ArcelorMittal Amends Revolving Credit Facility to Align With Sustainability Goals

30 April 2021 - 9:01PM

Dow Jones News

By Stephen Nakrosis

ArcelorMittal said Friday it reached agreement with lenders to

amend its $5.5 billion revolving credit facility and link the

calculation of loan margins to the company's performance in meeting

sustainability and emissions reduction goals.

ArcelorMittal said the margin payable will increase or decrease

depending on its performance against "certain metrics related to

its environmental and sustainability performance," including "the

CO(2) intensity of ArcelorMittal's European operations and the

number of ArcelorMittal facilities globally which have been

certified by ResponsibleSteel by the end of each year."

The company also said the amended revolving credit facility is

"the largest ESG linked facility of its kind in the metals and

mining sector."

The steel and mining company said it "set a group-wide target of

reaching carbon neutrality by 2050, and a 30% CO(2) reduction

target for its European operations by 2030."

--Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

April 30, 2021 14:46 ET (18:46 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

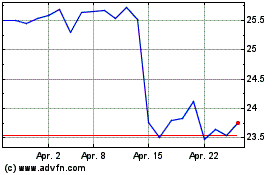

ArcelorMittal (EU:MT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

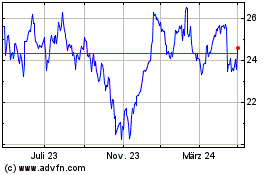

ArcelorMittal (EU:MT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024