ICAPE GROUP announces its 2023 half-year revenue AND GROSS MARGIN

26 Juli 2023 - 5:45PM

Business Wire

- Revenue of €94.1 million in the first half of 2023, impacted

by an adverse industrial context

- Gross margin improved to €24.2 million, representing 25.7%

of revenue, because of changes in the product mix and improved

operating efficiency

- Consolidating cash position for future acquisitions

- Continued post-integration synergies from

acquisitions

- Reaffirmation of 2024 and 2026 objectives

Regulatory News:

ICAPE Group (ISIN code: FR001400A3Q3 - Ticker: ALICA)

(Paris:ALICA), a global technology distributor of printed circuit

boards ("PCB"), today announced its 2023 half-year revenue and

gross margin.

Yann Duigou, ICAPE Group’s CEO, stated: "The first six

months of 2023 once again provided an opportunity to demonstrate

the resilience of our business model in an adverse economic

climate, as evidenced by the deterioration in industrial production

indexes and leading us to revise our organic growth objective for

this year. In fact, we were able to continue improving our gross

margin, a remarkable performance given the economic conditions

experienced by the sector which fully illustrates the relevance of

the Group's strategy, based on a high value-added proposition and

tangible synergies thanks to an offensive acquisition policy. The

integration of the acquisitions made over the past two years is

progressing well, and the resulting synergies are gradually coming

on stream, with the potential to generate additional profitable

revenue in the short to medium term. These various factors, coupled

with a consolidating cash position, enable us to reaffirm all our

objectives for 2024 and 2026.”

2023 half-year financial information

In €m (IFRS standards)

H1 2022 published

H1 2022 restated1

H1 20231

Var. restated1

Revenue

110.2

106.5

94.1

-11.7%

COGS

-87.4

-85.3

-69.9

-18.0%

Gross Margin

22.8

21.3

24.2

+13.6%

% revenue

20.7%

20.0%

25.7%

+5.7 pts

In the first half of 2023, Group revenue came to €94.1million,

down 11.7% compared with the first half of 2022, restated for the

disposal of the DIVSYS business in the United States and the

Russian subsidiary. As explained at the time of publication of 2023

first quarter revenue, the adverse economic environment, marked by

multiple exogenous factors (in particular, rising interest rates,

persistent inflation, prolongation of the war in Ukraine and the

components crisis), explains this level of activity.

The evolution of the product mix, including a greater proportion

of higher-margin, smaller-volume orders, coupled with enhanced

operating efficiency resulting from the acquisitions achieved,

supported the fall in cost of goods sold to €69.9 million over the

period, compared with €85.3 million in the first half of 2022. This

strategy enabled the Group to improve its gross margin by +13.6%

over the period, adjusted for the DIVSYS assets in the United

States and the Group's Russian subsidiary currently being sold, to

€24.2 million in 2023 first half-year, representing 25.7% of

revenue.

Consolidating the Group's cash position for future

acquisitions

At the end of June 2023, the Group received unanimous agreement

from its banking syndicate to release a further €13 million in

financing. With the consolidating of its cash position, the Group,

which intends to pursue its external growth strategy, has already

entered into advanced discussions with several international

targets meeting the following criteria:

- moderate size;

- a large portfolio of local customers;

- a gross margin higher than 25% while remaining profitable;

- strong potential for commercial synergies with the Group.

Reaffirmation of 2024 and 2026 objectives

The current unfavourable environment, characterized by

persistently high inventory levels among all industry players as

well as numerous macro-economic trends impacting the PCB

distribution sector, requires the Group to update its 2023 organic

growth objective. ICAPE Group will therefore be unable to achieve

organic growth in 2023 (vs. over 10% for 2023 and 2024 as

communicated within the framework of the IPO), while remaining

confident in its external growth objective for 2023 of an

additional €30 million in revenue.

In addition, the Group's strategy of capitalizing on a more

favorable product mix and greater operating efficiency thanks to

the acquisitions concluded over the past two years should generate

a greater-than-expected improvement in gross sales margin. With its

track-record of acquisitions and a continuing strong pipeline of

targets for 2023 and beyond, ICAPE Group therefore expects to

record a gross sales margin in 2023 of around 25.0%.

The Company also reaffirms all its other objectives announced

for 2024 and 2026 as set out in its registration document,

namely:

- revenue of around €500 million by 2026;

- more than 10% organic growth in 2024 and between 8 and 10%

organic growth per year in 2025 and 2026;

- around €30 million of additional revenue per year through

external growth in 2023 and 2024;

- around €20 million of additional revenue per year through

external growth in 2025 and 2026;

- a gross margin of around 23.5% in 2024 and around 24.0% in

2026;

- an EBIT margin of around 8% in 2024 and around 9.5% in

2026.

Next financial release

- 2023 Half-Year Results, on Wednesday, September 27,

2023, before market opening

About ICAPE Group

Founded in 1999, ICAPE Group acts as a key technological expert

in the PCB supply chain. With a global network of 35 subsidiaries

and a major presence in China, where most of the world’s PCB

production is done, the Group is a one-stop-shop provider for the

products and services which are essentials for customers. As of

December 31, 2022, ICAPE Group recorded a consolidated revenue of

nearly €220 million.

For more information: icape-group.com

1 Including IFRS restatements related to the disposal of the

Russian subsidiary and DIVSYS US

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726691008/en/

ICAPE Group CFO Arnaud Le Coguic Tel: +33 1 58 18

39 10 investor@icape.fr

Investor Relations NewCap Nicolas Fossiez

Louis-Victor Delouvrier Tel: +33 1 44 71 94 98 icape@newcap.eu

Media relations NewCap Arthur Rouillé Antoine

Pacquier Tel: +33 01 44 71 94 94 icape@newcap.eu

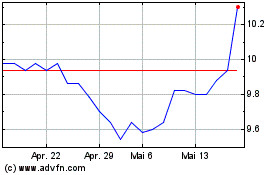

Icape (EU:ALICA)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Icape (EU:ALICA)

Historical Stock Chart

Von Mai 2023 bis Mai 2024