TIDMSML

RNS Number : 6855P

Strategic Minerals PLC

11 October 2023

11 October 2023

Strategic Minerals plc

("Strategic Minerals", "SML" or the "Company")

Cornwall Resources Limited Signs Memorandum of Understanding

with Oxford Sigma Limited

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company, is pleased to announce that its 100%

owned subsidiary Cornwall Resources Limited ("CRL") has signed a

Memorandum of Understanding ("MOU") with Oxford Sigma Limited

("Oxford Sigma"), a nuclear fusion technology company based in

Oxfordshire, UK.

Highlights:

-- MOU outlines how the two parties will collaborate to explore,

develop, promote, and secure critical mineral supply pathways for

tungsten to supply the fusion industry.

-- As one of the only high-grade tungsten resources in the UK,

Redmoor has the potential to be one of these supplies. In turn

complementing the UK Government's Critical Minerals Strategy.

-- Dennis Rowland, CRL's Project Manager, and Dr Thomas Davis of

Oxford Sigma recently held discussions at CRL's Redmoor offices in

Cornwall, where Dennis demonstrated the strengths of the Redmoor

Project and the nature of its high-grade resource.

-- CRL were encouraged by the projections of future tungsten

requirements from the fusion industry, with each potential fusion

reactor estimated to need between 100 - 5,000 tonnes of tungsten

(design dependent), with a requirement to renew tungsten components

on a regular timeline further strengthening potential demand.

-- MOU signed for an initial 5-year period

Tungsten Supply and Fusion Energy

Currently over 90% of global tungsten supply is controlled by

China (84%), Vietnam (5.7%) and Russia (2.7%). It is imperative for

the security of supply of this critical material that long-term

alternative supplies are established.

Fusion energy is potentially a near-limitless source of

carbon-free energy for the future, and tungsten will be a key

component in the process, required for dense, highly efficient

radiation shielding and plasma-facing components within fusion

energy devices.

Fusion energy is actively being developed to reach

commercialisation with over US$6.2 billion of mainly private

investment worldwide (as of August 2023 according to the Fusion

Industry Association). However, without a viable commercial pathway

for the supply of tungsten from raw materials to the fusion

community, the commercialisation of fusion energy could face

significant delays.

The strategic collaboration with Oxford Sigma, further growing

its network of tungsten development projects, will provide a

combination of skills and assets to secure the source of raw

tungsten material in the UK, with the goal of deploying these

tungsten-based components across the globe.

Commenting, Dr Thomas Davis, CTO of Oxford Sigma Limited,

reflects:

"Following on from other recent MOUs in tungsten supply, Oxford

Sigma has entered into a key collaboration agreement with Cornwall

Resources Limited. This is a natural fit to further strengthen our

approach to securing long-term tungsten supply for the fusion power

industry. Commercial fusion power stations are expected to become

the ultimate domestic energy source, providing our clean power

needs for generations.

"To make fusion sustainable, we must address the need of

securing the supply of critical minerals, such as tungsten, and the

projects that will produce them. Most of the technology that Oxford

Sigma develops for fusion energy depends on large quantities of raw

tungsten for various applications (radiation shielding and

plasma-facing components). By collaborating with Cornwall

Resources, Oxford Sigma continues to grow a network of world class

projects, in safe jurisdictions, aiming to establish the supply of

tungsten, ensuring a secure sustainable tungsten supply for the

world's fusion reactors of the future.

"We look forward to working with CRL, and our other partners, in

connecting and building relationships with the fusion

community."

Commenting, Peter Wale, Executive Director of Strategic Minerals

and Director of CRL, said:

"We are pleased to be working with the Oxford Sigma team who

have a deep understanding of the fusion energy industry within the

United Kingdom and abroad. Oxford Sigma is working to develop a

long-term supply chain approach to sourcing tungsten for this key

developing future technology.

"This agreement highlights the high grade, JORC (2012)

compliant, tungsten resource at Redmoor. We believe Redmoor to be a

world class deposit that has the potential to contribute towards

the large quantities of tungsten necessary to advance the UK's

ambition to advance nuclear fusion technology into commercial

production in the coming decades.

"By working with Oxford Sigma, we intend to further highlight to

national government the importance of establishing domestic

tungsten mining to provide long-term security of supply for the

fusion community, and Redmoor's ability to help meet these

needs."

About Oxford Sigma

Oxford Sigma is a Fusion Technology company with a vision to

tackle energy security and climate change by accelerating the

commercialisation of fusion energy. Its mission is to deliver

materials technology, materials solutions, and fusion design

services. Oxford Sigma aims to produce advanced materials

technologies, agnostic to fusion approach, for the materials

ecosystem. Its fusion core materials are engineered to enable

longer term operations for fusion pilot plants, with the aim of

roll out to the first-of-a-kind commercial power stations. Oxford

Sigma is internationally recognised as a key fusion materials and

technological leader. The company operates in the United States,

United Kingdom, European Union, Canada, and Japan, with offices in

the UK and USA. Our roots and headquarters are in Oxford, UK.

Get in touch at info@oxfordsigma.com

About Cornwall Resources Limited

Cornwall Resources Limited ("CRL") is a wholly owned subsidiary

of Strategic Minerals PLC ("SML") (AIM: SML; USOTC: SMCDY) focussed

on advancing the high-grade, underground Redmoor

Tungsten-Tin-Copper Project, through a current relogging and

sampling campaign of historic drill core and continuing to progress

towards securing further significant funding, as well as exploring

its minerals rights licence area in east Cornwall, Southwest

England.

The Redmoor Project is situated within the historically

significant Tamar Valley Mining District, yet the sheeted vein

system ("SVS") forming the basis of CRL's inferred resource is

unmined. SML bought into CRL in 2016, and in 2019 completed the

purchase of the project. CRL completed a JORC-compliant Inferred

Mineral Resource Estimate ("MRE") for Redmoor using a comprehensive

archive of historical data and through the completion of two

exploration campaigns, in 2017 and 2018, totalling 32 boreholes for

14,000m of drilling. An updated Scoping Study, published in 2020

shows that Redmoor has potentially economic viability as a new,

underground mine.

Mineral Resource Estimate published February 2019, as summarised

below:

Cut-off (SnEq%) Tonnage WO(3) Sn Cu Sn Eq(1) WO(3)

(Mt) Eq

% % % % %

>0.45 <0.65 1.5 0.18 0.21 0.3 0.58 0.41

-------- ------ ----- ----- --------- ------

>0.65 10.2 0.62 0.16 0.53 1.26 0.88

-------- ------ ----- ----- --------- ------

Total Inferred

Resource 11.7 0.56 0.16 0.5 1.17 0.82

-------- ------ ----- ----- --------- ------

1 Equivalent metal calculation notes; Sn(Eq)% = Sn%*1 +

WO3%*1.43 + Cu%*0.40. Commodity price assumptions: WO3 US$

33,000/t, Sn US$ 22,000/t, Cu US$ 7,000/t. Recovery assumptions:

total WO3 recovery 72%, total Sn recovery 68% & total Cu

recovery 85% and payability assumptions of 81%, 90% and 90%

respectively

Subject to the completion of necessary funding, CRL has in place

permissions for drill programs, in the Target Tip Valley ("TTV"),

to test at depth previously reported high-grade auger and trenching

results (as reported 17 November 2021), as a possible western

extension of the current Redmoor resource, and for further

exploration of the Redmoor Tungsten-Tin-Copper resource. A General

Permitted Development Order application, for necessary drilling

consents, was approved by Cornwall Council for the TTV program and

a full Planning Permission has been granted by Cornwall Council for

future drilling at Redmoor.

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Charlie Bouverat

Notes to Editors

Strategic Minerals plc:

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin/Tungsten project which was settled on 24

July 2019 by way of a vendor loan which was fully repaid on 26 June

2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project temporarily into production in

April 2019. In July 2021, the project was granted a conditional

approval by the South Australian Government for a Program for

Environmental Protection and Rehabilitation (PEPR) in relation to

mining of its Paltridge North deposit and processing at the

Mountain of Light installation. In early January 2022, an updated

PEPR, addressing the conditions associated with the July 2021

approval, was lodged.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFIRIELILIV

(END) Dow Jones Newswires

October 11, 2023 02:00 ET (06:00 GMT)

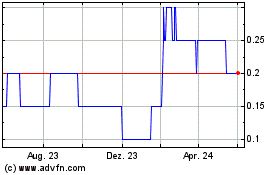

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

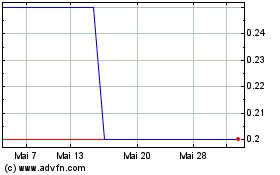

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024