- Operation aimed at replacing TheraVet's veterinary

activities with a high potential biotech program linked to the

repositioning of an innovative molecule in idiopathic pulmonary

fibrosis;

- Operation based on a strategic agreement between TheraVet

and H4Orphan, under which H4Orphan's flagship clinical program in

idiopathic pulmonary fibrosis is contributed to TheraVet in

exchange for the issue of new shares;

- Operation aimed at accelerating the development of an

innovative treatment for pulmonary fibrosis, in particular through

the launch of a Phase II study, and leveraging on the complementary

expertise and resources of the two companies;

- Operation associated with an initial refinancing of EUR

300,0001, offering a financial visibility up to the end of

the first quarter of 2025;

- The Operation will be submitted to shareholders for approval

at an Extraordinary General Meeting on October 17, 2024.

Regulatory News:

TheraVet (ISIN: BE0974387194 - ticker: ALVET) today announces

a strategic transformation project with H4Orphan aimed at

creating a leader in idiopathic pulmonary fibrosis and accelerating

the development of its multi-target drug candidate.

Operational highlights

The proposed Operation is part of the strategic transformation

project between TheraVet and H4Orphan aimed at developing the

H4Orphan's flagship clinical program in idiopathic pulmonary

fibrosis and capitalizing on TheraVet teams to accelerate its

development by leveraging its regulatory advances in Belgium.

Idiopathic pulmonary fibrosis is a rare disease that appears

after the age of 50, with a prevalence of ~2.7/10,000 inhabitants

(i.e., slightly more than 220,000 patients in Europe and the United

States), and for which there is currently no curative treatment.

With a median survival of 2.5 years from diagnosis, there are

almost 50,000 deaths per year in Europe and the United States.

More precisely, the objective of this strategic agreement is to

substitute TheraVet’s existing activities by high potential human

biotech development activities along the following axes:

- Launch, over 9 to 12 next months, of a Phase II clinical study

(of an estimated duration of 18 to 24 months) for patients

suffering of idiopathic pulmonary fibrosis through the opening of

clinical centers, primarily in Belgium;

- Elaboration of a research and development strategy based on

H4Orphan’s platforms and expertise, particularly in the

repositioning of existing molecules;

- Capitalize on TheraVet's presence in Belgium and the United

States to facilitate access to investors and clinical and

regulatory players in Belgium and North America in preparation of

clinical developments;

- Divestment of veterinary activities (incl. BIOCERA-VET® product

line and VISCO-VET® clinical program).

TheraVet will maintain its teams at its office in Gosselies,

Belgium. Beyond the first quarter of 2025, the continuation of

these activities will be conditional on refinancing (e.g.,

convertible bond line, subsidies, etc.).

“This operation stems from an in-depth review of TheraVet's

expertise in Belgium and the opportunity for the Company to acquire

a human clinical program in a major indication whose regulatory

advances have been welcomed in Belgium. Given TheraVet's track

record, we looked to apply our company's structure and capabilities

to a Phase II clinical asset in a major indication with significant

unmet needs. Moreover, the asset concerned is based on the

repositioning of an existing molecule which had already been

approved and demonstrated to be effective in patients with

pulmonary fibrosis in other respiratory indications, such as cystic

fibrosis. The H4Orphan team has carried out major preclinical and

regulatory developments on this molecule in this indication. We at

TheraVet believe that our capabilities and expertise could

contribute to tangible value creation, and what is more, on Belgian

soil. Together with our Board of Directors, we believe that the

strategic agreement with H4Orphan would enable Theravet to become a

leader in pulmonary fibrosis, where the need for treatment is more

than urgent,” stated Enrico BASTIANELLI, Founder and Chief

Executive Director of TheraVet.

“Our Board of Directors is convinced that the strategic

agreement with TheraVet will boost our development program in

Belgium, and fully supports this Operation. The TheraVet team will

be able to lead and accelerate the clinical development plan in

pulmonary fibrosis with a Phase II study aimed at validating the

clinical evidence of our treatment, enabling a breakthrough

innovation in a field with no truly effective treatment. With our

management team, we look forward to working with TheraVet,” stated

Gaétan TERRASSE, Chairman and CEO of H4Orphan.

About the proposed Operation

Main terms of the Operation

According to the Memorandum of Understanding between TheraVet

and H4Orphan, the Operation is structured as a contribution of

assets, valued at EUR 14 million2, under which H4Orphan’s

shareholders will receive newly issued TheraVet ordinary shares in

counterpart of contributed assets.

The number of new shares issued to H4Orphan will be calculated

by dividing the total value of the assets contributed by the issue

price per share, which will be equal to the average closing price

of the Company's shares on the Euronext Growth market over a period

running from the date of convening to the day before the

Extraordinary General Meeting, i.e., from September 30 to October

16, 2024.

Following the completion of the Operation, H4Orphan shareholders

will hold a very significant proportion (>95%) of TheraVet's

share capital and voting rights.

The Operation is fully supported by the main shareholders of

TheraVet and H4Orphan, namely Mr. Enrico BASTIANELLI on TheraVet's

side, and a pool of shareholders represented by Mr. Gaétan TERRASSE

and DOMUNDI represented by Mr. Emmanuel HUYNH on H4Orphan's

side.

Detailed information on the Operation, in particular a

description of the assets contributed and its dilutive impact, is

available in the Special Report of the Board of Directors, which

can be consulted on TheraVet's investor website

www.theravet-finances.com.

Indicative timetable and next deadlines

The Memorandum of Understanding, unanimously approved by the

Boards of Directors of TheraVet and H4Orphan, sets out the usual

provisions of a strategic agreement until approval of the agreement

by the Extraordinary General Meeting (“EGM”) on October 17,

2024.

The TheraVet EGM will be called to vote on the proposed

Operation, which is available at www.theravet-finances.com.

The resolution to approve the proposed Operation will require a

quorum of 50% of the shares (if not, a second meeting will be

convened on October 28 with the same agenda during which no minimum

quorum must be met) and obtain, at the TheraVet General Meeting,

the positive vote of three quarters of the shareholders present or

represented. The TheraVet EGM will also be required to approve:

- Business continuity;

- The authorized capital increase of the Company by EUR

2,500,000;

- Appointment of new directors;

- The change of name of the Company to EGEIRO Pharma, to mark the

start of a new stage of development for the new biotech

activity.

TheraVet has received undertakings from Mr Enrico BASTIANELLI,

who represents approximately 17% of TheraVet's share capital and

17% of its voting rights, to vote in favor of the resolutions

relating to the operation at TheraVet's EGM.

It is also planned that the IRIS Capital Investissement fund

represented by Mr Fabrice EVANGELISTA will grant, on the date of

TheraVet's EGM, a cash advance totaling EUR 300,000 in connection

with the existing convertible bond issue.

Governance of the new entity

Following the completion of the proposed Operation, all

directors, with the exception of Enrico BASTIANELLI SRL, will

resign their positions, and Mr Gaétan TERRASSE, Chairman of

H4Orphan, will become Chairman of the Board of Directors of

TheraVet. It is intended that TheraVet's Board of Directors will be

made up of directors proposed by H4Orphan's current shareholders,

alongside Mr Enrico BASTIANELLI.

TheraVet and H4Orphan have agreed to set up a strategic steering

committee to oversee the execution of the Memorandum of

Understanding, in particular the implementation of the proposed

operation and operational integration within TheraVet.

Finally, in addition to its participation as a director,

H4Orphan's management has requested the services of Enrico

Bastianelli SRL for 1.5 to 2 days a week.

About the EUR 300,000 financing

The initial financing of EUR 300,000, contributed in a single

tranche immediately after the approval of the Operation by the

Extraordinary General Assembly, comes from the equity-linked

financing facility set up by the Company in November 2023. This

line, for a maximum amount of €3,000,000, takes the form of

convertible bonds issued under the authorized capital and

subscribed by the French company IRIS. Afterwards, the new tranches

will be subscribed in tranches of €200,000, and then converted into

TheraVet shares over a period of up to 24 months: they are

subscribed one after the other when all the shares for the amount

of the tranche are sold. The bonds will have a par value of €2,500

and will be converted into shares at a discount of 5% to the

weighted average share price over the previous 15 days. Apart from

this conversion option, no other benefits are granted to IRIS: no

fees, commissions or expenses, and no subscription rights

(warrants).

About the attempts to refinance the veterinary

activities

Over the past 12 months, in addition to setting up the

equity-linked financing facility in November 2023, the Company has

explored numerous ways, without success, to raise additional funds

to continue its operations:

- the sale of its osteosarcoma franchise: no serious interest

shown by the companies contacted;

- a private placement: over 200 potential investors contacted; a

few introductory meetings but no clear appetite;

- the sale of the Company's US assets through a renowned

intermediary: the timeframe and budget did not allow to guarantee

feasibility;

- a merger with other veterinary companies to increase the

Company's visibility: preliminary discussions never led to a

Memorandum of Understanding.

About the contributed assets

Tritoqualin is a molecule known for its safety and multi-target

pharmacological activity (multifunctional ligand). It has

demonstrated very encouraging preclinical results in animal models

of idiopathic pulmonary fibrosis (IPF). In December 2023,

tritoqualine obtained a full “Scientific and Technical Advice”

(Full STA) from the AFMPS (Belgian Drug Agency) with approval to go

directly to Phase II for the IPF. It enjoys strong intellectual

protection worldwide, and in particular in the US, China and

Europe. Detailed information regarding the contributed assets is

available in Appendices 1 and 3 of the Special Report of the Board

of Directors, which can be consulted on TheraVet’s investors

website www.theravet-finances.com.

About the idiopathic pulmonary fibrosis

Idiopathic pulmonary fibrosis (IPF) is a rare and progressive

disease of the respiratory system, marked by thickening and

rigidification of lung tissue, associated with the formation of

scar tissue leading to a progressive decline in lung function.

Symptoms are generally marked by the progressive onset of

breathlessness and dry cough, and fatigue feeling. Once

established, IPF can lead to complications including pulmonary

hypertension, heart failure, pneumonia or pulmonary embolism. IPF

is fibrosis, i.e. the transformation of healthy tissue into

fibrotic tissue following an excessive accumulation of collagen and

fibronectin in the extracellular matrix. When excessively produced,

collagen progressively invades the matrix between the pulmonary

alveoli, with progressive extension from patch to patch. Fibrosis

is a tissue dysregulation resulting from many types of injuries,

including smoking, acid reflux, certain viral infections,

associated with genetic predisposition. IPF is a rare disease,

appearing after the age of 50, with a low prevalence: 2.7/10,000

inhabitants with over 250,000 patients worldwide (United States and

Europe). There is currently no curative treatment. There are almost

50,000 deaths per year in Europe and North America (median

survival: 2.5 years).

About TheraVet SA

TheraVet is a veterinary biotechnology company specialising in

osteoarticular treatments for companion animals. The Company

develops targeted, safe and effective treatments to improve the

quality of life of pets suffering from joint and bone diseases. For

pet owners, the health of their pets is a major concern and

TheraVet’s mission is to address the need for innovative and

curative treatments. TheraVet works closely with international

opinion leaders in order to provide a more effective response to

ever-growing needs in the field of veterinary medicine. TheraVet is

listed on Euronext Growth® Paris and Brussels, has its head office

in Belgium (Gosselies) with a US subsidiary.

For more information, visit the TheraVet website or follow us on

LinkedIn / Facebook / Twitter

Forward-looking statements

This release may contain forward-looking statements.

Forward-looking statements may include statements regarding the

Company's plans, objectives, goals, strategies, future events, the

safety and clinical activity of TheraVet’s pipelines and financial

condition, results of operation and business outlook. By their

nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and there are risks that

predictions, forecasts, projections, and other forward-looking

statements will not be achieved. These risks, uncertainties and

other factors include, among others, those listed and fully

described in the “Risk Factors” section in the Annual Report.

TheraVet expressly disclaims any obligation to update any such

forward-looking statements in this document to reflect any change

in its expectations with regard thereto or any change in events,

conditions, or circumstances on which any such statement is based,

unless required by law or regulation.

1 Refinancing, from convertible bonds from the equity-linked

financing facility set up in November 2023, contributed in one

tranche immediately after approval by the Extraordinary General

Meeting.

2 This is a conventional negotiated value; the value of the

assets contributed estimated by an independent expert is EUR 42

million (see Appendix 2 of the Special Report (Contribution in

Kind).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240929854806/en/

TheraVet Chief Executive Officer Enrico Bastianelli

investors@thera.vet Tel: +32 (0) 71 96 00 43

NewCap Investor Relations and Financial Communications

theravet@newcap.eu Tel: +33 (0)1 44 71 94 94

Press Relations theravet@newcap.eu Tel: +33 (0)1 44 71 00 15

NewCap Belgique Press Relations Laure-Eve Monfort

lemonfort@newcap.fr Tel: + 32 (0) 489 57 76 52

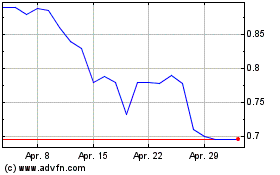

EGEIRO Pharma (EU:ALVET)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

EGEIRO Pharma (EU:ALVET)

Historical Stock Chart

Von Dez 2023 bis Dez 2024