ASML reports €14.0 billion net sales and €3.6 billion net income in

2020

ASML reports €14.0 billion net sales and €3.6 billion

net income in 2020 Continued growth expected in

2021 due to strong Logic demand and recovery in Memory

VELDHOVEN, the Netherlands, January 20, 2021 – today ASML

Holding NV (ASML) has published its 2020 fourth-quarter and

full-year results.

- Q4 net sales of €4.3 billion, gross margin of 52.0%, net income

of €1.4 billion

- Q4 net bookings of €4.2 billion

- 2020 net sales of €14.0 billion, gross margin of 48.6%, net

income of €3.6 billion

- ASML expects Q1 2021 net sales of between €3.9 billion and €4.1

billion and a gross margin between 50% and 51%

- ASML intends to declare a total dividend over 2020 of €2.75 per

ordinary share (15% increase)

|

(Figures in millions of euros unless otherwise

indicated) |

Q3 2020 |

Q4 2020 |

FY 2019 |

FY 2020 |

|

Net sales |

3,958 |

4,254 |

11,820 |

13,979 |

|

...of which Installed Base Management sales 1 |

862 |

1,056 |

2,824 |

3,662 |

|

|

|

|

|

|

|

New lithography systems sold (units) |

57 |

73 |

203 |

236 |

|

Used lithography systems sold (units) |

3 |

7 |

26 |

22 |

|

|

|

|

|

|

|

Net bookings 2 |

2,868 |

4,238 |

11,740 |

11,292 |

|

|

|

|

|

|

|

Gross profit |

1,881 |

2,212 |

5,280 |

6,798 |

|

Gross margin (%) |

47.5 |

|

52.0 |

|

44.7 |

|

48.6 |

|

|

|

|

|

|

|

|

Net income |

1,062 |

1,351 |

2,592 |

|

3,554 |

|

EPS (basic; in euros) |

2.54 |

3.23 |

6.16 |

8.49 |

|

|

|

|

|

|

|

End-quarter cash and cash equivalents and short-term

investments |

4,408 |

7,351 |

4,718 |

7,351 |

(1) Installed Base Management sales equals our net service and

field option sales.

(2) Our systems net bookings include all system sales orders for

which written authorizations have been accepted (for EUV excluding

the High-NA systems).

Numbers have been rounded for readers' convenience. A complete

summary of US GAAP Consolidated Statements of Operations is

published on www.asml.com

CEO statement and outlook"Our fourth-quarter

sales came in at €4.3 billion, which is above our guidance. This

was mainly due to additional DUV shipments and upgrade

opportunities. We shipped nine EUV systems and recognized revenue

for eight systems in the fourth quarter. Our fourth-quarter net

bookings came in at €4.2 billion, including €1.1 billion from EUV

systems (net six units).

"The total net sales for the year was €14.0 billion, including

€4.5 billion from 31 EUV systems. For ASML, 2020 was a year of

strong growth, both in sales and in profitability.

"For 2021, we expect another year of growth driven by strong

Logic demand and continued recovery in Memory. The build out of the

digital infrastructure and the continued technology innovation is

relevant to the consumer, automotive and industrial markets and

drives demand across our entire product portfolio," said ASML

President and Chief Executive Officer Peter Wennink.

ASML expects first-quarter revenue between €3.9 billion and €4.1

billion with a gross margin between 50% and 51%, R&D costs of

€620 million and SG&A costs of €165 million. The estimated

annualized effective tax rate is expected to be between 14% and 15%

for 2021.

Products and business highlights

- In our EUV business, we celebrated the milestone of the 100th

EUV system shipment. By end 2020, 26 million wafers were exposed on

our EUV installed base, of which 9 million in the fourth

quarter.

- In our DUV business, we focused on meeting our customers'

increasing demand for all DUV systems as well as on optimizing

factory capacity, reducing the install cycle time and supporting

the tools in the field for maximum productivity. While the first

NXT:2050i systems took up to 120 days to build, at the end of last

year we already showed build time capability of 60 days over the

last five systems.

We also shipped our first ArF dry system on the NXT platform

(NXT:1470). On our Twinscan KrF platform, we shipped a record

number of systems. The overall strong demand for DUV systems is

confirmed by a record value of DUV bookings during 2020 (€7.3

billion).

• In our Applications

business, we shipped the first YieldStar 385 to a customer in Q4

and achieved a record year for YieldStar shipments. The YieldStar

385 offers the latest in-resist overlay and focus metrology, with

enhanced throughput and accuracy, to meet N3 requirements. Compared

to previous systems, key enhancements include a faster stage and

faster wavelength switching, which enable highly accurate overlay

measurements and tool matching using multiple wavelengths.

We shipped three eScan1000 Multibeam systems in 2020. With 3x3

beams and high-speed stage technology, these systems provide up to

600% higher productivity than single beam systems, and will provide

customers with early process integration capability.

Dividend proposal and share buyback program

updateASML intends to declare a total dividend in respect

of 2020 of €2.75 per ordinary share. Recognizing the interim

dividend of €1.20 per ordinary share paid in November 2020, this

leads to a final dividend proposal to the General Meeting of €1.55

per ordinary share. This is a 15% increase compared to the 2019

total dividend of €2.40 per ordinary share.

As part of its financial policy to return excess cash to its

shareholders through growing dividends and share buybacks, in

January 2020, ASML announced a new three-year share buyback

program, to be executed within the 2020–2022 time frame. As part of

this program, ASML intends to purchase shares up to €6 billion,

which includes a total of up to 0.4 million shares to cover

employee share plans. ASML intends to cancel the remainder of the

shares repurchased. To date, €1.2 billion worth of shares has been

repurchased under the current program.

| Media

Relations contacts |

Investor

Relations contacts |

| Monique Mols +31 6

5284 4418 |

Skip Miller +1 480

235 0934 |

| Sander Hofman +31 6

2381 0214 |

Marcel Kemp +31 40

268 6494 |

| Brittney Wolff

Zatezalo +1 408 483 3207 |

Peter Cheang +886 3

659 6771 |

Quarterly video interview, press conference,

investor and media conference callWith this press release,

ASML has published a video interview in which CFO Roger Dassen

discusses the 2020 fourth-quarter and full-year results and outlook

for 2021. This can be viewed on www.asml.com.

CEO Peter Wennink and CFO Roger Dassen will host a virtual press

conference in Veldhoven on January 20, 2021, at 11:00 Central

European Time, which will be accessible via live webcast on

www.asml.com.

A conference call for investors and media will be hosted by CEO

Peter Wennink and CFO Roger Dassen on January 20, 2021 at 15:00

Central European Time / 09:00 US Eastern Time. Details can be found

on our website.

About ASMLASML is one of the world’s leading

manufacturers of chip-making equipment. Our vision is a world in

which semiconductor technology is everywhere and helps to tackle

society’s toughest challenges. We contribute to this goal by

creating products and services that let chipmakers define the

patterns that integrated circuits are made of. We continuously

raise the capabilities of our products, enabling our customers to

increase the value and reduce the cost of chips. By helping to make

chips cheaper and more powerful, we help to make semiconductor

technology more attractive for a larger range of products and

services, which in turn enables progress in fields such as

healthcare, energy, mobility and entertainment. ASML is a

multinational company with offices in more than 60 locations in 16

countries, headquartered in Veldhoven, the Netherlands. We employ

more than 28,000 people on payroll and flexible contracts

(expressed in full time equivalents). ASML is traded on Euronext

Amsterdam and NASDAQ under the symbol ASML. More information about

ASML, our products and technology, and career opportunities is

available on www.asml.com.

US GAAP and IFRS Financial Reporting ASML's

primary accounting standard for quarterly earnings releases and

annual reports is US GAAP, the accounting principles generally

accepted in the United States of America. Quarterly US GAAP

consolidated statements of operations, consolidated statements of

cash flows and consolidated balance sheets are available on

www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of

December 31, 2020, the related consolidated statements of

operations and consolidated statements of cash flows for the

quarter and twelve months ended December 31, 2020 as presented

in this press release are unaudited.

In addition to reporting financial figures in accordance with US

GAAP, ASML also reports financial figures in accordance with

International Financial Reporting Standards as adopted by the

European Union ('IFRS') for statutory purposes. The most

significant differences between US GAAP and IFRS that affect ASML

concern the capitalization of certain product development costs and

the accounting of income taxes.

2020 Annual ReportsASML will publish its 2020

Annual Report based on US GAAP and its 2020 Annual Report based on

IFRS on February 10, 2021. The reports will be published on

our website, www.asml.com.

Regulated informationThis press release

contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Forward Looking StatementsThis

document contains statements that are forward-looking, including

statements with respect to expected trends, including trends in end

markets and technology industry and business environment trends,

outlook and expected financial results for Q1 2021, including

expected revenues, gross margin, R&D costs, SG&A costs and

estimated annualized effective tax rate for 2021, expected growth

in net sales in 2021, expected strong Logic demand and continued

recovery in Memory, long term growth opportunity, revenue

opportunity through 2025, expected benefits and performance of new

systems and applications, the expectation that EUV will continue to

enable Moore's law and drive long term value for ASML, statements

with respect to plans regarding dividends, including the intention

to continue to return significant amounts of cash to shareholders

through a combination of share buybacks and growing dividends, the

amount of the final dividend for 2020 and statements with respect

to the 2020-2022 share buyback program including the amount of

shares intended to be repurchased under the program. You can

generally identify these statements by the use of words like "may",

"will", "could", "should", "project", "believe", "anticipate",

"expect", "plan", "estimate", "forecast", "potential", "intend",

"continue", "target", and variations of these words or comparable

words. These statements are not historical facts, but rather are

based on current expectations, estimates, assumptions and

projections about our business and our future financial results and

readers should not place undue reliance on them. Forward-looking

statements do not guarantee future performance and involve risks

and uncertainties. These risks and uncertainties include, without

limitation, economic conditions; product demand and semiconductor

equipment industry capacity; worldwide demand and manufacturing

capacity utilization for semiconductors; the impact of general

economic conditions on consumer confidence and demand for our

customers’ products; performance of our systems, the duration and

continued or increased severity of the COVID-19 outbreak and

measures taken to contain it and other risks related to the impact

of COVID-19 on the global economy and financial markets, as well as

on ASML and its customers and suppliers, including their

operations, and other risks relating to COVID-19 and other factors

that may impact ASML’s sales and gross margin, including customer

demand and ASML’s ability to obtain supplies for its products, the

success of technology advances and the pace of new product

development and customer acceptance of and demand for new products;

the number and timing of systems ordered, shipped and recognized in

revenue, and the risk of order cancellation or push out, production

capacity for our systems including delays in system production; our

ability to enforce patents and protect intellectual property rights

and the outcome of intellectual property disputes and litigation;

availability of raw materials, critical manufacturing equipment and

qualified employees; trade environment; import/export and national

security regulations and orders and their impact on us, changes in

exchange and tax rates; available liquidity and liquidity

requirements, our ability to refinance our indebtedness, available

cash and distributable reserves for, and other factors impacting,

dividend payments and share repurchases, results of the share

repurchase programs and other risks indicated in the risk factors

included in ASML’s Annual Report on Form 20-F and other filings

with and submissions to the US Securities and Exchange Commission.

These forward-looking statements are made only as of the date of

this document. We do not undertake to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

- Link to press release

- Link to consolidated financial statement

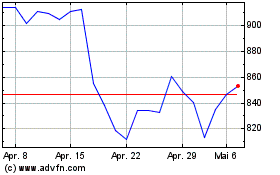

ASML Holding NV (BIT:1ASML)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

ASML Holding NV (BIT:1ASML)

Historical Stock Chart

Von Dez 2023 bis Dez 2024