TIDMAMC

RNS Number : 7269Q

Amur Minerals Corporation

30 June 2022

30 June 2022

AMUR MINERALS CORPORATION

("Amur", the "Company" or the Group)

AUDITED FINAL RESULTS FOR THE YEARED 31 DECEMBER 2021

2021 Highlights:

-- Advancing the TEO Project document for the Kun-Manie Project,

and submission of the draft report to the expert commission of the

State Committee on Reserves ("GKZ").

-- Sale of Amur's 14% interest in the Nathan River Resources

("NRR") Roper Bar iron ore operation in Australia.

-- Continued M&A effort to identify a partner and / or buyer

of the Kun-Manie nickel copper sulphide project located in the

Russian Far East.

Chairman's Statement

It is with pleasure that I update you on the activities of the

Company for the twelve month period to 31 December 2021, as well as

the period since the year end, including recent global events which

have impacted us. Along with all worldwide corporate entities, Amur

Minerals Corporation (the "Company") had to balance and endure the

challenges related to the Covid-19 pandemic during the year and the

more recent, post 2021, developing geopolitical situation in the

Ukraine. Broadly, our major areas of focus during the year

included:

-- Advancing the TEO Project document for the Kun-Manie Project,

compiled by the expert team of Oreoll Ltd. ("Oreoll") and

submission of the draft report to the expert commission of the

State Committee on Reserves ("GKZ"). This is a document required by

the Russian Federation which was completed post 2021 and maintains

our compliance with the Russian permitting regime.

-- Selling our 14% interest in the Nathan River Resources

("NRR") Roper Bar iron ore operation in Australia. Grossing US$5.9

million with a profit of US$0.9 million.

-- The continued M&A effort to identify a partner and / or

buyer of the Kun-Manie nickel copper sulphide project located in

the Russian Far East. A bona fide purchase offer being ultimately

rejected in May 2022.

The strategic plan for 2022 was to carry out the work plan and

strategy to maintain the extraction rights to its 100% controlled

Kun-Manie project and this continues to be our prime objective.

However, the current geopolitical situation in Ukraine has

radically altered our strategy for 2022. It is therefore important

that we also provide key additional information as to the impact of

Russia's "Special Military Operation" ("SMO"). Given the changing

situation regarding the SMO, the 2022 strategy may require rapid

adjustments depending on the actions of various nation states and

the Russian Federation ("RF"). This has not yet impacted our

in-Russia operational activities but has substantially altered our

activities related to our M&A strategy.

Looking at our 2021 activities in isolation, we present the

Annual Report and Accounts for the year 31 December 2021.

Importantly, we note that over the course of the year 2021, the

Company continued to remain debt-free, and its cash reserve

increased 2.4 times from US$2,790,000 (1 January 2021) to

US$6,682,000 (31 December 2021).

Kun-Manie Nickel-Copper Sulphide Project

Kun-Manie is and remains our flagship project as one of the

largest undeveloped nickel - copper sulphide projects in the world.

It is located near the three largest nickel consuming nations of

Japan, Korea and China and we will continue to focus on this

project.

Our primary objective is to maintain the Group's 100% production

rights at Kun-Manie. We shall continue to complete specific work

programmes per the terms and conditions of the licence to maintain

our production rights. Entering 2021, two objectives remained to be

completed. The first was the completion of an expert commission

report called a TEO Project which was scheduled for completion at

the end of 2021 and completed in H1 2022. Thereafter, a Mine Plan

document must also be completed.

Production approval for the Kun-Manie project requires RF

approvals based on Russian protocols. These approvals cannot be

obtained based on "western standard" Feasibility, Definitive or

Bankable studies. The approvals are derived from several RF

agencies based on Russian standard design work completed by

certified institutes. It has always been a priority for us to

obtain suitable and approvable Russian documentation for obtaining

the required approvals. This approach ensures that we maintain the

integrity of and production rights to the licence and have a fully

suitable and approved, ready to operate mining operation at the end

of the day. This part of our strategy remains unchanged from

2021.

For clarification, it is important to understand what a TEO

Project is. It is a feasibility study level document compiled by

certified Russian Federation experts using specific state-defined

procedures and reporting requirements and is ultimately approved by

the State Committee on Reserves ("GKZ"). The document addresses all

project disciplines and is similar to the contents of western

feasibility study. It is to include all available technical results

and study work specific to the project. For compilation of this TEO

Project report, we contracted an experienced and independent expert

company (Oreoll LLC) who warranted it would diligently complete and

defend the results submitted to the GKZ. Oreoll's first submission

date on our behalf was 20 August 2021.

In the evaluation process, the first submission of the TEO

Project is considered a draft document. A GKZ commission of

experienced, certified and approved experts covering all project

disciplines is then assembled and each expert examines specific

sections of the report relevant to their expertise. Discussions

between Oreoll and the GKZ experts are held and Oreoll is directed

to finalise the negotiated document. This final report covers the

design basis of the project with regard to operating parameters,

design considerations, operating and capital cost estimates,

infrastructure requirements and financial analysis.

In a post 2021 event, the Company announced the final TEO

Project results in an RNS released 7 June 2022. The key highlights

were:

-- The TEO Project was compiled by Oreoll LLC and GKZ Russian

Federation certified experts from all project disciplines.

-- The GKZ expert commission approved a 19-year open pit

operational design with revenue generation derived from two

saleable concentrates allowing for the recovery of both copper and

nickel. Minor payable amounts for gold, platinum and palladium will

also be recovered.

-- The design parameters maximise revenue generation to the RF

based on fully loaded taxation and royalty schemes. The total Net

Present Value ("NPV(10%) ") deliverable to the RF is projected to

be US$ 628 million. This approach does not optimise the financial

return to the project operator which is addressed during the next

and final requirement of the mine planning stage for the

licence.

-- The GKZ commission reviewed Oreoll's submission. Necessary

adjustments allowing for the identification and approval of

operational parameters and considerations, associated capital and

operating costs, the revenue generation from the sale of individual

nickel and copper concentrates and selected commodity prices were

defined. As a result of the expert evaluations, a Life of Mine

("LOM") cutoff grade ("COG") was defined to be 0.2% Ni. The annual

nominal production rate of 12.4 million ore tonnes was

selected.

-- Lerchs Grossman open pit production analyses including mining

loses and dilution indicate the average LOM ore production grades

for delivery to the sulphide flotation plant will be 0.66% Ni,

0.18% Cu, 0.015% Co, 0.05 grammes per tonne ("g/t") Au, 0.90 g/t

Ag, 0.14 g/t Pt and 0.14 gt/ Pd. The total cumulative LOM RF

National Association of Subsoil Examination ("NAEN") certified

Reserve totals 187.1 million ore tonnes. Approximately 4.6 cubic

metres ("m(3) ") (13.8 tonnes) of waste will be extracted per ore

tonne.

-- The Oreoll and GKZ experts have determined the LOM capital

cost estimate is US$ 1.92 billion with US$ 1.14 billion allocated

as preproduction and construction costs, US$ 698 million in

sustaining costs and US$ 85 million in working capital. The

increase in the capital cost estimate from previously reported

projections is attributable to the more than doubling of the

previous annual operational capacity impacting the expansion of the

open pit mining fleet, plant expansion and the addition of a copper

recovery circuit within the process plant, tailings storage

expansion, power plant requirements and the need to construct a

dual carriage way access road capable of handling the increased

mine support and concentrate transport needs. All capital

expenditure sectors include contingencies specific to the project

and its location.

-- Operating costs per ore tonne are projected to be US$ 42.32

including ore and waste mining costs, depreciation and

royalties.

-- Accounting for both flotation plant metallurgical losses and

adjustments for off take fees, the LOM recovered payable metals

from the two concentrates total 627 thousand nickel tonnes, 177

thousand copper tonnes, 1.5 tonnes of gold, 3.3 tonnes of platinum

and 3.5 tonnes of palladium. The payable metal schedules and all

fees are based on confidential metal trading schedules provided by

two reputable, internationally recognised industry metals

traders.

-- Nickel and copper account for 95% of the LOM revenue obtained

from the nickel and copper concentrate products. The GKZ approved

conservative prices for the primary revenue generators of nickel

and copper were US$ 14,468 per Ni tonne (US$ 6.56 per pound) and

US$ 6,758 per Cu tonne (US$ 3.07 per pound). Minor credits were

included for gold (US$ 58.90 / g), platinum (US$ 34.35 / g) and

palladium (US$ 80.75 / g). Metal prices for nickel and copper as at

28 June 2022 were US$10.82 and US$3.86, respectively.

-- Using these conservative/low metals prices across the 19 year

production schedule, the NPV(10%) to the Company is US$ 333 million

with an Internal Rate of Return ("IRR") of 15.6%. The payback

period for the 12.4 million ore tonne per year operation is

projected to be 5.5 years.

The most important component derived within the GKZ approved TEO

Project is the registration of the mining reserve. It is from these

final certified reserves that a Mine Plan will be developed. For

your convenience, the table below defines the 19 year GKZ Life of

Mine NAEN reserve by tonnages and grades to be delivered to the

mill.

Mine Delivered Mill Feed NAEN

Reserve

Dilution and Mining Losses Included

COG 0.2% Ni

--------------------------------------------

Commodity Factor In Balance -

B + C1 + C2

----------- -------- ---------------------

0.2% Ni Grade

COG

----------- -------- ------------ -------

Mill Feed

Tonnes T 187,134,000

-------- ------------ -------

Ni T 1,233,697 0.66%

-------- ------------ -------

Cu T 343,045 0.18%

-------- ------------ -------

Co T 25,518 0.014%

-------- ------------ -------

Pt Kg 25,709 0.14

g/t

-------- ------------ -------

Pd Kg 26,547 0.14

g/t

-------- ------------ -------

Au Kg 8,964 0.05

g/t

-------- ------------ -------

Ag Kg 168,505 0.90

g/t

-------- ------------ -------

JORC resources and reserves are not accepted by the Russian

Federation, however, we have provided JORC estimates over the life

of our exploration programme. We implemented this approach in

accordance with CRIRSCO recommendations which allow shareholders to

measure the progress of resource expansion of our resource with

time. Though not required, CRIRSCO recommend this approach be taken

for publicly listed companies such as Amur.

With the TEO Project now complete, our next phase is to compile

the Mining Plan due mid-year 2023, which leads to obtaining

construction, mining and operational approvals and funding

considerations.

Kun-Manie -Russia's SMO, Sanctions and Orders

Entering 2021, our strategy regarding funding was based on the

knowledge that the preproduction and construction start-up capital

expenditure would be relatively large (greater than US$ 0.5

billion) given the remote location of the project. We anticipated

that project funding would require a consortium of Russian and

international funding sources. The strategy throughout 2021 and

into the start of 2022 consisted of:

-- Completion of all required conditions per the terms of the

licence including the mandatory TEO Project (Feasibility Study),

review by the State Committee on Reserves ("GKZ") and the

subsequent mandatory Mine Plan work also requiring certified

Russian institutes input and approvals.

-- Detailed engineering and design work completed to Russian

standards thus making it suited for approvals by the specific

authorities and meeting the investment requirements of Russian

financial institutions.

-- In anticipation that we would have to raise substantial funds

from both inside and outside of Russia to fully support financing,

a western bankable study will also be compiled. Potential outside

funding sources will include internationally recognised financial

institutions and intermediate metal off-takers. Based on

discussions with western mining engineering companies experienced

in Russia, the western study should be a hybrid product based on

the Russian documentation but compiled in a manner meeting both

Russian and international requirements. The best time to undertake

this western work is during the later stages of the assembly of the

Russian banking study following the TEO Project.

In Q1 22, we revisited the funding approach of our strategy due

to the SMO in Ukraine. Sanctions are now in place and continue to

be introduced by various nation states. These target Russian

banking institutions, select Russian companies and numerous

individuals associated with mineral and industrial activities. In

response, the Russian Federation issued and continues to issue

counter measures (Orders). The main Order restricts the ability of

companies to operate within Russia through strict currency controls

restricting the outflow of funds from Russia.

To this point, our subsidiary, AO Kun-Manie a Russian company,

has functioned on an unhindered basis. The sanctions and orders

have, however, impacted the Group's activities.

AMC - The SMO, Sanctions and Orders

In 2020, Amur developed a shortlist of potential partners or

purchasers wherein a Russia-based project would be of interest. The

list included Russian and internationally based mining companies,

investment groups, financial institutions, metal trading groups and

electric vehicle battery manufacturers. Discussions were held with

potential partners and confidentiality agreements were signed with

interested parties.

In Q2 21 and Q3 21, the M&A market relating to nickel and

copper sulphide projects improved due to the increasing Green

Energy interest and electric vehicle battery demand. Three parties

(one western and two Russian) demonstrated bona fide interest in

funding or purchasing Kun-Manie.

Medea Naturals Resources ("MNR") were contracted to establish a

Fair Market Value ("FMV") for the sale of Kun-Manie. Based on their

survey and the analysis of world-wide nickel exploration and

development project transactions, they established a transaction

sale price ranging from US$106 million to US$131 million. The

majority of the transactions surveyed were external to Russia, but

focused on an anticipated yield earned by a project sale.

Negotiations advanced with all three parties and funding

alternatives and purchase options were tabled. Of the three, a

proposed outright purchase of Kun-Manie was selected as it offered

the highest consideration available to the Company, approaching

fair market value. Transaction documentation was initiated and

neared completion in late February 2022.

On 24 February 2022, Russia initiated the SMO. The action

resulted in the immediate implementation of sanctions and counter

measure responses by the Russian Government on 28 February, 1 March

and 8 March of 2022. The combined actions had an immediate impact

on the proposed sale of Kun-Manie, voiding the agreed terms of the

nearly final Share Purchase Agreement ("SPA"). The buyer and Amur

agreed to monitor the situation and revisit the SPA once the full

impact of the sanctions and orders were understood.

Upon completion of a sanction and order review period,

negotiations were resumed to modify the SPA allowing for all

constraints to be considered. Specific considerations and impacts

to the transaction and available alternatives is a transaction

structure as follows:

-- A transaction with a Russian entity or individual can be

implemented if they are not sanctioned. Searches by our Russian and

UK solicitors confirmed the buyer was free from restriction, and

regular reviews were conducted as sanctions are frequently updated.

The buyer remained unsanctioned and we were able to modify the

SPA.

-- Russian Government implemented Orders restricting foreign

currency flow out of Russia will have the greatest impact. Foreign

exchange payments may be made with the approval of a newly formed

Currency Control Committee and this committee has final approval on

the quantity and timing of currency flow from Russia. The buyer's

funds would originate from Russia, and therefore must be approved

by the committee.

-- For the transaction, the Company requires legal support using

Russian solicitors to ensure that the transaction will meet all

regulatory and statutory considerations. Many legal entities have

exited Russia, including our former Russian solicitors who were

involved in negotiations. We had anticipated that this might occur

and have already engaged a highly regarded, experienced Russian law

firm, Birch Legal.

-- In the event that Amur is unable to complete a transaction

with the buyer, the SMO has substantially and adversely impacted

the opportunity to sell and develop Kun-Manie. Sanctions have

eliminated many companies, including mining entities, some off-take

metal marketers and all sanctioned Russian companies as potential

business counterparts. Additionally, the larger and well-funded

Russian resource banks and fund sources are predominantly now

sanctioned. International funding sources are avoiding

participation in Russian based projects.

May 2022 Kun-Manie Transaction Offer

From late March through early May of 2022, a revised SPA was

negotiated and executed with the buyer. All necessary associated

documentation was completed, including the Circular for shareholder

approval of the offer. For a total consideration of US$105 million,

Stanmix Holding Limited offered to purchase AO Kun-Manie per the

following terms.

-- US$15 million upon Completion of the Transaction (to occur

within 60 days of signing the SPA)

-- US$10 million within 12 months of the date of the SPA

-- US$50 million within 48 months of the date of the SPA

-- US$30 million, payable in ten annual installments of US$3 million commencing in 2027

Requiring shareholder approval, a General Meeting was set for 25

May 2022. At the request of attending shareholders, our Chief

Executive Officer ("CEO"), Robin Young conducted a Q&A session

related to the transaction. Subsequent to the Q&A session, the

offer from Stanmix was rejected. The primary reasons from

shareholders attending were:

-- Payment terms extended over to long a period.

-- No absolute guarantee that all payments would be forthcoming.

-- Initial payments were insufficient.

-- Specific dividends to shareholders were not identified.

Robin Young was asked to revisit the M&A potential given the

concerns of the attending shareholders. As at the date of this

report we continue to be in discussions with Stanmix.

Of special note, the beneficial underlying owner of Stanmix (Mr.

Vladislav Sviblov) entered into an agreement to purchase the mining

assets of Kinross Gold in Russia. This transaction was announced

and completed by Kinross Gold on 15 June 2022. Based on

renegotiated terms, the total consideration purchase price reported

by Kinross was US$340 million, a reduction of nearly 50% from the

original offer. This is the first transaction completed by a

Russian buyer with a western owner since the SMO, introduction of

sanctions and the counter measure responses of the Russian

Federation.

Impact of Kun-Manie Sale On The Company

In the event of a sale of Kun-Manie is successful, the Company

will be classified as a cash shell by the Alternative Investment

Market ("AIM"). During the immediately following six months, the

Company will need to acquire another project or company via a

Reverse Take Over ("RTO") to maintain trading on AIM. Should an RTO

not be completed within that timescale, the Company will be

suspended from trading and if after six months in suspension with

no RTO having occurred, the Company would be delisted. In

anticipation of a sale, we are examining the acquisition of

projects, particularly within more favourable mining jurisdictions

as a part of our strategy.

An alternative scenario is to reclassify the Company as an

investment vehicle which would require the Company to successfully

raise gross placing proceeds of at least GBP6.0 million.

NRR Roper Bar Iron Ore Transaction

In 2020 the Group acquired a Convertible Loan Note ("CLN") on

Nathan River Resources Pte Limited ("NRR") which owns the Roper Bar

Iron Ore Project ("Roper Bar") totalling US$4,670,000. Roper Bar is

a large established iron ore deposit in the Northern Territory of

Australia with a defined JORC resource of 446,000,000 tonnes at

39.9% Fe and a JORC reserve of 4,760,000 tonnes at 60.1% Fe. NRR

had re-established the mining and shipping of iron ore to China

under an offtake agreement with Glencore.

On 3 July 2021, the Group announced that it sold its wholly

owned subsidiary Carlo Holdings Limited ("CHL"), the direct owner

of the NRR CLN, for a cash consideration of US$5,892,000 to

Hamilton Investments Pte. Ltd., a subsidiary of Britmar (Asia) Pte

Ltd. The Group recognised a profit on the sale of US$915,000. In

addition, the CLN carried an interest-bearing coupon at 14% which

was payable to the Company. Amur received US$530,000 during its

period of ownership, of which US$327,000 was received in the year

2021.

Since the completion of the sale, in November 2021, the Roper

Bar project was placed into care and maintenance.

Financial Overview

As at 31 December 2021 the Company had cash reserves of

US$6,682,000, up from US$2,790,000 at the start of 2021 and remains

debt free.

The increase in cash reserves derives largely from the sale of

the Company's wholly owned subsidiary CHL for cash consideration of

US$6,137,019. As a result, the Company has not found it necessary

to undertake any equity placings or other fundraising activities

during the period. The Group also received coupon interest payments

of 14% from the NRR CLN held within CHL. During the reporting

period US$327,000 was received.

Administration expenses for the 2021 year totalled US$1,790,000

(2020: US$3,083,000). The main reasons for the decrease in

administration expenses was the reduction in non-executive

directors from four to three, saving US$177,000, a reduction in

professional fees of US$150,000 as a result of completing the TEO

in mid-2022 and a lower share-based payment expense in 2021 of

$105,000 compared to $485,000 in 2020. Additionally, administration

expenses of US$367,000 relating to Kun-Manie were presented within

discontinued operation as at 31 December 2021 in line with the

Board's plans to sell the entity.

Other Comprehensive Income was charged with a translation loss

of US$138,000 (2020: US$4,123,000) due to the weakening of the

Russian rouble to the US dollar. Expenditure on exploration was

US$703,000 (2020: US$1,200,000) as the Group completed and

submitted the TEO Project for review in August 2021. Exploration

assets realised an exchange loss of US$585,000 (2020: exchange loss

US$3,840,000) also due to the weakening of the Russian rouble to

the US dollar.

An aggregate of GBP254,000 in cash was received, post year end

from the execution of warrants in late January / early February

2022.

Covid-19

During early 2021, the Group continued to care for the safety of

its personnel by implementing special measures to protect its

workforce while at the same time ensuring business continuity. The

Company continued to operate effectively over an extended period of

time without requiring regular access to physical offices, slowly

reverting to pre-Covid-19 operating conditions as the situation

eased towards the end of 2021.

Covid-19 created significant uncertainty and disruption in the

financial markets. However, the Company has not realised a negative

impact of Covid-19 on its ability to conduct business across the

Group including the sale of its iron ore subsidiary. With the virus

apparently in the rear view, the Directors will continue to monitor

developments.

Outlook

The Company's primary objectives for 2022 includes the

completion of the TEO Project and continuing the acquisition of all

necessary information for commencement of the Mining Plan and the

required incumbent study work.

Work will continue at a level allowing for the compilation of

bankable feasibility studies. Given that a mining operation within

Russia requires Russian sourced and certified work to obtain

operational permits and access, the initial focus is on the

generation of a Russian bankable study. Follow-on compilation of a

hybrid western bankable study is also planned. This hybrid study

will include the Russian study work with necessary considerations

to allow for the document to support external Russia funding

sources.

Both documents will include the technical, environmental, and

economic detail for needed by unsanctioned Russian and external

Russia institutional investors to advance funding for mine

construction and advancement into production. Completion of both

documents will require considerable interaction between Russian and

international organisations to complete an international BFS for

consideration.

We shall also continue to pursue the sale of the Kun-Manie

project. The most likely buyer will be a Russian entity due to the

current geopolitical situation in Ukraine.

On behalf of the Board of Directors, I would like to thank all

the staff for their dedication, loyalty and hard work throughout

this period in getting the TEO Project organised and progressing it

toward its completion.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries:

Company Nomad and Broker Public Relations

Amur Minerals Corp. S.P. Angel Corporate Finance LLP BlytheRay

Robin Young CEO Richard Morrison Megan Ray

Adam Cowl Tim Blythe

+7 (4212) 755 615 +44 (0) 20 3470 0470 +44 (0) 20 7138 3203

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

2021 2020

US$'000 US$'000

---------------------------------------- --------- ---------

Non-current assets

Intangible Assets - 23,542

Property, plant and equipment - 452

Financial assets at fair value through

profit and loss - 5,255

--------- ---------

Total non-current assets - 29,249

--------- ---------

Current assets

Inventories - 207

Trade and other receivables 109 158

Cash and cash equivalents 6,682 2,790

--------- ---------

Total current assets 6,791 3,155

Non-current assets classified as held 24,447 -

for sale

--------- ---------

Total assets 31,238 32,404

--------- ---------

Current liabilities

Trade and other payables 968 913

--------- ---------

Total current liabilities 968 913

--------- ---------

Non-current liabilities

Rehabilitation provision - 141

Total non-current liabilities - 141

--------- ---------

Liabilities directly associated with 159 -

non-current assets classified as held

for sale

--------- ---------

Total liabilities 1,127 1,054

--------- ---------

Net assets 30,111 31,350

--------- ---------

Equity

Share capital 80,449 80,449

Share premium 4,278 4,278

Foreign currency translation reserve (17,612) (17,474)

Share options reserve 512 577

Retained deficit (37,516) (36,480)

--------- ---------

Total equity 30,111 31,350

--------- ---------

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 DECEMBER 2021

2021 2020

US$'000 US$'000

Administrative Expenses (1,790) (3,083)

--------- ---------

Operating loss (1,790) (3,083)

--------- ---------

Finance Income - 205

Finance costs - (104)

Gain on revaluation of assets held at

fair value through profit and loss* - 423

Loss on early redemption - (109)

--------- ---------

Loss before taxation (1,790) (2,668)

--------- ---------

- -

Tax Expense

--------- ---------

Loss for the year from continuing operations (1,790) (2,668)

--------- ---------

956 -

Profit from discontinued operations -

assets sold

Loss from discontinued operations - assets (372) -

held for sale

--------- ---------

Loss for the year (1,206) (2,668)

--------- ---------

Loss attributable to:

* Owners of the parent (1,206) (2,668)

--------- ---------

Loss per share (cents) from continuing

operations attributable to owners of

the Parent - Basic & Diluted (0.13) (0.25)

--------- ---------

Earnings per share (cents) from discontinued

operations attributable to owners of

the Parent - Basic & Diluted (0.04) -

--------- ---------

*Assets held at fair value were disposed of in the period and

have been included in discontinued operation for the year ended 31

December 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2021

2021 2020

US$'000 US$'000

----------------------------------------- --------- ---------

Loss for the year (1,206) (2,668)

--------- ---------

Other comprehensive loss

Items that may be classified to

profit or loss:

Exchange differences on translation

of foreign operations (138) (4,123)

--------- ---------

Total other comprehensive loss for

the year (138) (4,123)

--------- ---------

Total comprehensive loss for the

year attributable to:

* Owners of the parent (1,344) (6,791)

--------- ---------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2021

2021 2020

US$'000 US$'000 US$'000 US$'000

Cash flows from operating activities

Payments to suppliers and employees (1,833) (2,196)

-------- ----------

Net cash outflow used in operating

activities (1,833) (2,196)

-------- ----------

Cash flow from investing activities

Payments for exploration expenditure (426) (564)

Loans granted - (4,658)

Sale of investments 6,137 -

Interest received 327 43

Net cash generated from/(used

in) investing activities 6,038 (5,179)

-------- ----------

Cash flow from financing activities

Cash received on issue of shares,

net of issue costs - 10,005

Issue of convertible loans,

net of issue costs - 607

Repayment of convertible loans - (720)

-------- --------

Net cash generated from financing

activities - 9,892

-------- ----------

Net Increase/(decrease) in

cash and cash equivalents 4,205 2,517

-------- ----------

Cash and cash equivalents at

beginning of year 2,790 398

Exchange differences on cash

and cash equivalents (313) (125)

-------- ----------

Cash and cash equivalents at

end of year 6,682 2,790

-------- ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2021

Foreign

Currency Share

Share Share Translation Options Retained

Capital Premium Reserve Reserve Deficit Total Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

---------------------------- --------- --------- ------------- --------- --------- -------------

Balance at 1 January

2020 69,510 4,790 (13,351) 1,136 (34,948) 27,137

---------------------------- --------- --------- ------------- --------- --------- -------------

Year ended 31 December

2020:

Loss for the year - - - - (2,668) (2,668)

Other comprehensive

loss

Exchange differences

on translation of foreign

operations - - (4,123) - - (4,123)

--------- --------- ------------- --------- --------- -------------

Total comprehensive

loss for the year - - (4,123) - (2,668) (6,791)

--------- --------- ------------- --------- --------- -------------

Issue of share capital 10,063 (512) - - - 9,551

Conversion warrants 876 - - - - 876

Options charge for the

year - - - 577 - 577

Options expired - - - (1,136) 1,136 -

---------------------------- --------- --------- ------------- --------- --------- -------------

Balance at 31 December

2020 80,449 4,278 (17,474) 577 (36,480) 31,350

---------------------------- --------- --------- ------------- --------- --------- -------------

Balance at 1 January

2021 80,449 4,278 (17,474) 577 (36,480) 31,350

---------------------------- --------- --------- ------------- --------- --------- -------------

Year ended 31 December

2021:

Loss for the year - - - - (1,206) (1,206)

Other comprehensive

loss

Exchange differences

on translation of foreign

operations - - (138) - - (138)

--------- --------- ------------- --------- --------- -------------

Total comprehensive

loss for the year - - (138) - (1,206) (1,344)

--------- --------- ------------- --------- --------- -------------

Issue of share capital - - - - - -

Conversion warrants - - - - - -

Options charge for the

year - - - 105 - 105

Options expired - - - (170) 170 -

Balance at 31 December

2021 80,449 4,278 (17,612) 512 (37,516) 30,111

---------------------------- --------- --------- ------------- --------- --------- -------------

1. Basis of prePARATION

a) General Information

Amur Minerals Corporation is incorporated under the British

Virgin Islands Business Companies Act 2004. The registered office

is Kingston Chambers, P.O. Box 173, Road Town, Tortola, British

Virgin Islands.

The Company and its subsidiaries ("Group") locates, evaluates,

acquires, explores and develops mineral properties and projects

with its primary asset being located in the Russian Far East.

The Company is also the 100% owner of Irosta Trading Limited

("Irosta"), an investment holding company incorporated and

registered in Cyprus. Irosta holds 100% of the shares in AO

Kun-Manie ("Kun-Manie"), an exploration and mining company

incorporated and registered in Russia, which holds the Group's

mineral licences. The Company also sold its wholly owned subsidiary

Carlo Holdings Limited during the year.

The Group's principal place of business is in the Russian

Federation.

The Group's principal asset is the Kun-Manie production licence,

which was issued in May 2015. The licence is valid until 1 July

2035 and allows the Company's subsidiary, AO Kun-Manie, to recover

all revenues from 100% (less metal extraction royalties) of the

mined metal that specifically includes nickel, copper, cobalt,

platinum, palladium, gold and silver. The Company's management are

evaluating the project with a view of determining an appropriate

model for the development and ultimate exploitation of the project.

This includes the potential sale of the asset.

b) Basis of Preparation

These financial statements have been prepared under the

historical cost convention, except for the valuation of derivative

financial instruments, on the basis of a going concern and in

accordance with UK-adopted international accounting standards.

The financial statements are presented in thousands of United

States Dollars.

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

The preparation of financial statements in accordance with

International Accounting Standards as issued by the International

Accounting Standards Board ("IASB") and interpretations issued by

the International Financial Reporting Interpretations Committee

("IFRIC") requires management to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of assets and liabilities, income and expenses. The

estimates and associated assumptions are based on historical

experience and factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources. Actual results may differ

from these estimates. The areas involving a higher degree of

judgement or complexity, or where assumptions and estimates are

significant to the consolidated financial statements, are disclosed

in note 3.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision only

affects that period, or in the period of revision and future

periods if the revision affects both current and future

periods.

c) Going concern

The Group operates as a natural resource exploration and

development group. To date, it has not earned any revenues and is

considered to be in the final stages of exploration and evaluation

activities of its Kun-Manie project.

The Directors have reviewed the Group's cash flow forecast for

the period to 30 June 2023 and believe the Group has sufficient

cash resources to cover planned and committed expenditures over the

period. As a result of the sale of Carlo Holdings Limited in the

year, the Group received a cash injection of US$6 million and has

retained a large portion of the proceeds to date.

The Group plans to sell its wholly owned subsidiary Kun-Manie

and if sold, the Group will use the proceeds of sale to pay

dividends while maintaining sufficient funds to acquire another

project via an RTO. Should an RTO not be completed, the Company

will enter into suspension and after six months in suspension the

Company will be delisted. In anticipation of a sale, the board are

examining projects of interest as a part of its strategy.

The Board are continuing the assess suitable offers to purchase

Kun-Manie, however, should a sale not go forward, the Directors

have forecast a scenario where the Kun-Manie project is advanced,

and per the requirements to maintain the license, develop a mine

plan. The Board are confident that they have sufficient funds to

take the TEO forward and to produce a mine plan, and in a

worse-case scenario mitigating actions within the Directors'

control could be taken to reduce overheads if required. However,

substantial funds would need to be raised in order to fully support

preproduction and construction of the mine, outside of the going

concern period.

The biggest risk with taking the Kun-Manie project forward is

the Company's ability to still operate within Russia in light of

Russia's SMO and the sanctions put in place by the rest of the

world. To date, the Company has still been able to control its

subsidiary and operations, however, the Board understands that

further restrictions and sanctions could make operating and raising

sufficient capital from financial institutions in Russia difficult

or impossible.

Additionally, the Directors are confident that funding will be

raised when required, however they understand that their ability to

do this is not completely within in their control.

Under both scenarios outlined above the Directors are confident

that throughout the going concern forecast period the Group will

have sufficient funds to meet obligations as they fall due and thus

the Directors continue to prepare the financial statements on a

going concern basis.

c) Loss per share

Basic and diluted loss per share is calculated and set out

below. The effects of warrants and share options outstanding at the

year ends are anti-dilutive and the total of 64.3 million (2020:

90.1 million) of potential ordinary shares have therefore been

excluded from the following calculations:

Number of shares

Weighted average number of ordinary shares

used in the calculation of basic 2021 2020

earnings per share 1,379,872,315 1,071,175,000

2021 2020

Earnings US$'000 US$'000

Net loss for the year from continued operations

attributable to equity shareholders (1,790) (2,688)

------------- -------------

Loss per share for continuing operations

(expressed in cents)

Basic and diluted loss per share (0.13) (0.25)

2021 2020

Earnings US$'000 US$'000

Net profit for the year from discontinued 584

operations attributable to equity shareholders -

------- -------

Earnings per share for continuing operations

(expressed in cents)

Basic and diluted earnings per share (0.04) -

d) Events after the reporting date

On 28 January 2022, Plena Global Opportunities LLC elected to

convert 3,000,000 warrants, at the warrant exercise price of 1.43

pence per share providing the Company GBP42,900.

On 3 February 2022, Axis Capital Marketing, LTD elected to

convert 5,000,000 warrants, at the warrant exercise price of 2.12

pence per share providing the Company GBP106,000.

On 11 February 2022, Axis Capital Marketing, elected to convert

5,000,000 warrants, at the warrant exercise price of 2.12 pence per

share providing the Company GBP106,000.

On 23 February 2022, the Russian Federation began its 'special

military operation' in Ukraine triggering the implementation of a

series of sanctions with the Russian Federation subsequently

enacting a series of currency control measures.

On 9 May 2022, the Group received an offer to be approved by

shareholders at a General Meeting (scheduled for 25 May 2022) for

the sale of 100% of its interest in Irosta's wholly owned

subsidiary, AO Kun-Manie. For a total consideration of US$105

million, Stanmix Holding Limited will purchase AO KM and the

benefit of all amounts owed by AO KM to Amur under intra-group

loans.

On 25 May 2022, the shareholders declined to approve the 9 May

2022 Share Purchase Agreement.

On 7 June 2022, the Company issued an RNS stating the results of

the TEO Project by the State Committee on Reserves ("GKZ") which

had been compiled by mining experts Oreoll and the GKZ.

Annual Accounts

Copies of the Group's Annual Accounts will be posted to the Amur

shareholders today and are available for download from the

Company's website at www.amurminerals.com .

Notes to Editors

The information on exploration results and Mineral Resources

contained in this announcement has been reviewed and approved by

the CEO of Amur, Robin Young. Mr. Young is a Geological Engineer

(cum laude) and is a Qualified Professional Geologist, as defined

by the Toronto and Vancouver Stock Exchanges and a Qualified Person

for the purposes of the AIM Rules for Companies.

Glossary

DEFINITIONS OF EXPLORATION RESULTS, RESOURCES & RESERVES

EXTRACTED FROM THE JORC CODE: (December 2012) ( www.jorc.org

)

A 'Mineral Resource' is a concentration or occurrence of

material of intrinsic economic interest in or on the Earth's crust

in such form, quality and quantity that there are reasonable

prospects for eventual economic extraction. The location, quantity,

grade, geological characteristics and continuity of a Mineral

Resource are known, estimated or interpreted from specific

geological evidence and knowledge. Mineral Resources are

sub-divided, in order of increasing geological confidence, into

Inferred, Indicated and Measured categories.

An 'Inferred Mineral Resource' is that part of a Mineral

Resource for which tonnage, grade and mineral content can be

estimated with a low level of confidence. It is inferred from

geological evidence and assumed but not verified geological and/or

grade continuity. It is based on information gathered through

appropriate techniques from locations such as outcrops, trenches,

pits, workings and drill holes which may be limited or of uncertain

quality and reliability.

An 'Indicated Mineral Resource' is that part of a Mineral

Resource for which tonnage, densities, shape, physical

characteristics, grade and mineral content can be estimated with a

reasonable level of confidence. It is based on exploration,

sampling and testing information gathered through appropriate

techniques from locations such as outcrops, trenches, pits,

workings and drill holes. The locations are too widely or

inappropriately spaced to confirm geological and/or grade

continuity but are spaced closely enough for continuity to be

assumed.

A 'Measured Mineral Resource' is that part of a Mineral Resource

for which tonnage, densities, shape, physical characteristics,

grade and mineral content can be estimated with a high level of

confidence. It is based on detailed and reliable exploration,

sampling and testing information gathered through appropriate

techniques from locations such as outcrops, trenches, pits,

workings and drill holes. The locations are spaced closely enough

to confirm geological and/or grade continuity.

An 'Ore Reserve' is the economically mineable part of a Measured

and/or Indicated Mineral Resource. It includes diluting materials

and allowances for losses which may occur when the material is

mined. Appropriate assessments and studies have been carried out,

and include consideration of and modification by realistically

assumed mining, metallurgical, economic, marketing, legal,

environmental, social and governmental factors. These assessments

demonstrate at the time of reporting that extraction could

reasonably be justified. Ore Reserves are sub-divided in order of

increasing confidence into Probable Ore Reserves and Proved Ore

Reserves.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FZGZVGLLGZZZ

(END) Dow Jones Newswires

June 30, 2022 02:00 ET (06:00 GMT)

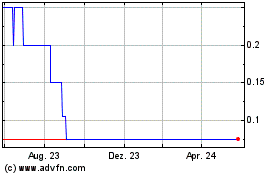

Crism Therapeutics (AQSE:AMC.GB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

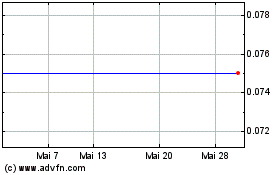

Crism Therapeutics (AQSE:AMC.GB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024