2013 has already been a banner year for WisdomTree, as the

company has seen incredible asset growth across its lineup, and

especially in its now ultra-popular hedged Japan ETF

(DXJ). This burst of success has pushed WisdomTree to put

several new funds into the registration pipeline, and to debut a

handful of new products as well.

The latest addition for the company comes to us in the dividend

space, an extremely competitive niche in the ETF sphere where

WisdomTree has already seen a great level of success. The new fund

could see a decent amount of interest despite the competition

though, as it looks to focus on dividend growth.

The new product, the U.S. Dividend Growth Fund

(DGRW), looks to hold a basket of stocks that are

currently paying dividends and have growth characteristics. This

approach is a relatively untapped one, and with a low expense ratio

of 28 basis points, we could see some decent inflows in this ETF

(read 3 Red Hot Dividend ETFs).

Below, we highlight some of the key details from this new

dividend ETF launch for those looking to learn more about this

potentially better way to target yield in today’s low rate

environment:

DGRW in Focus

This new ETF tracks the WisdomTree U.S. Dividend Growth Index, a

benchmark that consists of about 300 companies that have a market

cap of at least $2 billion. These 300 are selected based on a

combined rank of growth and quality factors in order to give a

holistic approach to dividend investing.

In terms of specific factors used, long term earnings growth

expectations, three year averages for ROE and ROA, are the biggest

drivers of the selection process. Additionally, it is worth noting

that the ETF is dividend weighted annually in order to reflect the

proportionate share of the aggregate cash dividends each company is

projected to pay in the coming year, based on the most recently

declared payout (see Retire Early with these 3 Dividend ETFs).

The underlying index is showing a 2.2% yield, so the fund isn’t

exactly a high yielder, but it does offer up a competitive payout

when compared to other dividend funds. Plus, it is important to

remember that the focus is more on companies that have been

increasing payouts as opposed to those that have huge distributions

already.

This results in a portfolio that is heavy in tech companies,

while classic staples and capital goods companies are also

well-represented. Current top holdings include AAPL, MSFT, WMT, PG,

and KO, suggesting that well-known large cap firms are likely to

dominate this holdings list.

“Investors are hungry for income in this low interest rate-, low

yield-environment” said Jeremy Schwartz, WisdomTree Director of

Research in a press release. “Rather than relying on historical

records of dividend increases, DGRW uses real-time growth and

quality metrics focused on companies who are growing their

dividends.”

How does it fit in a portfolio?

This ETF could be an interesting choice for investors seeking to

make a play on companies that are poised to increase dividends over

time, as opposed to just focusing on high yielding securities (see

4 Excellent Dividend ETFs for Income and Stability).

Additionally, given the focus on earnings growth, and historical

ROA and ROE, it could result in a more growth-oriented dividend

portfolio, something that isn’t found in most of the other dividend

ETFs on the market.

However, it is important to remember that this product probably

won’t be suitable for investors seeking high yields, as the 2.2%

payout is unlikely to cut it for truly income-starved investors.

Additionally, the portfolio is heavy in widely-held names, so some

might find themselves doubling down on large caps if they are

already holding them in other funds—or as standalone stocks—in

their portfolio.

ETF Competition

Unfortunately for this new ETF and for WisdomTree, the dividend

growth market does have a few competitors. A few of these funds are

quite popular and thus could be tough to beat in this corner of the

dividend ETF world.

In particular, two ETFs come to mind; the Vanguard

Dividend Appreciation ETF (VIG), and the SPDR

S&P Dividend ETF (SDY). Both of these funds focus—in

slightly different ways—on dividend aristocrats, or companies that

have a solid history of raising dividends year after year (read

Time to Buy This Top Ranked Dividend ETF).

These two both have more than $10 billion in AUM and daily

volume exceeding one million shares a day on average. So, clearly

both could pose as difficult foes for any new competitor in the

increasing dividend space of the income ETF world.

Still, it is important to remember that WisdomTree’s new fund is

taking a different approach than either of these aforementioned

ETFs, as it looks to focus on companies that are likely to

raise dividends in the future, as opposed to those who have shown a

history of increases in the past.

While this might be a small distinction, the forward looking

nature could appeal to some ETF investors and potentially allow

this product to accumulate a decent level of interest among

dividend ETF buyers as well.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

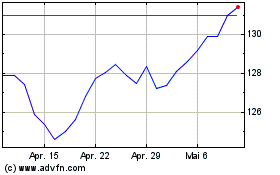

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

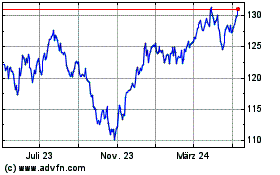

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024