Bitcoin Fear And Greed Index Falls To ‘Extreme Fear’ As BTC Dips Below $54,000

07 September 2024 - 7:30AM

NEWSBTC

On Friday, the cryptocurrency market’s Fear and Greed Index

plummeted to “extreme fear,” reflecting growing anxiety among

investors as the Bitcoin price dipped to a weekly low of

$53,700. This downturn marks a continuation of a broader

sell-off that has plagued the market, particularly since Bitcoin

struggled to maintain momentum above the critical $60,000

threshold. Bitcoin Targets $53,000 Amid Bearish Sentiment The steep

decline in Bitcoin’s value can be traced back to August’s

significant crash, attributed to challenging macroeconomic

conditions that resulted in increased liquidity exiting risk

assets, including cryptocurrencies. Furthermore, September

has historically been a bearish month for Bitcoin, with an average

negative return of 6%. As of now, just six days into the month,

Bitcoin has already recorded an 8% decline, a trend that market

expert Benjamin Cowen suggests could align with typical September

behavior if the month concludes at this rate. Related Reading:

Here’s How Cardano Price Will ‘Survive’ A US Recession: Crypto

Analyst However, further price retracements could occur if key

support levels fail to hold. Analyst Justin Bennett pointed out

that Bitcoin appears to be heading towards a target of $53,000

after a failed attempt to retest its all-time high of $69,000,

which was achieved at the end of August. Bennett indicated

that while the situation remains fluid, there is potential for a

brief relief rally in the $52,000 to $53,000 range before a deeper

correction could lead the price down to $48,000. Another analyst,

Michael van de Poppe, has also weighed in on the current market

dynamics, stating that the market may have overreached by taking

liquidity from above. Van de Poppe anticipates that Bitcoin

will likely test the $53,000 level before any upward movement

occurs. For Bitcoin to regain its footing, van de Poppe emphasizes

the necessity of reclaiming the $56,000 mark following the recent

dip. Key Factors That Could Catalyze BTC’s Price Recovery Despite

this bearish sentiment dominating the market, BTC investor Lark

Davis remains optimistic about the future, suggesting that the next

six months could be pivotal for Bitcoin and the broader market,

regardless of recent price corrections. One of Davis’ key points is

the upcoming fourth quarter, which has historically been a bullish

period for BTC, especially in Halving years. In addition, he

highlights the rising M2 money supply, which could lead to more

capital being injected into the market, further fueling a potential

rally. Davis also discusses the possibility of rate cuts by the US

Federal Reserve, which analysts suggest could act as a significant

catalyst for BTC’s price. Should the Fed implement cuts of 25 basis

points, it could create a more favorable environment for the entire

crypto market. Related Reading: Shiba Inu Recovery To $0.000081 ATH

Levels Still In Play Another critical factor Davis points to is the

upcoming US election, which is just 60 days away. As reported

by NewsBTC, a potential return of former President Donald Trump

could positively impact the crypto market. Trump has

indicated plans to put BTC at the forefront of his economic agenda,

including loosening regulations and fostering a more supportive

environment for cryptocurrencies. This shift could instill greater

confidence among investors and potentially boost BTC prices

significantly. However, it remains to be seen what the next few

days will bring for the Bitcoin price as the bearish sentiment in

the market is palpable, but with October holding potential gains as

has historically happened in past years. When writing, the

largest cryptocurrency on the market was trading at $54,100.

Featured image from DALL-E, chart from TradingView.com

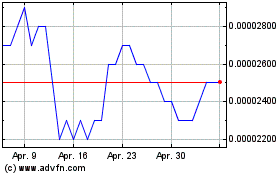

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024