Regulatory News:

Groupe SEB (Paris:SK):

AN EXCELLENT FIRST HALF

Consolidated financial results

(€m)

H1 2020

H1 2021

Change 2021/2020

Q2 2021

Change 2021/2020

Sales

2,914

3,610

+23.9% +26.3% LFL

1,758

+20.3% +21.8% LFL

Operating Result from Activity

(ORfA)

103

320

x3.1

122

+42.5%

Operating profit

58

258

x4.4

Profit attributable to owners

of the parent

3

151

x50

Net debt at 06/30

2,085

1,850

-€235m

Statement by T. de La Tour d’Artaise, Chairman and CEO of

Groupe SEB

“Groupe SEB posted an excellent first half, with performance

even outstripping pre-pandemic levels despite unprecedented

external tensions in the supply chain relating to raw materials and

components, delays and additional freight costs. These performances

were driven by buoyant demand for small domestic equipment and

continued strong momentum in e-commerce. Our Consumer business grew

faster than the market, fueled by all geographies and categories.

The quarter was also market by the return to growth of the

Professional division, with an improved trend in the Professional

Coffee core business.

These very good results reflect above all the outstanding

commitment of all of the Group’s employees, that I wish to thank

warmly again.

The Group pursues its strategy of profitable and responsible

growth multiplying initiatives in the field of environment, as well

as circular and social economy, which prove to be strong drivers of

value creation.

In a context of a still unstable global health environment, but

given the performance of the first half, we now anticipate for

full-year 2021 a growth in reported sales exceeding 10%, along with

an operating margin of close to 10%.”

GENERAL COMMENTS ON GROUP SALES

In what remains a disrupted overall environment marked by the

continuation of the COVID-19 crisis and unprecedented inflationary

tensions in the supply chain, Groupe SEB reported sales of

€3,610m in first-half 2021, up 23.9% compared with end-June

2020. The increase includes organic growth of 26.3% (€768m),

a currency effect of -4.3% (-€125m), and a scope effect

of +1.8% (+€53m; StoreBound, acquired in July 2020). Though the

increase is to be compared with a first-half 2020 that was heavily

impacted by the spread of the pandemic, it also reflects solid

growth relative to first-half 2019, with sales up

8.2%.

The excellent performance was underpinned both by vigorous

Consumer business and a significant rebound in Professional sales

in the second quarter.

The Consumer business posted organic growth of 29.6% in

the first six months, against weak 2020 comparatives in all

regions. After a brisk start to the year (+39.1% LFL), the Group

maintained robust sales momentum in the second quarter

(+20.6% LFL), still driven by strong demand for small

domestic equipment around the world. In this environment,

promotional pressure remained moderate, ensuring a firm price-mix.

E-commerce continued to be a powerful growth engine, the reopening

of stores having come late in numerous countries.

After a 12-month period heavily impacted by the almost complete

closure of the hospitality and catering sector, the Group’s

Professional business returned to growth in the second

quarter. Coming out at 34.2% LFL, growth did reflect a

certain recovery in the Professional Coffee core business (coffee

machines and service) and included the roll-out of a few contracts

with European and US customers. It almost entirely offsets the

shortfall at end-March (-26.2% LFL) leading to a very limited

decline in Professional sales at June 30, 2021 (-1.7%

LFL).

DETAIL OF REVENUE BY REGION – 1st HALF-YEAR

Revenue (€m)

H1

H1

Change 2021/2020

Q2 2021

2020

2021

As reported

Like-for-like*

Like-for-like

EMEA

1,272

1,662

+30.7%

+34.9%

+28.2%

Western Europe

920

1,171

+27.3%

+27.2%

+20.2%

Other countries

352

490

+39.6%

+55.0%

+52.5%

AMERICAS

298

480

+61.2%

+57.2%

+53.4%

North America

209

348

+66.6%

+50.8%

+38.9%

South America

89

132

+48.5%

+72.2%

+96.5%

ASIA

1,039

1,178

+13.4%

+15.3%

+3.3%

China

794

898

+13.1%

+13.8%

-0.1%

Other countries

245

280

+14.3%

+20.0%

+14.8%

TOTAL Consumer

2,608

3,319

+27.3%

+29.6%

+20.6%

Professional business

306

290

-5.1%

-1.7%

+34.2%

GROUPE SEB

2,914

3,610

+23.9%

+26.3%

+21.8%

*Like-for-like: at constant exchange rates and scope Rounded

figures in €m % calculated in non-rounded figures

SALES BY REGION

Revenue (€m)

H1

H1

Change 2021/2020

Q2 2021

2020

2021

As reported

Like-for-like

LFL

EMEA

1,272

1,662

+30.7%

+34.9%

+28.2%

Western Europe

920

1,171

+27.3%

+27.2%

+20.2%

Other countries

352

490

+39.6%

+55.0%

+52.5%

WESTERN EUROPE

In what remains a delicate health situation, the Groupe achieved

organic sales growth of 27.2% in Western Europe in the first half

of the year. The performance stems from continued sustained demand

for small domestic equipment, persistently strong momentum in

e-commerce, and the easing of restrictive measures, as well as the

gradual reopening of physical retail.

In France, after an extremely vigorous start to the year,

the Group maintained a robust pace of growth in the second quarter

despite unfavorable comparatives in cookware (owing to a major

loyalty program last year with a key customer). Increase in revenue

was driven by small electrical appliances, with a positive

contribution from almost all our product categories and in

particular electrical cooking, notably thanks to the new Cookeo

range, and food and beverage preparation (full-automatic espresso

coffee machines in particular).

In Germany, the second quarter confirmed the brisk

momentum of the start of the year, propelled more specifically by

e-commerce. Bestsellers in electrical cooking, our progress in

cookware and the positive performances of WMF, notably online, were

the main growth drivers.

In all the other key European markets, the Group reported

double-digit sales growth, with remarkable scores in Italy, the

Netherlands, the UK and Belgium. The leading product categories

over the period were electrical cooking and floor care, as well as

WMF ranges.

OTHER EMEA COUNTRIES

In a still volatile and uncertain overall environment, with the

health crisis, lockdowns and currency issues, the Group posted

organic growth of 55% in first-half 2021, with similar paces in

both quarters. This confirmed the excellent general dynamic in the

area over time, based on the consolidation of our positions in the

large markets and rapid progress in new territories.

The widespread vigorous performance in the first half of the

year was notably fueled by:

- strengthened Group presence in e-commerce, with our

electro-specialists or pure players partners,

- ongoing development in direct-to-consumer sales, offline and

online;

- further inroads in WMF’s Consumer business.

Russia, our largest market in the region, Ukraine, as

well as most other Central European countries, Poland, Romania,

the Czech Republic, Slovakia, Bulgaria, and Croatia, also

achieved substantial business expansion (frequently over 50%),

confirming the Group’s fresh advances in these markets.

Turkey, which was heavily impacted in 2020 by the

pandemic and an unfavorable economic and monetary environment,

posted like-for-like growth of nearly 100% in the period.

In the first half of the year, and in a cross-functional manner,

the flagship products were versatile and robot vacuum cleaners,

cookware, electrical cooking (with a special mention for oil-less

fryers) and full-automatic espresso machines.

Revenue (€m)

H1

H1

Change 2021/2020

Q2 2012

2020

2021

As reported

Like-for-like

LFL

AMERICAS

298

480

61.20%

57.20%

53.40%

North America

209

348

66.60%

50.80%

38.90%

South America

89

132

48.50%

72.20%

96.50%

NORTH AMERICA

In North America, the strong rise in revenue in the first half

(+66.6% as reported) comprises the integration of StoreBound,

acquired in July 2020, along with negative currency effects (US

dollar, Mexican peso). Like-for-like growth amounted to 50.8% at

June 30 and 38.9% for the second quarter.

As in the first quarter, business momentum was fueled by the

three countries of the region.

In the United States, strong demand was fueled by the

economic recovery and government stimulus plans, still in place.

These consumption incentives, as well as the requirement to stay at

and work from home, continued to prove extremely favorable to small

domestic equipment. As in 2020, cooking was a powerful growth

driver. As a result, we posted record performances in cookware in

the first six months of the year, nourished by our three brands,

All Clad, T-Fal, and Imusa. StoreBound also reported excellent

business activity development, underpinned by the continued

expansion of its distribution network.

In Canada and Mexico, sales momentum was extremely

buoyant throughout the first half of the year, served primarily by

our performances in cookware and electrical cooking.

SOUTH AMERICA

Although concerns persist regarding the economic and health

situation, Group revenue in South America increased 72.2% LFL and

48.5% in euros in the first half. The significant difference

between the two figures can be attributed to important currency

depreciations (Brazilian real, Colombian peso, Argentinian peso).

The surge in turnover at June 30 reflect a strong pick-up in growth

in the second quarter, as the Group benefited from a weaker

comparison base in 2020. Organic revenue growth came out at 96.5%

in the second quarter.

Sales in Brazil, the largest country in the region, more

than doubled on a like-for-like basis in the second quarter.

However, this performance should be seen in the light of very low

2020 comparatives, strongly impacted by the COVID crisis. Most

product categories contributed to growth, both in volume and value

terms, mainly owing to price increases made to counter negative

currency and raw material effects. Major contributors to this solid

sales momentum included food preparation and cookware. In

electrical cooking, the stand-out category over the period was

oil-less fryers, whose market is developing rapidly.

In Colombia, despite a tense political environment since

May, the Group posted a record second quarter with like-for-like

sales growth of over 70%, driven by electrical cooking, and in

particular by oil-less fryers, as well as blenders and Imusa

cookware.

Revenue (€m)

H1

H1

Change 2021/2020

Q2 2021

2020

2021

As reported

Like-for-like

LFL

ASIA

1,039

1,178

+13.4%

+15.3%

+3.3%

China

794

898

+13.1%

+13.8%

-0.1%

Other countries

245

280

+14.3%

+20.0%

+14.8%

CHINA

In China, in the first half of the year, the Group achieved

organic revenue growth of close to 14%. This positive change was

the result of opposite dynamics in the first and second quarters,

mirroring business volatility in 2020, with sales up 30% at

end-March (compared with -32% in 2020) and stable in the second

quarter (vs. +10% in 2020). Recovery in cookware (against low 2020

comparatives) and a firm momentum in electrical cooking (flagship

products and new, more Western categories such as oil-less fryers)

fueled rise in half-year sales. Conversely, following several years

of brisk growth, business was more difficult in food

preparation.

In a context of milder consumption dynamic and ongoing

transformation in the retail industry, footfall in stores remained

low versus the continued progress of e-commerce thanks to

ramping-up new web platforms. The increased weight of online sales

resulted since last year in a drop in average prices, weighing on

the growth in value of the small domestic equipment market.

The Group is constantly adapting to the changes in the

distribution sector. As achieved in the past in the offline

channels, Supor is now working on the extension and upgrading of

its product offering online, leveraging its strong and proven

innovation capabilities. The latter materialize in 2021 in several

major launchings and in a rich and diversified new product

pipeline.

OTHER ASIAN COUNTRIES

In Asia excluding China, sales at end-June were up 20%

LFL following a more modest second quarter yet still showing

double-digit organic growth. This stands as an excellent

performance relative to the strong business resilience in 2020 over

the period in the midst of the COVID crisis.

In Japan, our number-one market in the region, sales

continued to trend extremely positively, up double-digit, LFL, in

both first and second quarters. The long-term positive momentum in

the country is based on flagship product families such as cookware

(Ingenio, G6 range) and electrical cooking (Cook4me electric

pressure cooker). Following an upsurge of the pandemic, a state of

health emergency was decreed again, twice since late April. This

led to the closure of some of our physical points of sales over the

semester, with an impact on business activity.

In South Korea, following a solid first quarter and a

stable second quarter, the Group ended the first half with

sustained LFL sales growth. The latter can be attributed to

cookware (success of the new Tefal G6 range launched last November)

and vacuum cleaners. While the health crisis continues to weigh on

store footfall, e-commerce remained our main growth engine at June

30.

In the other countries in the region, despite the

reintroduction of some restrictive measures to address a resurgence

of the pandemic (lockdowns, curfews, store closures, etc.),

business activity trended positively overall, both for the second

quarter and the first half.

COMMENTS ON PROFESSIONAL BUSINESS

Revenue (€m)

H1

H1

Change 2021/2020

Q2 2021

2020

2021

As reported

LFL

LFL

Professional business

306

290

-5.1%

-1.7%

+34.2%

The Professional division, composed 90% of the

Professional Coffee business, posted half-year revenue of €290m,

down 1.7% on a like-for-like basis. The slight decrease

resulted from two contrasting trends:

- a 26.2% LFL decrease in the first quarter, impacted by

the near-total closures in the hospitality and catering sector and

by demanding 2020 comparatives (pre-COVID);

- a substantial rebound in the second quarter, with revenue up

by over 34% LFL against extremely low 2020 comparatives. Growth

was fueled by a more positive trend in core business (notably in

Germany, Switzerland and Austria) and by the fresh implementation

or continued roll-out of a few contracts signed with key customers

in EMEA and North America. While sales of professional coffee

machines were the main contributor to the trend reversal in the

second quarter, service (maintenance) also contributed to the

change in dynamic.

In contrast, hotel equipment continued to be affected by the

extended closure of hotels and restaurants, with a sharp decline in

revenue over the period.

OPERATING RESULT FROM ACTIVITY (ORfA)

Operating Result from Activity (ORfA) amounted to €320m in

first-half 2021, versus €103m at end-June 2020. The total

includes a currency effect of -€36m and a scope effect of

+€3m (StoreBound).

The constituent items of the change in ORfA on a like-for-like

basis at end-June 2021 are as follows:

- a highly positive volume effect (+€190m), directly linked to

very robust growth in sales;

- a price-mix effect that was also sharply positive (+€161m),

reflecting a less promotional environment and upselling;

- cost of sales at -€11m, resulting from strong industrial

activity, with excellent absorption of costs but significant

headwinds (raw material procurement, components, freight, etc.) as

from the second quarter;

- a €87m increase in growth drivers, compared with very low

investments in first-half 2020;

- strict control of sales, marketing and administrative expenses

(slightly increased by €3m), despite a buoyant context.

After a completely atypical first-quarter (ORfA increased by a

factor of 11 compared with March 31, 2020), second-quarter

ORfA came out at €122m, versus €86m in 2020

(+42.5%).

It should also be noted that while Operating Result from

Activity at June 30, 2021 was three times higher than in first-half

2020, which was heavily impacted by the effects of the COVID-19

crisis, it also shows an increase by 39% on the ORfA achieved in

the first semester of 2019.

OPERATING PROFIT AND NET PROFIT

At end-June 2021, Group operating profit amounted to

€258m, versus €58m at June 30, 2020. This result includes an

employee profit-sharing expense of €16m (€5m in 2020) and other

operating income and expense of -€46m, compared with -€40m in

first-half 2020. Most of these expenses stem from the costs related

to the closure of the Erbach site in Germany, with the remainder

relating to several items of modest amounts.

The net financial expense at June 30, 2021 came out at -€27m, a

slight improvement on -€29m in first-half 2020 (mainly attributable

to a decrease in other financial expenses).

In these circumstances, profit attributable to owners of the

parent totaled €151m in the first half, compared with €3m at

end-June 2020. This comes after a tax charge of €53m, based on an

estimated effective tax rate of 23%, and after minority interests

of €27m (versus €19m in first-half 2020) owing to improved results

for Supor in China and, to a lesser extent, the consolidation of

StoreBound.

FINANCIAL STRUCTURE AT JUNE 30, 2021

Consolidated equity stood at €2,816m at June 30, 2021, up

€81m from end-2020 and up €317m from June 30, 2020.

At the same date, the Group's net debt was €1,850m

(including €333m of IFRS 16 debt), down €235m versus June 30, 2020

and up €332m versus December 31, 2020, due to business seasonality

as well as to non-operational items, including the payment of

dividends (€147m) and Supor’s share buybacks. Capital expenditures

were stable in the first half compared with the same period in

2020. At June 30, 2021, the operating working capital

requirement amounted to 14.8% of sales, an improvement of 200

basis points compared with the same date last year, but an increase

versus the ratio of 12.2% of sales at end-December 2020. The

increase largely owes to the exceptional level reached at end-2020

and the usual seasonality effects.

At June 30, 2021, the Group’s debt ratio stood at 0.7

(0.5 excluding IFRS 16) and the net debt/adjusted EBITDA ratio

at 1.75 (1.6 excluding IFRS 16). The Group continues to rely on

a stable financial base, underpinned by a healthy and well-balanced

financing structure in terms of instruments and maturity, and free

of financial covenants.

OUTLOOK

As a reminder, given the seasonal nature of the Consumer

business, the first half of the year is not traditionally

representative of the entire year. Furthermore, in 2021,

performance should be viewed in light of the very atypical level of

business in 2020, disrupted by the effects of the Covid-19 pandemic

and the related health crisis.

That said, the Group reported an excellent performance in the

first half. Ultimately, the second-quarter showing was better than

expected, thanks to maintained robust momentum for the Consumer

division and a solid rebound in Professional Coffee.

However, caution remains the watchword for the second half of

the year. Visibility is still limited for the Consumer business, in

between the widespread reopening of stores and public

places—potentially resulting in a reallocation of consumer

spending—and the spread of new variants leading to further health

restrictions in some countries.

Moreover, uncertainties persist regarding the pace of recovery

for Professional Coffee, despite the low comparison base from the

second semester of 2020.

Pulling all this together leads the Group:

- to upgrade its reported sales growth assumption for 2021, which

should exceed 10% (vs around 10% previously);

- to maintain its ORfA margin assumption for the full year at

close to 10%, despite significantly more penalizing headwinds (FX,

raw materials, components and freight) than anticipated and

currently estimated at more than €250m on the Operating Result from

Activity (vs. €140m estimate at end-April). These very negative

effects will lead the Group to apply price increases in the fourth

quarter 2021.

The Group is on track to ensure the continuation of its

profitable and responsible growth.

Groupe SEB’s company and consolidated financial statements at

June 30, 2021, were approved by the Board of Directors’ meeting

held on July 22, 2021.

CONSOLIDATED INCOME STATEMENT

(in € millions)

30/06/2021 6 months

30/06/2020 6 months

31/12/2020 12 months

Revenue

3,609.6

2,914.4

6,940.0

Operating expenses

(3,289.6)

(2,811.0)

(6,334.6)

OPERATING RESULT FROM ACTIVITY

320.0

103.4

605.4

Statutory and discretionary employee

profit-sharing*

(15.7)

(5.0)

(24.2)

RECURRING OPERATING PROFIT

304.3

98.4

581.2

Other operating income and expense

(46.3)

(40.2)

(77.9)

OPERATING PROFIT

258.0

58.2

503.3

Finance costs

(21.6)

(16.5)

(39.8)

Other financial income and expense

(5.7)

(12.2)

(21)

Share of profits of associates

0.0

PROFIT BEFORE TAX

230.7

29.5

442.5

Income tax expense

(53.0)

(7.4)

(93.8)

PROFIT FOR THE PERIOD

177.7

22.1

348.7

Non-controlling interests

(27.2)

(19.4)

(48.2)

PROFIT ATTRIBUTABLE TO OWNERS OF THE

PARENT

150.5

2.7

300.5

PROFIT ATTRIBUTABLE TO OWNERS OF THE

PARENT PER SHARE (IN UNITS)

Basic earnings per share

2.79

0.05

6.00

Diluted earnings per share

2.78

0.05

5.96

BALANCE SHEET

ASSETS (in € millions) 30/06/2021 30/06/2020

31/12/2020

Goodwill

1,671.6

1,642.6

1,642.4

Other intangible assets

1,272.7

1,259.7

1,261.6

Property, plant and equipment

1,201.4

1,189.4

1,219.5

Investments in associates

-

Other investments

120.7

87.0

108.0

Other non-current financial assets

15.9

19.0

15.9

Deferred tax assets

120.3

95.7

107.7

Other non-current assets

54.7

48.2

47.2

Long-term derivative instruments -

assets

20.1

6.3

17.9

NON-CURRENT ASSETS

4,477.4

4,347.9

4,420.2

Inventories

1,455.3

1,194.0

1,211.5

Trade receivables

785.9

860.5

965.4

Other receivables

188.0

135.9

160.6

Current tax assets

44.9

51.9

42.0

Short-term derivative instruments -

assets

64.7

39.1

36.2

Financial investments and other financial

assets

686.0

47.4

664.7

Cash and cash equivalents

1,437.7

1,746.3

1,769.4

CURRENT ASSETS

4,662.5

4,075.1

4,849.8

TOTAL ASSETS

9,139.9

8,423.0

9,270.0

EQUITY & LIABILITIES (in € millions) 30/06/2021

30/06/2020 31/12/2020

Share capital

55.3

50.3

50.3

Reserves and retained earnings

2,523.6

2,237.0

2,436.8

Treasury stock

(30.5)

(18.8)

(19.6)

Equity attributable to owners of the

parent

2,548.4

2,268.5

2,467.5

Non-controlling interests

268.0

230.3

267.3

CONSOLIDATED SHAREHOLDERS’

EQUITY

2,816.4

2,498.8

2,734.8

Deferred tax liabilities

176.1

242.2

191.0

Employee benefits and other long-term

provisions

328.1

340.4

355.9

Long-term borrowings

2,352.8

2,638.2

2,285.8

Other non-current liabilities

56.2

52.5

52.0

Long-term derivative instruments –

liabilities

9.4

19.4

15.5

NON-CURRENT LIABILITIES

2,922.6

3,292.7

2,900.2

Employee benefits and other short-term

provisions

135.7

106.1

122.9

Trade payables

1,161.4

853.2

1,260.3

Other current liabilities

389.0

415.2

493.3

Current tax liabilities

51.2

1.8

35.9

Short-term derivative instruments –

liabilities

48.8

16.8

50.4

Short-term borrowings

1,614.8

1,238.4

1,672.2

CURRENT LIABILITIES

3,400.9

2,631.5

3,635.0

TOTAL EQUITY AND LIABILITIES

9,139.9

8,423.0

9,270.0

APPENDIX

REVENUE BY REGION – 2ND QUARTER

Revenue (€m)

Q2 2020

Q2 2021

Change 2021/2020

As reported

LFL*

EMEA

631

791

+25.4%

+28.2%

Western Europe

475

572

+20.4%

+20.2%

Other countries

156

219

+40.7%

+52.5%

AMERICAS

149

237

+59.3%

+53.4%

North America

112

170

+52.6%

+38.9%

South America

37

67

+79.1%

+96.5%

ASIA

556

568

+2.1%

+3.3%

China

429

430

+0.1%

-0.1%

Other countries

127

138

+8.7%

+14.8%

TOTAL

Consumer

1,336

1,597

+19.5%

+20.6%

Professional

business

124

161

+29.5%

+34.2%

GROUPE

SEB

1,460

1,758

+20.3%

+21.8%

*Like-for-like: at constant exchange rates and scope Rounded

figures in €m % calculated in non-rounded figures

On a like-for-like basis (LFL) – Organic

The amounts and growth rates at constant exchange rates and

consolidation scope in a given year compared with the previous year

are calculated:

- using the average exchange rates of the previous year for the

period in consideration (year, half-year, quarter);

- on the basis of the scope of consolidation of the previous

year.

This calculation is made primarily for sales and Operating

Result from Activity.

Operating Result from Activity (ORfA)

Operating Result from Activity (ORfA) is Groupe SEB’s main

performance indicator. It corresponds to sales minus operating

expenses, i.e. the cost of sales, innovation expenditure (R&D,

strategic marketing and design), advertising, operational marketing

as well as sales and marketing expenses. ORfA does not include

discretionary and non-discretionary profit-sharing or other

non-recurring operating income and expense.

Adjusted EBITDA

Adjusted EBITDA is equal to Operating Result from Activity minus

discretionary and non-discretionary profit-sharing, to which are

added operating depreciation and amortization.

Free cash flow

Free cash flow corresponds to the “cash from operating

activities” item in the consolidated cash flow statement, adjusted

for non-recurring transactions with an impact on the Group’s net

debt (for example, cash outflows related to restructuring) and

after taking account of recurring investment (CAPEX).

SDA

Small Domestic Appliances: Kitchen Electrics, Home and Personal

Care

Net financial debt

This term refers to all recurring and non-recurring financial

debt minus cash and cash equivalents, as well as derivative

instruments linked to Group financing. It also includes debt from

application of the IFRS 16 standard “Leases” in addition to

short-term investments with no risk of a substantial change in

value but with maturities of over three months.

Loyalty program (LP)

These programs, run by distribution retailers, consist in

offering promotional offers on a product category to loyal

consumers who have made a series of purchases within a short period

of time. These promotional programs allow distributors to boost

footfall in their stores and our consumers to access our products

at preferential prices.

This press release may contain certain forward-looking

statements regarding Groupe SEB’s activity, results and financial

situation. These forecasts are based on assumptions which seem

reasonable at this stage, but which depend on external factors

including trends in commodity prices, exchange rates, the economic

climate, demand in the Group’s large markets and the impact of new

product launches by competitors.

As a result of these uncertainties, Groupe SEB cannot be held

liable for potential variance on its current forecasts, which

result from unexpected events or unforeseeable developments.

The factors which could considerably influence Groupe SEB’s

economic and financial result are presented in the Annual Financial

Report and Universal Registration Document filed with the Autorité

des Marchés Financiers, the French financial markets authority. The

balance sheet and income statement included in this press release

are excerpted from financial statements consolidated as of June 30,

2021 examined by SEB SA’s Statutory Auditors and approved by the

Group’s Board of Directors, dated July 22, 2021.

Watch the live webcast and presentation at

10:00 a.m. CET on our website: www.groupeseb.com or click here

Next key dates - 2021

August 6 | 10:00 am (Paris time)

Ordinary

general Meeting

October 26 | after market closes

9-month

2021 sales and financial data

Find us on www.groupeseb.com

World reference in small domestic equipment, Groupe SEB operates

with a unique portfolio of 31 top brands including Tefal, Seb,

Rowenta, Moulinex, Krups, Lagostina, All-Clad, WMF, Emsa, Supor,

marketed through multi-format retailing. Selling more than 360

million products a year, it deploys a long-term strategy focused on

innovation, international development, competitiveness and client

service. Present in over 150 countries, Groupe SEB generated sales

of €6.9 billion in 2020 and has more than 33,000 employees

worldwide.

SEB SA ■ SEB SA - N° RCS 300 349 636 RCS LYON – with a

share capital of €55,337,770 – Intracommunity VAT: FR

12300349636

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210722006029/en/

Investor/Analyst Relations Groupe SEB Financial

Communication and IR Dept Isabelle Posth Raphaël

Hoffstetter comfin@groupeseb.com +33 (0) 4 72 18 16

04

Media Relations Groupe SEB Corporate

Communication Dept Cathy Pianon Anissa Djaadi

com@groupeseb.com +33 (0) 6 33 13 02 00 +33 (0) 6

88 20 90 88

Image Sept Caroline Simon Claire Doligez

Isabelle Dunoyer de Segonzac caroline.simon@image7.fr

cdoligez@image7.fr isegonzac@image7.fr +33 (0) 1

53 70 74 70

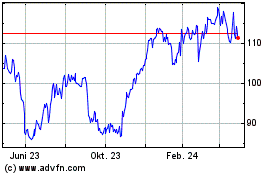

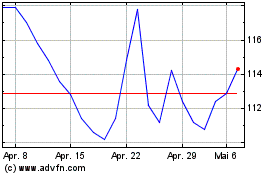

SEB (EU:SK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SEB (EU:SK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024