Dogecoin Rally To $0.35 Could Trigger Massive Short Squeeze

28 Januar 2025 - 10:30AM

NEWSBTC

Dogecoin (DOGE) could be on the cusp of a significant price move

that might ignite a powerful short squeeze, according to analyst

Ali Martinez (@ali_charts). He pointed out on January 27, via X,

that “$766.45 million in short positions will be liquidated if

Dogecoin DOGE rebounds to $0.35,” implying that bearish traders

stand on precariously thin ice. Massive Dogecoin Short Squeeze

Incoming? A look at the up-to-date liquidation heatmap from

Coinglass shows hefty short positions clustered between roughly

$0.339755 and $0.34368. Coinglass data shows $464.8 million at

$0.339755, $534.79 million at $0.34054, $503.97 million at

$0.341325, $433.04 million at $0.34211, and $325.29 million at

$0.34368, bringing the total to around $2.26 billion in potential

forced liquidations. That figure underscores the magnitude of a

possible short squeeze should DOGE climb above that tight range.

Coinglass describes its heatmap as a way “to predict where

liquidation levels are likely to initiate,” and has also

underscored that “liquidations play a crucial role in the

cryptocurrency market” because they can influence rapid price

swings when traders with large leveraged positions are forced to

close out. Related Reading: Ready To Rocket? Dogecoin Chart Hints

At Major Gains Ahead Coinglass emphasizes the value of

understanding “high liquidity areas,” since they can serve as

magnet zones where big players, sometimes referred to as whales,

seize the opportunity to execute sizable trades. Traders often jump

on liquidation clusters at advantageous prices, which then paves

the way for sharp reversals. In the case of Dogecoin, that magnet

zone is now sitting just below $0.35. Martinez’s analysis of DOGE

aligns with the broader technical picture, which suggests the token

may be at a make-or-break juncture. Since December 8, when Dogecoin

briefly surged to $0.4834, the price action has been defined by a

descending trendline. Although DOGE broke above this line on

January 15, 2025—indicating a potential bullish shift—broader

market volatility on January 26 quickly dragged it back below. The

result is a scenario in which the descending line, now around

$0.335 to $0.34, stands as a formidable barrier. A successful

breach of that zone could be pivotal, especially given the sheer

concentration of shorts that Coinglass has identified just above

it. Should DOGE rally enough to pierce that level, traders holding

short positions may be forced to cover quickly, and that wave of

buying pressure can rapidly accelerate an upward move. Related

Reading: Think Dogecoin Has Topped Out? Two Factors That Say ‘No

Way’ Meanwhile, DOGE remains above the crucial 0.382 Fibonacci

retracement near $0.313, a support level that prevented further

downside during the latest market sell-off. The next technical

support lies deeper on the chart, near $0.212 (0.236 Fibonacci

retracement), where traders will be watching closely for any sign

of weakening momentum. On the upside, the 0.5 retracement at $0.394

remains a key pivot. A sustained recovery above that threshold

might spark greater bullish confidence, with potential resistance

emerging again around the 0.476 to 0.592 region if Dogecoin can

regain enough force. Featured image created with DALL.E, chart from

TradingView.com

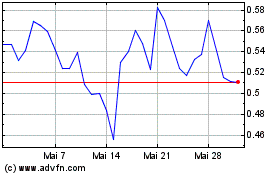

Sei (COIN:SEIUSD)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Sei (COIN:SEIUSD)

Historical Stock Chart

Von Mär 2024 bis Mär 2025