The Next Nemaska?

World-Class Drill Results from One of the World‘s Best

Performing Lithium Stocks

Picture Source: Brent Baldwin,

author and keynote speaker ThinkWorldClass.com

Considering that lithium explorer Far Resources‘ stock price has

been on an impressive run lately, one may wonder where this junior

is heading? Considering today‘s landmark announcement of new drill

results, Far Resources could very well be on its way to become a

senior within the next years! Today´s announced new set of drill

results from Dyke #1 at the Zoro Lithium Project in Manitoba,

Canada, underpin the argument of a world-class lithium project:

• 1.43% Li2O over 20.6 m including 2.19%

Li2O over 4 m and 3.12% Li2O over 1

m in Hole DDHFAR17-18. These exceptionally high-grade

lithium intercepts come along with strongly enriched tantalum

(60-137 ppm) and niobium (142-409 ppm), potentially highly valuable

by-products. In early November, Far Resources re-assayed some drill

core and also found elevated tantalum grades with up to 927

ppm.

• 1.15% Li2O over 12.4 m in Hole

DDHFAR17-19, along with 45 ppm tantalum and 155 ppm niobium.

• This drilling was performed in areas of Dyke #1, where no

previous modern drilling had taken place.

• As announced today, a winter drill program is planned to

assess deeper levels (>150 m) of Dyke #1 for the extension of

high-grade lithium spodumene and to test historic high-grade

lithium drill intersections and recent assay results from trench

and outcrop sampling at Dykes #5 and #7.

• Field crews are currently expanding the prospecting and soil

geochemical surveys to find new pegmatite dykes on the recently

enlarged property.

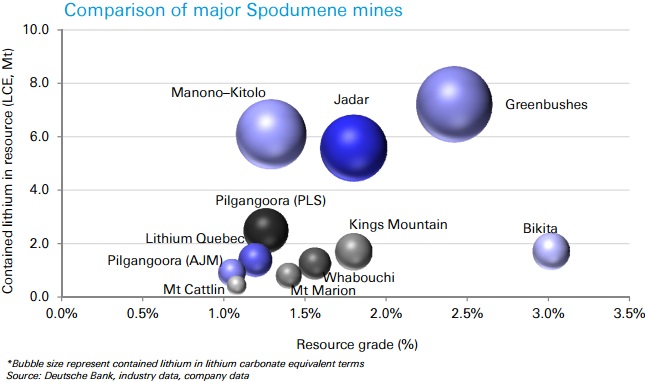

Considering that Canada‘s top lithium projects have average

resource grades which are similar to today‘s and past drill

results, shareholders are eagerly waiting for the first resource

estimate on Dyke #1 (and as the name suggests, there are many more

lithium-bearing pegmatite dykes on the Zoro Property waiting to get

drilled in order to further expand total resources, not to speak of

the great potential of many more dykes hidden below overburden

waiting to get discovered with the ongoing exploration

programs).

With a current market capitalization of $90 million CAD,

Far Resources is simply catching up to its peers:

Whabouchi Lithium Deposit in Québec, Canada

Nemaska Lithium Inc.(TSX.V: NMX; $1.93 CAD;

market capitalization: $689 million CAD)

Measured + Indicated Resource:28 million t @ 1.57 %

Li2O

Inferred Resource:4.7 million t @ 1.51%

Li2O

(January 2014 In-Pit Mineral Resource Estimate; the project is

under development with full commercial production estimated to

start in 2018)

Lithium Quebec Deposit in Québec, Canada

North American Lithium Inc. (private

company)

Measured & Indicated Resource: 33.2 million t @

1.19% Li2O

Inferred Resource:13.8 million t @ 1.21%

Li2O

(December 2011 Mineral Resource Estimate; the project is under

development with full commercial production estimated to start in

2018)

Rose Lithium-Tantalum Deposit in Québec, Canada

Critical Elements Corp. (TSX.V: CRE; $1.58 CAD;

market capitalization: $239 million CAD)

Indicated Resource: 31.9 million t @ 0.93%

Li2O and 148 ppm

Ta2O5

Inferred Resource:2.8 million t @ 0.82% Li2O and

145 ppm Ta2O5

(August 2017 Mineral Resource Estimate)

PAK Lithium Deposit in Ontario, Canada

Frontier Lithium Inc. (TSX.V: FL; $0.67 CAD;

market capitalization: $136 million CAD)

Measured & Indicated Resource: 7.9 million t @ 1.58%

Li2O, 104 ppm Ta2O5, 0.04%

Cs20 and 0.31% Rb20

Inferred Resource:0.3 million t @ 1.2% Li2O,

103ppm Ta2O5, 0.06% Cs20 and 0.36%

Rb20

(May 2016 Mineral Resource Estimate; Note: "Access to the

Property is available year-round by chartered ski or float equipped

aircraft from Red Lake, Ontario (175 km) to the south of Pakeagama

Lake. The project is located in a relatively isolated area of

northwestern Ontario where infrastructure is absent except for a

winter road, which services the communities of Deer Lake, Sandy

Lake, and North Spirit Lake." Source: Frontrier Lithium Inc.

Technical Report May 2016)

The Zoro Premium

There are several reasons why Far Resources‘ Zoro

Lithium Project is attracting massive attention around the

globe:

• High-grade lithium drill results with

potential of significant by-product credits from tantalum and

niobium enrichment.

• Highly favourable metallurgy expected due to

low impurities, such as iron, and a coarse-grained spodumene

mineralization (white to light-greenish colour, similar to

Whabouchi).

• Lithium-bearing pegmatites accessible at

surface and extending to depth (potentially ideal for

cost-effective open-pit mining).

• 7 known pegmatites on the property provide

significant resource definition potential in 2018.

• Blue-sky exploration potential: Many more

pegmatites possibly hidden beneath overburden.

• Most recently on November 27, Far Resources

signed a MOU for the near-by Thompson Brothers Lithium

Dyke, an 800 m long vertically dipping pegmatite dyke with

an historic non-NI43-101 resource of 3.97 million tonnes grading

1.29% Li2O (see also here).

• Near-by infrastructure (power line: 4 km;

road: 11 km; airport: 12 km; rail: 30 km). The Zoro Property is

situated in west-central Manitoba within the historic Snow Lake

Mining Camp. The hydro power line to Snow Lake is 5 km south of the

property and the small historic gold mining community of Herb Lake

is located about 10 km southwest. A rail link is located at Wekusko

siding approximately 20 km south of Herb Lake.

• First Nation consultation and engagement not required in the

Flin Flon-Snow Lake greenstone belt where the Zoro Property is

located.

• One of the world‘s best jurisdictions for mining and

investments: Manitoba is known to be very mining-friendly.

Last year, Manitoba ranked #2 in the world becoming the 2nd best

area for investment in mining (according to reputable Fraser

Institute). The Manitoba Government has implemented key policies to

attract investments for its prolific mining sector, including

already implemented policies such as a Progressive Mining Tax Rate,

Tax Holiday for New Mines, Off-Site Exploration Allowances, New

Investment Tax Credit, Processing Allowance. Junior explorer Far

Resources is also benefitting from such pro-active governmental

policies: In December 2016, Far Resources received a Minerals

Exploration Assistance Program (MEAP) Grant, which means that the

company is getting up to 50% of eligible exploration

expenses from the government! Another grant could be given

in December 2017 again. This MEAP Grant was implemented to

stimulate exploration and encourage companies to start developing

new mines. MEAPs are only granted to projects with a high

probability of success!

On top of all that, there is another good reason for being a

shareholder right now: In early October, the company provided an

update on its Plan of Arrangement about

the proposed spin-out of its gold assets, the Winston Gold Project in New Mexico,

USA (i.e. each eligible shareholders of Far Resources will

receive shares of this new company, at no costs). This will allow

the company to focus exclusively on its Zoro Lithium Project, while

shareholders will benefit from owning 2 stocks.

Bottom-Line

Think world-class. The trend is your friend.

Picture Source: Brent Baldwin,

author and keynote speaker ThinkWorldClass.com

Company Details

Far Resources Ltd.

Unit 114B – 8988 Fraserton Court

Burnaby, BC V5J 5H8 Canada

Phone: +1 604 805 5035

Email: info@farresources.com

www.farresources.com

Shares Issued & Outstanding: 91,051,316

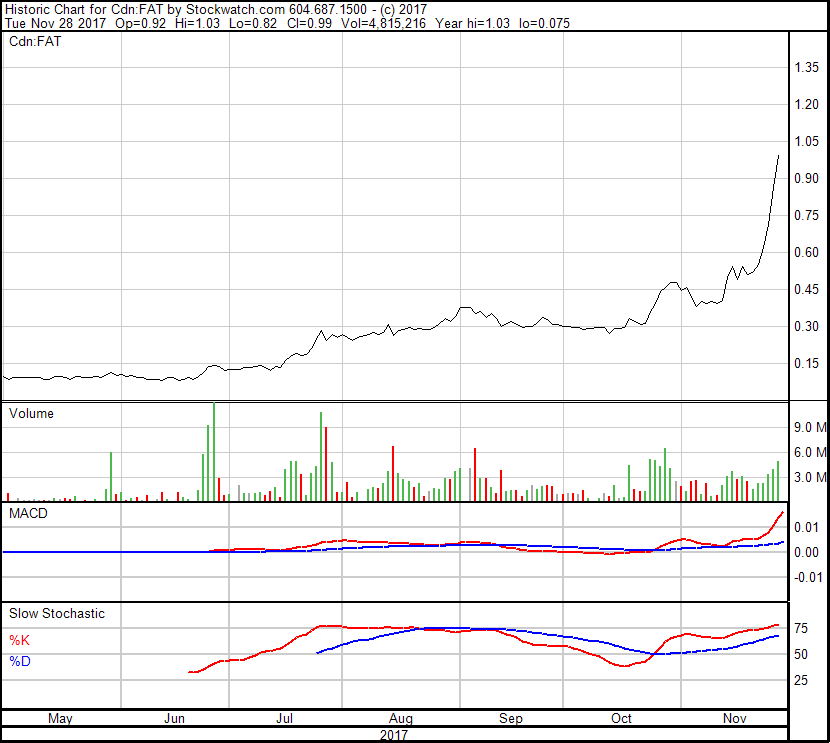

Chart

Canadian Symbol (CSE): FAT

Current Price: $0.99 CAD (11/28/2017)

Market Capitalization: $90 Million CAD

Chart

German Symbol / WKN (Frankfurt): F0R / A2AH8W

Current Price: €0.662 EUR (11/29/2017)

Market Capitalization: €60 Million EUR

Previous Coverage

Report #9: "Great Time to

be a FAT Shareholder"

Report #8: "Far Resources

reports substantial lithium drill results"

Report #7: "Richer Than

Expected: Far Resources reports lithium assays from rock chip

samples at Dyke #7"

Report #6: "Impressive

Lithium Drill Results on the Horizon?"

Report #5: "Drills Back in

Action at the Zoro Lithium Property in Manitoba: Confidently

Awaiting Second Round of Drill Results"

Report #4: "Savvy lithium

explorer getting ready for phase-2"

Report #3: "Far Resources

drills 23 m of 1.1% Li2O and gets ready for 6 additional

pegmatites"

Report #2: "Far Resources

gains momentum with drill results pending from its Zoro Lithium

Project in Manitoba"

Report #1: "Drill Results

Pending From a Potentially World-Class Hard-Rock Lithium

Project"

Disclaimer: Please read the full disclaimer within the full

research report as a PDF (here) as fundamental risks and

conflicts of interest exist. The author holds a long position in

Far Resources Ltd. and is being paid, on a monthly basis, a

retainer from Zimtu Capital Corp., which company also holds a long

position in Far Resoures Ltd.

|