AN EXTREMELY DYNAMIC START TO THE

YEAR

- Sales: €1,852m, +27.4% as reported and +30.9% LFL*

- Operating Result from Activity: €198m, vs. €18m in Q1

2020

- Net debt: €1,465m vs. €1,518m at 12/31/2020

Regulatory News:

GENERAL COMMENTS ON GROUP SALES

Groupe SEB (Paris:SK) sales in the first quarter of 2021

amounted to €1,852m, up 27.4% as compared to the first

quarter of 2020. This improvement includes like-for-like growth

of 30.9% (+€449m), a currency effect of -5.6% (-€81m)

and a scope effect of +2.1% (+€30m; related to

StoreBound).

This excellent performance was driven by the Consumer

business, up 39.1% LFL, resulting from a combination of several

positive factors:

- in line with second semester of 2020, a very firm demand for

small domestic appliances and cookware;

- continued solid momentum in online sales, which is

sustained;

- an overall less promotional environment, reflected in quality

sales;

- low comparative basis resulting from the very penalizing effect

on the activity from lockdown measures implemented at the onset of

Covid-19 epidemic in the first quarter 2020.

Conversely, the Professional business recorded a

decline in turnover of 26.2% LFL versus a first-quarter 2020

that was less impacted by the COVID-19 crisis than the Consumer

business. This marked decrease in sales is directly linked to the

persistent difficulties in the hospitality and catering sector,

which is still largely under lockdown at this stage.

* Like-for-like: at constant exchange rates and scope of

consolidation

Statement by T. de La Tour d’Artaise, Chairman and CEO of

Groupe SEB

“Groupe SEB achieved an excellent performance in the first

quarter, with sales and operating result exceeding pre-pandemic

levels. All our products and regions contributed to this upswing

and we are particularly pleased with this momentum, which was

driven by the efforts of all our teams that I want to thank today.

In this still strong environment, we remain focus on our

fundamentals: the health of our employees, the service to our

customers and products innovation”.

DETAIL OF REVENUE BY REGION

Sales (€m)

First- quarter

2020

First-quarter

2021

Change 2021/2020

Reminder

Q1 2020

LFL*

As reported

LFL*

EMEA

Western Europe

Other countries

641

445

195

870

599

271

+35.8%

+34.6%

+38.6%

+41.5%

+34.7%

+57.1%

-10.4%

-14.7%

+1.0%

AMERICAS

North America

South America

149

97

52

243

178

65

+63.1%

+82.6%

+26.2%

+61.0%

+64.4%

+54.6%

-8.6%

-7.2%

-10.9%

ASIA

China

Other countries

482

365

117

609

468

142

+26.3%

+28.3%

+20.4%

+29.1%

+30.2%

+25.5%

-26.9%

-32.4%

-1.5%

TOTAL Consumer

1,272

1,722

+35.4%

+39.1%

-17.3%

Professional business

182

130

-28.7%

-26.2%

-9.7%

GROUPE SEB

1,454

1,852

+27.4%

+30.9%

-16.5%

*Like-for-like: at constant exchange rates

and scope

Rounded figures in €m

% calculated in non-rounded

figures

COMMENTS ON CONSUMER BUSINESS BY REGION

Sales (€m)

First- quarter

2020

First- quarter

2021

Change 2021/2020

Q1 2020 LFL

As reported

LFL*

EMEA

Western Europe

Other countries

641

445

195

870

599

271

+35.8%

+34.6%

+38.6%

+41.5%

+34.7%

+57.1%

-10.4%

-14.7%

+1.0%

WESTERN EUROPE

As in the second semester of 2020, first-quarter 2021 sales

benefited from very robust demand. Organic growth came out at

34.7%, vs early 2020 hard hit by the effects of the COVID-19

pandemic. The continuation or extension of restrictive measures in

almost all European countries (additional lockdowns of varying

strictness, curfews, closure of stores, restrictions on people’s

movements, etc.) continued to favor household equipment across all

markets. Under these circumstances, e-commerce was the main growth

driver, as in 2020.

In France, in an extremely buoyant market further propelled by

extended winter sales, activity was very dynamic, reflecting the

confidence of all retailers—even those who had to close—who

maintained their orders and secured their supplies. All product

families contributed to the sales momentum, both in cookware and

small domestic appliances.

In Germany, despite a hard lockdown and the wide-scale closure

of physical points of sale (including our WMF stores) over the

quarter, our turnover was up considerably, propelled by continued

growth in online sales.

In other countries (UK, Belgium, Netherlands, Scandinavia,

Italy, etc.), the rebound in activity vs first-quarter 2020 was

general and often spectacular. However, in Spain, sales momentum

was slowed by the collapse of the roof on our main warehouse

following significant snowfall.

The entire product portfolio, with the exception of linen care,

contributed to the region’s growth.

OTHER EMEA COUNTRIES

In a mixed overall environment (lockdown measures varying by

country, launch of vaccination campaigns, new currency

depreciations, etc.), demand for small domestic appliances remained

very robust. It was fueled by the continued and fast development of

home cleaning—which represents a third of the market—and ongoing

development in e-commerce. In this context, the Group posted

organic growth of 57.1% in Eurasia in the first quarter, confirming

remarkable business momentum in the region, relative to a weak

(though positive) 2020 owing to the COVID crisis.

This considerable progress was driven by all markets and was

based on the continued strengthening of our positions in

e-commerce, via all channels (pure players, essentially national or

regional, click&mortar, etc.). As regards products, cookware

was still the main performance driver, specifically Ingenio and the

new Unlimited range, Optigrill and vacuum cleaners (versatile and

robot models).

These growth drivers were observed in all our major Eurasia

markets: Russia, Poland, Ukraine, Romania and Central Europe. Such

drivers were also key to the significant turnaround in business in

Turkey, despite a difficult macroeconomic context.

In Egypt, growth in first-quarter turnover was more moderate

than in other countries, largely owing to the non-repeat of an

“anniversary” commercial operation made in early 2020.

Sales (€m)

First- quarter

2020

First- quarter

2021

Change 2021/2020

Q1 2020 LFL

As reported

LFL*

AMERICAS

North America

South America

149

97

52

243

178

65

+63.1%

+82.6%

+26.2%

+61.0%

+64.4%

+54.6%

-8.6%

-7.2%

-10.9%

NORTH AMERICA

Turnover in North America increased 64.4% LFL and 82.6% as

reported, including the integration of StoreBound and negative

currency effects. The outstanding performance was generated by the

three countries and included a particularly strong month in

March.

In the US, growth was bolstered by the widespread continuation

of teleworking, which continued to benefit home cooking, and by the

replacement of appliances facilitated by government stimulus

programs. The Group posted record performances in cookware under

the All-Clad, T-Fal and Imusa brands. StoreBound posted an

excellent first quarter, with growth of over 100% and a

particularly striking acceleration in e-commerce. However, the

situation was more complicated for linen care, in a market that

remains down.

In Canada, the favorable trend in home-cooked meals drove

considerable growth in cookware and electrical cooking sales.

Solid growth in Mexico was underpinned by strong core-business

momentum (cookware, oil-less deep fryers, juicers, etc.), the

continuation of a loyalty program with a retailer, and a solid

performance by the retail network (with an over 50% increase in

footfall despite reduced opening hours owing to the health

crisis).

SOUTH AMERICA

Our sales in South America at end-March were up 54.6% LFL and

26.2% as reported. The latter figure comprises the unfavorable

currency effects stemming from the depreciation of the Brazilian

real and, to a lesser extent, the Colombian peso.

South America remains heavily impacted by the COVID-19 epidemic.

Brazil, the biggest country in the region, has also been the

hardest hit, with an extremely worrying health crisis. The economic

and social consequences of the crisis are severe and deepening.

In this deteriorated economic environment, the Group managed to

achieve very significant organic growth in sales in the first

quarter. This growth was driven by cooking categories (cookware,

oil-less deep fryers and blenders) and by price hikes implemented

to offset penalizing currency effects. Volumes sold are trending

downward. Fan sales are declining due to unfavorable weather

conditions.

In Colombia, organic sales growth in the first quarter came out

at over 50%, notably thanks to oil-less deep fryers (sales success

confirmed and growing), Imusa cookware, and blenders. In response

to the considerable demand, our plants in Colombia are operating at

full capacity and have set record production levels.

Sales (€m)

First-

quarter

2020

First-quarter

2021

Change 2021/2020

Q1 2020

LFL

As reported

LFL*

ASIA

China

Other countries

482

365

117

609

468

142

+26.3%

+28.3%

+20.4%

+29.1%

+30.2%

+25.5%

-26.9%

-32.4%

-1.5%

CHINA

Last year, China was the first country to be impacted by the

COVID-19 epidemic, with strong repercussions on the Group’s

business in this market (-32% LFL), particularly in cookware, which

was adversely affected by the extended closure of the Wuhan site.

Due to this, first-quarter 2020 represents low comparative basis.

As expected, growth in Supor’s domestic sales was very robust in

the first three months: up +30% LFL.

All product families contributed to the upturn in sales:

– particularly dynamic growth in cookware, all categories

together, on weak first quarter 2020 comparatives. This strong

momentum also applied to large kitchen appliances: – substantial

growth in kitchen electrics, driven by flagship products (rice

cookers, electric pressure cookers and kettles) and the fast

ramp-up in recently launched more “Western” categories (oil-less

fryers, ovens, etc.); – solid rebound in Home and Personal Care,

largely owing to vacuum cleaners.

Although physical stores are ordinarily opened again, online

sales are the main driver of market and of Supor’s sales growth.

This growth remains driven by volumes, while the increased

contribution from e-commerce has an unfavorable mix effect on

prices, without impacting Supor’s operating margin.

OTHER COUNTRIES IN ASIA

In Asia excluding China, sales at end-March grew by over 25%

LFL, even though the region held up well in first-quarter 2020.

In Japan, the Group’s largest market in the region, our

quarterly sales rose substantially, driven by excellent

performances in cookware and electrical cooking (Cook4me, Lakula

Cooker). Linen care activity picked up markedly in March, but

remains down over the entire quarter. The state of emergency

decreed across most of the country led to a dip in store footfall

at the beginning of the period, followed by a marked recovery in

February and March.

As in Japan, our sales in South Korea increased sharply in the

first quarter on a like-for-like basis, thanks in particular to the

successful launch of our new cookware range, home cleaning (new

listings with our specialist customers), food preparation and

electrical cooking. Moreover, the Group continued to expand its

retail network, with two new openings in the first three months of

2021, and achieved significant growth with the main online pure

player in the country.

Almost all the countries in the region (notably Australia and

Thailand) posted double-digit organic sales growth over the period,

apart from Hong Kong, negatively impacted by demanding comparatives

(loyalty program in 2020).

COMMENTS ON PROFESSIONAL BUSINESS ACTIVITY

Sales (€m)

First-

quarter

2020

First-quarter

2021

Change 2021/2020

Q1 2020

LFL

As reported

LFL*

Professional business

182

130

-28.7%

-26.2%

-9.7%

The first quarter of 2021 followed the same negative trend as

the previous three quarters, with sales down by 26.2% LFL.

Professional Coffee continues to be heavily affected by the

extremely negative effects of the crisis on the hospitality and

catering sectors, still largely under lockdown at this stage, and

that comprise many of our customers : hotels, cafés, coffee shops,

restaurants, fast-food chains and convenience stores.

This very difficult and uncertain environment led to

postponements and reductions in investments in machines and

maintenance operations. However, the diversified marketing strategy

deployed to serve WMF/Schaerer's customers around the world allows

to maintain significant level of activity and to fuel the order

book.

Hotel business, which accounts for a much smaller share of

sales, was also severely impacted by the crisis.

OPERATING RESULT FROM ACTIVITY (ORfA)

As a reminder, the first quarter is not representative of annual

performance, owing in particular to the seasonal nature of the

business

Groupe SEB posted Operating Result from Activity (ORfA) of €198m

in first-quarter 2021 versus €18m at March 31, 2020 (and €138m in

the first quarter of 2019).

The vitality and quality of sales as well as the return to

strong industrial activity (vs. COVID-19-related production

shutdowns in the first quarter of 2020) are the main drivers behind

the improvement of ORfA at March 31, 2021, which also includes a

negative currency effect of €28m. Headwinds overruns related to raw

materials, components and freight remained limited in the first

quarter.

DEBT AT MARCH 31, 2021

Net financial debt amounted to €1,465m at March 31, 2021,

compared with €1,518m at end-December 2020. It includes €332m in

IFRS 16 debt.

The €53m quarterly reduction in net debt was mainly attributable

to the vigorous growth in EBITDA, outpacing the increase in working

capital requirement (WCR).

Groupe SEB reiterates that it can rely on a solid financial

situation, underpinned by a healthy financial structure that is

well-balanced in terms of instruments and maturities and free of

financial covenants.

CLOSURE OF THE ERBACH PLANT

On March 17, Rowenta Werke announced to all employees concerned

that it would cease its activities in Erbach (Germany) effective

June 30, 2022, entailing the closure of the plant.

The structural decline in the global ironing market for several

years has been compounded by the effects of the COVID-19 crisis

with the increase in remote working. Despite the investments and

efforts made to maintain Erbach’s activity, the continued drop in

volumes has prompted the Group to close this long-standing site and

redeploy the industrial ironing activity notably to the Pont-Evêque

plant in France. This decision confirms the plant’s status as a

linen care expertise center.

The Group’s top management will do everything in their power to

minimize the social impact for each and every employee. They are

working closely with the workers’ committee to find the best

solution for everyone concerned.

OUTLOOK

Following an excellent first quarter, the Group is expecting the

second quarter sales to remain very dynamic, on a favorable

comparable basis, with the Consumer business still driven by very

strong demand and a rebound in Professional Coffee linked to

specific contracts.

The Group additionally anticipates a stable second semester vs.

2020 owing to a demanding comparison basis, uncertainties on demand

trend for small domestic equipment and contingencies as for the

pace of recovery for Professional Coffee.

Under these conditions and based on these assumptions:

- Reported sales growth could end up around 10% for 2021,

including a negative currency impact of -€100m

- ORfA margin for 2021 could be close to 10%, including more

penalizing headwinds (FX, raw materials and components, freight)

than initially anticipated and currently estimated at -€140m on the

Operating Result from Activity (ORfA).

The Group’s remains confident in its ability to return to

profitable and responsible growth right from this year, after a

very atypical financial year in 2020. It relies on its solid and

balanced strategic model which allows the Group to adapt to

short-term requirements without losing sight of its long-term

ambitions.

Conference with management on April 22, 6:00

p.m. CET

Click here to access the live webcast (in

English)

Replay available on our website on April 22

from 8:00 p.m. CET at www.groupeseb.com

Access (audio only): From France: +33 (0)1 7037

7166 – Password: SEB From abroad: +44 (0) 33 0551 0200 – Password:

SEB From the United States: +1 (0) 866 966 5335 – Password: SEB

GLOSSARY

On a like-for-like basis (LFL) – Organic

The amounts and growth rates at constant exchange rates and

consolidation scope in a given year compared with the previous year

are calculated:

- using the average exchange rates of the previous year for the

period in consideration (year, half-year, quarter);

- on the basis of the scope of consolidation of the previous

year.

This calculation is made primarily for sales and Operating

Result from Activity.

Adjusted EBITDA

Adjusted EBITDA is equal to Operating Result from Activity minus

discretionary and non-discretionary profit-sharing, to which are

added operating depreciation and amortization. Net debt – Net

indebtedness.

Operating Result from Activity (ORfA)

Operating Result from Activity (ORfA) is Groupe SEB’s main

performance indicator. It corresponds to sales minus operating

costs, i.e. the cost of sales, innovation expenditure (R&D,

strategic marketing and design), advertising, operational marketing

as well as commercial and administrative costs. ORfA does not

include discretionary and non-discretionary profit-sharing or other

non-recurring operating income and expense.

Free cash flow

Free cash flow corresponds to adjusted EBTIDA, after considering

changes in operating working capital, recurring capital

expenditures (CAPEX), taxes and financial expenses, and other

non-operating items.

Net financial debt

This term refers to all recurring and non-recurring financial

debt minus cash and cash equivalents, as well as derivative

instruments linked to Group financing. It also includes debt from

application of the IFRS 16 standard “Leases” in addition to

short-term investments with no risk of a substantial change in

value but with maturities of over three months.

Loyalty program (LP)

These programs, led by distribution retailers, consist in

offering promotional offers on a product category to loyal

consumers who have made a series of purchases within a short period

of time. These promotional programs allow distributors to boost

footfall in their stores and our consumers to access our products

at preferential prices.

SDA

Small domestic appliances: electrical cooking and home, linen

and personal care.

PCM

Professional coffee machines

This press release may contain certain forward-looking

statements regarding Groupe SEB’s activity, results and financial

situation. These forecasts are based on assumptions which seem

reasonable at this stage, but which depend on external factors

including trends in commodity prices, exchange rates, the economic

climate, demand in the Group’s large markets and the impact of new

product launches by competitors. As a result of these

uncertainties, Groupe SEB cannot be held liable for potential

variance on its current forecasts, which result from unexpected

events or unforeseeable developments. The factors which could

considerably influence Groupe SEB’s economic and financial result

are presented in the Annual Financial Report and Universal

Registration Document filed with the Autorité des Marchés

Financiers, the French financial markets authority.

Next key dates - 2021

May 20 | 3:00 p.m.

Annual General Meeting

July 23 | before market opens

H1 2021 sales and results

October 26 | after market closes

9-month 2021 sales and financial

data

Find us on www.groupeseb.com

World reference in small domestic equipment, Groupe SEB operates

with a unique portfolio of 31 top brands including Tefal, Seb,

Rowenta, Moulinex, Krups, Lagostina, All-Clad, WMF, Emsa, Supor,

marketed through multi-format retailing. Selling more than 360

million products a year, it deploys a long-term strategy focused on

innovation, international development, competitiveness, and service

to clients. Present in over 150 countries, Groupe SEB generated

sales of €6.9 billion in 2020 and has more than 33,000 employees

worldwide.

SEB SA SEB SA - N° RCS 300 349 636 RCS LYON

– with a share capital of €55,337,770 – Intracommunity VAT: FR

12300349636

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210422005878/en/

Investor/Analyst Relations

Groupe SEB Financial Communication and IR Dept

Isabelle Posth Raphaël Hoffstetter

comfin@groupeseb.com

Tel. +33 (0) 4 72 18 16 04

Media Relations

Groupe SEB Corporate Communication Dept

Cathy Pianon Anissa Djaadi

com@groupeseb.com

Tel.: + 33 (0) 6 33 13 02 00 Tel:. + 33 (0) 6 88 20 90

88

Image Sept Caroline Simon Claire Doligez

Isabelle Dunoyer de Segonzac

caroline.simon@image7.fr cdoligez@image7.fr

isegonzac@image7.fr

Tel. +33 (0)1 53 70 74 70

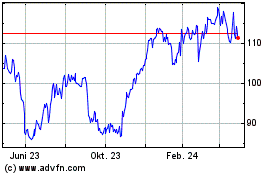

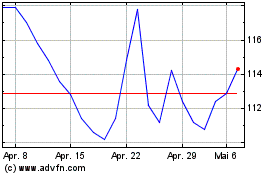

SEB (EU:SK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SEB (EU:SK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024