TIDMADA

RNS Number : 9954F

Adams PLC

14 July 2023

14 July 2023

Adams Plc

("Adams" or the "Company")

ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEARED 31 MARCH

2023

Adams Plc presents its annual report and audited financial

results for the year ended 31 March 2023

Highlights:

- Net assets at 31 March 2023 of GBP5.11 million (2022: GBP7.48 million).

- Net assets per share 3.50 pence at 31 March 2023 based on

145.9 million shares in issue (2022: 5.13 pence).

- Loss after tax of GBP2.37 million (2022: loss GBP1.73 million).

- Investments at 31 March 2023 valued at GBP5.10 million (2022: GBP6.62 million).

- Spend on new investments of GBP1.22 million (2022: GBP3.09 million).

- Proceeds from investment realisations GBP0.56 million (2022: GBPnil).

- Cash at 31 March 2023 of GBP0.05 million (2022: GBP0.87million).

- No part of the GBP3.00 million shareholder loan facility drawn down to date.

Michael Bretherton, Chairman, said:

"The global economy is still being impacted by the adverse

effects of Russia's invasion of Ukraine and rising inflation,

coupled with governments heavily indebted by the financial support

measures provided during the period of Covid restrictions. As a

result, financial conditions and monetary policy are likely to

continue to tighten and with growth expected to remain weak by

historical standards.

"Your Board will, therefore, continue to maintain a rigorous and

highly selective investment approach, coupled with strict cost

control with a view to delivering additional value for shareholders

going forward. We remain confident in the underlying fundamentals,

technologies and long-term potential for growth at the companies

within our investment portfolio ."

The Company's 2023 Annual Report will shortly be posted to

shareholders together with a Notice of Annual General Meeting,

copies of which will be made available on the Company's website at

www.adamsplc.co.uk under the Investor Relations / Company &

Shareholder Documents section. The Annual General Meeting is to be

held at 11.30 a.m. on Friday 18 August 2023 at the Company's

registered office at 55 Athol Street, Douglas, Isle of Man, IM1

1LA.

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 ("MAR") as

retained as part of UK law by virtue of the European Union

(Withdrawal) Act 2018 as amended.

Enquiries:

Adams Plc Michael Bretherton

Tel: +44 1534 719 761

Nomad Cairn Financial Advisers LLP. Sandy Jamieson, James

Caithie Tel: +44 207 213 0880

Broker Peterhouse Capital Limited. Heena Karani, Martin

Lampshire Tel: +44 207 469 0930

Chairman's Statement

Results

Adams incurred a net loss of GBP2.37 million for the year to 31

March 2023 (FY2023) compared to a loss of GBP1.73 million in the

previous year ended 31 March 2022 (FY2022).

This FY2023 loss comprises a net investment loss of GBP2.19

million, together with overhead costs of GBP0.18 million. The

previous FY2022 loss comprised a net investment loss of GBP1.57

million, together with administrative costs of GBP0.16 million.

During FY2023, the Company spent GBP1.22 million on three equity

investments, two of which were new investments comprising Tremor

International Ltd and WANdisco Plc and the other being a follow-on

investment in Seeing Machines Limited. Disposal proceeds during the

period amounted to GBP0.56 million on a partial realisation of the

Niox Group Plc investment holding. In addition, the Company's small

GBP0.10 million investment in 4D Pharma Plc had to be written off

when it went into administration on 24 June 2022.

The carrying value of the Company's equity investments at 31

March 2023 was GBP5.10 million represented by nine quoted

investment holdings and three private investments (31 March 2022:

GBP6.62 million represented by nine quoted investment holdings and

two private investments). In addition, Adams holds a derivative

investment asset in the form of warrants in C4X Holdings Plc which

have an exercise price that is significantly above the market price

of the underlying shares and the warrants are therefore considered

to have a nil fair value.

The investment in WANdisco was made in December 2022 following

that company's reporting of very significant new orders received

during the previous 2 months. Subsequently on 9 March 2023,

WANdisco announced it had requested a suspension of its shares from

trading on AIM while a legal investigation is carried out on

irregularities discovered on purchase orders and related revenue

bookings, which gave rise to a material misstatement of its

financial position. The WANdisco shares remained suspended at 31

March 2023 and are not due to recommence trading on AIM until

around 25 July 2023 when a recently announced share offer equity

fundraise to raise gross proceeds of US$ 30 million at a price of

50 pence per share is due to complete. The offer shares will

represent approximately 70.7% of WANdisco's existing issued share

capital. This investment holding is, therefore, being carried by

Adams at a 50 pence per share value at the 31 March 2023 year end,

being the best indication of fair value at that date.

The Company held cash balances of GBP0.05 million as at 31 March

2023, compared to cash balances of GBP0.87 million at the previous

31 March 2022 year end.

Net assets reduced to GBP5.11 million (equivalent to 3.50p per

share) at the 31 March 2023 balance sheet date, compared with

GBP7.48 million (equivalent to 5.13p per share) at 31 March 2022.

The GBP2.37 million decrease in net assets reflects the loss

reported for the year.

Business model and investing policy

Adams is an investing company with an investing policy under

which the Board is seeking to acquire interests in special

situation investment opportunities that have an element of

distress, dislocation, dysfunction or other special situation

attributes and that the Board perceives to be undervalued. The

principal focus is in the small to middle-market capitalisation

sectors in the UK or Europe, but the Directors will also consider

possible special situation opportunities anywhere in the world if

they believe there is an opportunity to generate added value for

shareholders.

Investment Portfolio

The principal listed investments held by the Company at 31 March

2023 comprised Niox Group Plc ("Niox" formerly known as Circassia

Group Plc), C4X Discovery Holdings Plc ("C4XD"), Seeing Machines

Limited ("Seeing Machines") and Access Intelligence Plc ("Access

Intelligence") and Adams also holds Oxehealth Limited ("Oxehealth")

and Telit Cinteron Ltd ("Telit") as principal unquoted

investments.

Niox is an AIM listed global medical device company focused on

point of care asthma diagnosis and management. Following a major

restructuring and the transfer of the Tudorza and Duaklir products

back to AstraZeneca in March 2021, Niox has now been transformed

into a debt-free business with a strong NIOX(R) asthma management

products based continuing operations business. The group is

progressing its transition to a distributor-led business model with

new arrangements in the USA and China expected to drive scalable

growth as it continues to implement access to a large and

underserved population of patients suffering from asthma. For the

year ended 31 December 2022, sales increased 15% to GBP31.3 million

and generated an EBITDA profit of GBP7.3 million. The profit after

tax for the period amounted to GBP16.1 million inclusive of an

GBP8.1 million settlement consideration recognised on milestone

payments due from Beyond Air Inc., following FDA approval for its

LungFit PH device, together with a profit of GBP2.1 million on

discontinued operations. The company had net cash balances of

GBP19.4 million at 31 December 2022. The shareholding of Adams at

31 March 2023 was, and continues to be, 0.37 per cent of the Niox

shares in issue.

C4XD is a pioneering drug discovery company combining its

enhanced DNA-based target identification and candidate molecule

design capabilities to efficiently deliver world--leading medicines

which are developed by licensing partners. C4XD has a number of

existing partnership deals including a milestone and royalties

agreement with Indivior UK Limited for its oral Orexin-1 receptor

antagonist for the treatment of opioid addiction disorders worth up

to $284 million and a second milestones and royalties out-licensing

agreement with Sanofi for its IL-17A inhibitor programme worth up

to EUR414 million plus potential for single -- digit royalties. In

November 2022, C4XD signed an exclusive licensing agreement with

AstraZeneca for its NRF2 activator programme addressing the

treatment of inflammatory and respiratory diseases. The agreement

is worth up to $402 million including pre-clinical milestone

payments of up to $16 million ahead of the first clinical trial,

with $2 million upfront. In addition, the company has continued to

drive other key programmes towards partnering with a near term

focus on inflammatory and oncology diseases. C4XD reported a loss

after tax of GBP3.9 million in the six months ending 31 January

2023 inclusive of R&D investment of GBP5.2 million and with

revenues of GBP1.7 million. Cash balances at 31 January 2023

amounted to GBP9.6 million . The shareholding of Adams in C4XD at

31 March 2023 was, and continues to be, 1.98 per cent of the C4XD

shares in issue.

Seeing Machines is an AIM listed industry leader in advanced

computer vision technologies. The company designs Artificial

Intelligence / AI powered operator monitoring systems using

camera-based optics and embedded processing to improve transport

safety in automotive, commercial fleet, aviation, rail and off-road

markets. The technology incorporates warnings when human state

attention impairment is identified, in order to re-engage the

operator or driver. Seeing Machines continues to invest in R&D

and grow as an automotive leader in such technology having now won

contracts with a total of ten automotive Tier 1 global customers

covering 15 automotive driver monitoring safety ("DMS") programmes.

In October 2022, the company entered into an exclusive

collaboration with Magna International, to pursue driver and

occupant monitoring system business targeting the vehicle's

interior rear-view mirror and under which Magna also provided

additional investment through a Convertible Note of up to US$47.5m

which matures in October 2026 and has a conversion rate per

ordinary share of 11 pence. At 31 December 2022, there were 710,049

vehicles on the road featuring Seeing Machines' DMS technology, an

increase of 188% over the 12 month period. In the half year to 31

December 2022, Seeing Machines reported underlying revenue growth

of 54% per cent, to give revenues of $24.4 million and a loss for

the period of $5.4 million. Seeing Machines' cash balances at 31

December 2022 amounted to $52.2 million inclusive of $28.8 million

received on partial draw down of the Magna Convertible Loan Note.

The shareholding of Adams in Seeing Machines as at 31 March 2023

was, and continues to be, 0.19 per cent of the Seeing Machines

shares in issue.

Access Intelligence is an AIM listed London based technology

innovator delivering Artificial Intelligence / AI

Software-as-a-Service solutions for the global marketing and

communications industries. The company combines AI technologies

with human expertise to analyse data and provide strategic insights

as a single, real-time view of what is important. It is supported

by partnerships with the world's largest data providers and social

media platforms including Twitter, Reddit and Twitch. For the year

ended 30 November 2022, Access Intelligence reported revenues of

GBP65.7 million and delivered a positive EBITDA of GBP2.3 million

before exceptional costs associated with the integration of Isentia

Group which had been acquired in September 2021. The loss for the

year amounted to GBP4.2 million after exceptional costs and

inclusive of additional investment in sales and marketing to drive

global expansion. Cash balances at 30 November 2022 amounted to

GBP4.9 million . During the period, the group delivered continued

growth in the EMEA and North America region and won a substantial

number of blue-chip clients across every region, including

significant win backs in the APAC region. The shareholding of Adams

in Access Intelligence as at 31 March 2023 was, and continues to

be, 0.52 per cent of the Access Intelligence voting shares in

issue.

Oxehealth is a private company and an industry leader in

vision-based patient monitoring and management systems. The company

uses proprietary signal processing and computer vision to process

normal digital video camera data to measure the vital signs and

activity of patients in a number of different markets, primarily in

Mental Health, Acute Hospital settings, Primary Care settings, Care

Home, and Custodial facilities in both the UK and also in Sweden

and more recently the USA. This is achieved through the deployment

of its Oxevision platform which enables clinicians to take

non-contact cardiorespiratory measurements of a patient's pulse and

breathing rate, and which generate alerts to potentially risky

activity and reports on a patient's vital signs and behaviour. This

can all be done without the clinician entering the patient's room,

including by use of mobile handsets on the ward. Adams has

participated in the Oxehealth new share issue funding rounds

undertaken in the previous few years but did not participate in the

last one undertaken in the March quarter of 2023 and as a result

has seen some dilution of its shareholding in this investment. At

31 March 2023, the investment holding by Adams in Oxehealth

represents 2.22 per cent of Oxehealth's issued share capital at

that date.

Telit is a private company and a global leader in Internet of

Things (IoT) enablement. Telit has over twenty years of experience

designing, building, and executing complex digital business. The

company has an extensive portfolio of wireless connectivity

modules, software platforms and global IoT connectivity services,

empowering hundreds of millions of connected 'things' to date, and

trusted by thousands of direct and indirect customers, globally. On

1 January 2023, the company completed a transaction with the global

defence, aerospace and security group, Thales, under which it

acquired the cellular IoT products business of Thales and thereby

expanded Telit's presence in the growing industrial IoT segments

and end markets, including payment systems, energy, e-health, and

security. It will also enhance the company's capabilities in the

rapidly growing cybersecure IoT solutions market. At 31 March 2023,

the investment holding by Adams in Telit represents 0.35 per cent

of Telit's issued share capital at that date.

In addition to the above investments, at 31 March 2023 Adams

held five other quoted holdings, together with one other private

company holding. The five quoted holdings comprise Griffin Mining

Limited, which is an AIM listed mining and investment company that

has been the leader in foreign investment in mining in China having

been engaged in developing the Caijiaying zinc and gold project

since 1997; Tremor International Ltd, which is an AIM listed

advertising-technology company focused on digital advertising

including video, mobile, native, display technology, and connected

TV; WANdisco Plc, which is a data activation company that enables

organisations to move large datasets to the cloud at massive scale

in order to activate all their data for AI, machine learning and

analytics on modern cloud data platforms; Euromax Resources Ltd,

which is a Canadian development company listed on the Toronto Stock

Exchange and focused on building and operating the Ilovica-Shtuka

copper and gold project in Macedonia; and Afentra Plc, which is an

AIM listed upstream oil and gas company focused on acquiring mature

production and development assets in Africa. The private company

holding comprises Source Bioscience International Ltd, which is an

international provider of state-of-the art laboratory services,

clinical diagnostics and analytical testing services.

Outlook

The global economy is still being impacted by the adverse

effects of Russia's invasion of Ukraine and rising inflation,

coupled with governments heavily indebted by the financial support

measures provided during the period of Covid restrictions. As a

result, financial conditions and monetary policy are likely to

continue to tighten and with growth expected to remain weak by

historical standards.

Your Board will, therefore, continue to maintain a rigorous and

highly selective investment approach, coupled with strict cost

control with a view to delivering additional value for shareholders

going forward. We remain confident in the underlying fundamentals,

technologies and long-term potential for growth at the companies

within our investment portfolio .

Michael Bretherton

Chairman

14 July 2023

Investing Policy

The current Investing Policy is:

The Board will seek to acquire a direct and/or indirect

interests in special situation investment opportunities that have

an element of distress, dislocation, dysfunction or other special

situation attributes and that they perceive to be undervalued. The

principal focus will be in the small to middle-market

capitalisation sectors in the UK or Europe but the Directors will

also consider possible special situation opportunities anywhere in

the world if they believe there is an opportunity to generate added

value for Shareholders.

The Directors intend to identify investment opportunities

offering the potential to deliver a favourable return to

Shareholders over the medium to long term, primarily in the form of

a capital gain. A particular consideration will be to identify

businesses which, in the opinion of the Directors, are under-valued

due to any of a number of special situations that adversely impact

the business's short-term prospects and/or underlying value but

which business interests the Directors believe have a solid

fundamental core or sound development potential to present

opportunities for value creation.

The Company's interest in a potential investment may range from

a minority position to 100 per cent. ownership and the interest may

be either quoted or unquoted. Investments may be made in shares, or

by the acquisition of assets (including intellectual property) of a

relevant business, or by entering into partnerships, joint

ventures, equity derivatives, contracts for differences or other

equity or debt related securities that the Board deem

appropriate.

There will be no limit on the number of projects into which the

Company may invest, and the Company's financial resources may be

invested in a number of propositions or in just one investment,

which may be deemed to be a reverse takeover pursuant to Rule 14 of

the AIM Rules.

While the Directors intend to take into account the level of

existing funds available for investment when assessing the amount

of any investment, it is not proposed that there be any maximum

investment limit.

The Company may be both an active and a passive investor

depending on the nature of the individual investments. Although the

Company intends to be a medium to long term investor, there will be

no minimum or maximum limit on the length of time that any

investment may be held and short-term investments may be made.

The Company will not have a separate investment manager.

The Company may require additional funding as investments are

made and new opportunities arise. The Directors may offer new

Ordinary Shares by way of consideration, as well as cash, thereby

helping to preserve the Company's cash resources. The Company may,

in appropriate circumstances, issue debt securities or otherwise

borrow money to complete an investment.

Given the nature of the Company's Investing Policy, the Company

does not intend to make regular periodic disclosures or

calculations of net asset value other than at the time of

publication of its half year and annual results.

The Board's principal focus will be on achieving capital growth

for Shareholders.

Statement of Comprehensive Income for the year ended 31 March

2023

Year ended Year ended

31 March 2023 31 March 2022

GBP'000 GBP'000

--------------------------------------------- --------------- ----------------

Investment loss return (2,188) (1,571)

Expenses and other income

Administrative expenses (182) (160)

Operating loss (2,370) (1,731)

Interest income - -

--------------------------------------------- --------------- ----------------

Loss on ordinary activities before taxation (2,370) (1,731)

Tax on loss on ordinary activities - -

--------------------------------------------- --------------- ----------------

Loss for the year (2,370) (1,731)

---------------------------------------------- --------------- ----------------

Basic and diluted loss per share (1.62)p (1.21)p

---------------------------------------------- --------------- ----------------

Statement of Financial Position at 31 March 2023

31 March 31 March

2023 2022

GBP'000 GBP'000

----------------------------- --------- -----------

Assets

Non-current assets

Investments 5,095 6,622

------------------------------ --------- -----------

Current assets

Trade and other receivables 11 12

Cash and cash equivalents 47 871

------------------------------ --------- -----------

Current assets 58 883

------------------------------ --------- -----------

Total assets 5,153 7,505

------------------------------ --------- -----------

Liabilities

Current liabilities

Trade and other payables (43) (25)

------------------------------ --------- -----------

Total liabilities (43) (25)

------------------------------ --------- -----------

Net current assets 15 858

------------------------------ --------- -----------

Net assets 5,110 7,480

------------------------------ --------- -----------

Equity

Share capital 1,459 1,459

Share premium 3,425 3,425

Retained earnings reserve 226 2,596

------------------------------ --------- -----------

Total shareholder equity 5,110 7,480

------------------------------ --------- -----------

Statement of Changes in Equity as at 31 March 2023

Share Capital Share premium Retained earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2021 826 - 4,327 5,153

Changes in equity

Issue of shares 633 3,482 - 4,115

Share issue costs - (57) - (57)

Changes in equity

Total comprehensive loss - - (1,731) (1,731)

At 31 March 2022 1,459 3,425 2,596 7,480

--------------------------- -------------- -------------- -------------------------- --------

Changes in equity

Total comprehensive loss - - (2,370) (2,370)

--------------------------- -------------- -------------- -------------------------- --------

At 31 March 2023 1,459 3,425 226 5,110

--------------------------- -------------- -------------- -------------------------- --------

Statement of Cash Flows for the year ended 31 March 2023

Year ended Year ended

31 March

2022

31 March

2023 *Restated

GBP'000 GBP'000

Loss for the year (2,370) (1,731)

Unrealised loss on revaluation of

portfolio investments 2,203 1,571

Realised gain on disposal of portfolio

investments (15) -

Decrease in trade and other receivables 1 10

Increase in trade and other payables 18 2

--------------------------------------------- ----------- ------------

Net cash outflow from operating activities (163) (148)

--------------------------------------------- ----------- ------------

Cash flows from investing activities

Purchase of portfolio investments (1,216) (3,088)

Proceeds from sales of investments 555 -

-------------------------------------------- ----------- ------------

Net cash used in investing activities (661) (3,088)

--------------------------------------------- ----------- ------------

Cash flows from financing activities

Issue of new ordinary shares - 4,058

Net cash generated from financing

activities - 4,058

--------------------------------------------- ----------- ------------

Net (decrease) / increase in cash

and cash equivalents (824) 822

Cash and cash equivalents at beginning

of year 871 49

--------------------------------------------- ----------- ------------

Cash and cash equivalents at end

of year 47 871

--------------------------------------------- ----------- ------------

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKNBPFBKDBOD

(END) Dow Jones Newswires

July 14, 2023 02:00 ET (06:00 GMT)

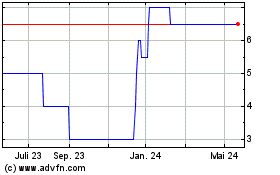

Adams (AQSE:ADA.GB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Adams (AQSE:ADA.GB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024