TIDMPSYC

RNS Number : 3350K

Clarify Pharma PLC

05 May 2022

Press Release

05 May 2022

Clarify Pharma PLC

("Clarify Pharma" or "The Company")

Full Year Results

Clarify Pharma (AQSE: PSYC), an investment vehicle specialising

in biotech and life sciences companies seeking to prove the safety

and efficacy of psychedelic-based substances, announces its audited

financial results for the twelve months ended 30 November 2021.

Highlights:

-- Raised a total of GBP1.29 million in a pre-IPO funding

round

-- Successfully completed an IPO on London's AQSE Growth Market

(AQSE) on 11 June 2021 with a market capitalisation of

approximately GBP7.43 million raising GBP1.96 million in total

before expenses via a placing and subscription at 2.5p per

share

-- Made a first capital investment in Beckley Psytech Limited

("Beckley Psytech"), a private company dedicated to addressing

neurological and psychiatric disorders through the novel

application of psychedelic medicines

-- Net cash of GBP1.3m as at 30 April 2022

Outlook:

-- The deal flow of potential investments remains strong, and

the Directors and Advisers continue to evaluate exciting new

opportunities that will generate long-term value for investors

-- The Company is well positioned to take advantage of the

growing psychedelics market as it continues to develop

significantly along with the regulatory environment

Commenting on the results, Jonathan Bixby, Executive Director of

Clarify Pharma, said: "Within the twelve months prior to 30

November 2021, Clarify Pharma completed a successful flotation on

the AQSE Growth Market. We also made our first capital investment

in an exciting company and continue to explore new opportunities

that meet with our investment criteria and offer significant value

for shareholders. We look forward to the continued growth of

confidence among investors in this nascent sector."

The directors of Clarify Pharma plc accept responsibility for

this announcement.

For further information please contact:

Clarify Pharma

Jon Bixby via Tancredi +44 207 887 7633

Executive Chairman

------------------------------

First Sentinel

------------------------------

Corporate Adviser

Brian Stockbridge +44 7876 888 011

------------------------------

Tennyson Securities

------------------------------

Corporate Broker

Peter Krens +44 207 186 9030

------------------------------

Tancredi Intelligent Communication

------------------------------

Media Relations

Catrina Daly

Emma Hodges

Salamander Davoudi +44 7727 153 868

+44 7861 995 628

clarifypharma@tancredigroup.com +44 7957 549 906

------------------------------

About Clarify Pharma PLC:

Listed on the Aquis Stock Exchange in London, Clarify Pharma is

an investment vehicle focusing on investing in biotech and life

sciences companies seeking to prove the safety and efficacy of

psychedelic based substances. The Company looks to identify

investment opportunities in the life sciences sector within the UK,

Canada and other growing markets, with the objective of generating

long-term capital growth and building investments in an R&D

pipeline of companies which are discovering, developing, or

deploying safe and evidence-based psychedelic inspired medicines

and experiential therapies that alleviate mental health problems

and enhance wellbeing. The Company's Directors have an established

track record, experience and networks in the psychedelic,

cannabinoid and media industries, to drive value creation.

www.clarifypharma.com

Executive Director's Statement

Introduction

I am pleased to report the Company's first set of full year

results following our debut on the Access Segment of the AQSE

Growth Market on 11 June 2021.

The potential benefits of psychedelic drugs have been recognised

in both the UK and the US and the medical use of psychedelics is

progressively emerging as an alternative candidate to conventional

therapies for individuals suffering from elusive maladies like

PTSD, addiction, Alzheimer's, and depression.

The Company made a first capital investment in Beckley Psytech,

a private company dedicated to addressing neurological and

psychiatric disorders through the novel application of psychedelic

medicines.

There was no revenue during the period as the Company was in

start-up phase. A loss before tax of GBP1.3m (H1 2021: GBP0.5m) was

incurred in the year, reflecting costs related to the valuation of

warrants issued, the start-up of the business as well as

operational expenses. The Company ended the year with cash and cash

equivalents of GBP1.5m as at 30 November 2021.

Following our maiden investment, we see opportunities for

investing in companies with the required expertise and potential to

become pioneers in the market.

I would like to take this opportunity to thank our board for

their ongoing commitment and expertise as well as our shareholders

for their continued support.

Jonathan Bixby, Executive Director

Investment strategy

The Company's objective is to generate capital growth over the

long term through a portfolio of businesses concentrating on fast

growing biotech and life science companies that research or produce

neuro-pharmaceutical drug development platforms advancing medicines

based on psychedelic substances through rigorous science and

clinical trials.

The Board seeks to build out an R&D pipeline of companies

which are discovering, developing or deploying safe and

evidence-based psychedelic inspired medicines and experiential

therapies that alleviate mental health problems and enhance

wellbeing. Through those drug development platforms, Clarify will

invest in companies which seek to prove the safety and efficacy of

psychedelic-based substances as disruptive technologies and

solutions for a continuum of mental illnesses and high unmet

medical need.

Clarify seeks to assemble a portfolio of drug development

companies with a compelling pipeline of psychedelic inspired

medicines and experiential therapies for human clinical trials

which adhere strictly to the guidelines of the United Kingdom's

MHRA, Canada's Health Canada and similar regulatory authorities in

other jurisdictions where Clarify or its Investee Companies

operate.

Market size

The Company considers that there is a sizable potential market

for psychedelic products as clinical trials into

psychedelic-assisted psychotherapy continue to show promising

results for the treatment of the mental health conditions such as

depression, anxiety and addiction. According to analysts at

Canaccord, the global psychedelics industry could soon be worth

over US$100 billion.

Outlook

As the field of psychedelic science continues to grow, the Board

considers that psychedelic-assisted psychotherapy will continue to

gain acceptance in the medical community with numerous recent

studies highlighting the contributions of psychotherapy treatments

and accredited research organisations demonstrating its clinical

effectiveness. As a result, the Board looks forward to the future

with great confidence.

STATEMENT OF COMPREHENSIVE INCOME

AS AT 30 NOVEMBER 2021

Period ending Period ending

30 November 2021 30 November 2020

Note GBP GBP

Continuing Operations

------------------ ------------------

Gross Profit - -

------------------ ------------------

Administrative expenses 4 (1,255,552) -

Other operating income - -

Operating loss (1,255,552) -

------------------ ------------------

Finance Income 5 59 -

------------------ ------------------

Loss before taxation (1,255,493) -

------------------ ------------------

Taxation on loss of ordinary activities 8 - -

------------------ ------------------

Loss for the year from continuing operations (1,255,493) -

------------------ ------------------

Other comprehensive income 9 23,631 -

Total comprehensive loss for the year attributable to shareholders (1,231,862)

from continuing operations

-

------------------ ------------------

Basic & dilutive earnings per share - pence 10 (0.56) 0.00

------------------ ------------------

The accompanying notes in the Company's Annual Report form an

integral part of these financial statements.

STATEMENT OF FINANCIAL POSITION

AS AT 30 NOVEMBER 2021

As at 30 November 2021 As at 30 November 2020

Note GBP GBP

NON-CURRENT ASSETS

Investments 13 528,375 -

-----------------------

TOTAL NON-CURRENT ASSETS 528,375 -

CURRENT ASSETS

Cash and cash equivalents 11 1,523,665 -

Trade and other receivables 12 508,000 1

TOTAL CURRENT ASSETS 2,031,665 1

----------------------- -----------------------

TOTAL ASSETS 2,560,040 1

----------------------- -----------------------

EQUITY

Share capital 15 297,195 1

Share premium account 15 2,859,005 -

Share based payment reserve 16 575,024 -

Retained Earnings (1,231,862) -

TOTAL EQUITY 2,499,362 1

----------------------- -----------------------

CURRENT LIABILITIES

Trade and other payables 14 60,678 -

TOTAL CURRENT LIABILITIES 60,678 -

----------------------- -----------------------

TOTAL LIABILITIES 60,678 -

----------------------- -----------------------

TOTAL EQUITY AND LIABILITIES 2,560,040 1

======================= =======================

The accompanying notes in the Company's Annual Report form an

integral part of these financial statements.

The financial statements were approved by the Board of Directors

on 03 May 2022 and were signed on its behalf by:

Nicholas Lyth

Director

The financial information set out in this announcement does not

constitute statutory accounts. This financial information has been

extracted from the audited full accounts of the Company for the

period ended 30 November 2021. The Company does not declare a

dividend for the period.

The full Annual Report of the Company will be available on the

Company's website: www.clarifypharma.com .

The Directors of the Company accept responsibility for the

contents of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXXZLFBLELXBBF

(END) Dow Jones Newswires

May 05, 2022 02:01 ET (06:01 GMT)

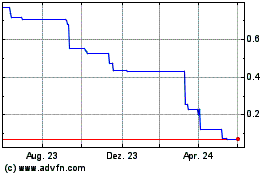

Clarify Pharma (AQSE:PSYC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

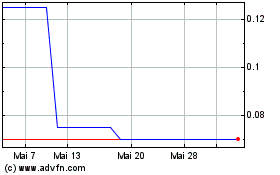

Clarify Pharma (AQSE:PSYC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024