posted on the AMF's website

(www.amf-france.org) and the Company's website (www.balyo.com).

In accordance with the provisions of article 231-26 of the

General Regulation of the AMF, a press release setting out the main

elements of the Draft Response Document and specifying the terms

and conditions for making the Draft Response Document available was

published on the Company's website (www.balyo.com) on 16 August

2023.

The Draft Offer Document and the Draft Response Document remain

subject to review by the AMF, which may declare the Offer compliant

after ensuring that it complies with the applicable legal and

regulatory provisions.

This decision of compliance will entail approval by the AMF of

the Draft Response Document drawn up by the Company.

In accordance with the provisions of articles 231-27 and 231-28

of the General Regulation of the AMF, the Draft Response Document

approved by the AMF and the document containing the "Other

Information" ("Autres Informations") relating to the Company's

legal, financial and accounting characteristics will be made

available to the public free of charge, no later than the day

before the opening of the Offer, at the Company's registered

office. These documents will also be posted on the AMF website

(www.amf-france.org) and on the Company's website

(www.balyo.com).

A press release specifying how these documents will be made

available will be issued no later than the day before the opening

of the Offer, in accordance with the provisions of articles 231-27

and 231-28 of the General Regulation of the AMF.

Prior to the opening of the Offer, the AMF will publish a notice

of the opening and the timetable of the Offer, and Euronext Paris

will publish a notice setting out the content of the Offer and the

terms and conditions of its completion.

2.3 Terms of the Offer

2.3.1. Acceptance Threshold

In accordance with the provisions of article 231-9, I of the

General Regulation of the AMF, the Offer will lapse if, at its

closing date, the Offeror does not hold, directly or indirectly, a

number of Shares representing a fraction of the Company's share

capital or voting rights in excess of 50% (this threshold is

hereinafter referred to as the "Acceptance Threshold").

This threshold is determined in accordance with the provisions

set out in article 234-1 of the General Regulation of the AMF.

It will not be known until the AMF publishes the final results

of the Offer, which will take place after the close of the

Offer.

If the Acceptance Threshold is not reached, the Offer will lapse

and the Target Securities tendered to the Offer will be returned to

their owners after publication of the notice of result informing of

the lapse of the Offer, without any interest, indemnity or other

payment of any nature whatsoever being due to such owners.

2.3.2. Waiver Threshold

In addition to the Acceptance Threshold, pursuant to the

provisions of article 231-9, II of the General Regulation of the

AMF, the Offer will lapse if, at the closing date of the Offer, the

Offeror does not hold, alone or in concert, directly or indirectly,

a number of shares representing a fraction of the share capital and

theoretical voting rights of the Company in excess of 66.67% on a

diluted basis and on a fully diluted basis (the “Waiver

Threshold”).

On a non-diluted basis, the Waiver Threshold will be calculated

as follows:

- in the numerator, will be included (i) all the Ordinary Shares

and Preferred Shares held by the Offeror alone or in concert,

directly or indirectly, on the date of the closing of the Offer,

pursuant to acquisitions on the market as well as all the Ordinary

Shares assimilated to those of the Offeror in accordance with

Article L. 233-9 of the French Commercial Code including the 34,894

Treasury Shares and the 180,000 Ordinary Shares and the 900 ADP T3,

900 ADP T4, 900 ADP T5 held by Mr. Pascal Rialland, subject to the

liquidity agreement and (ii) all the Ordinary Shares and Preferred

Shares of the Company validly tendered in the Offer as at the date

of the closing of the Offer; and

- in the denominator, all the existing Ordinary Shares and

Preferred Shares issued by the Company making up the share capital

on the date of the closing of the Offer.

On a fully diluted basis, the Waiver Threshold will be

calculated as follows:

- in the numerator, will be included (i) the Ordinary Shares and

Preferred Shares held by the Offeror alone or in concert, directly

or indirectly, on the date of the closing of the Offer, pursuant to

acquisitions on the market as well as all the Ordinary Shares

assimilated to those of the Offeror in accordance with Article L.

233-9 of the French Commercial Code including the 34,894 Treasury

Shares and the 180,000 Ordinary Shares, and the 900 ADP T3, 900 ADP

T4, 900 ADP T5 held by Mr. Pascal Rialland subject to the liquidity

agreement (ii) all the Ordinary Shares and Preferred Shares of the

Company validly tendered in the Offer as at the date of the closing

of the Offer and (iv) all the Ordinary Shares of the Company likely

to be issued by exercise of the Company Warrants validly tendered

in the Offer as at the date of the closing of the Offer - excluding

any shares which may be subscribed or held by the Offeror pursuant

to the conversion of the Bonds;

- in the denominator, (i) all the existing Ordinary Shares and

Preferred Shares issued by the Company making up the capital on the

date of the closing of the Offer, (ii) all the Ordinary Shares of

the Company likely to be issued by exercise of the Company Warrants

on the date of the closing of the Offer and (iii) all the Ordinary

Shares likely to be issued by the Company on the date of the

closing of the Offer (excluding all Ordinary Shares likely to be

subscribed or held by the Offeror pursuant to the conversion of the

Bonds).

The reaching of the Waiver Threshold will not be known before

the publication by the AMF of the final result of the Offer, which

will take place at the end of the Offer.

In accordance with article 231-9, II of the General Regulation

of the AMF, if the Waiver Threshold (calculated as indicated above)

is not reached, and unless the Offeror has decided to waive the

Waiver Threshold in accordance with the conditions set out in the

following paragraphs, the Securities of the Company tendered in the

Offer (excluding shares acquired on the market) will be returned to

their owners without any interest, indemnity or other payment of

any kind being due to the said owners.

However, the Offeror reserves the right to waive the Waiver

Threshold until the date of publication by the AMF of the result of

the Offer.

In addition, the Offeror also reserves the right to remove or

lower the Waiver Threshold by filing an improved offer at the

latest five (5) trading days before the closing of the Offer, in

accordance with the provisions of articles 232-6 and 232-7 of the

General Regulation of the AMF.

2.3.3. Regulatory authorizations

The Offer is not subject to any regulatory authorization, it

being specified that prior to Press Release, the Offer gave rise to

a decision by the Ministry of the Economy, Finance and Industrial

and Digital Sovereignty, in accordance with Article L.151-3 of the

French Monetary and Financial Code relating to foreign investments

made in France, dated 1 August 2023, pursuant to which the Offer

was considered outside the scope of the provisions of Article

L.151-3 of the Monetary and Financial Code.

2.4 Offer restrictions abroad

The section 2.4 of the Draft Offer Document sets out the

restrictions applicable to the Offer abroad.

3. REASONED OPINION OF THE BOARD OF DIRECTORS

3.1 Composition of the Board of Directors

As of the date of this Presse Release, the Company's Board of

Directors is composed as follows:

- Pascal Rialland, Chairman and Chief Executive Officer;

- Ms Bénédicte Huot de Luze, Director ;

- Ms Corinne Jouanny, Director ;

- Mr Christophe Lautray, representing Linde Material Handling,

Director;

- Mr Alexandre Pelletier, representing BPI France investissement,

Director.

3.2. Prior decisions of the Board of Directors

The Company's Board of Directors met on 13 June 2023 to review

the proposed Offer. At this meeting, the Company's Board of

Directors unanimously approved the proposed transaction and

authorized the signature of a tender offer agreement between the

Company and the Offeror.

In accordance with the provisions of article 261-1 III of the

General Regulation of the AMF, best governance practices and AMF

recommendation no. 2006-15, the Board of Directors, at its meeting

on 13 June 2023, decided to set up an ad hoc committee to monitor

the independent expert's mission, comprising three members,

including two independent members, namely:

- Ms Corinne Jouanny, independent member of the ad hoc

Committee;

- Bénédicte Huot de Luze, independent member of the ad hoc

Committee; and

- Alexandre Pelletier, representing BPI France

Investissement.

In addition, at its meeting on 13 June 2023, on the

recommendation of the ad hoc committee, the Company's Board of

Directors appointed Eight Advisory, represented by Mr Geoffroy

Bizard, as an independent expert in accordance with the provisions

of articles 231-19 and 261-1 I, 2° of the General Regulation of the

AMF, with the task of preparing a report including a fairness

opinion on the financial terms of the Offer.

The ad hoc committee was tasked with supervising the work of the

independent expert, making recommendations to the Company's Board

of Directors concerning the Offer, and preparing the draft reasoned

opinion for the Company's Board of Directors on the proposed Offer,

in accordance with the provisions of article 261-1, III of the

General Regulation of the AMF.

The members of the ad hoc committee met several times with the

independent expert, monitored his work and prepared the draft

reasoned opinion of the Board of Directors.

3.3. Reasoned opinion of the Board of Directors

In accordance with the provisions of article 231-19 of the

General Regulation of the AMF, the members of the Board of

Directors met on 4 August 2023, having been convened in accordance

with the Company's articles of association, to examine the Draft

Offer Document and to give their reasoned opinion on the interest

of the Offer and its consequences for Balyo.

All members of the Company's Board of Directors were present or

represented. The discussions and vote on the Board of Directors's

reasoned opinion were chaired by Pascal Rialland, in his capacity

as Chairman of the Board of Directors.

The reasoned opinion of the Board of Directors was adopted

unanimously by the members present or represented, including the

independent members.

An extract from the proceedings of this meeting, containing the

reasoned opinion of the Board of Directors, is reproduced at

section 3. of the Draft Response Document.

The reasoned opinion of the Board of Directors is reproduced

below:

"3. Reasoned opinion of the Board of Directors in connection

with the tender offer initiated by SoftBank Group

In accordance with the provisions of Article 231-19 of the

General Regulations of the Autorité des Marchés Financiers (the

"AMF"), the Chairman reminds shareholders that the Board of

Directors is meeting today to give a reasoned opinion on the

interest represented by, and the consequences for the Company, its

shareholders and employees, the proposed public tender offer (the

"Offer") for the Company's shares at a price of 0.85 euro

per ordinary share, 0.01 euro per preferred share (the

"ADP") and 0.07 euro per share purchase warrant (the

"BSA"), initiated by SVF II STRATEGIC INVESTMENTS AIV LLC, a

wholly-owned and directly held subsidiary of the Japanese company

SoftBank Group Corp. ("SVF AIV" or the

"Offeror").

The Chairman notes that the terms of the Offer will be described

in the draft offer document to be filed with the AMF by 16 August

2023.

The Chairman also points out that, in accordance with the

provisions of article 261-1, III of the AMF General Regulations

("Règlement général de l'AMF") and AMF recommendation no.

2006-15, the Board of Directors, at its meeting on 13 June 2023,

set up an ad hoc committee (the "Ad Hoc Committee") to

examine the terms and conditions of the proposed transaction,

proposing to the Board of Directors the appointment of an

independent appraiser under the terms of article 261-1 of the AMF

General Regulations, supervising the work carried out by the

appraiser until the submission of his valuation report, and

preparing in good time the draft reasoned opinion of the Board of

Directors.

The Ad Hoc Committee comprises three members, the majority of

whom are independent directors: Corinne Jouanny (Chairwoman of the

Ad Hoc Committee and independent member of the Board of Directors),

Bénédicte Huot de Luze (independent member of the Board of

Directors) and Alexandre Pelletier (member of the Board of

Directors representing BPI France Investissement).

The Chairman also points out that, at its meeting on 13 June

2023, the Board of Directors approved the principle of the proposed

Offer, pending the conclusions of the work of the independent

expert and the opinion of the CSE.

Prior to today's meeting, the members of the Board of Directors

were provided with the following documents in order to provide them

with all the information they needed to issue a reasoned

opinion:

- The draft offer document drawn up by the Offeror, which will be

filed with the AMF by 16 August 2023, containing in particular the

background to and reasons for the Offer, the Offeror's intentions,

the characteristics of the Offer and the factors for assessing the

Offer price drawn up by the presenting institution, Alantra Capital

Markets (this institution also being the guarantor of the

Offer);

- The report of the independent expert, Eight Advisory, which

concludes that the financial terms of the Offer, namely the offered

price of 0.85 euro per ordinary share, 0.01 euro per ADP and 0.07

euro per warrant of the Company, are fair to the shareholders

holding ordinary shares and/or ADP and to Amazon as holder of

warrants of the Company;

- The opinion of the Comité Social et Economique on the Offer

issued on 5 July 2023; and

- The draft note in response prepared by the Company for filing

with the AMF by 16 August 2023, which remains to be completed with

the reasoned opinion of the Board of Directors.

An independent appraiser has been appointed on the basis of

articles (i) 261-1 I, 2° of the AMF General Regulations insofar as

certain officers and directors of the Company have entered into an

agreement with the Offeror likely to affect their independence,

(ii) 261-1 I, 4° because of transactions related to the Offer that

are likely to have an impact on the assessment of the financial

terms of the Offer, (iii) 261-1 I, 5° because the Offer concerns

financial instruments of different categories and (iv) 261-1 II

because of the planned squeeze-out.

At its first meeting on 13 June 2023, following the ad hoc

Committee's in-depth review of Eight Advisory's detailed proposal,

the ad hoc Committee recommended that Eight Advisory be appointed,

primarily in view of (i) the absence of any present or past link

between Eight Advisory and the Company that might affect its

independence, (ii) its recent experience in market transactions of

similar or comparable size, (iii) the financial terms of its

proposal, and (iv) more generally, its professional reputation and

the human and material resources at its disposal to carry out its

assignment.

Eight Advisory has confirmed that it has no conflicts of

interest with any of the parties involved, and that it has

sufficient resources and availability to carry out its assignment

during the period in question.

In view of the above, the Ad Hoc Committee decided on 13 June

2023 to recommend the appointment of Eight Advisory to the Board of

Directors to act as independent expert.

At its meeting on 13 June 2023, the Company's Board of

Directors, on the recommendation of the ad hoc committee,

unanimously appointed Eight Advisory, represented by Mr Geoffroy

Bizard, as an independent expert in accordance with the provisions

of article 261-1, I 2°, 4° and 5° of the AMF's General Regulations,

with the task of preparing a report on the financial terms of the

Offer.

In view of the information submitted, and in particular (i) the

objectives and intentions expressed by the Offeror, (ii) the

valuation information prepared by the presenting institution,

Alantra Capital Markets, (iii) the work of the ad hoc Committee,

(iv) the conclusions of the independent expert's report, (v) the

opinion of the Conseil Social et Economique and (vi) more

generally, of the elements set out above, and in particular of the

fact that the Offer is consistent with the long-term viability of

Balyo, its managerial continuity, and the preservation of

employees' interests, the Board of Directors, having no

observations, adopts the following resolution:

FOURTH

RESOLUTION

The Board of Directors decides, after deliberation:

- to endorse in every respect the observations, conclusions and

recommendations of the ad hoc Committee;

- to issue, in the light of the observations, conclusions and

recommendations of the ad hoc Committee, a favorable opinion on the

draft Offer as presented to it;

- to recommend that holders of the Company's shares tender their

shares to the Offer;

- take formal note that the Company will not tender its treasury

shares to the Offer (which may be reopened);

- approve the Company's draft response document;

- authorize the Chairman, where necessary, to: - finalize the

draft reply memorandum relating to the Offer, as well as any other

documents required in connection with the Offer, in particular the

"Other Information" document relating to the legal, financial and

accounting characteristics of the Company; - prepare, sign and file

with the AMF all documentation required in connection with the

Offer; - sign all certificates required in connection with the

Offer; and - more generally, to take all steps and measures

necessary or useful for the completion of the Offer, including

entering into and signing, in the name and on behalf of the

Company, all transactions and documents necessary and related to

the completion of the Offer, in particular any press release.

Board members' intentions

The Board of Directors notes that three members of the Board of

Directors have undertaken to tender their shares to the Offer:

- Mr Pascal Rialland ;

- Linde Material Handling ; and

- BPI France Investissement.

Linde Material Handling and • FCPI FSN PME - Ambition numérique

represented by Bpifrance Investissement, holding a total of

6,863,926 ordinary shares, and Pascal Rialland, holding 180,000

available ordinary shares representing approximately 20.87% of the

Company's share capital and voting rights, have agreed to tender

their ordinary shares to the Offer.

The Company's intentions regarding treasury shares

The Company holds 34,894 of its own shares.

The Board of Directors has decided that these 34,894 treasury

shares will not be tendered to the Offer and that the Company will

not sell them until the close of the Offer, in accordance with the

terms of the Tender Offer Agreement dated 14 June 2023.

This resolution is adopted unanimously by the directors

present and represented."

4. INTENTION OF BOARD MEMBERS

The Board of Directors has noted that three members of the Board

of Directors have undertaken to tender their shares to the

Offer:

- Mr Pascal Rialland ;

- Linde Material Handling ; and

- BPI France Investissement.

Indeed, Linde Material Handling and FPCI FSN PME - Ambition

Numérique represented by Bpifrance Investissement, holding a total

of 6,863,926 shares, and Pascal Rialland, holding a total of

180.000 Ordinary Shares, representing 20.87% of the Company's

capital and voting rights, have undertaken to tender their shares

to the Offer, as described in section 7.2.1 of the Draft Response

Document.

5. COMPANY'S INTENTION REGARDING TREASURY SHARES

At the date of the Press Release, the Company held 34,894

Treasury Shares.

As authorized by the Board of Directors, the Company has decided

not to tender the 34,894 Treasury Shares.

6. OPINION OF THE WORKS COUNCIL OF THE COMPANY (THE "COMITÉ

SOCIAL ET ECONOMIQUE", (THE "CSE"))

In accordance with the provisions of articles L. 2332-2 et seq.

of the French Labor Code, the CSE was informed of the Offer and met

on 16 June 2023 as part of the procedure for informing the

Company's employee representative bodies.

Following this meeting, the Company's CSE requested a hearing

with the Initiator in accordance with the provisions of article L.

2312-42 of the French Labor Code, which was held on 21 June

2023.

As part of the consultation procedure provided for in article

2312-46 of the French Labor Code, the Company's Works Council has

issued its opinion on the proposed Offer.

Said notice, dated 5 July 2023, is reproduced in full at section

6. of the Draft Response Document.

7. AGREEMENTS LIKELY TO HAVE AN INFLUENCE ON THE ASSESSMENT

OR OUTCOME OF THE OFFER

7.1 Tender Offer Agreement between the Company and the

Offeror

On 14 June 2023, the Company and the Offeror entered into the

Tender Offer Agreement (the "TOA"), which is described in

more detail in section 7.1. of the Draft Offer Document.

7.2. Undertaking to tender

7.2.1. Undertakings to tender entered into with

shareholders

On 13 June 2023, FPCI FSN PME - Ambition Numérique represented

by Bpifrance Investissement, Hyster-Yale UK Limited, SSUG PIPE Fund

SCSp, SICAVRAIF, Linde Material Handling GmbH, Financière Arbevel,

Thomas Duval, and on June 14 June 2023 Invus Public Equities, L.P.

provided the Offeror with an undertaking to tender to the Offer

13,866,075 shares, representing 41.08% of the Company's share

capital at the date of signature of the said commitments to

tender.

These undertakings may be revoked in the event of a competing

tender offer.

- FPCI FSN PME - Ambition numérique represented by Bpifrance

Investissement has committed to contribute 5,053,950 shares

representing approximately 14.96% of the Company's share capital

and voting rights as of the date of this undertaking to

tender;

- SSUG PIPE Fund SCSp, SICAVRAIF, has undertaken to contribute

2,000,000 shares representing approximately 5.92% of the Company's

capital and voting rights as of the date of this undertaking to

tender;

- Linde Material Handling, GmbH has undertaken to contribute

1,809,976 shares representing approximately 5.37% of the Company's

share capital and voting rights as of the date of this undertaking

to tender;

- Financière ARBEVEL, which has undertaken to tender to the Offer

the Target Securities it will hold at the opening of the Offer,

holds 1,334,404 shares at 13 June 2023, representing approximately

3.95% of the Company's capital and voting rights as of the date of

this undertaking to tender;

- Hyster-Yale UK Limited, has undertaken to tender 1,216,545

shares representing approximately 3.60% of the Company's share

capital and voting rights as of the date of this undertaking to

tender;

- Mr Thomas Duval has undertaken to contribute 851,200 shares

representing approximately 2.52% of the Company's share capital and

voting rights as of the date of this undertaking to tender;

- Invus Public Equities, L.P. has undertaken to contribute

1,600,000 shares representing approximately 4.74% of the Company's

share capital and voting rights as of the date of this undertaking

to tender.

The Ordinary Shares held by the above-mentioned shareholders,

together representing approximately 41.08% of the Company's share

capital and voting rights at the date of signature of the said

undertakings to tender (and around 40.36% of the share capital and

voting rights at 17 July 2023), will be contributed to the

Offer at the Offer Price of the Ordinary Shares, less any Ordinary

Shares that may be sold by Financière ARBEVEL in advance of the

opening of the Offer, without any additional consideration to be

paid by the Offeror.

These undertakings are described in greater detail in section

7.2.1 of the Draft Response Document.

7.2.2 Undertakings to tender entered into with ADP

holders

At 31 December 2022, the Company's share capital consisted of

16,150 preference shares divided into 5 tranches:

- 3,230 ADP T1 ; - 3,230 ADP T2 ; - 3,230 ADP

T3 ; - 3,230 ADP T4; and - 3,230 ADP T5.

These ADP were issued to their holders in the context of a free

share plans put in place by the Company which acquisition and

conservation periods expired. The ADP are subject to the following

cumulative conditions, based on aggregate performance over the

period from the date of grant 1 January 2020 up to the 31 December

2024:

- Tranche 1: consolidated turnover exceeding

35 million euros and gross margin exceeding 14 million euros. -

Tranche 2: consolidated turnover exceeding 85 million euros and

gross margin exceeding 35 million euros. - Tranche 3: consolidated

turnover exceeding 165 million euros and gross margin exceeding 70

million euros. - Tranche 4: consolidated turnover exceeding 295

million euros and gross margin exceeding 130 million euros. -

Tranche 5: consolidated turnover exceeding 500 million euros and

gross margin exceeding 235 million euros.

Provided that the performance conditions of each Tranche are

met, each ADP of the relevant Tranche will be converted into 100

Ordinary Shares of the Company.

Prior to the date of Press Release, the performance conditions

of the ADP T1 were met, as acknowledged by a decision of the Board

of Directors dated 27 March 2023.

On 22 June 2023, in accordance with the terms and conditions of

the ADP, the Board of Directors, after having received the

favorable opinion of the appointment and remuneration committee,

acknowledged in advance the fulfilment of the performance

conditions of Tranche 2 based on the high probability of reaching

the conditions of consolidated turnover and gross margin by the end

of the year 2023. In accordance with the terms and conditions of

the ADP, the Board of Directors has all powers to determine

specific conversion ratio and cases notably in the context of a

tender offer. Consequently, on 22 June 2023 the Board of Directors,

decided that the conversion ratio applicable to the ADP T2 was 1

ADP T2 for 100 Ordinary Shares.

As described in the section 7.2.2. of the Draft Response

Document, on the 6, 7, 9, 10 and 12 July 2023, the holders of the

ADP entered into undertakings to tender with the Offeror pursuant

to which they undertook to

(i) convert all their 2.090 ADP T1 and 2.090 ADP T2 as soon as

possible following the Board's decision on the conversion of the

ADP T2 and to tender to the Offer all 598,000 Ordinary Shares

resulting from the conversion of the T1 ADP and the T2 ADP; and

resulting from the conversion of ADP T1 and ADP T2; and

(ii) tender all of their 2,090 ADP T3, 2,090 ADP T4 and 2,090

ADP T5 to the Offer.

7.2.3. Liquidity Agreement

The Offeror entered into a liquidity agreement with Mr. Pascal

Rialland for his Ordinary Shares resulting from the conversion of

his ADP T1, ADP T2, ADP T3, ADP T4 and ADP T5 which are subject to

the constraints provided for by article L. 225-197-1. II §4 of the

French Commercial Code, pursuant to which Balyo’s Board of

Directors has imposed on corporate officers an obligation to retain

a percentage of their shares (the “Unavailable Shares” and

the “Liquidity Agreement”), the main terms and conditions of

which are described in section 7.2.3. of the Draft Response

Document.

7.2.4. Intention to tender expressed by the Company Warrant

holder

On 10 July 2023, the holder of the 11,753,581 Company Warrants,

Amazon.com NV Investment Holdings LLC, addressed a non-binding

letter of intent to Balyo expressing its intention to tender all of

the Company Warrants to the Offer and terminate the Transaction

Agreement entered into between Amazon and the Company that the main

terms and conditions of which are described in section 7.2.4 of the

Draft Response Document.

7.3. Interim Financing

On 13 June 2023, the Board of Directors authorized the issuance

by the Company of bonds convertible into fully paid-up ordinary

shares to be subscribed by the Offeror for an aggregate principal

amount of up to EUR 5,000,000 (the “Bonds”) which will allow

Balyo to meet its working capital requirements

(“Financing”).

On 14 June 2023, the Offeror and the Company entered into a

subscription agreement providing for the terms and conditions of

the issuance of the Bonds and regulate the relations of the Company

and the Offeror as for the subscription of the Bonds (the

“Subscription Agreement”).

Pursuant to the Subscription Agreement, the Bonds will be

governed by their terms and conditions described in the section

7.3. of the Draft Response Document.

On 20 July 2023, the Offeror subscribed to 150 Convertibles

Bonds of EUR 10,000 par value each for a total amount of EUR

1,500,000 euros.

10. INDEPENDENT EXPERT'S REPORT

In accordance with the provisions of article 261-1 I, 2° of the

General Regulation of the AMF, the Company's Board of Directors, at

its meeting of 13 June 2023, appointed Eight Advisory, represented

by Mr Geoffroy Bizard, as independent appraiser with the task of

preparing a report including a fairness opinion on the financial

terms of the Offer, including the squeeze-out.

Said report, dated 4 August 2023, is reproduced in full in

section 10 of the Draft Response Document.

The conclusions of its report, dated August, 4 2023, are

reproduced below:

"We have been appointed as Independent Expert by the Ad Hoc

Committee of Balyo based on Article 261-1 I 2°, 4° and 5° and II of

the general regulation of the AMF.

Our mission was to assess the fairness of the price offered by

SVF II Strategic Investments AIV LLC, a direct subsidiary of

SoftBank Group Corp., in connection with the Tender Offer procedure

followed by a Squeeze-Out should the required conditions be

met.

The price offered to Balyo shareholders is €0.85 per ordinary

share.

We observe that the Offer price of €0.85 shows a premium of:

- 6.3% on the central value derived from the

Discounted Cash Flows method;

- 3.3% on the central value derived from the

Market multiples method;

- 58.9% on the last closing share price

before the announcement of the Offer, 54.9% on the 30-day

volume-weighted average price, and 48.3% on the 60-day

volume-weighted average price; and

- 21.4% on the central value derived from the

analyst’s target price.

We also observe that the Offer price is higher than Balyo's

share price post announcement of the Offer (€0.82 as of July 26,

2023).

In this context, given the elements presented above, we are of

the opinion that the price of €0.85 per ordinary share offered by

the Initiator in the context of the Tender Offer is fair from a

financial point of view for the shareholders of Balyo SA, including

in the perspective of a Squeeze-Out.

Regarding to the BSAs, we note that the price of €0.07 per BSA

proposed by the Offeror is consistent with the result of applying

the Black & Scholes method, based on an Offer price of of €0.85

per share. The price offered is therefore fair to the holder and is

not likely to affect the equality between the holder of the BSAs

and the holders of Balyo shares, including in the event of the the

implementation of a mandatory squeeze-out.

Regarding the 6,270 Unconverted AGADP available, we note that

the price of €0.01 per AGADP proposed by the Offeror is consistent

with the near-zero probability of the performance conditions of

these performance conditions and that the overall amount is not

material. The price offered is therefore fair for their holders and

is therefore not likely to affect the equality between the holders

of the and the holders of Balyo shares, including in the event of a

mandatory squeeze-out.

Lastly, the analysis of the related agreements does not call

into question our assessment of the financial conditions of the

Offer, including in this perspective the case of the implementation

of a mandatory squeeze-out.

Paris, August 4, 2023

Geoffroy Bizard

Partner

Eight Advisory S.A.S."

____________________________________

1 It should be noted that the Ordinary Shares

resulting from the conversion of the 2,090 ADP T3, 2,090 ADP T4 and

2,090 ADP T5 are not targeted by the Offer, as the 6,270 preferred

shares (i) are not convertible prior to the closing of the Offer,

or, as the case may be, of the Reopened Offer, and (ii) are all

subject to undertakings to tender from their holders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230815378103/en/

Balyo

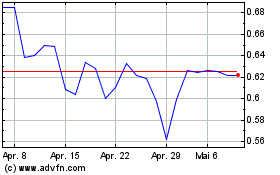

Balyo (EU:BALYO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Balyo (EU:BALYO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024