Zacks.com ETF Strategist Eric Dutram highlights: Invest Like the 1% with These Three ETFs - Press Releases

18 Mai 2012 - 10:30AM

Zacks

For Immediate Release

Chicago, IL – May 18, 2012 - Stocks

and funds in this article include: iShares S&P National

Municipal Bond Fund (MUB), Vanguard Dividend

Appreciation ETF (SDY), iShares FTSE NAREIT

Mortgage REIT ETF (REM). Eric

Dutram looks at three ETFs which can help regular investors match

the portfolio techniques that are often popular among the

ultra-rich.

Invest Like the One Percent with These Three ETFs

written by Eric Dutram of Zacks Investment Research:

With income inequality issues and

economic protests dominating the headlines as of late, the

so-called ‘one percent’ have been in focus. These wealthy

individuals—in case you have been living under a rock the past few

months—consist of the richest 1% of the populace in the country and

control a disproportionate amount of the nation’s wealth.

In fact, some reports suggest that

this small group of people possesses more than 40% of all financial

assets in the country including half of all stocks, bonds, and

funds. Furthermore, they only have just 5% of the debt and are

taking home more of the national pay than any time in the past 90

years.

Yet despite these trends and the

growing backlash against these ultra-wealthy, little seems likely

to be done in order to change the status quo. The major political

parties seem unwilling and unable to compromise on any economic

issues, especially in an election year, so it looks as though these

trends will continue at least into the foreseeable future (see more

in the Zacks ETF Center).

While this certainly isn’t good

news for those in any of the protest ‘movements’ across the

country, there are definitely ways for investors to play the

scenario. After all, many of the techniques and strategies being

used by the 1% are well known and easy to employ in a personal

portfolio and could be great choices for investors seeking to make

a similar play with their assets.

This is especially true given the

vast proliferation of ETFs over the past few years and all the

strategies that these products have opened up to regular investors.

Now, mom and pop investors can use many of the techniques that were

once reserved for the ultra rich of the country that have millions

in liquid assets (One Percenters should also read the Complete

Guide to Preferred Stock ETF Investing).

Below, we have highlighted three

ETFs in order to help people invest like the one percent. These

products look to target many of the methods that ultra-high net

worth investors have been using for years in their own portfolios,

but in a way that is accessible and cheap to buy for the ’99%’ of

investors out there.

iShares S&P National

Municipal Bond Fund (MUB)

Municipal bonds are securities that

are issued by local and state governments in order to build or

finance any number of projects ranging from infrastructure

improvements to general budget uses as well. Often times, in order

to encourage investment, these securities are exempt from federal

income tax and are often free from inclusion in AMT calculations as

well.

Since regular taxable bonds are

taxed at 35% for the top bracket, this can be a huge selling point

for rich investors who are seeking to keep their tax liabilities

low while still participating in the fixed income world. Luckily

for investors looking to apply this strategy with funds, there are

a number of muni bond ETFs available.

For the rest of this ETF

article, please visit Zacks.com at:

http://www.zacks.com/stock/news/75336/invest-like-the-one-percent-with-these-three-etfs

Disclosure: Officers, directors

and/or employees of Zacks Investment Research may own or have sold

short securities and/or hold long and/or short positions in options

that are mentioned in this material. An affiliated investment

advisory firm may own or have sold short securities and/or hold

long and/or short positions in options that are mentioned in this

material.

About Zacks

Zacks.com is a property of Zacks

Investment Research, Inc., which was formed in 1978 by Leonard

Zacks. As a PhD in mathematics Len knew he could find patterns in

stock market data that would lead to superior investment results.

Amongst his many accomplishments was the formation of his

proprietary stock picking system; the Zacks Rank, which continues

to outperform the market by nearly a 3 to 1 margin. The best way to

unlock the profitable stock recommendations and market insights of

Zacks Investment Research is through our free daily email

newsletter; Profit from the Pros. In short, it's your steady

flow of Profitable ideas GUARANTEED to be worth your time! Register

for your free subscription to Profit from the Pros

http://at.zacks.com/?id=113

Follow Eric on Twitter:

http://twitter.com/ericdutram

Join Zacks on Facebook:

http://www.facebook.com/ZacksInvestmentResearch

Zacks Investment Research is under

common control with affiliated entities (including a broker-dealer

and an investment adviser), which may engage in transactions

involving the foregoing securities for the clients of such

affiliates.

Visit

http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Contact: Eric Dutram

Company: Zacks.com

Phone: 312-265-9462

Email: pr@zacks.com

Visit: www.Zacks.com

To read this article on Zacks.com click here.

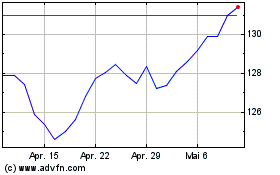

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

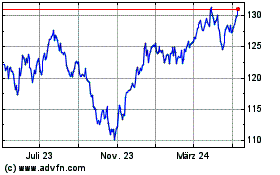

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024