Solutions 30 : 2020 EARNINGS REPORT

Operational performance remains

extremely resilient

- Revenue grew by 18% to €819.3 million

- EBITDA margin increases to 13.0%

- Net cash position of €59.2 million

Accelerating the group’s

transformation

- Foundations reinforced to consolidate growth

Long-term outlook confirmed

- Potential for growth underpinned by the digital

transformation and the energy transition, and bolstered by European

recovery plans

Solutions 30 SE today announces its

consolidated earnings for the financial year ended December 31. The

Supervisory Board of Solutions 30, meeting on April 27,

examined and approved the financial results for 2020, as approved

by the Group Management Board. These results are still being

audited. The complete consolidated financial statements, including

the notes, will be made available as soon as possible. The

financial presentation of the accounts will be available on the

company’s website at 2 pm on April 29th.

Key figures

|

In millions of euros |

FY2020 |

FY2019 Restated(1) |

Change |

|

Revenue |

819.3 |

691.4 |

+18% |

| Adjusted EBITDA |

106.5 |

89.4 |

+19% |

| As a %

of revenue |

13.0% |

12.9% |

|

| Adjusted EBIT |

60.9 |

52.9 |

+15% |

| As a %

of revenue |

7.4% |

7.7% |

|

| Consolidated net income |

38.3 |

38.1 |

+0.3% |

| As a %

of revenue |

4.7% |

5.5% |

|

| Net income, group share |

36.9 |

38.7 |

-5% |

| As a %

of revenue |

4.5% |

5.6% |

|

|

Financial structure figures |

12/31/2020 |

12/31/2019 Restated(1) |

Change |

|

Equity |

172.4 |

134.5 |

+38.0 |

| Net

debt |

28.9 |

92.1 |

-63.1 |

| Net

bank debt |

-59.2 |

3.0 |

-62.2 |

| Free

cash flow |

124.8 |

49.6 |

+75.2 |

Very strong revenue growth

After a strong start to the year, travel

restrictions and the closure of some businesses during the first

lockdown disrupted Solutions 30’s activities from mid-March to

mid-May. Over these two months, revenue was 35% lower than

pre-COVID levels. When the lockdown ended, most of the group’s

markets quickly bounced back to their pre-crisis levels and

Solutions 30 returned to sustainable growth by June, growth

which continued throughout the year.

Solutions 30 was able to quickly adapt its

call-out processes to deal with the health crisis, ensuring the

safety of its employees and its business continuity. As a result,

the group posted solid performance throughout the year, proving the

resilience of its business model, its operational and financial

flexibility, as well as its ability to seize new opportunities,

especially in the telecom sector.

For 2020, Solutions 30 posted revenue of

€819.3 million compared to €691.4 million in 2019,

representing growth of +18.5% (+13.0% organic growth). The group’s

maintenance business, which is recurrent in nature, represents 59%

of the group’s revenue.

In France, 2020 revenue was €522.7 million,

compared to €434.4 million a year earlier, an increase of

20.4% (+19.7% organic growth). This performance was mainly driven

by the 40% growth in the telecom business linked to FTTH sales and

an uptick in the number of fiber subscribers.

In the Benelux, revenue reached

€136.3 million, up +8.3% (+1.4% organic growth), thanks to the

strong resilience of the telecom business.

In other countries, Solutions 30’s 2020

revenue amounted to €160.3 million, up +22.2% (+2.1% organic

growth). The year was remarkable for the successful integration of

the Polish business and the group’s entry into the UK market.

Adjusted EBITDA margin of

13.0%

Solutions 30 has the advantage of a largely

variable cost structure that, along with the partial unemployment

measures implemented during the first lockdown, helped to limit the

impact of lower activity in March, April, and May on profitability

for the first half of the year. Excellent momentum in the second

half of the year helped Solutions 30’s operating margin bounce

back for the period, wiping out the one-off decline in

profitability from earlier in the year.

This meant that by the end of December 2020,

adjusted EBITDA stood at €106.5 million, or 13.0% of revenue,

compared to €89.4 million, or 12.9% of revenue in 2019. Excluding

IFRS 16, adjusted EBITDA amounted to €83.0 million, or

10.1% of revenue, a stable margin compared to 2019.

In France, adjusted EBITDA

reached €86.6 million, a margin of 16.6%, up 0.5 points from

last year, thanks to an increase in call-out volumes in the second

half of the year.

In the Benelux, adjusted EBITDA

amounted to €21.4 million. The margin remained stable at 15.7%

of revenue.

In other countries, and despite

the effects of lockdown measures that particularly affected Italy

and Spain, EBITDA was €7.6 million, representing 4.8% of

revenue, compared to 4.5% a year earlier.

After accounting for €22.2 million in

impairments and operational provisions, and after amortizing the

usage rights for leased assets (IFRS 16), worth

€23.5 million, adjusted EBIT stood at €60.9 million, a

15.0% increase compared to the previous year.

Customer relationship amortization amounted to

€13.0 million in 2020, compared to €10.7 million a year

earlier.

In 2020, Solutions 30 posted non-recurring

income of €0.4 million, mainly related to negative goodwill

recognized following the acquisitions of Algor and Brabamij,

compared to non-recurring income of €5.1 million posted in

2019, mainly composed of negative goodwill related to the

acquisition of a 51% stake in Byon and the income on the sale of

Italian subsidiaries BSI and BRSI.

Net financial income, arising mostly from

financial fees, represented an expense of €4.1 million,

compared to €1.6 million in 2019. This includes finance costs

from applying IFRS 16, which amounted to €0.6 million in

2020, stable compared to 2019.

After including tax expenses of

€6.0 million, compared to €7.5 million a year earlier,

the group share of net income amounted to €36.9 million,

compared to €38.7 million in 2019.

A solid financial structure, the

foundation for sustainable growth

At December 31, 2020, the group had

€172.4 million in equity, compared to €134.5 million at

December 31, 2019. The group had €159.3 million in gross

cash, an increase of €75.1 million over the end of December

2019. Gross bank debt increased by €12.9 million compared to

December 31, 2019, reaching €100.0 million. The group had cash

net of debt (excluding IFRS 16) of €59.2 million at the

end of December 2020, compared to net bank debt (excluding

IFRS 16) of €3.0 million at the end of December 2019.

Including €63.5 million in leasing

liabilities (IFRS 16) and €24.6 million of potential

financial debt on future call options and earnouts, the group has a

total net debt of €28.9 million, compared to €92.1 million a

year earlier.

Outstanding receivables under the group’s

deconsolidating factoring program amounted to €93.5 million at

December 31, 2020, compared with €54 million at the end of

2019. Committed to a particularly sustained growth trajectory,

since 2018 Solutions 30 has had in place a non-recourse, and

therefore deconsolidating, factoring program with all of its

subsidiaries to finance working capital from recurring activities

that are fully developed. The use of factoring frees up the cash

generated by these receivables to finance the group’s growth

strategy, in particular the ramp-up of new contracts, at a cost of

less than 1% of the amount of assigned receivables.

Operating cash flow amounted to

€91.5 million in 2020. Sustained revenue growth throughout the

year led to an increase of €45 million in working capital

requirements. Net operational investments amounted to

€11.6 million, or 1.4% of revenue, compared to 2.0% a year

earlier. This falls within a normal range, generally considered to

be between 1.5% and 4% of revenue, and goes mostly to investing in

the group’s IT infrastructure and technical equipment. This means

that the group had €124.8 million in free cash flow. Excluding

IFRS 16, free cash flow amounted to €101.3 million, or

12.4% of the group’s total revenue.

Accelerating the group’s

transformation

At the beginning of April, Solutions 30

announced that it would be accelerating the improvement plan it

began in 2019, which has already seen concrete progress, including

the adoption of IFRS in 2019, the transfer of company shares to a

regulated exchange, and better governance.

In line with these actions intended to support

its strong growth, the Solutions 30 group has embarked on a

new phase of its transformation, led by Robert Ziegler, newly

appointed Chief Transformation Officer and member of the management

board.

Solutions 30 is launching a transformation

plan designed to strengthen its organization in terms of

governance, risk management, and compliance, with the aim of having

its new management and control procedures in place by the end of

2021. This plan integrates issues related to corporate social

responsibility and extends the efforts undertaken by the group

since 2019 in terms of environmental, social, and governance (ESG)

accountability criteria. One result of this action plan is a

significant improvement in its ratings in 2020 and early 2021.

Through this transformation plan,

Solutions 30 intends to consolidate its foundations to build a

better future for the company and its growth. To this end, the

group will rely on the commitment of its teams, the loyalty of its

customers, the solidity of its financial structure, and the agility

of its business model.

Sustained growth prospects throughout

Europe

From an operational standpoint, the group took

advantage of 2020 to consolidate its achievements and confirm the

strength of its business model in a booming market, entering a new

phase of growth driven by the digital transformation and the energy

transition (smart grids and electric mobility).

The group’s teams remain focused on executing

the growth strategy and capitalizing on its recent successes,

especially in Italy with the broadband Internet roll-out and in

Belgium with the installation of smart meters. Solutions 30 is

heading into 2021 with confidence and serenity, determined to reach

its goal of €1 billion in revenue.

All over Europe, recovery plans of unprecedented

scale—both in terms of their amount and their duration—are being

implemented, allocating significant funds to deploy more efficient

telecommunication infrastructures and to accelerate the energy

transition. These public measures are in addition to the

initiatives of private service providers spearheading efforts to

deploy fiber-optic networks, next generation mobile networks, and

electric mobility. Solutions 30 is well positioned in all of

these sectors, which greatly enhances its prospects for growth.

Upcoming event

2021 Q2

Revenue

July 27, 2021

(1) Following the investigations

carried out by Deloitte and Didier Kling Expertise & Conseil,

Solutions 30 has made two changes to its consolidation scope

which have led to a restatement of its 2019 accounts:

Worldlink: On December 1, 2020, the group

acquired 100% of the share capital of Worldlink Gmbh, in which it

had previously held a 20% stake. When the 2019 consolidated

financial statements were published, the group had not accounted

for its control of Worldlink, so that company had not been fully

consolidated into the accounts. However, given that purchase and

sale options had been signed by the end of March 2019,

Solutions 30 could have increased its stake in Worldlink and

become its majority shareholder before it officially took over

operations in 2020. According to IFRS, Worldlink should have been

fully consolidated into the accounts as of April 1, 2019. Data for

2019 have been restated after the decision was made to set

Worldlink’s takeover date at April 1, 2019.

Vitgo Telecomunicaciones: On October 23, 2019,

the group acquired 100% of Vitgo Telecomunicaciones’ share capital,

having previously held a 49% stake in the company. As of the date

of preparation of the 2018 and 2019 annual consolidated financial

statements, the group had not considered it was in control of Vitgo

Telecomunicaciones until October 23, 2019 and had therefore

consolidated it using the equity method until that date. However,

given the group’s economic exposure to Vitgo Telecomunicaciones,

the objective of prioritizing substance over form should have led

Solutions 30 to fully consolidate Vitgo Telecomunicaciones

from the IFRS transition date of January 1, 2018, even before the

effective takeover date in October 2019. Data for 2018 and 2019

have been restated after the decision was made to set Vitgo

Telecomunicaciones’s takeover date at January 1, 2018.

The impact of these restatements will be

detailed in the financial statements. This mainly resulted in a

positive impact of €9.2 million on 2019 revenue, and a

negative impact of €2.4 million on adjusted EBITDA and

-€1.1 million on consolidated net income.

About Solutions 30

SE

The Solutions 30 group is the European

leader in solutions for new technologies. Its mission is to make

the technological developments that are transforming our daily

lives accessible to everyone, individuals and businesses alike.

Yesterday, it was computers and the Internet. Today, it’s digital

technology. Tomorrow, it will be technologies that make the world

even more interconnected in real time. With more than

30 million call-outs carried out since it was founded and a

network of more than 15,700 local technicians, Solutions 30

currently covers all of France, Italy, Germany, the Netherlands,

Belgium, Luxembourg, the Iberian Peninsula, the United Kingdom, and

Poland. The share capital of Solutions 30 SE consists of

107,127,984 shares, equal to the number of theoretical votes

that can be exercised.Solutions 30 SE is listed on the

Euronext Paris exchange (ISIN FR0013379484- code S30). Indexes:

MSCI Europe Small Cap | Tech40 | CAC PME | SBF120 | CAC Mid 60.

Visit our website for more information: www.solutions30.com

Contact

Analysts/investors

Nathalie Boumendil | Tel: +33 6 85 82

41 95

|

nathalie.boumendil@solutions30.com

Press - Image 7:

Leslie Jung

| Tel: +44 7818

641803

|

ljung@image7.fr

Flore

Larger

| Tel: +33 6 33 13 41

50

|

flarger@image7.fr

Charlotte Le Barbier | Tel: +33

6 78 37 27 60

|

clebarbier@image7.fr

APPENDIX 1 - Glossary

Organic

growth

Organic growth includes the organic growth of acquired companies

after they are acquired, which Solutions 30 assumes they would

not have experienced had they remained independent.

| |

FY2019 Restated(1) |

|

FY 2020 |

|

|

|

Total |

|

Organic growth of existing subsidiaries |

Organic growth from acquired companies |

Acquisitions |

Total |

| |

|

|

Value |

% |

Value |

% |

Value |

% |

Value |

Change |

| Total |

691.4 |

|

76.3 |

11% |

13.8 |

2% |

38.0 |

5% |

819.3 |

19% |

| From France |

434.4 |

|

77.5 |

18% |

8 |

2% |

2.9 |

1% |

522.7 |

20% |

| From Benelux |

125.9 |

|

2.2 |

2% |

-0.5 |

0% |

8.7 |

7% |

136.3 |

8% |

| From

other countries |

131.1 |

|

-3.5 |

-3% |

6.3 |

5% |

26.3 |

20% |

160.3 |

22% |

EBITDA

Earnings before interest, taxes, depreciation, and amortization, as

well as non-recurring income and expenses. It corresponds to the

“operating margin” in the consolidated statement of comprehensive

income.

Adjusted

EBIT

Operating income before amortization of intangible assets,

including customer relationships, and non-recurring income and

expenses.

| In

thousands of euros |

FY2020 |

FY2019

Restated(1) |

| Operating income |

48,279 |

47,337 |

| Customer relationship amortization |

12,996 |

10,694 |

| Earnings on sale of holdings |

49 |

-2,057 |

| Other non-recurring operating income,

including badwill |

-464 |

-3,071 |

|

Adjusted EBIT |

60,858 |

52,903 |

Non-recurring

transactions Income

and expenses that are infrequent, unusual in nature, and

significant in amount are considered non-recurring

transactions.

Customer

relationships

Intangible assets related to the fair value measurement of acquired

companies at the time of consolidation. The amortization period of

3 to 15 years is the estimated time for the consumption

of the majority of economic benefits flowing to the company.

Net

debt

Net debt includes loans from credit institutions, bank overdrafts,

lease liabilities, and future liabilities from earnouts and put

options, less cash and cash equivalents.

| In

thousands of euros |

12/31/2020 |

12/31/2019 Restated(1) |

| Bank debt |

100,045 |

87,153 |

| Lease liabilities |

63,548 |

61,916 |

| Future liabilities from earnouts and

put options |

24,618 |

27,179 |

| Cash and cash equivalents |

-159,279 |

-84,194 |

|

Net debt |

28,933 |

92,054 |

Net bank

debt

Net bank debt includes loans from credit institutions and bank

overdrafts, less cash and cash equivalents. This represents net

debt excluding the impact of IFRS 16. Net bank debt is used as

a reference in calculating the covenants included in the group’s

debt contracts.

| In

thousands of euros |

12/31/2020 |

12/31/2019 Restated(1) |

| Loans from credit institutions,

long-term |

71,977 |

65,827 |

| Loans from credit institutions,

short-term and lines of credit |

28,068 |

21,326 |

| Cash and cash equivalents |

-159,279 |

-84,194 |

|

Net bank debt |

-59,234 |

2,959 |

Free cash

flow

Free cash flow corresponds to the net cash flow from operating

activities minus the acquisitions of intangible assets and

property, plant and equipment net of disposals.

| In

thousands of euros |

12/31/2020 |

12/31/2019

Restated(1) |

| Net cash flow from operating

activities |

136,847 |

63,679 |

| Acquisition of non-current assets |

-12,670 |

-15,297 |

| Disposal of non-current assets after

tax |

639 |

1,223 |

|

Free cash flow |

124,816 |

49,606 |

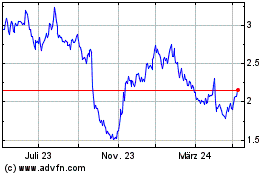

Solutions 30 (EU:S30)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Solutions 30 (EU:S30)

Historical Stock Chart

Von Apr 2023 bis Apr 2024