Séché Environnement: Issue of an Impact Bond With ESG Criteria to Accelerate Growth in Sustainable Development Markets

24 März 2021 - 5:45PM

Business Wire

Regulatory News:

Séché Environnement (Paris:SCHP) announces the issue of an

impact bond with ESG criteria to accelerate its growth in circular

economy and ecological transition markets.

The success of this issue illustrates the appeal of its

long-term strategy for sustainable finance investors.

Séché Environnement issued a €50 million impact bond with a

maturity of eight years (bullet repayment) under improved rate

conditions, with ESG criteria:

- Energy self-sufficiency rate;

- Actions to promote the protection of biodiversity;

- Changes in accidentology, measured with the TF1 index.

In the event of the favorable evolution of these criteria, which

are measured annually, the nominal interest rate of the issue, of

2.90%, can be revised downward by 20 basis points (0.2%).

The issue is intended to finance the recent acquisition of Spill

Tech in South Africa1 and investments for growth scheduled for

20212.

According to Baptiste Janiaud, Group Chief Financial and

Administrative Officer of Séché Environnement, "the success of our

impact bond issue with ESG criteria to leading sustainable finance

institutions confirms the recognition of the status of Séché

Environnement as a major player in ecological transition and,

particularly, the quality of its social and environmental approach.

The issue provides the Group with new resources to accelerate its

internal and external growth strategy, starting in 2021, in

sustainable development markets in France and internationally".

Next press release

Q1 2021 revenue April 27, 2021 after market

About Séché Environnement

Séché Environnement is the leading player in the recovery and

treatment of all types of waste, including the most complex and

hazardous waste, and in remediation services for the benefit of the

environment and health. Séché Environnement is a family-owned

French industrial group that has supported industrial and regional

ecology for over 35 years with innovative technology developed by

its R&D team. It delivers its unique expertise on the ground in

local regions, with more than 100 sites around the world, including

around 40 industrial sites in France. With 4,600 employees, of

which 2,000 in France, Séché Environnement has revenue of about

€700 million, of which 25% is earned internationally, driven by

internal and external growth momentum via its many acquisitions.

Thanks to its expertise in creating circular economy loops, the

treatment of pollutants and greenhouse gases, and hazard

containment, the Group directly contributes to the protection of

the living world and biodiversity – an area it has actively

supported since its creation.

Séché Environnement has been listed on Eurolist by Euronext

(Compartment B) since November 27, 1997. It is eligible for equity

savings funds dedicated to investing in SMEs and is included in the

CAC Mid&Small, EnterNext Tech 40 and EnterNext PEA-PME 150

indexes. ISIN: FR 0000039139 – Bloomberg: SCHP.FP – Reuters:

CCHE.PA

1 See press release from Monday, January 18, 2021

2 See press release from March 8, 2021

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210324005494/en/

SÉCHÉ ENVIRONNEMENT

Analyst/Investor Relations Manuel Andersen Director of

Investor Relations m.andersen@groupe-seche.com +33

(0)1 53 21 53 60

Media Relations Constance Descotes Communication Director

c.descotes@groupe-seche.com +33 (0)1 53 21 53 53

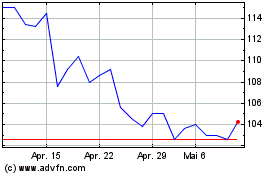

Seche Environnement (EU:SCHP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Seche Environnement (EU:SCHP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024