Bitcoin Open Interest, Funding Rates Point To Growing Bullish Sentiment

17 September 2022 - 1:00AM

NEWSBTC

Bitcoin has seen fluctuating sentiment lately. With numerous dips

and recoveries, it is no surprise that investors have had a hard

time deciding on which side of the fence to sit on. However, while

retail investors seem to be uncertain about the market, there has

been some growth in both the funding rates and the open interest

over the last week, showing that positive sentiment may be

stabilizing. Funding Rates Recover Over the last couple of weeks,

bitcoin funding rates have been consistently below neutral. This

coincided with the times when the market was struggling, ushering

in a new bear trend. But with the last week’s events, there has

been a remarkable recovery in the funding rates. Related Reading:

Displaced ETH Miners Seek Refuge In Ethereum Classic, Ravencoin

Toward the end of last week, the funding rates had returned to

neutral levels for the first time in one month. It followed the

recovery in bitcoin’s price last Friday before it slid back down.

The bitcoin funding rates have since lost their footing at the

neutral territory but continue to maintain higher levels before the

BTC recovery on Friday. Funding rates return to neutral | Source:

Arcane Research What this shows is that there is still demand for

both bitcoin longs and shorts. This means that while it does look

to be swinging in the favor of the bulls due to the elevated

levels, it is still an uncertain market. Additionally, last week’s

recovery to neutral levels did not really change much about the

current trend, as funding rates have now spent nine consecutive

months at or below neutral levels. Bitcoin Open Interest Say ‘Short

Squeeze’ Despite the decline in the bitcoin price, the open

interest has not had a hard time of it like the rest of the market.

Instead, BTC-denominated open interest has hit multiple new

all-time highs this year, leading to various short squeezes in the

market. Open interest continued to see favorable market conditions

as it hit a new all-time high of 421,000 BTC last Wednesday. Even

the short squeeze that was recorded on Friday did not do much to

bring down the open interest, which remained elevated at 418,000

BTC at the start of this week. Related Reading: Ethereum

Merge Fails To Move ETH Price, $2,000 Remains Elusive The depressed

market sentiment suggests that this elevated trend is unlikely to

continue for very long. Bitcoin’s price decline also points to

this, given that the elevated open interest coincided with a period

of price recovery. It also means that bears have been in control of

the market for the period where the open interest has been high.

Bitcoin’s fall below $20,000 is a testament that short traders

continue to control the market. Featured image from PYMNTS,

charts from Arcane Research and TradingView.com Follow Best Owie on

Twitter for market insights, updates, and the occasional funny

tweet…

Ravencoin (COIN:RVNUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

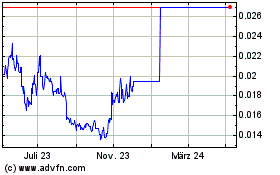

Ravencoin (COIN:RVNUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024

Echtzeit-Nachrichten über Ravencoin (Cryptocurrency): 0 Nachrichtenartikel

Weitere Ravencoin News-Artikel