Solana Leaves Competition In The Dust: Blazing Speed To Fuel Price Surge?

21 Mai 2024 - 6:39AM

NEWSBTC

Solana (SOL), the self-proclaimed “world’s fastest blockchain,” has

been grabbing headlines for its blazing transaction speeds and

surging token price. But is it all sunshine and rainbows in Solana

land, or are there cracks in the seemingly smooth road? Related

Reading: Solana Blasts Past Resistance: Buckle Up For $330 Breakout

– Analyst Solana Takes The TPS Crown According to CoinGecko data,

Solana blew past competitors like Polygon and Ethereum in

transactions per second (TPS). This translates to faster

transaction processing times, a key factor for scalability and mass

adoption in the blockchain world. However, a closer look reveals a

more nuanced picture. While daily active addresses, which represent

unique users interacting with the network, have indeed increased,

the daily transaction count hasn’t kept pace. This suggests a

scenario where more users are entering the Solana ecosystem, but

they aren’t necessarily conducting a high volume of transactions.

Is this a case of casual crypto tourists dipping their toes in, or

is there something else at play? Fees Take A Tumble, But Is It A

Sustainable Slide? Another interesting wrinkle is the decline in

transaction fees on Solana. This might seem like good news for

users, but it could be a double-edged sword. Lower fees could

indicate that the transactions being processed are less complex and

require lower charges. This could potentially limit Solana’s

revenue generation in the long run. Additionally, a drop in fees

could signal a decrease in network congestion, which might explain

the stagnant daily transaction count. DeFi Keeps The Party Going,

But Caution Flickers A bright spot for Solana is the continued

growth in its Decentralized Finance (DeFi) Total Value Locked

(TVL). DeFi refers to a suite of financial services built on

blockchains, and TVL represents the total value of crypto assets

deposited in DeFi protocols. Solana’s rising TVL indicates its

growing adoption within the DeFi space, where users can lock up

their crypto to earn interest or participate in other financial

activities. This is a positive sign for the overall health of the

Solana ecosystem. Related Reading: Litecoin Put To The Test: Can

LTC Break Through $94? However, a note of caution emerges from

technical indicators like the Money Flow Index (MFI). This

indicator suggests a potential price correction for SOL, hinting

that the current uptrend might not be entirely sustainable. Combine

this with the mixed signals on network activity and the declining

fee structure, and investors are left with a question mark hanging

over Solana’s long-term prospects. A Blockchain In High Gear, But

the Destination Is Unclear Solana’s impressive transaction speeds

and strong DeFi presence are undeniable strengths. However, the

network’s overall activity and tokenomics raise questions about its

long-term viability. Meanwhile, at the time of writing, SOL was

trading at $185, up 7.1% and 26.0% in the daily and weekly

timeframes, data from Coingecko shows. This price surge, coupled

with the network’s breakneck transaction speeds, paints a picture

of a project with immense potential. However, for Solana to truly

become a dominant force, it will need to address the questions

surrounding its network activity and long-term sustainability, not

to mention add some fuel to its price. Featured image from F1,

chart from TradingView

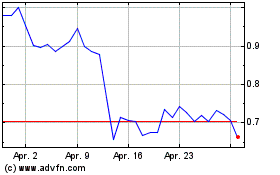

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

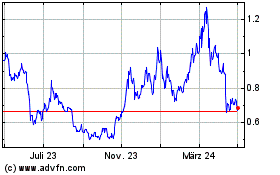

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024