Rare Earths Supply Deficit Peaking, To Surplus By 2013 -Goldman

05 Mai 2011 - 3:23AM

Dow Jones News

A global deficit in supply of rare earth elements is likely to

peak this year before moving into surplus by 2013, according to

Goldman Sachs analysts.

In a research note Thursday, analyst Malcolm Southwood said the

world was likely to see a deficit of 18,734 metric tons of the

metals this year, equivalent to 13.2% of demand, before slipping

into a surplus in 2013 which will rise to 5,860 tons the following

year, or 3.2% of projected demand.

However, prices will likely continue to rise, the bank said. "We

envisage that the market for rare earths will remain in severe

deficit in 2011 and 2012, and that prices will trend higher over

the next 18 months. We envisage a closely balanced market in 2013,

and modest surpluses thereafter--at least, for some of the more

abundant light rare earths--with some price softening in the

2013-2015 period."

Prices for rare earths have jumped sharply since last July as

China, which accounts for around 90% of global production of the

elements, has clamped down on export quotas and illegal

production.

The basket price of rare earths in Lynas Corp. (LYC.AU) Mount

Weld deposit was last recorded at $162.66 per kilogram on May 2,

compared to an average of $10.32/kilogram throughout 2009.

Goldman said that Chinese output would fall 2.5% this year and

resume growth in 2012, as a campaign to cut down on illicit

production and improve environmental records reached its

conclusion.

Rare earths are a suite of 17 elements with diverse uses from

high-powered magnets and fuel refining to energy-efficient light

bulbs and mobile phone screens.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

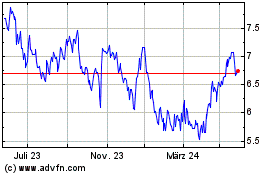

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024

Echtzeit-Nachrichten über Lynas Rare Earths Limited (Australische Börse): 0 Nachrichtenartikel

Weitere Lynas News-Artikel