TIDMANIC

RNS Number : 8329I

Agronomics Limited

09 August 2023

THIS ANNOUNCEMENT REPLACES THE ANNOUNCEMENT "MEATABLE COMPLETES

EUR35M SERIES B FINANCING ROUND" OF 8 AUGUST 2023 WITH RNS NUMBER

64131.

- in the headline and in the first paragraph the reference to

"EUR35 million of financing" should read "EUR30 million of

financing"

- the following text from the third line of the first paragraph

should be added in describing the Subscription: "using cash from

the Company's own resources. Agronomics also received 200 warrants

exerciseable any time in the next five years at a price per share

equivalent to the Subscription"

- the figure of EUR195k paid as a secondary transaction in May 2021 should read GBP195,632

- the statement relating to Agronomics' investments should read

" will be carried at GBP11.8 million (EUR13.7 million)" , rather

than EUR14.2 million; "including an unrealised gain of GBP3.9

million (EUR4.5 million)", rather than EUR5 million; " and

represents a gross IRR of 22.31%. Agronomics now holds an equity

stake of 6.51%", rather than 6.7%; " in Meatable, with the position

accounting for approximately 7.4%", rather than 9%, "of Agronomics'

30 June 2023 Net Asset Value (as adjusted for this investment)

"

- in the third paragraph the phrase "together with" was omitted

from the phrase "led by Agronomics together with New Agrarian"

- and also in the third paragraph, the amount of the

contribution from Invest-L should have read "EUR15 million", rather

than EUR17 million.

All other text remains the same.

9 August 2023

Agronomics Limited

("Agronomics" or the "Company")

Meatable Announces Successful EUR30 Million Series B Financing

Round

Agronomics (ANIC:LSE), the leading listed company focused on the

field of cellular agriculture, is pleased to announce it has

invested EUR4 million (the "Subscription") as part of Meatable's

EUR30 million Series B financing round using cash from the

Company's own resources. Agronomics also received 200 warrants,

exercisable at any time in the next five years at a price per share

equivalent to the Subscription. The funding round was co-led

alongside New Agrarian Company Limited ("New Agrarian").

Agronomics first invested EUR2 million in Meatable B.V.

("Meatable") in December 2019 , followed by an additional EUR1

million in June 2020 , EUR2 million in February 2021 and EUR195,632

via a secondary transaction in May 2021 . Subject to audit,

Agronomics' investments, inclusive of the Subscription, will be

carried at GBP11.8 million (EUR13.7 million), including an

unrealised gain of GBP3.9 million (EUR4.5 million) and represents a

gross IRR of 22.31%. Agronomics now holds an equity stake of 6.51%

in Meatable, with the position accounting for approximately 7.4% of

Agronomics' 30 June 2023 Net Asset Value (as adjusted for this

investment).

The successful funding round was led by Agronomics together with

New Agrarian and saw the Dutch impact fund, Invest-NL, join as a

new investor, contributing EUR15 million , alongside renewed

support from existing investors, including BlueYard, Bridford,

MilkyWay, DSM Venturing and Taavet Hinrikus (chairman and founder

of Wise).

The funding will be used to further scale Meatable's production

processes and accelerate its commercial programme in target markets

to deliver cultivated meat products that are price competitive with

traditional meat. Starting in Singapore, Meatable's sausages and

pork dumpling products will be available in selected restaurants

and retailers from 2024. It is also establishing a presence in the

United States and target European countries. These steps ensure

Meatable can bring to life its mission to make cultivated meat

available for everyone, without compromising on taste or harming

animals, people or the planet.

Innovative technology to produce cultivated meat at scale

Consumer demand for meat continues to grow across the world, but

this comes at a huge cost to the planet. Cultivated meat is part of

the solution - a study by independent research company CE Delft

found that cultivated meat can reduce the footprint of conventional

beef by up to 92% for greenhouse gas emissions and 95% for land

use. Investors have poured nearly US$ 900 million into the sector

in 2022 alone, with the Netherlands announcing the world's largest

ever-public investment into cellular agriculture last year.

To make its cultivated pork, Meatable takes one sample of cells

from an animal without harming it and replicates the natural growth

process of the cells using its patented opti-ox (TM) technology

combined with pluripotent stem cells. This technology makes it

possible for Meatable to produce real muscle and fat cells in only

eight days , 30 times faster than the time it takes to rear a pig

for pork on the farm. Meatable has all processes in place to be

able to scale cultivated meat production affordably and provide a

genuine solution to this global, pressing problem.

Taking its revolutionary cultivated meat process global

To truly make an impact, cultivated meat needs to be widely

available. To address this demand, Meatable is launching its first

commercial products in Singapore starting in 2024, and is currently

partnering with the relevant authorities to secure regulatory

approval. Meatable has already successfully held its first external

tasting events in Singapore earlier in 2023, following approval

from the Singapore Food Agency (SFA). In addition, it has started

production of its products on the ground together with Esco Aster

Pte Ltd , the first and only commercially licensed cultivated meat

manufacturer in Singapore, and has begun co-development of its

product range with plant-based butcher Love Handle SC .

Meatable is also working to expand its operations into the

United States and across Europe. Recent regulatory developments

have boosted confidence in the industry, with the USA approving two

cultivated meat companies to start selling their products.

Meanwhile, the Netherlands recently became the first European

country to officially give the green light for companies to

organise tastings.

Jim Mellon, co-founder of Agronomics, said:

"Meatable is one of the leading companies helping to transform

the cultivated meat industry. With 80 billion animals slaughtered

every year for meat and vast amounts of the Amazon rainforest

already destroyed because of animal agriculture, there is a real

need to find a solution that can provide meat at the scale needed

to address a growing mass market. The latest funding round will

allow Meatable to scale up production in Singapore, and soon in the

US, as it moves towards commercialisation as part of its

Go-to-Market strategy."

Krijn de Nood, co-founder and CEO of Meatable, said:

"We are thrilled to have the renewed support of our existing

investors, including Agronomics, while welcoming Invest-NL as a new

investor. This is a huge sign of confidence in the incredible

quality, taste, and proven scalability of our product, especially

in the current investment climate. When 14% of the world's global

emissions comes from the traditional meat industry, it is clear

there needs to be an alternative to reduce the harm our diets are

currently causing the planet. We believe cultivated meat is the

answer and we are confident we have the tools and the processes in

place to make this a reality. We look forward to working closely

with our investors as we enter our next growth phase and cement our

position as global leaders."

Since this Subscription is considered a Substantial Transaction

under AIM Rule 12, this announcement requires certain disclosures

under Schedule Four. Meatable is an early-stage company with no

revenues with operating costs of approximately EUR1.6 million per

month, and total assets as at 31 December 2022 of EUR23 million,

including cash or near cash of EUR20 million with no material

liabilities.

New Agrarian, the affiliate of Agronomics, has invested EUR6

million on identical terms to Agronomics for 2.86%. In aggregate,

Agronomics and New Agrarian will own 9.63% of Meatable on a fully

diluted basis and have the right to a board seat following the

close of the financing round.

About Meatable

Meatable is an innovative, Dutch food company, aiming to

deliver, at scale, the new natural , cultivated meat that looks

like, tastes like, and has the nutritional profile of traditional

meat. Its proprietary opti-ox (TM) technology [is designed to

enable] Meatable to produce meat rapidly, sustainably, and without

harming animals. Founded in 2018 by Krijn de Nood (CEO), Daan

Luining (CTO), and Dr. Mark Kotter (principal inventor of opti-ox

(TM) technology), Meatable has brought together a team of close to

100 experts with unique knowledge in fields including molecular

biology, chemistry, tissue engineering, bioprocess development,

food safety, and food science to create the new natural meat.

Follow Meatable : LinkedIn , Twitter , Instagram , Facebook .

About Agronomics

Agronomics is the leading listed venture capital firm with a

focus on cellular agriculture. The Company has established a

portfolio of over 20 companies at the Pre-Seed to Series C stage in

this rapidly advancing sector. It seeks to secure minority stakes

in companies owning technologies with defensible intellectual

property that offer new ways of producing food and materials with a

focus on products historically derived from animals. These

technologies are driving a major disruption in agriculture,

offering solutions to improve sustainability, as well as addressing

human health, animal welfare and environmental damage. This

disruption will decouple supply chains from the environment and

animals, as well as being fundamental to feeding the world's

expanding population.

About Invest-NL

Invest-NL serves as the Dutch National Promotional Institution.

As a leading impact investor, its core mission is to facilitate

financing for ventures that may initially seem challenging to fund.

By working in collaboration with diverse stakeholders, including

financiers, investors, and development specialists from both the

public and private sectors, Invest-NL actively tackles significant

societal challenges. These encompass the transition towards a

carbon-neutral and circular economy, promoting affordable and

accessible healthcare, and fostering advancements in deep tech

innovations.

About Cellular Agriculture

Cellular Agriculture is the production of agriculture products

directly from cells, as opposed to raising an animal for slaughter

or growing crops. This encompasses cell culture to produce

cultivated meat and materials, and fermentation processes that

harness a combination of molecular biology, synthetic biology,

tissue engineering and biotechnology to massively simplify

production methods in a sustainable manner.

Over the coming decades, the source of the world's food supply

traditionally derived from conventional agriculture is going to

change dramatically. We have already witnessed the first wave of

this shift with the consumer adoption of plant-based alternative

proteins but today, we are on the cusp of an even bigger wave of

change. This is being facilitated by advances in cellular

agriculture. This change is necessary, given scientists' claims

that if we maintain existing animal protein consumption patterns,

then we will not meet the Paris Agreement's goal of limiting

warming to 1.5 .

AT Kearney, a global consultancy firm, projects that cultivated

meat's market share will reach 35% by 2040. This combined with the

Good Food Institute's estimate that a US $1.8 trillion investment

will be required in order to produce just 10% of the world's

protein using this technology, means that we are on the cusp of a

multi-decade flow of capital to build out manufacturing facilities.

Funding in the field of cellular agriculture is accelerating,

however, still, less than US$ 5 billion has been invested worldwide

since the industry's inception in 2016.

For further information please contact:

Agronomics Beaumont Canaccord Cenkos Peterhouse SEC Newgate

Limited Cornish Genuity Securities Capital

Limited Limited Plc Limited

The Company Nomad Joint Broker Joint Broker Joint Public Relations

Broker

========== ============ =============== =============== =============================

Richard Reed Roland Andrew Giles Balleny Lucy Williams Bob Huxford

Denham Eke Cornish Potts Michael Charles George Esmond

James Harry Rees Johnson Goodfellow Anthony Hughes

Biddle Alex Aylen Alice Cho

(Head of

Equities)

========== ============ =============== =============== =============================

+44 (0) 1624 +44 (0) +44 (0) +44 (0) +44 (0)

639396 207 628 207 523 207 397 207 469

info@agronomics.im 3396 8000 8900 0936 agronomics@secnewgate.co.uk

========== ============ =============== =============== =============================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFIFTVIAIIV

(END) Dow Jones Newswires

August 09, 2023 08:06 ET (12:06 GMT)

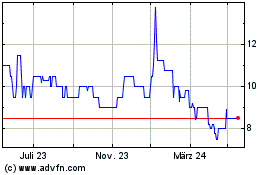

Agronomics (AQSE:ANIC.GB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

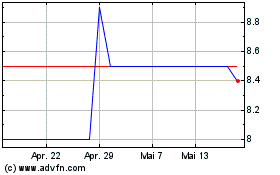

Agronomics (AQSE:ANIC.GB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024