2012 was not a great year for the dividend ETFs as many investors

avoided them in the last quarter of the year due to risk of a huge

increase in taxes. Fortunately, the agreement on dividend taxes was

more favorable than expected and thus the dividend ETFs should

regain their appeal and popularity this year.

Dividend taxes for top-bracket taxpayers will rise from 15% to

20% (plus an additional 3.8% surcharge for Obamacare) while the

taxes for those in the lower tax brackets would remain at the

current levels. (Read: Three Great ETFs to Buy This Earnings

Season)

Per S&P Dow Jones, companies in the S&P 500 index paid

out regular cash dividends of $281 billion in 2012--17% higher than

2011 and 13% more than the previous record in 2008—without counting

all the dividends that companies might have paid in January but

paid in 2012 in order to avoid higher taxes in 2013. S&P

expects 2013 to be another record year for dividend payments, after

the cliff resolution.

Most large US corporations are sitting on large cash piles and

are in a position to increase payouts to the shareholders. Further,

there would be no difference between tax rates on long-term capital

gains and dividends. In case the dividend taxes had increased more

than the taxes on capital gains, many companies would have

increased share buybacks and reduced dividend payouts. (Read: Best

ETF Strategies for 2013)

Also, dividend stocks and ETFs are much better options for

yield-hungry investors in this environment of ultra-low rates. Many

investors continued to seek refuge in so called “safe-haven” assets

last year as the markets stayed volatile due to uncertain situation

in Europe, slowing growth in the emerging markets and fiscal cliff

in the US. Further as the Fed continued its massive asset

purchases, Treasury yields plunged to new lows.

However the situation is likely to change this year. Federal

Reserve may slow-down or end its bond purchases in 2013 and the

interest rates may start going up. At current yield levels the

losses will be very high when the rates go up and thus it would be

best for the individual investors to stay away from Treasury bonds

now. (Read: Time to Exit Treasury Bond ETFs)

At the same time, since most dividend paying companies are

stable, mature companies, these investments also provide greater

stability and safety in a volatile environment—and the markets are

expected to experience higher volatility if the debt ceiling

negotiations turn ugly or if the Euro-zone situation worsens.

We prefer the ETFs that invest in stable, cash rich, low-risk

companies that have solid growth potential, compared with the ETFs

that focus just on the yield. Below we present four such ETFs that

provide a stable stream of income to the investors and provide

stability to the portfolio. (Read: Which Volatility Hedged ETF

should you consider?)

Vanguard Dividend Appreciation ETF (VIG)

VIG follows the Dividend Achievers Select Index, which is

composed of common stocks of high quality companies that have a

record of increasing dividends for at least 10 years. Launched in

April 2006, the fund is now the largest dividend ETF, with $12.7

billion in AUM.

The fund is currently home to 133 securities, with a median

market cap of about $40 billion. Wal-Mart, Coke and P&G are top

three holdings while the top ten largest holdings account for 37.5%

of the assets. The ETF is heavily weighted towards Consumer

Discretionary (15%), Consumer Staples (24%) and Energy (10%)

sectors.

With an expense ratio of 0.13%, this is one of the cheapest

funds in this space. The dividend yield at 2.26% is just slightly

above average S&P dividend yield, but this fund is better

suited for investors who seek long-term capital appreciation along

with income and not just high current yield. The fund has a beta of

0.82 vs. S&P 500.

SPDR S&P Dividend ETF (SDY)

Launched in November 2005, this fund is based on the S&P

High Yield Dividend Aristocrats Index which is designed to track

the performance of highest dividend yielding companies within

S&P Composite 1500 Index companies which have been consistently

increasing their dividends every year for at least 20 years.

In terms of sector exposure, the fund focuses on Consumer

staples (21%), Industrials (16%) and Financials (15%). The fund

holds 83 securities and is very well diversified with the top

holding accounting for just 2.9% of total assets.

With an expense ratio of 35 basis points, this fund is more

expensive than VIG but has an attractive yield of 3.13% currently.

PowerShares S&P 500 High Dividend Portfolio

(SPHD)

SPHD intends to combine two most desirable investment

themes—high dividend and low volatility, which almost guarantees

the long-term success of this ETF. The index is composed of 50

stocks that historically have provided high dividend yields and

exhibited low volatility.

The ETF is heavily weighted towards Consumer Staples (17%),

Financials (14%) and Telecom (10%) sectors.

Launched in October last year, the fund has attracted more than

$41 million in assets so far. It charges an expense ratio of 30

basis points and currently has an excellent distribution yield of

4.27%.

EGShares Low Volatility EM Dividend ETF

(HILO)

HILO is an ideal option for investors seeking to benefit from

high dividend yield and high growth potential of the emerging

market companies while trying to avoid excess volatility associated

with some such companies.

HILO tracks INDXX Emerging Market High Income Low Beta Index,

designed to provide high income and to be significantly less

volatile through the utilization of low beta stocks. The index has

a beta of 0.94 vs. MSCI EAFE Index. Further, the Index limits

concentration in any position to 5% and country exposure to a

maximum of 5 positions.

South Africa (21.4%), Turkey (16.1%) and India (11.4%) occupy

the top spots in terms of country exposure. The fund holds 30

securities with an average market cap of about $14 billion. The ETF

is tilted towards Financials (21%), Consumer Goods (18%) and

Telecom (17%) sectors. The fund has an expense ratio of 85 basis

points and yields 4.96% currently.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

EGS-LO VT EM DV (HILO): ETF Research Reports

EGS-LO VT EM DV (HILO): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

PWRSH-SP5 HI DV (SPHD): ETF Research Reports

PWRSH-SP5 HI DV (SPHD): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

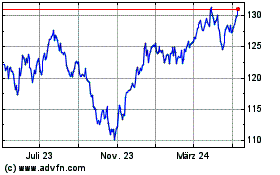

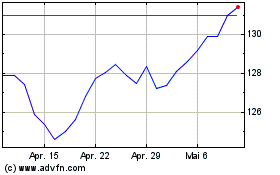

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024