$25 Million Drained From Compound (COMP) Treasury In Latest Governance Exploit Incident

30 Juli 2024 - 8:00AM

NEWSBTC

The Compound Finance (COMP) treasury has been drained of $25

million in a recent governance attack, raising alarms about the

state of decentralized governance in the decentralized finance

(DeFi) ecosystem. Compound DAO Hijacked According to researcher

DeFi Ignas, the attack began with an initial proposal to grant

92,000 COMP tokens, submitted without prior discussion on the

Compound DAO forum. Despite “glaring red flags”

identified by the project’s security advisor, Michael Lewellen, the

warning received minimal engagement from the community, with only a

few voices, such as MonetSupply and Wintermute, raising concerns.

Related Reading: Shiba Inu’s NVT Ratio Sees Drastic Increase, Is A

Rise To $0.00003 Still Possible? But the story took an even more

troubling turn when Humpy returned with a third proposal, this time

requesting 499,000 COMP tokens – a 5.4x increase from the initial

92,000. Interestingly, this proposal sailed through, with only 57

addresses casting their votes. Who Is Humpy, And How Did He Amass

Such Outsized Influence? According to DeFi researcher

StableScarab, Humpy is a major player across multiple DeFi

protocols, adeptly exploiting incentive designs to accumulate vast

amounts of governance tokens. His tactics allowed him to gain

significant control over Balancer, an Ethereum-based automated

market maker in 2022, and now he has set his sights on Compound.

The researcher highlights that this incident unveils a critical

issue in DeFi governance: “the illusion of decentralization.”

While Compound decentralized autonomous organization (DAO) is

touted as a decentralized decision-making body, the reality, in the

words of StableScarab, is that a mere 20 addresses typically

participate in governance votes. The researchers claim that

even when contentious proposals are put forth, the broader

community remains largely indifferent, seemingly unaware or

unconcerned with the implications. Related Reading: Bitcoin Bull

Cycle Likely To Go On Till Mid-2025: CryptoQuant CEO Moreover, the

Compound team itself appears disengaged, with the official

@compoundfinance X account going silent at the time of writing,

hours after the incident. This raises questions about the

true nature of the protocol’s governance structure, as it seems

Gauntlet, a paid advisor, effectively runs the DAO. StableScrab

further noted: Humpy’s influence goes beyond governance. He has his

own token, @Gold_On_Chain, for his ‘Golden Boys’ community. After

today’s Compound event, $GOLD’s value doubled as speculators bet on

Humpy’s ability to continue finding “highly profitable”

governance/farming strategies. On the other hand, the Compound’s

native token COMP has retraced over 1% in the last 24 hours and

over 7% in the past week alone in the wake of the latest deemed

governance exploit. Additionally, this has further

exacerbated the token’s ongoing downtrend since the 2021 bull run,

which saw the token hit an all-time high of $910 in May of that

year, and is currently down nearly 95% from that level. It

remains to be seen what communications the Compound team will issue

to investors and what other findings will come to light in the wake

of the exploit. Featured image from DALL-E, chart from

TradingView.com

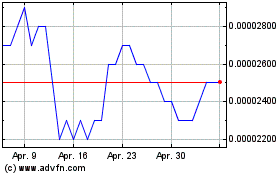

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025