Chase Corporation Announces October 6, 2023 Special Meeting Results

06 Oktober 2023 - 10:18PM

Business Wire

Chase Corporation (“Chase” or the “Company”) (NYSE

American: CCF), a leading global manufacturer of protective

materials for high-reliability applications across diverse market

sectors, held a special meeting of shareholders earlier today (the

“Special Meeting”) at which Chase shareholders approved the

transactions contemplated by that certain Agreement and Plan of

Merger (the “Merger Agreement”) dated July 21, 2023 by and

among Chase, Formulations Parent Corporation (“Parent”) and

Formulations Merger Sub Corporation (“Merger Sub”). Pursuant

to the Merger Agreement, Merger Sub will merge with and into Chase,

with Chase surviving as a wholly owned subsidiary of Parent (the

“Merger”). Parent and Merger Sub are affiliates of

investment funds managed by Kohlberg Kravis Roberts & Co. L.P.,

a global investment firm (collectively, “KKR”).

A total of 8,295,298 shares of Chase common stock of the

9,508,483 shares of Chase common stock issued and outstanding at

the record date were voted at the Special Meeting, representing

87.24% of the issued and outstanding shares of Chase common stock

as at the record date of August 29, 2023. Holders of approximately

85.16% of Chase common stock outstanding as of the record date and

entitled to vote voted to approve and adopt the Merger

Agreement.

The final voting results of the proposals submitted to a vote of

the shareholders at the Special Meeting are as follows:

Proposal 1 - The Merger Proposal: To approve and adopt the

Merger Agreement (the “Merger Proposal”).

For

Against

Abstain

Total

8,097,605

184,269

13,424

8,295,298

Proposal 2 - The Merger Compensation Proposal: To approve, on a

non-binding advisory basis, certain compensation that will or may

be paid by Chase to its named executive officers that is based on

or otherwise relates to the Merger.

For

Against

Abstain

Total

7,414,771

865,641

14,886

8,295,298

Proposal 3 - The Adjournment Proposal: To approve the

adjournment of the Special Meeting, including if necessary, to

solicit additional proxies in favor of Proposal 1 - The Merger

Proposal, if there are not sufficient votes at the time of such

adjournment to approve the Merger Proposal. Although Proposal 3 was

approved, the adjournment of the Special Meeting was not necessary

because Chase’s shareholders approved Proposal 1.

For

Against

Abstain

Total

7,783,690

449,843

61,765

8,295,298

Forward Looking Statements

This communication contains “forward-looking statements” within

the Private Securities Litigation Reform Act of 1995. Any

statements contained in this communication that are not statements

of historical fact, including statements about Chase’s ability to

consummate the proposed transaction and the expected benefits of

the proposed transaction, may be deemed to be forward-looking

statements. All such forward-looking statements are intended to

provide management’s current expectations for the future of the

Company based on current expectations and assumptions relating to

the Company’s business, the economy and other future conditions.

Forward-looking statements generally can be identified through the

use of words such as “believes,” “anticipates,” “may,” “should,”

“will,” “plans,” “projects,” “expects,” “expectations,”

“estimates,” “forecasts,” “predicts,” “targets,” “prospects,”

“strategy,” “signs,” and other words of similar meaning in

connection with the discussion of future performance, plans,

actions or events. Because forward-looking statements relate to the

future, they are subject to inherent risks, uncertainties and

changes in circumstances that are difficult to predict. Such risks

and uncertainties include, among others: (i) the timing to

consummate the proposed transaction, (ii) the risk that a condition

of closing of the proposed transaction may not be satisfied or that

the closing of the proposed transaction might otherwise not occur,

(iii) the risk that a regulatory approval that may be required for

the proposed transaction is not obtained or is obtained subject to

conditions that are not anticipated, (iv) the diversion of

management time on transaction-related issues, (v) risks related to

disruption of management time from ongoing business operations due

to the proposed transaction, (vi) the risk that any announcements

relating to the proposed transaction could have adverse effects on

the market price of the common stock of Chase, (vii) the risk that

the proposed transaction and its announcement could have an adverse

effect on the ability of Chase to retain customers and retain and

hire key personnel and maintain relationships with its suppliers

and customers, (viii) the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the Merger Agreement, including in circumstances requiring the

Company to pay a termination fee, (ix) unexpected costs, charges or

expenses resulting from the Merger, (x) potential litigation

relating to the Merger that could be instituted against the parties

to the Merger Agreement or their respective directors, managers or

officers, including the effects of any outcomes related thereto,

(xi) worldwide economic or political changes that affect the

markets that the Company’s businesses serve which could have an

effect on demand for the Company’s products and impact the

Company’s profitability, (xii) challenges encountered by the

Company in the execution of restructuring programs, and (xiii)

disruptions in the global credit and financial markets, including

diminished liquidity and credit availability, changes in

international trade agreements, including tariffs and trade

restrictions, cyber-security vulnerabilities, foreign currency

volatility, swings in consumer confidence and spending, raw

material pricing and supply issues, retention of key employees,

increases in fuel prices, and outcomes of legal proceedings, claims

and investigations. Accordingly, actual results may differ

materially from those contemplated by these forward-looking

statements. Investors, therefore, are cautioned against relying on

any of these forward-looking statements. They are neither

statements of historical fact nor guarantees or assurances of

future performance. Additional information regarding the factors

that may cause actual results to differ materially from these

forward-looking statements is available in Chase’s filings with the

Securities and Exchange Commission (the “SEC”), including

the risks and uncertainties identified in Part I, Item 1A - Risk

Factors of Chase’s Annual Report on Form 10-K for the year ended

August 31, 2022 and in the Company’s other filings with the

SEC.

These forward-looking statements speak only as of the date of

this communication, and Chase does not assume any obligation to

update or revise any forward-looking statement made in this

communication or that may from time to time be made by or on behalf

of the Company.

About Chase Corporation

Chase Corporation, a global specialty chemicals company that was

founded in 1946, is a leading manufacturer of protective materials

for high-reliability applications throughout the world. More

information can be found on our website at

https://chasecorp.com/.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people and supporting growth in its portfolio companies

and communities. KKR sponsors investment funds that invest in

private equity, credit and real assets and has strategic partners

that manage hedge funds. KKR’s insurance subsidiaries offer

retirement, life and reinsurance products under the management of

Global Atlantic Financial Group. References to KKR’s investments

may include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231006940851/en/

For Chase Corporation Investor & Media Contact:

Jackie Marcus or Ashley Gruenberg Alpha IR Group Phone: (617)

466-9257 E-mail: CCF@alpha-ir.com Shareholder & Investor

Relations Department: Phone: (781) 332-0700 E-mail:

investorrelations@chasecorp.com For KKR Liidia Liuksila or

Miles Radcliffe-Trenner (212) 750-8300 media@kkr.com

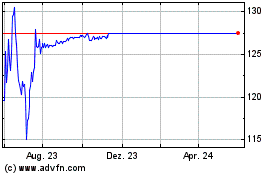

Chase (AMEX:CCF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

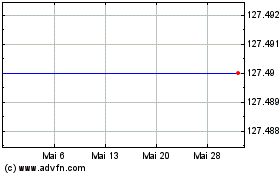

Chase (AMEX:CCF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025