Amur Minerals Corporation Transaction Approvals Update (5835B)

03 Oktober 2022 - 1:35PM

UK Regulatory

TIDMAMC

RNS Number : 5835B

Amur Minerals Corporation

03 October 2022

3 October 2022

AMUR MINERALS CORPORATION

(AIM: AMC)

Transaction Approvals Update

Amur Minerals Corporation ("Amur" or the "Company") is pleased

to announce that it has been informed by Bering Metals LLC (the

"Buyer") a Russian incorporated company that it has successfully

obtained the necessary consents from the appropriate Russian

Federation authorities to complete the Disposal of its Kun-Manie

nickel copper sulphide project. Shareholder approval on 24 August

2022 for the sale of its Russian subsidiary ("AO Kun-Manie") in the

total amount of US$35 million was contingent upon the Buyer

obtaining the following:

-- the consent of the Federal Antimonopoly Service of Russia or

its relevant territorial department to the Disposal being granted

and such consent not being conditional upon any further actions or

omissions by any of the parties to the Share Purchase

Agreement;

-- the approval under the Presidential Decree No. 81 dated 1

March 2022 and all ensuing Russian Federation regulatory statutes

having been granted on the terms required by applicable law, and

not having been subsequently revoked, and such approval not being

conditional upon any further actions or omissions by any party.

Having been informed by the Buyer that the necessary permissions

are granted, both the Company and Buyer have now entered the final

stage of the Completion process wherein final documentation is

being compiled allowing for final transfer of the Company's wholly

owned AO Kun-Manie subsidiary to the Buyer. The parties have

discussed and agree that completion is scheduled around 1 November

2022 ("Completion") with the one time payment of US$35 million

scheduled five days post Completion.

Robin Young, CEO of Amur, commented: "We are pleased that the

Russian Federation has approved the Disposal of our AO Kun-Manie

wholly owned subsidiary in the agreed amount of US$35 million. It

is our intent to advance to Completion as rapidly as possible given

the ongoing geopolitical situation where sanctions by various

nation states continue to be modified on an ongoing basis.

"As reported in various RNS releases and public domain news

updates, a special dividend of 1.8p is to be paid within 90 days of

receipt of the closing payment. With the key approvals now in hand,

we shall complete our assessment of the classification of the

dividend regarding shareholder taxation.

"Following Completion, we will turn our full attention to the

future of the Company, where we endeavour to identify and secure

another business opportunity to deliver value to shareholders."

Future Strategy and Special Dividend

Upon Completion, the Company will move forward as an AIM Rule 15

cash shell and retain cash balances of approximately US$38 million

after paying certain expenses and any Company related taxes

relating to the Disposal.

Following receipt of the consideration of US$ 35 million, the

Company intends to pay a special dividend of 1.8 pence per share to

be paid to Shareholders within 90 days of Completion. The Company

has received tax advice that the Disposal is unlikely to attract

capital gains or withholding tax. The Board proposes that the

record date and payment date for the distribution of the

post-Completion dividend shall be no later than 90 days following

receipt of the consideration payment.

The Directors intend to seek to acquire another company or

business in exchange for the issue of Ordinary Shares in a single

transaction (a "reverse takeover"), which will be subject to

Shareholder approval. In considering the Company's future strategy,

the Board will seek to identify opportunities offering the

potential to deliver value creation and returns to Shareholders

over the medium to long-term in the form of capital and / or

dividends.

The Company will be required to undertake an acquisition or

acquisitions which constitute(s) a reverse takeover under AIM Rule

14 on or before the date falling six months from the completion of

the Disposal, or be re-admitted to trading on AIM as an investing

company under AIM Rule 8. Failing that, the Company's Ordinary

Shares would then be suspended from trading on AIM pursuant to AIM

Rule 40. If the Company's shares remain suspended for six months,

admission of the Company's shares will be cancelled.

Market Abuse Regulation (MAR) Disclosure)

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Company Nomad and Broker Public Relations

Amur Minerals S.P. Angel Corporate BlytheRay

Corp. Finance LLP

Robin Young CEO Richard Morrison Megan Ray

Adam Cowl Tim Blythe

+44 (0) 7981 126 +44 (0) 20 7138

818 +44 (0) 20 3470 0470 3203

For additional information on the Company, visit the Company's

website, www.amurminerals.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSBBBDGDXGDGDX

(END) Dow Jones Newswires

October 03, 2022 07:35 ET (11:35 GMT)

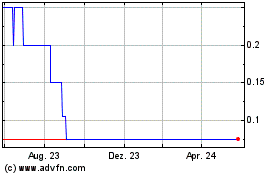

Crism Therapeutics (AQSE:AMC.GB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

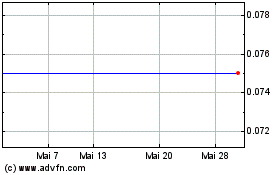

Crism Therapeutics (AQSE:AMC.GB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024