Statement of Changes in Beneficial Ownership (4)

10 Juni 2016 - 1:10AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Luxor Capital Group, LP

|

2. Issuer Name

and

Ticker or Trading Symbol

Altisource Asset Management Corp

[

AAMC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

__

X

__ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Last)

(First)

(Middle)

1114 AVENUE OF THE AMERICAS, 29TH FLOOR

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/7/2016

|

|

(Street)

NEW YORK, NY 10036

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common stock, par value $0.01

(1)

(2)

|

6/7/2016

|

|

S

|

|

30733

|

D

|

$24.3100

|

84344

|

I

(3)

|

By Luxor Wavefront, LP

|

|

Common stock, par value $0.01

(1)

(2)

|

6/7/2016

|

|

S

|

|

2067

|

D

|

$24.3100

|

4076

|

I

(5)

|

By Thebes Offshore Master Fund, LP

|

|

Common stock, par value $0.01

(1)

(2)

|

6/8/2016

|

|

S

|

|

2984

|

D

|

$21.7227

|

81360

|

I

(3)

|

By Luxor Wavefront, LP

|

|

Common stock, par value $0.01

(1)

(2)

|

6/8/2016

|

|

S

|

|

144

|

D

|

$21.7227

|

3932

|

I

(5)

|

By Thebes Offshore Master Fund, LP

|

|

Common stock, par value $0.01

(1)

(2)

|

6/8/2016

|

|

S

|

|

15465

|

D

|

$22.0888

|

65895

|

I

(3)

|

By Luxor Wavefront, LP

|

|

Common stock, par value $0.01

(1)

(2)

|

6/8/2016

|

|

S

|

|

747

|

D

|

$22.0888

|

3185

|

I

(5)

|

By Thebes Offshore Master Fund, LP

|

|

Common stock, par value $0.01

(1)

(2)

|

|

|

|

|

|

|

|

131200

|

I

(4)

|

By Luxor Capital Partners Offshore Master Fund, LP

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Notional Principal Amount Derivative Agreement

(1)

(2)

(6)

(7)

|

(6)

(7)

|

6/7/2016

|

|

S/K

|

|

|

4469

|

(6)

(7)

|

3/24/2017

|

Common stock, par value $0.01

(1)

(2)

|

4469

|

$22.0152

|

4666

|

I

(3)

|

By Luxor Wavefront, LP

|

|

Notional Principal Amount Derivative Agreement

(1)

(2)

(6)

(7)

|

(6)

(7)

|

6/7/2016

|

|

S/K

|

|

|

2139

|

(6)

(7)

|

3/24/2017

|

Common stock, par value $0.01

(1)

(2)

|

2139

|

$22.0152

|

71

|

I

(5)

|

By Thebes Offshore Master Fund, LP

|

|

Notional Principal Amount Derivative Agreement

(1)

(2)

(7)

|

$203.0000

|

6/7/2016

|

|

S/K

|

|

|

4666

|

(7)

|

3/25/2020

|

Common stock, par value $0.01

(1)

(2)

|

4666

|

$23.5468

|

0

|

I

(3)

|

By Luxor Wavefront, LP

|

|

Notional Principal Amount Derivative Agreement

(1)

(2)

(7)

|

$878.7140

|

6/7/2016

|

|

S/K

|

|

|

71

|

(7)

|

3/25/2020

|

Common stock, par value $0.01

(1)

(2)

|

71

|

$23.5468

|

0

|

I

(5)

|

By Thebes Offshore Master Fund, LP

|

|

Explanation of Responses:

|

|

(

1)

|

This Form 4 is filed jointly by Luxor Capital Group, LP ("Luxor Capital Group"), Luxor Capital Partners Offshore, Ltd. ("Offshore Feeder Fund"), Thebes Partners Offshore, Ltd. ("Thebes Feeder Fund"), Luxor Wavefront, LP ("Wavefront Fund"), LCG Holdings, LLC ("LCG Holdings"), Luxor Management, LLC ("Luxor Management") and Christian Leone (collectively, the "Reporting Persons").

|

|

(

2)

|

Each of the Reporting Persons may be deemed to be a member of a Section 13(d) group that may be deemed to collectively beneficially own more than 10% of the Issuer's outstanding shares of Common Stock. Each of the Reporting Persons disclaims beneficial ownership of the securities reported herein except to the extent of his or its pecuniary interest therein.

|

|

(

3)

|

Securities owned directly by Wavefront Fund. Each of LCG Holdings and Luxor Capital Group, as the general partner and investment manager, respectively, of Wavefront Fund, may be deemed to beneficially own the securities owned directly by Wavefront Fund. Luxor Management, as the general partner of Luxor Capital Group, and Christian Leone, as the managing member of each of LCG Holdings and Luxor Management, may be deemed to beneficially own the securities owned directly by Wavefront Fund.

|

|

(

4)

|

Securities owned directly by Luxor Capital Partners Offshore Master Fund, LP ("Offshore Master Fund"). Offshore Feeder Fund, as the owner of a controlling interest in Offshore Master Fund, may be deemed to beneficially own the securities owned directly by Offshore Master Fund. Each of LCG Holdings and Luxor Capital Group, as the general partner and investment manager, respectively, of Offshore Master Fund, may be deemed to beneficially own the securities owned directly by Offshore Master Fund. Luxor Management, as the general partner of Luxor Capital Group, and Christian Leone, as the managing member of each of LCG Holdings and Luxor Management, may be deemed to beneficially own the securities owned directly by Offshore Master Fund.

|

|

(

5)

|

Securities owned directly by Thebes Offshore Master Fund, LP ("Thebes Master Fund"). Thebes Feeder Fund, the owner of a controlling interest in, and together with a minority investor, the owner of 100% of the interests in Thebes Master Fund, may be deemed to beneficially own the securities owned directly by Thebes Master Fund. Each of LCG Holdings and Luxor Capital Group, as the general partner and investment manager, respectively, of Thebes Master Fund, may be deemed to beneficially own the securities owned directly by Thebes Master Fund. Luxor Management, as the general partner of Luxor Capital Group, and Christian Leone, as the managing member of each of LCG Holdings and Luxor Management, may be deemed to beneficially own the securities owned directly by Thebes Master Fund.

|

|

(

6)

|

Notional principal amount derivative agreements (the "Derivative Agreements") in the form of cash settled swaps. The strike prices of the Derivative Agreements range in price from $765.0490 to $1,033.4556.

|

|

(

7)

|

The Derivative Agreements provide the holders with economic results that are comparable to the economic results of ownership payable on each settlement date applicable to the expiration or earlier termination of such Derivative Agreement, but do not provide such holder with the power to vote or direct the voting or dispose of or direct the disposition of the shares of Common Stock that are the subject of the Derivative Agreements (such shares, the "Subject Shares"). Each of the holders of the Derivative Agreements disclaims beneficial ownership in the Subject Shares. The counterparties to the Derivative Agreements are unaffiliated third party financial institutions.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Luxor Capital Group, LP

1114 AVENUE OF THE AMERICAS

29TH FLOOR

NEW YORK, NY 10036

|

|

X

|

|

|

LCG HOLDINGS LLC

1114 AVENUE OF THE AMERICAS

29TH FLOOR

NEW YORK, NY 10036

|

|

X

|

|

|

Luxor Wavefront, LP

1114 AVENUE OF THE AMERICAS

29TH FLOOR

NEW YORK, NY 10036

|

|

X

|

|

|

LUXOR CAPITAL PARTNERS OFFSHORE LTD

C/O M&C CORPORATE SVCS LTD

PO BOX 309 GT UGLAND HOUSE

GEORGE TOWN, E9 KY1-1104

|

|

X

|

|

|

Thebes Partners Offshore, Ltd.

C/O MAPLES CORPORATE SERVICES LIMITED

BOX 309, UGLAND HOUSE

GRAND CAYMAN, E9 KY1-1104

|

|

X

|

|

|

Signatures

|

|

/s/ Norris Nissim, as General Counsel of Luxor Management, LLC, General Partner of Luxor Capital Group, LP

|

|

6/9/2016

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

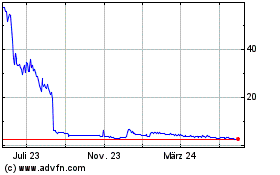

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024